- Unemployment Benefits in California: What Happens if You Get Fired?

- Understanding Unemployment Benefits

- What are Unemployment Benefits?

- Who Qualifies for Unemployment Benefits?

- How are Unemployment Benefits Calculated?

- Question-answer:

- Can I receive unemployment benefits in California if I get fired?

- What are the conditions to receive unemployment benefits in California if you get fired?

- How much money can I receive in unemployment benefits if I get fired in California?

- What should I do if I get fired and want to apply for unemployment benefits in California?

Getting fired from your job can be a stressful and uncertain time. Not only do you have to deal with the emotional impact of losing your job, but you also have to worry about your financial stability. One question that often comes up in these situations is whether or not you can receive unemployment benefits if you get fired.

In the state of California, the answer to this question is not a simple yes or no. While it is possible to receive unemployment benefits if you get fired, there are certain circumstances that need to be met in order to qualify. The California Employment Development Department (EDD) carefully evaluates each case to determine if the individual is eligible for benefits.

One of the key factors that the EDD considers is the reason for the termination. If you were fired due to misconduct or a violation of company policies, you may not be eligible for unemployment benefits. However, if you were let go due to reasons beyond your control, such as downsizing or a company closure, you may be eligible to receive benefits.

It is important to note that even if you are eligible for unemployment benefits, there are still certain requirements that you must meet in order to continue receiving them. For example, you must actively search for new employment and be available and able to work. Failure to meet these requirements can result in a loss of benefits.

If you find yourself in a situation where you have been fired from your job in California, it is important to understand your rights and options. Contacting the EDD and speaking with a representative can provide you with the information you need to determine if you are eligible for unemployment benefits. Remember, it is always best to seek professional advice to ensure that you are making the right decisions for your specific situation.

Unemployment Benefits in California: What Happens if You Get Fired?

Getting fired from your job can be a stressful and uncertain time. One of the main concerns that may arise is how you will financially support yourself during this period of unemployment. In California, there are specific guidelines and regulations in place regarding unemployment benefits for individuals who have been fired from their jobs.

When you get fired from your job in California, you may still be eligible to receive unemployment benefits. However, there are certain circumstances that may affect your eligibility. For example, if you were fired due to misconduct or a violation of company policies, you may not be eligible for benefits. It is important to understand the specific reasons for your termination and how they may impact your ability to receive unemployment benefits.

If you believe that you were wrongfully terminated or that your firing was unjust, you have the right to appeal the decision and provide evidence to support your case. The California Employment Development Department (EDD) will review your appeal and make a determination on whether you are eligible for benefits.

It is important to note that even if you are eligible for unemployment benefits after being fired, there are certain requirements that you must meet in order to continue receiving benefits. For example, you must actively search for new employment and be available and able to work. Failure to meet these requirements may result in a loss of benefits.

When you apply for unemployment benefits in California after being fired, you will need to provide documentation and information about your previous employment, including the reason for your termination. It is important to be honest and accurate in your application to avoid any potential issues or delays in receiving benefits.

Overall, if you get fired from your job in California, you may still be eligible to receive unemployment benefits. However, it is important to understand the specific circumstances of your termination and how they may impact your eligibility. By following the guidelines and requirements set forth by the EDD, you can ensure that you receive the financial support you need during this period of unemployment.

Understanding Unemployment Benefits

Unemployment benefits are a form of financial assistance provided to individuals who have lost their jobs through no fault of their own. These benefits are designed to help unemployed workers meet their basic needs and provide temporary financial support until they are able to find new employment.

Unemployment benefits are typically funded through taxes paid by employers, and the amount of benefits an individual is eligible to receive is based on their previous earnings. The specific amount of benefits can vary depending on factors such as the individual’s income history and the state in which they reside.

To qualify for unemployment benefits, individuals must meet certain eligibility requirements. These requirements typically include being actively seeking employment, being able and available to work, and having earned a minimum amount of wages during a specified period of time. Additionally, individuals must have lost their job through no fault of their own, such as being laid off or having their position eliminated.

Once an individual is approved for unemployment benefits, they must continue to meet certain requirements in order to receive ongoing benefits. This may include regularly reporting their job search activities, attending job training programs, or accepting suitable job offers. Failure to meet these requirements can result in a loss of benefits.

It is important to note that unemployment benefits are intended to be temporary and are not meant to replace an individual’s entire income. They are designed to provide a safety net for individuals who are actively seeking employment and are in need of financial assistance during their job search.

What are Unemployment Benefits?

Unemployment benefits are financial assistance provided by the government to individuals who have lost their jobs and meet certain eligibility criteria. These benefits are designed to help unemployed individuals cover their basic living expenses while they search for new employment.

Unemployment benefits are typically paid out on a weekly or bi-weekly basis and are calculated based on the individual’s previous earnings. The amount of benefits received may vary depending on factors such as the individual’s income history, the state’s unemployment rate, and the maximum benefit amount set by the state.

Unemployment benefits can provide temporary financial relief to individuals who are actively seeking employment. They can help cover expenses such as rent or mortgage payments, utilities, groceries, and other essential needs.

To qualify for unemployment benefits, individuals must meet certain requirements, such as being unemployed through no fault of their own, actively seeking employment, and being able and available to work. Additionally, individuals must meet the state-specific eligibility criteria, which may include having a certain amount of prior earnings and having worked a certain number of weeks.

