- Overview of Inheritance Tax Laws in Colorado

- What is Inheritance Tax?

- Is There an Inheritance Tax in Colorado?

- How Does Inheritance Tax Work in Colorado?

- Exemptions and Tax Rates

- Question-answer:

- What is inheritance tax?

- How much can you inherit tax-free in Colorado?

- Are there any exceptions to the inheritance tax laws in Colorado?

- What happens if I inherit property from someone who lived in a different state?

When a loved one passes away, dealing with the legal and financial aspects of their estate can be overwhelming. One important consideration is the inheritance tax, which is the tax imposed on the transfer of assets from the deceased to their beneficiaries. In Colorado, understanding the inheritance tax laws is crucial to ensure that you are aware of your rights and obligations.

Colorado is one of the few states in the United States that does not impose an inheritance tax. This means that beneficiaries in Colorado can inherit assets tax-free, without having to pay any state-level taxes on the transferred assets. However, it is important to note that this exemption only applies to state-level taxes, and federal estate taxes may still apply depending on the value of the estate.

While Colorado does not have an inheritance tax, it is important to understand the federal estate tax laws. The federal estate tax is a tax imposed on the transfer of assets from a deceased person’s estate to their beneficiaries. Currently, the federal estate tax exemption is set at $11.7 million per individual, meaning that estates valued below this threshold are not subject to federal estate taxes.

It is also worth noting that Colorado has its own laws regarding probate and estate administration. Probate is the legal process through which a deceased person’s assets are distributed to their beneficiaries. Understanding the probate process in Colorado can help ensure a smooth and efficient transfer of assets, while minimizing any potential tax implications.

Overview of Inheritance Tax Laws in Colorado

When it comes to inheritance tax laws, Colorado has some specific regulations in place. Inheritance tax is a tax that is imposed on the transfer of property or assets from a deceased person to their heirs or beneficiaries. It is important to understand these laws to ensure that you are in compliance and to properly plan for any potential tax liabilities.

Unlike some other states, Colorado does not have an inheritance tax. This means that there is no tax imposed on the transfer of property or assets to heirs or beneficiaries. However, it is important to note that there is still a federal estate tax that may apply depending on the value of the estate.

The federal estate tax is a tax that is imposed on the transfer of property or assets from a deceased person’s estate to their heirs or beneficiaries. In 2021, the federal estate tax exemption is $11.7 million per individual. This means that if the value of the estate is below this threshold, no federal estate tax will be owed.

It is also important to note that Colorado does have a gift tax. The gift tax is a tax that is imposed on the transfer of property or assets from one person to another during their lifetime. However, there are certain exemptions and exclusions that may apply, such as the annual gift tax exclusion of $15,000 per recipient.

Overall, it is important to consult with a qualified tax professional or estate planning attorney to fully understand the inheritance tax laws in Colorado and to ensure that you are in compliance with all applicable regulations. Proper planning and understanding of these laws can help minimize any potential tax liabilities and ensure that your assets are transferred to your heirs or beneficiaries in the most efficient manner possible.

What is Inheritance Tax?

Inheritance tax, also known as estate tax or death tax, is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries. It is a tax on the right to transfer property upon death and is based on the value of the assets inherited.

The purpose of inheritance tax is to generate revenue for the government and to redistribute wealth. It is a way for the government to collect taxes on the transfer of wealth from one generation to the next. Inheritance tax laws vary from state to state, and some states have no inheritance tax at all.

Inheritance tax is different from estate tax, which is a tax on the total value of a deceased person’s estate. Estate tax is paid by the estate before it is distributed to the heirs, while inheritance tax is paid by the heirs or beneficiaries when they receive the assets.

It is important to note that inheritance tax is separate from income tax. Inheritance tax is based on the value of the assets inherited, while income tax is based on the income earned by an individual.

Overall, inheritance tax is a complex and often controversial topic. It is important for individuals to understand the inheritance tax laws in their state and to consult with a tax professional or estate planning attorney to ensure compliance and minimize tax liability.

Is There an Inheritance Tax in Colorado?

In Colorado, there is no inheritance tax. This means that when someone passes away and leaves behind an inheritance, the recipients of that inheritance do not have to pay any taxes on it to the state of Colorado.

Unlike some other states, Colorado does not impose an inheritance tax on the transfer of assets from a deceased person to their beneficiaries. This can be a significant advantage for individuals who are inheriting property or money in Colorado, as they will not have to worry about setting aside a portion of their inheritance to pay taxes.

It is important to note, however, that while Colorado does not have an inheritance tax, there is still a federal estate tax that may apply in certain cases. The federal estate tax is a tax on the transfer of property from a deceased person’s estate to their beneficiaries. However, this tax only applies to estates that exceed a certain value, which is quite high and not applicable to most individuals.

Overall, the absence of an inheritance tax in Colorado can be seen as a positive aspect for individuals who are receiving an inheritance. It allows them to receive their inheritance in full, without any additional tax burdens imposed by the state.

