- Understanding Probate in Florida

- What is Probate?

- Probate Process in Florida

- Duration of Probate in Florida

- Selling a House While in Probate in Florida

- Can You Sell a House in Probate?

- Steps to Sell a House in Probate in Florida

- Question-answer:

- What is probate?

- Can you sell a house while in probate in Florida?

- What is the process of selling a house in probate in Florida?

- How long does it take to sell a house in probate in Florida?

- What happens if a house is not sold during probate in Florida?

When a loved one passes away, their assets, including their real estate properties, go through a legal process called probate. Probate is the court-supervised process of distributing the deceased person’s assets to their beneficiaries or heirs. If you find yourself in the position of selling a house while in probate in Florida, it’s important to understand the specific rules and regulations that apply.

In Florida, selling a house while in probate is possible, but it can be a complex and time-consuming process. The first step is to determine whether the deceased person left a valid will. If there is a will, the executor named in the will is responsible for handling the probate process and selling the house. If there is no will, the court will appoint a personal representative to handle the probate process.

Once the executor or personal representative is appointed, they must obtain court approval to sell the house. This involves filing a petition with the court and providing documentation such as an appraisal of the property’s value and a proposed sales contract. The court will review the petition and determine whether the sale is in the best interest of the estate and its beneficiaries.

If the court approves the sale, the executor or personal representative can proceed with listing the house for sale. It’s important to note that the house cannot be sold until the court gives its approval. The sale must also be conducted in a fair and transparent manner, with the property being marketed and sold at a reasonable price.

Once a buyer is found and a sales contract is signed, the executor or personal representative must again seek court approval for the sale. This involves submitting the sales contract to the court for review. The court will ensure that the terms of the contract are fair and that the sale will benefit the estate and its beneficiaries.

Overall, selling a house while in probate in Florida is possible, but it requires navigating the legal process and obtaining court approval at various stages. It’s important to consult with an experienced probate attorney who can guide you through the process and ensure that all legal requirements are met.

Understanding Probate in Florida

Probate is the legal process that takes place after a person passes away. It involves the distribution of the deceased person’s assets and the resolution of any outstanding debts or claims. In Florida, probate is governed by the Florida Probate Code, which outlines the procedures and requirements for administering an estate.

When a person dies, their assets are typically held in their name alone. Probate is necessary to transfer these assets to the rightful beneficiaries or heirs. The probate process ensures that the deceased person’s debts are paid and that their assets are distributed according to their wishes or state law if there is no will.

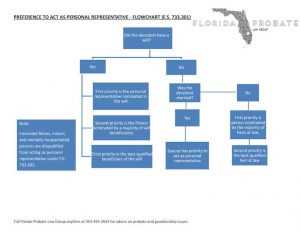

During probate, a personal representative is appointed to oversee the administration of the estate. This person is responsible for gathering the deceased person’s assets, paying any outstanding debts or taxes, and distributing the remaining assets to the beneficiaries or heirs. The personal representative has a fiduciary duty to act in the best interests of the estate and its beneficiaries.

Probate can be a complex and time-consuming process, especially if there are disputes or challenges to the will. It typically involves filing various documents with the court, notifying creditors and interested parties, and obtaining court approval for certain actions. The duration of probate in Florida can vary depending on the complexity of the estate and any challenges that arise.

It’s important to note that not all assets are subject to probate. Some assets, such as jointly owned property or assets with designated beneficiaries, may pass outside of probate. These assets can be transferred directly to the surviving joint owner or beneficiary without the need for probate.

Understanding probate in Florida is essential for anyone involved in the administration of an estate or considering selling a house while in probate. It’s important to consult with an experienced probate attorney to navigate the process and ensure compliance with Florida law.

What is Probate?

Probate is the legal process that takes place after someone passes away. It involves proving the validity of the deceased person’s will, identifying and inventorying their assets, paying off any debts or taxes owed, and distributing the remaining assets to the beneficiaries or heirs. The probate process is overseen by the court and ensures that the deceased person’s wishes are carried out and that their estate is properly settled.

During probate, the court appoints a personal representative, also known as an executor or administrator, to handle the estate’s affairs. This person is responsible for gathering all necessary documents, notifying creditors and beneficiaries, managing the estate’s assets, and ultimately distributing the assets according to the terms of the will or the state’s intestacy laws if there is no will.

Probate can be a complex and time-consuming process, as it requires various legal filings, court appearances, and the resolution of any disputes or challenges that may arise. It is important to consult with an attorney experienced in probate law to ensure that the process is carried out correctly and efficiently.