It’s important to note that unemployment benefits are not intended to be a long-term solution, but rather a temporary form of assistance. Individuals receiving unemployment benefits are typically required to actively search for work and report their job search activities to the state unemployment agency.

| Key Points about Unemployment Benefits: |

|---|

| – Financial assistance provided by the government to individuals who have lost their jobs |

| – Designed to help cover basic living expenses while searching for new employment |

| – Paid out on a weekly or bi-weekly basis |

| – Calculated based on previous earnings |

| – Amount of benefits received may vary based on income history and state-specific factors |

| – Temporary form of assistance, not a long-term solution |

| – Individuals must meet eligibility criteria and actively search for work |

Overall, unemployment benefits provide a safety net for individuals who have lost their jobs and are actively seeking new employment. They can help alleviate some of the financial stress associated with unemployment and provide individuals with the means to meet their basic needs while they work towards reentering the workforce.

Who Qualifies for Unemployment Benefits?

In order to qualify for unemployment benefits in California, you must meet certain eligibility requirements. These requirements include:

- You must have earned enough wages during a specific base period, which is typically the first four out of the last five calendar quarters before you filed your claim.

- You must have lost your job through no fault of your own. This means that if you were fired for misconduct or voluntarily quit your job without good cause, you may not be eligible for benefits.

- You must be able and available to work. This means that you must be physically and mentally capable of performing suitable work and actively seeking employment.

- You must be actively looking for work and making a reasonable effort to find employment. This includes applying for jobs, attending job fairs, and participating in job training programs.

- You must be registered with the California Employment Development Department (EDD) and actively participating in their job search assistance programs.

- You must be willing to accept suitable work if it is offered to you. Suitable work is defined as work that is similar to your previous employment in terms of skills, wages, and working conditions.

It is important to note that each case is evaluated individually, and the EDD will consider all relevant factors when determining your eligibility for unemployment benefits. If you believe you meet these requirements, you should file a claim with the EDD and provide all necessary documentation to support your case.

How are Unemployment Benefits Calculated?

Calculating unemployment benefits in California is based on a formula that takes into account your earnings during a specific base period. The base period is a 12-month period that is divided into four quarters, with the most recent quarter being excluded.

During the base period, your earnings from all employers are considered. This includes wages, salaries, tips, commissions, bonuses, and any other form of compensation. However, certain types of income, such as self-employment income, rental income, and income from a business you own, are not included in the calculation.

Once your total earnings during the base period are determined, the Employment Development Department (EDD) uses a formula to calculate your weekly benefit amount. The formula takes into account your highest quarter earnings and divides it by 26, which is the maximum number of weeks you can receive benefits.

However, there are minimum and maximum limits to the weekly benefit amount. As of 2021, the minimum weekly benefit amount is $40, and the maximum weekly benefit amount is $450. These amounts are subject to change each year based on the state’s average weekly wage.

In addition to the weekly benefit amount, you may also be eligible for additional benefits, such as the Federal Pandemic Unemployment Compensation (FPUC) program, which provides an extra $300 per week to eligible individuals.

It’s important to note that unemployment benefits are taxable income, and you will receive a Form 1099-G at the end of the year to report the benefits you received. You may choose to have taxes withheld from your benefits or make estimated tax payments to avoid owing a large tax bill at the end of the year.

Overall, calculating unemployment benefits in California involves considering your earnings during the base period and applying a formula to determine your weekly benefit amount. It’s important to understand the eligibility requirements and any additional benefits that may be available to you.

Question-answer:

Can I receive unemployment benefits in California if I get fired?

Yes, you may be eligible for unemployment benefits in California even if you get fired. However, there are certain conditions that need to be met in order to qualify for benefits.

What are the conditions to receive unemployment benefits in California if you get fired?

In order to receive unemployment benefits in California if you get fired, you must have been let go from your job through no fault of your own. This means that if you were fired due to misconduct or violation of company policies, you may not be eligible for benefits.

How much money can I receive in unemployment benefits if I get fired in California?

The amount of money you can receive in unemployment benefits if you get fired in California depends on your previous earnings. The maximum weekly benefit amount is currently $450, but this amount can vary based on your earnings during the base period.

What should I do if I get fired and want to apply for unemployment benefits in California?

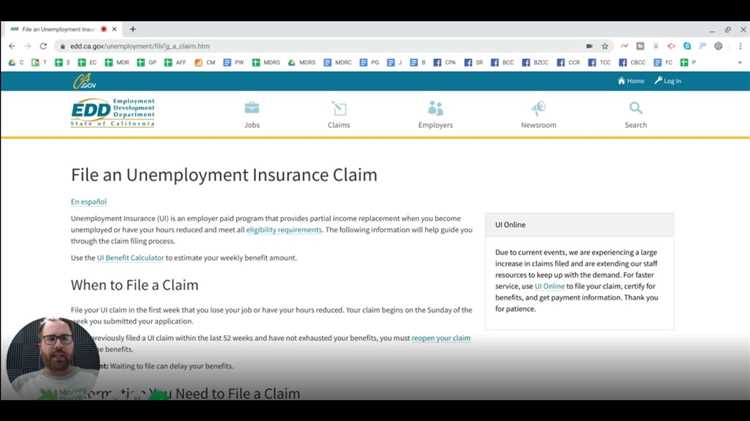

If you get fired and want to apply for unemployment benefits in California, you should file a claim with the Employment Development Department (EDD) as soon as possible. You can file a claim online or by phone, and you will need to provide information about your previous employment and the reason for your separation from your job.