- Can You Set Up a Bank Account for Someone Else? All You Need to Know

- Section 1: Legal Considerations

- Understanding the Legalities

- Power of Attorney

- Joint Bank Accounts

- Section 2: Practical Steps

- Question-answer:

- Can I set up a bank account for someone else?

- What documents do I need to set up a bank account for someone else?

- Can I set up a bank account for my child?

- What are the benefits of setting up a bank account for someone else?

Setting up a bank account for someone else can be a helpful and convenient way to manage their finances. Whether you are assisting a family member, a friend, or a business partner, it is important to understand the process and requirements involved. This article will guide you through the necessary steps and provide you with all the information you need to know.

Firstly, it is important to determine the type of account you want to open for the individual. There are various options available, such as a checking account, savings account, or even a joint account. Each type of account has its own benefits and limitations, so it is crucial to choose the one that best suits the person’s needs and financial goals.

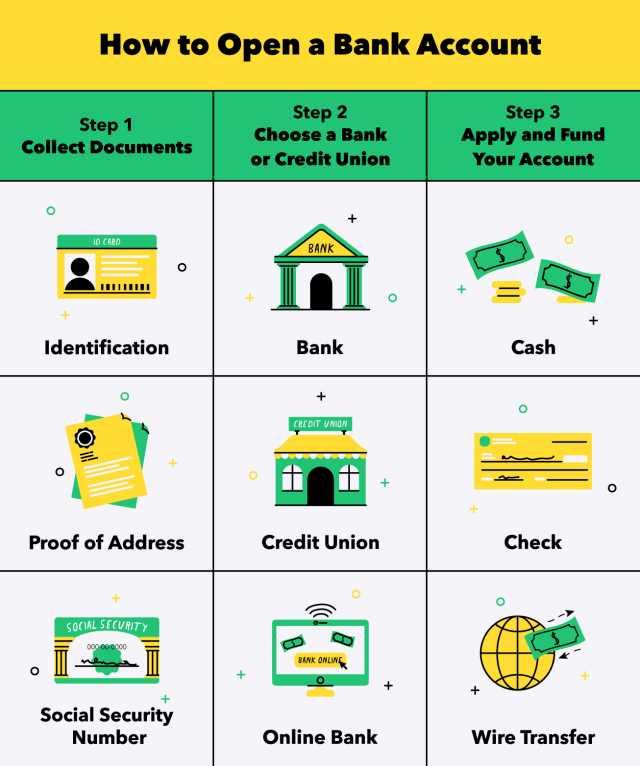

Secondly, you will need to gather the necessary documentation. This typically includes the person’s identification documents, such as a passport or driver’s license, as well as proof of address, such as a utility bill or bank statement. Additionally, you may be required to provide additional documentation depending on the bank’s policies and regulations.

Next, you will need to visit the bank in person to initiate the account opening process. It is important to bring all the required documentation and any additional paperwork that may be necessary. During the visit, you will be asked to fill out application forms and provide relevant information about the individual, such as their name, date of birth, and social security number.

Finally, once the account is set up, it is important to educate the individual about the account’s features, such as online banking, debit card usage, and any fees or charges associated with the account. It is also crucial to emphasize the importance of responsible financial management and security measures, such as keeping personal information confidential and regularly monitoring the account for any suspicious activity.

Can You Set Up a Bank Account for Someone Else? All You Need to Know

Setting up a bank account for someone else can be a helpful and convenient way to manage their finances. Whether you are assisting an elderly parent, a child, or a friend, there are a few important things you need to know before proceeding.

Legal Considerations

Before setting up a bank account for someone else, it is crucial to understand the legalities involved. There are two common options to consider: power of attorney and joint bank accounts.

Power of Attorney

A power of attorney is a legal document that grants someone else the authority to act on behalf of another person. This can include managing their finances, including setting up and managing a bank account. However, it is important to note that the power of attorney must be granted by the account holder while they are still mentally capable of making such decisions.

Joint Bank Accounts

Another option is to set up a joint bank account with the person you are assisting. This allows both parties to have access to the account and manage it together. However, it is important to carefully consider the implications of a joint bank account, as both parties will have equal control and responsibility for the account.