Overall, probate serves as a safeguard to protect the rights of the deceased person’s beneficiaries or heirs and to ensure that their assets are distributed fairly and in accordance with the law.

Probate Process in Florida

The probate process in Florida is the legal process by which a deceased person’s assets are distributed to their beneficiaries. It is overseen by the court and can be a complex and time-consuming process. Here are the key steps involved in the probate process in Florida:

- Filing the Petition: The first step in the probate process is to file a petition with the court. This petition initiates the probate proceedings and provides information about the deceased person, their assets, and their beneficiaries.

- Appointment of Personal Representative: The court will appoint a personal representative, also known as an executor, to administer the estate. The personal representative is responsible for managing the assets, paying debts and taxes, and distributing the remaining assets to the beneficiaries.

- Inventory and Appraisal: The personal representative is required to prepare an inventory of the deceased person’s assets and have them appraised. This is done to determine the value of the estate and ensure that all assets are accounted for.

- Notifying Creditors: The personal representative must notify any known creditors of the deceased person’s death and the probate proceedings. Creditors have a certain amount of time to file claims against the estate for any outstanding debts.

- Paying Debts and Taxes: The personal representative is responsible for paying any valid debts and taxes owed by the estate. This includes funeral expenses, outstanding bills, and any estate or income taxes.

- Distributing Assets: Once all debts and taxes have been paid, the personal representative can distribute the remaining assets to the beneficiaries according to the terms of the deceased person’s will or the state’s intestacy laws if there is no will.

- Closing the Estate: After all assets have been distributed and all necessary paperwork has been filed, the personal representative can petition the court to close the estate. Once the court approves the petition, the probate process is complete.

It is important to note that the probate process can vary depending on the complexity of the estate and any disputes that may arise. It is recommended to seek the guidance of an experienced probate attorney to navigate the process effectively.

Duration of Probate in Florida

The duration of probate in Florida can vary depending on several factors. In general, the probate process can take anywhere from several months to a year or more to complete. The length of time it takes to complete probate can be influenced by factors such as the complexity of the estate, the number of beneficiaries involved, and any disputes or challenges that may arise during the process.

One of the first steps in the probate process is the appointment of a personal representative, also known as an executor or administrator, who is responsible for managing the estate and overseeing the probate process. Once appointed, the personal representative must gather and inventory the assets of the estate, pay any outstanding debts or taxes, and distribute the remaining assets to the beneficiaries according to the terms of the will or the laws of intestacy if there is no will.

The personal representative must also notify creditors and potential heirs of the probate proceedings and give them an opportunity to make any claims against the estate. This can add additional time to the probate process, especially if there are disputes or challenges to the validity of the will or the distribution of assets.

In some cases, the probate process can be expedited if the estate qualifies for a simplified probate procedure. This may be available for smaller estates or estates where the assets are primarily held in a revocable living trust. The simplified probate process can help to shorten the duration of probate and reduce the costs associated with the process.

It is important to note that the duration of probate can also be affected by the efficiency of the personal representative and the cooperation of the beneficiaries. Delays can occur if there are disagreements or conflicts among the parties involved, or if there are challenges to the actions of the personal representative.

Selling a House While in Probate in Florida

When a person passes away and leaves behind a property, the process of transferring ownership to the rightful heirs or beneficiaries is known as probate. Probate is a legal process that ensures the deceased person’s debts are paid and their assets are distributed according to their will or the state’s intestacy laws.

During the probate process in Florida, it is possible to sell a house that is part of the deceased person’s estate. However, there are certain steps and requirements that need to be followed.

The first step is to determine who has the authority to sell the house. This is usually determined by the deceased person’s will or by the court if there is no will. The personal representative or executor of the estate is typically responsible for handling the sale of the house.

Once the personal representative has been appointed, they must obtain the necessary court approval to sell the house. This involves filing a petition with the court and providing documentation such as an appraisal of the property’s value and a proposed sales contract.

After obtaining court approval, the personal representative can proceed with listing the house for sale. It is important to note that the house must be marketed and sold at fair market value to ensure the best interests of the estate and its beneficiaries are protected.

When a potential buyer is found, the personal representative must obtain another court approval for the sale. This involves submitting the proposed sales contract to the court for review and approval. The court will ensure that the terms of the sale are fair and in the best interests of the estate.

Once the court approves the sale, the personal representative can proceed with closing the sale. The proceeds from the sale will be used to pay off any outstanding debts of the estate and distribute the remaining funds to the beneficiaries.

