- Understanding Power of Attorney (POA)

- What is Power of Attorney?

- Types of Power of Attorney

- Importance of Power of Attorney

- Limitations on the Number of POAs

- Legal Restrictions on Multiple POAs

- Question-answer:

- What is POA?

- Is there a limit to the number of POAs a person can have?

- What are the limitations of having multiple POAs?

- Can a person revoke a POA if they have multiple ones?

- What should a person consider before appointing multiple POAs?

- What is a POA?

Power of Attorney (POA) is a legal document that grants someone the authority to act on behalf of another person in various matters. It is a crucial tool that allows individuals to delegate decision-making powers to trusted individuals, especially in situations where they are unable to make decisions themselves.

However, there are limitations to the number of POAs one can have. While it is possible to have multiple POAs, it is important to understand the potential drawbacks and considerations involved. Having too many POAs can lead to confusion, conflicts of interest, and difficulties in managing and coordinating the actions of multiple attorneys.

One of the main limitations is the potential for conflicting instructions and decisions. If multiple POAs are appointed for different matters, there is a risk that their instructions may contradict each other, leading to confusion and potential legal issues. It is crucial to ensure that the appointed attorneys are aware of each other’s roles and responsibilities to avoid any conflicts.

Another limitation is the practicality of managing multiple POAs. Each POA requires time, effort, and attention to ensure that the appointed attorney is acting in the best interests of the grantor. Having too many POAs can make it challenging to effectively oversee and coordinate the actions of each attorney, potentially leading to mismanagement or neglect of important matters.

Additionally, some institutions or organizations may have their own limitations on the number of POAs they accept. For example, financial institutions may have specific requirements or restrictions on the number of POAs they allow for managing accounts or making financial decisions. It is important to check with the relevant institutions to ensure compliance with their policies.

Understanding Power of Attorney (POA)

A Power of Attorney (POA) is a legal document that grants someone the authority to act on behalf of another person in legal and financial matters. It is a crucial tool that allows individuals to appoint someone they trust to make decisions and handle their affairs when they are unable to do so themselves.

When creating a Power of Attorney, the person granting the authority is known as the “principal,” while the person receiving the authority is called the “agent” or “attorney-in-fact.” The agent can be a family member, friend, or even a professional such as a lawyer or accountant.

The Power of Attorney document outlines the specific powers and responsibilities granted to the agent. These powers can range from managing bank accounts and paying bills to making healthcare decisions and selling property. The document can be tailored to meet the individual needs and preferences of the principal.

It is important to note that a Power of Attorney is only valid while the principal is alive and mentally competent. If the principal becomes incapacitated or passes away, the authority granted to the agent ceases to exist. In such cases, other legal documents, such as a living will or a trust, may come into effect.

Having a Power of Attorney in place can provide peace of mind and ensure that someone trusted is able to handle important matters on behalf of the principal. It is a proactive step that can help avoid potential conflicts and complications in the future.

Overall, understanding the Power of Attorney is essential for individuals who want to plan for their future and ensure that their affairs are taken care of in accordance with their wishes. Consulting with a legal professional can help navigate the complexities of creating a Power of Attorney and ensure that all legal requirements are met.

What is Power of Attorney?

Power of Attorney (POA) is a legal document that grants someone the authority to act on behalf of another person in legal and financial matters. The person granting the power is known as the principal, while the person receiving the power is known as the agent or attorney-in-fact.

Power of Attorney allows the agent to make decisions and take actions on behalf of the principal, such as signing documents, managing finances, or making healthcare decisions. The agent has a fiduciary duty to act in the best interests of the principal and must follow any instructions or limitations outlined in the POA document.

Power of Attorney can be useful in various situations, such as when someone is unable to manage their affairs due to illness, disability, or absence. It provides a legal framework for someone to step in and handle important matters on their behalf.

It’s important to note that Power of Attorney is a powerful legal tool and should be granted with careful consideration. The principal should choose someone they trust implicitly and clearly define the scope and limitations of the agent’s authority in the POA document.

Overall, Power of Attorney is a valuable legal instrument that allows individuals to designate someone to act on their behalf in legal and financial matters. It provides peace of mind and ensures that important decisions can be made even when the principal is unable to do so themselves.

Types of Power of Attorney

Power of Attorney (POA) is a legal document that grants someone the authority to act on behalf of another person in legal, financial, or medical matters. There are several types of POA, each with its own specific purpose and scope. Understanding the different types of POA can help you determine which one is most appropriate for your needs.