Practical Steps

Once you have considered the legal aspects, there are a few practical steps to follow when setting up a bank account for someone else:

| 1. Choose the Right Bank | Research different banks and their account options to find the best fit for the person you are assisting. Consider factors such as fees, accessibility, and customer service. |

| 2. Gather the Necessary Documents | Typically, you will need to provide identification documents for both yourself and the person you are assisting. This may include passports, driver’s licenses, or social security cards. |

| 3. Visit the Bank | Make an appointment or visit the bank in person to start the account opening process. Bring all the necessary documents and be prepared to answer any questions the bank may have. |

| 4. Complete the Application | Fill out the account application form, providing accurate information for both yourself and the person you are assisting. Double-check all the details before submitting the application. |

| 5. Fund the Account | Once the account is open, you will need to deposit funds into it. This can be done through a cash deposit, check, or electronic transfer from another account. |

| 6. Set Up Online Banking | Take advantage of online banking services to easily manage the account, monitor transactions, and set up automatic payments if needed. |

Setting up a bank account for someone else can be a beneficial way to assist them with their financial needs. By understanding the legal considerations and following the practical steps, you can ensure a smooth and successful account setup process.

Section 1: Legal Considerations

When it comes to setting up a bank account for someone else, there are several legal considerations that need to be taken into account. It is important to understand the legalities involved to ensure that you are acting within the boundaries of the law.

One of the key legal considerations is the concept of power of attorney. Power of attorney is a legal document that grants someone the authority to act on behalf of another person. This means that if you want to set up a bank account for someone else, you will need to have the legal authority to do so.

Another option to consider is opening a joint bank account. A joint bank account allows two or more individuals to have equal access and control over the funds in the account. This can be a good option if you want to set up a bank account for someone else but do not have power of attorney.

| Legal Considerations | Explanation |

|---|---|

| Power of Attorney | A legal document granting authority to act on behalf of another person. |

| Joint Bank Accounts | An account that allows multiple individuals to have equal access and control over the funds. |

It is important to consult with a legal professional to fully understand the legal considerations and options available when setting up a bank account for someone else. They can provide guidance and ensure that you are following the proper legal procedures.

Understanding the Legalities

When it comes to setting up a bank account for someone else, it is important to understand the legalities involved. There are certain considerations that need to be taken into account to ensure that the process is done correctly and legally.

One of the key legal considerations is the concept of power of attorney. This is a legal document that grants someone the authority to act on behalf of another person. In the context of setting up a bank account, having power of attorney allows you to open and manage the account on behalf of the other person.

Another option to consider is opening a joint bank account. This involves adding the other person’s name to your existing bank account, giving them access and control over the account. However, it is important to note that this option comes with certain risks, as both parties have equal rights and responsibilities for the account.

It is crucial to consult with a legal professional to fully understand the legalities and implications of setting up a bank account for someone else. They can provide guidance on the best approach based on your specific situation and ensure that all necessary legal requirements are met.

| Pros | Cons |

|---|---|

| Allows you to manage the account on behalf of the other person | Requires legal documentation and processes |

| Provides a convenient way to handle financial matters for someone else | May have limitations on the types of transactions you can perform |

| Can be useful for elderly or incapacitated individuals | Requires trust and responsibility |

Overall, understanding the legalities of setting up a bank account for someone else is crucial to ensure that the process is done correctly and legally. By considering options such as power of attorney or joint bank accounts, you can find the best approach that suits your specific situation and meets all necessary legal requirements.

Power of Attorney

When setting up a bank account for someone else, one option to consider is obtaining a power of attorney. A power of attorney is a legal document that grants someone else the authority to act on your behalf. This means that the person with the power of attorney can open and manage a bank account for you.

There are different types of power of attorney, including general and specific. A general power of attorney gives broad authority to the designated person, allowing them to handle various financial matters, including setting up a bank account. A specific power of attorney, on the other hand, grants limited authority for a specific purpose, such as opening a bank account.

It’s important to note that the power of attorney must be properly executed and recognized by the bank. This typically involves signing the document in the presence of a notary public or other authorized individual. The bank may also require additional documentation, such as proof of identification for both the account holder and the person with the power of attorney.

Before granting someone power of attorney, it’s crucial to carefully consider the implications and potential risks. You should only choose someone you trust implicitly, as they will have significant control over your financial affairs. It’s also advisable to consult with a legal professional to ensure that the power of attorney is drafted correctly and meets your specific needs.

Once the power of attorney is in place, the designated person can visit the bank and provide the necessary documentation to open a bank account on your behalf. They will need to present the power of attorney document, along with any additional identification or paperwork required by the bank.

