- Can You Have Both a Will and a Living Trust?

- Understanding Your Estate Planning Options

- The Difference Between a Will and a Living Trust

- The Benefits of Having Both a Will and a Living Trust

- Factors to Consider When Deciding Between a Will and a Living Trust

- Question-answer:

- What is a will?

- What is a living trust?

- Can I have both a will and a living trust?

- What are the advantages of having a living trust?

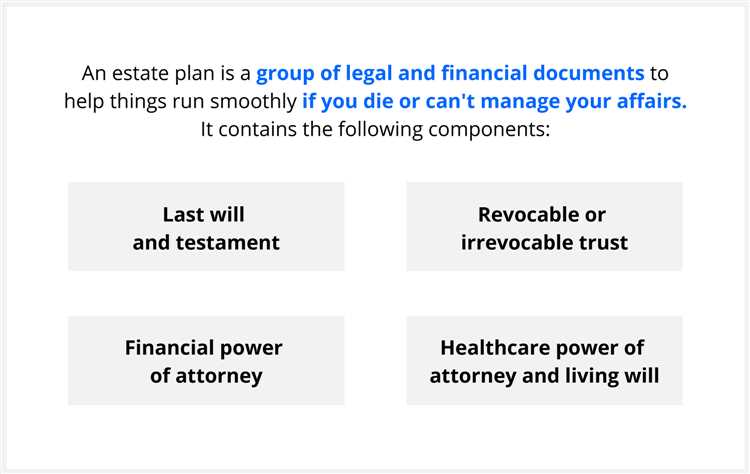

When it comes to estate planning, many people wonder if they can have both a will and a living trust. The answer is yes, and in fact, it is quite common for individuals to have both of these legal documents in place. Each document serves a different purpose and can work together to ensure that your wishes are carried out and your assets are protected.

A will is a legal document that outlines how you want your assets to be distributed after your death. It allows you to name beneficiaries, appoint an executor to handle your estate, and specify any other wishes you may have, such as guardianship for minor children. A will goes into effect after your death and must go through the probate process, which can be time-consuming and costly.

A living trust, on the other hand, is a legal entity that holds your assets during your lifetime and allows for the seamless transfer of those assets to your beneficiaries after your death. Unlike a will, a living trust avoids probate, which can save time and money for your loved ones. Additionally, a living trust can provide for the management of your assets if you become incapacitated, ensuring that your financial affairs are taken care of.

So, why would you want both a will and a living trust? The answer lies in the fact that a will can cover any assets that are not included in your living trust. For example, if you acquire new assets after creating your living trust and do not transfer them into the trust, a will can ensure that those assets are still distributed according to your wishes. Additionally, a will can serve as a backup plan in case any assets are inadvertently left out of your living trust.

Can You Have Both a Will and a Living Trust?

When it comes to estate planning, many people wonder if they can have both a will and a living trust. The answer is yes, it is possible to have both. In fact, having both a will and a living trust can provide added protection and flexibility for your assets and beneficiaries.

A will is a legal document that outlines your wishes for the distribution of your assets after your death. It allows you to name an executor who will be responsible for carrying out your wishes and ensures that your assets are distributed according to your instructions. A will also allows you to name guardians for any minor children you may have.

A living trust, on the other hand, is a legal entity that holds your assets during your lifetime and allows for the seamless transfer of those assets to your beneficiaries after your death. Unlike a will, a living trust does not go through probate, which can be a lengthy and costly process. It also provides privacy, as the details of your estate are not made public.

So, why would you want to have both a will and a living trust? One reason is that a will can be used to cover any assets that are not included in your living trust. For example, if you acquire new assets after creating your living trust and forget to transfer them into the trust, a will can ensure that those assets are still distributed according to your wishes.

Additionally, a will can be used to name guardians for any minor children you may have. While a living trust can provide for the financial needs of your children, it does not address the issue of guardianship. By having both a will and a living trust, you can ensure that all aspects of your estate plan are covered.

