- Can You Write Off Tools for Work?

- Exploring Tax Deductions for Work-Related Tools

- Understanding Tax Deductions

- Eligibility for Work-Related Tools Deductions

- How to Claim Work-Related Tools Deductions

- Question-answer:

- Can I deduct the cost of tools I use for work on my taxes?

- What types of tools can I write off on my taxes?

- Do I need to keep receipts for the tools I want to write off?

- Can I deduct the full cost of the tools in one year?

- What if I use the tools for personal use as well as for work?

- Can I deduct the cost of tools I use for work on my taxes?

- What types of tools can I write off on my taxes?

When it comes to tax deductions, many people are aware of the common expenses that can be claimed, such as home office expenses or business travel. However, one area that often goes overlooked is the ability to write off tools used for work. Whether you’re a carpenter, a mechanic, or an artist, the tools you use for your job can be a significant investment. The good news is that in many cases, these tools can be deducted from your taxes, potentially saving you a substantial amount of money.

Before you start claiming every tool you own as a tax deduction, it’s important to understand the rules and limitations. The IRS has specific guidelines for what qualifies as a deductible work-related tool. Generally, a tool must be necessary for your job and used exclusively for work purposes. For example, if you’re a plumber, the wrenches and pipe cutters you use on the job would likely qualify. However, if you also use those tools for personal projects around the house, they may not be eligible for a deduction.

It’s also important to note that not all tools are eligible for a tax deduction. The IRS distinguishes between tools that have a lifespan of less than one year and those that have a longer lifespan. Tools with a shorter lifespan, such as disposable gloves or paintbrushes, are considered consumable supplies and can be deducted in the year they were purchased. On the other hand, tools with a longer lifespan, such as power tools or computer equipment, must be depreciated over time.

When it comes to claiming the deduction, you’ll need to keep detailed records of your tool purchases and their use for work. This includes receipts, invoices, and any other documentation that proves the expense was necessary and exclusively for work purposes. It’s also a good idea to consult with a tax professional to ensure you’re following all the necessary guidelines and maximizing your deductions.

So, if you’re a professional who relies on tools to do your job, don’t overlook the potential tax savings. By understanding the rules and keeping accurate records, you may be able to write off your work-related tools and reduce your tax liability. It’s just one more way to make the most of your hard-earned money.

Can You Write Off Tools for Work?

When it comes to tax deductions, one question that often arises is whether you can write off tools for work. The answer to this question depends on several factors, including the nature of your work and the specific tools you are using.

In general, if you are using tools for work and they are necessary for you to perform your job, you may be able to deduct the cost of those tools from your taxes. However, there are some important considerations to keep in mind.

Firstly, the tools must be used solely for work-related purposes. If you also use them for personal use, you may not be eligible for the deduction. It’s important to keep detailed records of how and when you use your tools to ensure that you can prove their work-related use.

Secondly, the tools must be considered ordinary and necessary for your line of work. This means that they must be commonly used in your industry and essential for you to perform your job effectively. For example, if you are a carpenter, the cost of your hammer and saw would likely be deductible, as they are essential tools for your trade.

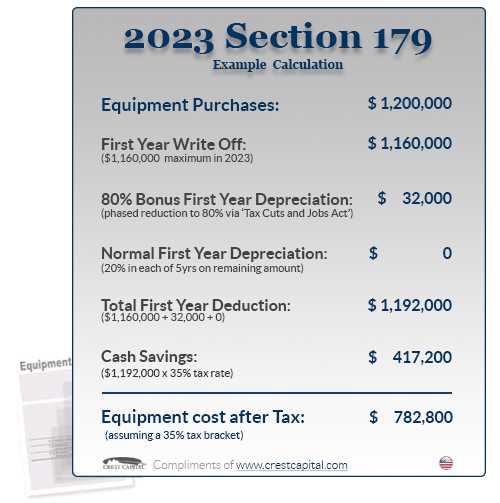

It’s also worth noting that the cost of tools can be deducted in different ways. You may be able to deduct the full cost of the tools in the year of purchase, or you may need to depreciate the cost over several years. The specific rules for deducting tools can vary, so it’s important to consult with a tax professional or refer to the IRS guidelines for more information.

Exploring Tax Deductions for Work-Related Tools

When it comes to tax deductions, one area that many people overlook is work-related tools. If you use tools for your job, you may be eligible to claim a deduction on your taxes. However, it’s important to understand the rules and regulations surrounding this deduction to ensure you are eligible and to maximize your savings.

First and foremost, it’s important to determine if the tools you use for work are considered deductible expenses. In general, work-related tools are items that are necessary for you to perform your job duties. This can include anything from a computer or software to specialized equipment or tools specific to your industry.