It’s important to maintain open communication with the person holding the power of attorney and regularly review the activity on the bank account. This will help ensure that the account is being managed responsibly and in accordance with your wishes.

Setting up a bank account for someone else through a power of attorney can be a convenient option, especially for individuals who are unable to manage their own financial affairs. However, it’s essential to approach this process with caution and seek professional advice to protect your interests.

Joint Bank Accounts

Setting up a joint bank account can be a convenient option for individuals who want to share financial responsibilities with someone else. Whether it’s a spouse, family member, or business partner, a joint bank account allows both parties to have equal access and control over the funds.

When setting up a joint bank account, it’s important to consider a few key factors. First, you’ll need to choose the right type of joint account. There are two common types: joint tenants with rights of survivorship (JTWROS) and tenants in common (TIC).

With a JTWROS account, both parties have an equal share of the funds, and in the event of one person’s death, the remaining funds automatically transfer to the surviving account holder. This type of account is commonly used by married couples or partners who want to ensure that the surviving spouse or partner has immediate access to the funds.

On the other hand, a TIC account allows each account holder to have a specific percentage of ownership over the funds. In the event of one person’s death, their share of the funds will be distributed according to their will or state laws. This type of account is often used by business partners or individuals who want to maintain separate ownership of their funds.

Once you’ve chosen the type of joint account, you’ll need to visit the bank together with the other account holder. Both parties will need to provide identification documents, such as a driver’s license or passport, and complete the necessary paperwork. The bank will also require both parties to sign a joint account agreement, which outlines the terms and conditions of the account.

It’s important to note that setting up a joint bank account means that both parties will have equal access and control over the funds. This includes the ability to withdraw money, make deposits, and manage the account online or through mobile banking. It’s crucial to establish clear communication and trust with the other account holder to ensure that both parties are on the same page regarding the use of the funds.

Section 2: Practical Steps

Setting up a bank account for someone else can be a straightforward process if you follow these practical steps:

1. Obtain the necessary documentation: To open a bank account for someone else, you will typically need their identification documents, such as a passport or driver’s license, proof of address, and social security number. Make sure to gather all the required paperwork before proceeding.

2. Choose the right bank: Research different banks and compare their account options to find the one that best suits the needs of the person you are setting up the account for. Consider factors such as fees, interest rates, and customer reviews.

3. Visit the bank in person: Most banks require the account holder to be present during the account opening process. Schedule a visit to the bank and bring along the person you are setting up the account for. This will ensure that all necessary signatures and identification verifications can be completed.

4. Complete the application form: Fill out the bank’s account application form accurately and provide all the required information. Double-check the form before submitting it to avoid any mistakes or delays in the account opening process.

5. Deposit funds: Depending on the bank’s requirements, you may need to make an initial deposit to activate the account. Ensure that you have the necessary funds available and follow the bank’s instructions for making the deposit.

6. Set up online banking: If the person you are setting up the account for wishes to have online banking access, inquire about the process during the account opening. The bank will provide instructions on how to set up online banking and access the account remotely.

7. Order checks and debit cards: If the account holder wants to have checks or a debit card, inquire about the process for ordering these items. The bank will provide instructions on how to request and receive checks and debit cards associated with the newly opened account.

8. Familiarize yourself with account features: Take the time to understand the account’s features and benefits, such as overdraft protection, mobile banking apps, and any additional services offered by the bank. This will allow you to provide the account holder with accurate information and guidance.

By following these practical steps, you can successfully set up a bank account for someone else. Remember to always consult with the bank directly for specific requirements and procedures, as they may vary depending on the financial institution.

Question-answer:

Can I set up a bank account for someone else?

Yes, you can set up a bank account for someone else. However, you will need to provide certain documents and meet specific requirements set by the bank.

What documents do I need to set up a bank account for someone else?

To set up a bank account for someone else, you will typically need to provide their identification documents, such as a passport or driver’s license, proof of address, and their social security number or taxpayer identification number.

Can I set up a bank account for my child?

Yes, you can set up a bank account for your child. Many banks offer special accounts for minors, and you will usually need to provide their birth certificate, your identification documents, and proof of address.

What are the benefits of setting up a bank account for someone else?

Setting up a bank account for someone else can provide them with a safe place to keep their money, teach them financial responsibility, and allow them to easily manage their finances. It can also be helpful for parents who want to monitor their child’s spending or provide them with an allowance.