It’s important to note that having both a will and a living trust can add complexity to your estate plan. It’s essential to work with an experienced estate planning attorney who can help you navigate the legal requirements and ensure that your wishes are properly documented.

Understanding Your Estate Planning Options

When it comes to estate planning, it’s important to understand your options. Two common options are a will and a living trust. While both serve the purpose of distributing your assets after your death, they have some key differences.

A will is a legal document that outlines your wishes for the distribution of your assets and the care of any minor children. It goes into effect after your death and is subject to probate, which is the legal process of validating the will and distributing your assets. A will allows you to name an executor who will be responsible for carrying out your wishes.

A living trust, on the other hand, is a legal entity that holds your assets during your lifetime and allows for the seamless transfer of those assets after your death. Unlike a will, a living trust avoids probate, which can be time-consuming and costly. With a living trust, you can name yourself as the trustee and maintain control over your assets while you’re alive. You can also name a successor trustee who will take over the management of the trust after your death.

There are several factors to consider when deciding between a will and a living trust. One factor is privacy. A will becomes a public record once it goes through probate, which means anyone can access the information. A living trust, on the other hand, remains private and confidential. If privacy is a concern for you, a living trust may be the better option.

Another factor to consider is the complexity of your estate. If you have a large estate with multiple properties, businesses, or investments, a living trust may provide more flexibility and control over the distribution of your assets. A will, on the other hand, may be sufficient for smaller estates with straightforward distribution plans.

It’s also important to consider the cost and time involved in each option. While a will is generally less expensive to create, it may result in higher costs and longer timelines due to the probate process. A living trust, on the other hand, may require more upfront costs but can save time and money in the long run by avoiding probate.

Ultimately, the decision between a will and a living trust depends on your individual circumstances and goals. Consulting with an estate planning attorney can help you understand your options and make an informed decision. They can assess your assets, discuss your wishes, and guide you towards the best solution for your specific needs.

The Difference Between a Will and a Living Trust

When it comes to estate planning, two common options are a will and a living trust. While both serve the purpose of distributing your assets after your death, there are some key differences between the two.

A will is a legal document that outlines your wishes regarding the distribution of your assets and the care of any minor children. It becomes effective upon your death and is subject to probate, which is the legal process of validating the will and distributing your assets according to your wishes. A will allows you to name an executor who will be responsible for carrying out your wishes and settling your estate.

A living trust, on the other hand, is a legal entity that holds your assets during your lifetime and allows for the seamless transfer of those assets upon your death. With a living trust, you can name yourself as the trustee and maintain control over your assets. You can also name a successor trustee who will take over the management of the trust after your death or incapacity. Unlike a will, a living trust avoids probate, which can be a lengthy and costly process.

One of the main benefits of a living trust is privacy. Unlike a will, which becomes a public record upon probate, a living trust allows for the private distribution of your assets. This can be particularly important if you have complex or sensitive assets that you wish to keep confidential.

Another difference between a will and a living trust is the ability to plan for incapacity. A will only becomes effective upon your death, so it does not provide any provisions for managing your assets or making healthcare decisions if you become incapacitated. A living trust, on the other hand, can include provisions for the management of your assets and healthcare decisions in the event of your incapacity.

It’s important to note that both a will and a living trust can be valuable estate planning tools, and in some cases, it may be beneficial to have both. A will can be used to address any assets that are not included in the living trust, such as personal belongings or assets acquired after the creation of the trust. Additionally, a will can be used to name a guardian for any minor children, which cannot be done through a living trust.

Ultimately, the decision between a will and a living trust will depend on your individual circumstances and goals. Consulting with an estate planning attorney can help you determine the best option for your specific needs.

The Benefits of Having Both a Will and a Living Trust

When it comes to estate planning, having both a will and a living trust can provide numerous benefits. While each document serves a different purpose, they can work together to ensure that your assets are protected and distributed according to your wishes.