It is important to note that selling a house while in probate can be a complex process. It is recommended to seek the guidance of an experienced probate attorney to ensure all legal requirements are met and the sale is conducted properly.

Can You Sell a House in Probate?

When a person passes away and leaves behind a property, the property usually goes through a legal process called probate. During probate, the court oversees the distribution of the deceased person’s assets, including their real estate property. Many people wonder if it is possible to sell a house while it is in probate in Florida.

The answer is yes, you can sell a house while it is in probate in Florida. However, there are certain steps and requirements that need to be followed in order to do so.

First, it is important to determine who has the authority to sell the house. This is usually determined by the deceased person’s will or by the court-appointed personal representative. The personal representative is responsible for managing the probate process and has the authority to sell the house.

Next, it is necessary to obtain court approval for the sale of the house. This involves filing a petition with the court and providing all necessary documentation, such as a copy of the sales contract and an appraisal of the property. The court will review the petition and determine if the sale is in the best interest of the estate.

Once court approval is obtained, the next step is to market the property and find a buyer. It is important to disclose to potential buyers that the property is in probate. This can sometimes deter buyers, but there are also investors and buyers who specialize in purchasing probate properties.

After finding a buyer, the sale of the house can proceed like any other real estate transaction. The personal representative will work with the buyer’s agent and the court to finalize the sale. The proceeds from the sale will be used to pay off any debts or expenses of the estate, and the remaining funds will be distributed to the beneficiaries according to the terms of the will or the court’s instructions.

It is important to note that selling a house in probate can be a complex process, and it is recommended to seek the guidance of an experienced probate attorney or real estate professional. They can help navigate the legal requirements and ensure a smooth and successful sale.

Steps to Sell a House in Probate in Florida

When it comes to selling a house in probate in Florida, there are several important steps that need to be followed. These steps ensure that the sale of the property is done legally and efficiently. Here is a breakdown of the process:

- Obtain court approval: Before selling a house in probate, you need to obtain court approval. This involves filing a petition with the court and providing all necessary documentation, such as the will, death certificate, and inventory of assets.

- Appoint a personal representative: The court will appoint a personal representative to oversee the probate process. This person will have the authority to sell the house on behalf of the estate.

- Get a professional appraisal: It is important to get a professional appraisal of the house to determine its fair market value. This will help you set an appropriate asking price for the property.

- List the property for sale: Once you have court approval and a fair market value for the house, you can list it for sale. You can work with a real estate agent or sell it on your own.

- Market the property: To attract potential buyers, you need to market the property effectively. This can include online listings, signage, open houses, and advertising.

- Negotiate and accept an offer: When you receive an offer on the house, you can negotiate the terms and conditions with the buyer. Once both parties agree, you can accept the offer.

- Obtain court confirmation: After accepting an offer, you need to obtain court confirmation. This involves presenting the accepted offer to the court for approval.

- Complete the sale: Once the court confirms the sale, you can proceed with the closing process. This includes transferring the title, paying off any outstanding debts or taxes, and distributing the proceeds to the beneficiaries.

It is important to note that the probate process can be complex and time-consuming. It is recommended to work with an experienced probate attorney who can guide you through the process and ensure that all legal requirements are met.

By following these steps, you can successfully sell a house in probate in Florida and ensure a smooth and efficient transaction.

Question-answer:

What is probate?

Probate is the legal process of administering the estate of a deceased person. It involves proving the validity of the will, identifying and inventorying the deceased person’s property, paying debts and taxes, and distributing the remaining assets to the beneficiaries.

Can you sell a house while in probate in Florida?

Yes, you can sell a house while in probate in Florida. However, there are certain steps and requirements that need to be followed. The sale must be approved by the court, and the proceeds from the sale will be used to pay off any outstanding debts and distribute the remaining assets to the beneficiaries.

What is the process of selling a house in probate in Florida?

The process of selling a house in probate in Florida involves several steps. First, the personal representative of the estate must obtain permission from the court to sell the property. Then, the property must be appraised and listed for sale. Once a buyer is found, the sale must be approved by the court. Finally, the proceeds from the sale are used to pay off any debts and distribute the remaining assets to the beneficiaries.

How long does it take to sell a house in probate in Florida?

The length of time it takes to sell a house in probate in Florida can vary depending on various factors, such as the complexity of the estate and the court’s schedule. On average, the process can take anywhere from a few months to a year or more.

What happens if a house is not sold during probate in Florida?

If a house is not sold during probate in Florida, it will typically be distributed to the beneficiaries according to the terms of the will or the state’s intestacy laws. The beneficiaries may choose to keep the property or sell it at a later date.