1. General Power of Attorney: This type of POA grants broad powers to the appointed person, known as the agent or attorney-in-fact. The agent can make decisions and take actions on behalf of the principal in various areas, such as managing finances, signing contracts, and making healthcare decisions. A general POA is often used when the principal wants to give someone the authority to handle their affairs temporarily or in specific situations.

2. Limited Power of Attorney: Also known as a special power of attorney, this type of POA grants specific powers to the agent for a limited period or purpose. The powers granted can be narrowly defined, such as selling a property, making investment decisions, or handling a specific legal matter. A limited POA is often used when the principal wants to delegate certain tasks or decisions to someone they trust, without giving them broad authority over all their affairs.

3. Durable Power of Attorney: A durable POA remains in effect even if the principal becomes incapacitated or unable to make decisions. This type of POA is often used to plan for future incapacity or to ensure continuity of decision-making in case of illness or disability. The agent appointed under a durable POA can continue to act on behalf of the principal and make decisions in their best interest.

4. Springing Power of Attorney: A springing POA only becomes effective under specific conditions or events, typically when the principal becomes incapacitated. This type of POA is often used as a safeguard to ensure that the agent’s powers are activated only when necessary. The specific conditions for activating a springing POA should be clearly defined in the document.

5. Medical Power of Attorney: Also known as a healthcare power of attorney or healthcare proxy, this type of POA grants the agent the authority to make medical decisions on behalf of the principal. The agent can communicate with healthcare providers, access medical records, and make treatment decisions based on the principal’s wishes or best interests. A medical POA is often used to ensure that someone trusted can make healthcare decisions if the principal is unable to do so.

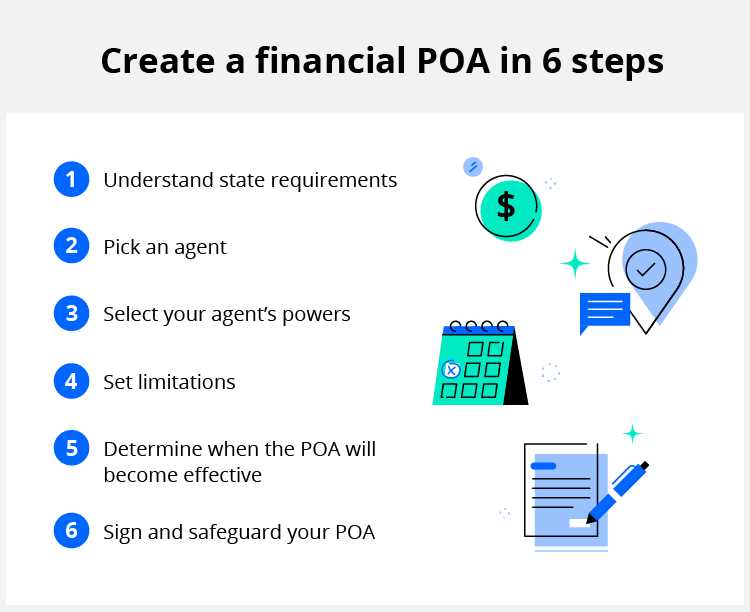

6. Financial Power of Attorney: A financial POA grants the agent the authority to manage the principal’s financial affairs, such as paying bills, managing investments, and filing taxes. This type of POA can be general or limited in scope, depending on the principal’s needs and preferences. A financial POA is often used to ensure that someone trusted can handle financial matters on behalf of the principal.

It’s important to consult with a legal professional to understand the specific requirements and implications of each type of POA. They can help you determine which type of POA is most appropriate for your situation and assist you in drafting a legally valid and comprehensive document.

Importance of Power of Attorney

A Power of Attorney (POA) is a legal document that grants someone the authority to act on your behalf in financial and legal matters. It is an important tool that can provide peace of mind and protection for individuals who may become incapacitated or unable to make decisions for themselves.

There are several reasons why having a Power of Attorney is important:

- Ensuring your wishes are followed: By appointing a trusted individual as your agent, you can ensure that your wishes are followed even if you are unable to communicate or make decisions. This can include managing your finances, paying bills, and making healthcare decisions.

- Protecting your assets: A Power of Attorney can help protect your assets by allowing your agent to manage your financial affairs. They can pay bills, manage investments, and make financial decisions on your behalf, ensuring that your assets are properly cared for.