One of the main benefits of having both a will and a living trust is that it allows for flexibility in estate planning. A will is a legal document that outlines your wishes for the distribution of your assets after your death. It allows you to name beneficiaries, specify how your assets should be divided, and appoint an executor to carry out your wishes.

On the other hand, a living trust is a legal entity that holds your assets during your lifetime and allows for the seamless transfer of those assets to your beneficiaries after your death. By placing your assets in a living trust, you can avoid probate, which can be a lengthy and costly process. Additionally, a living trust can provide privacy, as it does not become part of the public record like a will does.

By having both a will and a living trust, you can ensure that all of your assets are covered. Some assets, such as retirement accounts and life insurance policies, cannot be placed in a living trust. These assets can be designated in your will to ensure they are distributed according to your wishes.

Another benefit of having both a will and a living trust is that it allows for the possibility of incapacitation. A living trust can include provisions for the management of your assets in the event that you become unable to do so yourself. This can provide peace of mind knowing that your assets will be taken care of and managed according to your wishes.

Having both a will and a living trust also allows for greater control over your estate. With a will, you can specify how your assets should be distributed and appoint guardians for minor children. With a living trust, you can provide detailed instructions for the management and distribution of your assets, including any conditions or restrictions you may have.

Factors to Consider When Deciding Between a Will and a Living Trust

When it comes to estate planning, deciding between a will and a living trust can be a difficult decision. Both options have their advantages and disadvantages, and it’s important to carefully consider your individual circumstances before making a choice. Here are some factors to consider when deciding between a will and a living trust:

1. Complexity of your assets:

If you have a complex estate with multiple properties, investments, or business interests, a living trust may be a better option. A living trust allows for more flexibility in managing and distributing these assets, while a will may require probate, which can be time-consuming and costly.

2. Privacy:

If you value privacy and want to keep your estate affairs confidential, a living trust may be the way to go. Unlike a will, which becomes a public record after probate, a living trust allows for the transfer of assets privately and without court involvement.

3. Incapacity planning:

If you’re concerned about what would happen if you become incapacitated and unable to manage your own affairs, a living trust can provide a solution. With a living trust, you can appoint a successor trustee who can step in and manage your assets on your behalf, ensuring that your financial affairs are taken care of.

4. Cost:

While a will is generally less expensive to set up than a living trust, it’s important to consider the potential costs associated with probate. Probate fees can vary depending on the complexity of your estate and the state you live in. In some cases, the cost of probate can outweigh the initial cost of setting up a living trust.

5. Flexibility:

A living trust offers more flexibility than a will when it comes to making changes or updates. With a living trust, you can easily amend or revoke the trust as your circumstances change. On the other hand, making changes to a will may require executing a new document or adding a codicil.

6. Family dynamics:

If you have a blended family, minor children, or beneficiaries with special needs, a living trust can provide more control and protection. With a living trust, you can specify how and when your assets should be distributed, ensuring that your wishes are carried out and your loved ones are taken care of.

Ultimately, the decision between a will and a living trust depends on your individual needs and goals. It’s important to consult with an experienced estate planning attorney who can help you understand the options available to you and guide you in making the best decision for your unique circumstances.

Question-answer:

What is a will?

A will is a legal document that outlines how a person’s assets and property should be distributed after their death.

What is a living trust?

A living trust is a legal document that allows a person to transfer their assets and property into a trust during their lifetime, and then have those assets distributed to beneficiaries after their death without going through probate.

Can I have both a will and a living trust?

Yes, it is possible to have both a will and a living trust. In fact, many people choose to have both in order to cover all their bases and ensure that their assets are distributed according to their wishes.

What are the advantages of having a living trust?

There are several advantages to having a living trust. One of the main advantages is that it allows your assets to bypass probate, which can be a lengthy and expensive process. Additionally, a living trust can provide privacy, as the details of your assets and beneficiaries do not become public record like they would with a will.