How Does Inheritance Tax Work in Colorado?

Inheritance tax is a tax that is imposed on the transfer of assets or property from a deceased person to their heirs or beneficiaries. However, it is important to note that Colorado does not have an inheritance tax. This means that beneficiaries in Colorado do not have to pay any taxes on the assets or property they inherit.

Unlike some other states, Colorado only has an estate tax, which is a tax on the total value of a deceased person’s estate. The estate tax is paid by the estate itself, not by the beneficiaries. The estate tax in Colorado is only applicable if the total value of the estate exceeds a certain threshold, which is currently set at $5.7 million.

If the value of the estate is below the threshold, no estate tax is owed. However, if the value of the estate exceeds the threshold, the estate must file a Colorado estate tax return and pay the applicable tax. The tax rates for the Colorado estate tax range from 0.8% to 16% depending on the value of the estate.

It is also worth noting that Colorado has a simplified estate tax process called the “small estate affidavit.” This process allows estates with a value of $70,000 or less to bypass the formal probate process and instead use a simplified affidavit to transfer assets to the beneficiaries.

Exemptions and Tax Rates

When it comes to inheritance tax in Colorado, there are certain exemptions and tax rates that you should be aware of. These exemptions can help reduce the amount of tax you owe or even eliminate it altogether.

One of the main exemptions in Colorado is the spousal exemption. This means that if you inherit assets from your spouse, you are exempt from paying any inheritance tax on those assets. This exemption applies regardless of the value of the assets.

Another exemption is the family exemption. This exemption allows certain family members, such as children, grandchildren, and parents, to inherit up to a certain amount tax-free. The exact amount varies depending on the relationship to the deceased and is subject to change. It’s important to check the current exemption limits to ensure you are aware of any changes.

Additionally, there is a small business exemption in Colorado. If you inherit a small business, you may be eligible for a reduced tax rate or even a complete exemption. This exemption is designed to support small businesses and encourage their continuation after the death of the owner.

It’s important to note that the tax rates for inheritance in Colorado are progressive. This means that the tax rate increases as the value of the inheritance increases. The exact tax rates can vary, so it’s essential to consult the current tax laws or seek professional advice to determine the applicable rates.

Overall, understanding the exemptions and tax rates for inheritance in Colorado is crucial to ensure you are aware of any potential tax liabilities. By taking advantage of the available exemptions and understanding the tax rates, you can minimize the amount of tax you owe and ensure a smooth transfer of assets.

Question-answer:

What is inheritance tax?

Inheritance tax is a tax imposed on the transfer of assets or property from a deceased person to their heirs or beneficiaries.

How much can you inherit tax-free in Colorado?

In Colorado, there is no inheritance tax. This means that you can inherit any amount of money or property without having to pay taxes on it.

Are there any exceptions to the inheritance tax laws in Colorado?

No, there are no exceptions to the inheritance tax laws in Colorado because there is no inheritance tax in the state.

What happens if I inherit property from someone who lived in a different state?

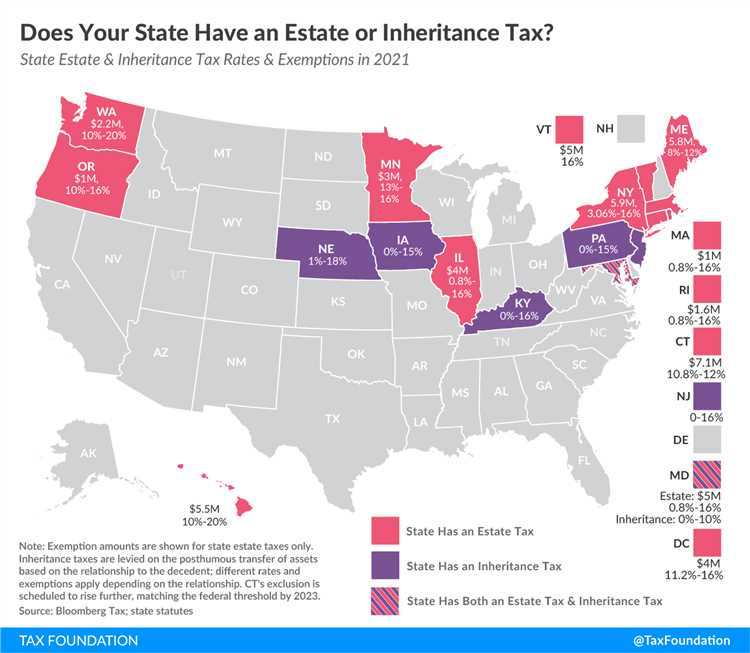

If you inherit property from someone who lived in a different state, you may be subject to the inheritance tax laws of that state. It is important to consult with a tax professional to understand the specific laws and requirements of the state where the deceased person lived.