- Providing for your loved ones: With a Power of Attorney, you can designate someone to handle your financial affairs and make decisions for your loved ones. This can be especially important if you have minor children or dependents who rely on you for support.

- Avoiding court intervention: Without a Power of Attorney in place, if you become incapacitated, a court may need to appoint a guardian or conservator to make decisions on your behalf. This can be a lengthy and costly process, and the court-appointed individual may not be someone you would have chosen.

- Planning for the future: Creating a Power of Attorney is an important part of estate planning. It allows you to choose who will handle your affairs and make decisions for you if you are unable to do so. By planning ahead, you can ensure that your wishes are carried out and that your loved ones are taken care of.

Limitations on the Number of POAs

When it comes to creating a Power of Attorney (POA), it is important to understand that there are limitations on the number of POAs that an individual can have. These limitations are in place to ensure that the power granted to an agent is not abused and to protect the interests of the principal.

One of the main limitations on the number of POAs is that an individual can only appoint one agent per POA. This means that if you want to grant power to multiple individuals, you will need to create separate POAs for each person. Each POA will outline the specific powers and responsibilities granted to the agent.

Another limitation is that some states have restrictions on the number of POAs that can be created. For example, in some states, there may be a limit on the number of financial POAs that can be created. This is to prevent individuals from creating multiple financial POAs in an attempt to defraud or manipulate their assets.

It is also important to note that having multiple POAs can sometimes lead to conflicts of interest. For example, if you appoint two agents who have conflicting views or interests, it can create complications and disagreements when it comes to making decisions on your behalf. It is important to carefully consider the individuals you choose as agents and ensure that they are capable of working together harmoniously.

Overall, while there may be limitations on the number of POAs that can be created, it is important to remember that the purpose of a POA is to protect your interests and ensure that your wishes are carried out. By carefully considering your options and working with a legal professional, you can create a POA that meets your specific needs and provides you with peace of mind.

Legal Restrictions on Multiple POAs

When it comes to having multiple Power of Attorney (POA) documents, there are certain legal restrictions that need to be considered. While it is possible to have more than one POA, there are limitations in place to prevent abuse and ensure that the principal’s best interests are protected.

One of the main limitations is that each POA document must clearly state its scope and powers. This means that if you have multiple POAs, each document should specify the specific powers granted to the agent. For example, one POA may grant the agent the power to make financial decisions, while another may grant the agent the power to make medical decisions.

Another limitation is that some states have laws in place that restrict the number of POAs a person can have. These laws vary by state, so it is important to consult with an attorney or legal expert to understand the specific limitations in your jurisdiction.

Additionally, it is important to consider the practical implications of having multiple POAs. Having multiple agents with overlapping powers can lead to confusion and potential conflicts of interest. It is important to carefully consider the individuals you appoint as agents and ensure that they are trustworthy and capable of making decisions in your best interest.

Furthermore, it is important to regularly review and update your POA documents to reflect any changes in your circumstances or preferences. This includes revoking any outdated or unnecessary POAs to avoid confusion or conflicting instructions.

Question-answer:

What is POA?

POA stands for Power of Attorney. It is a legal document that allows an individual (the principal) to appoint another person (the agent or attorney-in-fact) to act on their behalf in legal and financial matters.

Is there a limit to the number of POAs a person can have?

There is no specific limit to the number of POAs a person can have. However, it is important to note that having multiple POAs can sometimes lead to complications, especially if the appointed agents have conflicting interests or if there is a lack of communication between them.

What are the limitations of having multiple POAs?

Having multiple POAs can create confusion and potential conflicts of interest. For example, if a person appoints two agents to handle their financial matters, there may be disagreements on how to manage the assets. Additionally, if the agents are not in regular communication, important decisions may be delayed or overlooked.

Can a person revoke a POA if they have multiple ones?

Yes, a person can revoke a POA at any time, regardless of how many POAs they have. It is important to follow the proper legal procedures for revoking a POA, such as notifying the agent in writing and ensuring that the revocation is properly recorded.

What should a person consider before appointing multiple POAs?

Before appointing multiple POAs, a person should carefully consider the potential complications and conflicts that may arise. They should also ensure that the appointed agents are trustworthy, reliable, and capable of working together if necessary. It may also be helpful to consult with a legal professional to understand the implications and potential risks of having multiple POAs.

What is a POA?

A POA, or Power of Attorney, is a legal document that allows an individual, known as the principal, to appoint someone else, known as the agent or attorney-in-fact, to make decisions and act on their behalf.