Once you have determined that your tools are eligible for a deduction, you will need to keep detailed records of your expenses. This includes receipts, invoices, and any other documentation that proves the cost of the tools. It’s important to keep these records organized and easily accessible in case of an audit.

When claiming a deduction for work-related tools, you have two options: you can either deduct the full cost of the tools in the year of purchase or you can depreciate the cost over a number of years. The option you choose will depend on your individual circumstances and financial goals.

If you choose to deduct the full cost of the tools in the year of purchase, you will need to use Form 4562 to report the deduction on your tax return. This form allows you to claim the deduction and provide details about the tools and their cost.

If you choose to depreciate the cost of the tools over a number of years, you will need to use Form 4562 as well. This form allows you to calculate the depreciation expense and spread it out over the useful life of the tools.

It’s important to note that there are certain limitations and restrictions when it comes to deducting work-related tools. For example, the tools must be used solely for work purposes and not for personal use. Additionally, if your employer reimburses you for the cost of the tools, you may not be eligible for a deduction.

Understanding Tax Deductions

When it comes to tax deductions, it’s important to understand how they work and what expenses are eligible. Tax deductions are expenses that can be subtracted from your taxable income, reducing the amount of tax you owe. This can result in significant savings for individuals and businesses.

However, not all expenses are eligible for tax deductions. The Internal Revenue Service (IRS) has specific rules and guidelines regarding what expenses can be deducted. In the case of work-related tools, they must meet certain criteria to be considered eligible for a tax deduction.

Firstly, the tools must be necessary for your job. This means that they must be directly related to the work you do and be required for you to perform your job effectively. For example, if you are a carpenter, the tools you use, such as hammers, saws, and drills, would be considered necessary for your job.

Secondly, the tools must be used exclusively for work purposes. This means that you cannot use them for personal use or any other non-work-related activities. If you use the tools for both work and personal use, you may only be able to deduct a portion of the expense.

Thirdly, the tools must be ordinary and necessary for your job. This means that they must be commonly used in your industry and essential for you to perform your job duties. For example, if you are a graphic designer, a computer and design software would be considered ordinary and necessary tools for your job.

It’s important to keep detailed records of your work-related tool expenses, including receipts and invoices. This will help you accurately calculate the amount you can deduct and provide evidence in case of an audit by the IRS.

When claiming a tax deduction for work-related tools, you will need to itemize your deductions on your tax return using Schedule A. This means that you will need to provide a detailed list of your expenses, including the cost of each tool and any other related expenses.

Eligibility for Work-Related Tools Deductions

When it comes to claiming tax deductions for work-related tools, it’s important to understand the eligibility criteria. The Internal Revenue Service (IRS) has specific guidelines that determine whether or not you can write off the cost of tools used for work purposes.

First and foremost, the tools you are looking to deduct must be used solely for work-related activities. This means that if you use the tools for personal use as well, you may not be eligible for the deduction. The IRS requires that the tools be necessary for your job and directly related to the work you perform.

Additionally, the tools must be considered “ordinary and necessary” for your specific line of work. This means that they must be commonly used in your industry and essential for you to perform your job effectively. For example, if you are a carpenter, the IRS would consider a hammer and a saw as ordinary and necessary tools for your trade.

It’s important to note that not all work-related tools are eligible for deductions. The IRS has specific rules regarding the depreciation of tools, which means that some tools may need to be depreciated over time rather than deducted in a single year. It’s best to consult with a tax professional or refer to IRS guidelines to determine the specific rules for the tools you are looking to deduct.

When claiming deductions for work-related tools, it’s crucial to keep detailed records and receipts. You will need to provide evidence of the cost of the tools, as well as documentation that proves they are used solely for work purposes. This can include invoices, receipts, and any other relevant documentation.

Overall, the eligibility for work-related tools deductions depends on the specific guidelines set forth by the IRS. By understanding these guidelines and keeping accurate records, you can determine if you are eligible for deductions and ensure that you are in compliance with tax laws.

How to Claim Work-Related Tools Deductions

Claiming work-related tools deductions can help you reduce your taxable income and potentially save money on your taxes. Here are the steps to follow when claiming these deductions:

- Keep detailed records: It is important to keep accurate and detailed records of all work-related tools you purchase. This includes receipts, invoices, and any other documentation that proves the purchase and cost of the tools.

- Determine eligibility: Before claiming the deductions, make sure that the tools you are claiming are eligible. Generally, work-related tools must be necessary for your job and used solely for work purposes.

- Calculate the deduction amount: To calculate the deduction amount, you will need to determine the cost of the tools and the percentage of their use for work. This can be done by dividing the total cost of the tools by the percentage of their work-related use.

- Complete the necessary forms: When filing your taxes, you will need to complete the appropriate forms to claim the work-related tools deductions. This may include Form 2106 or Form 1040 Schedule C, depending on your employment status.

- Attach supporting documentation: Along with the completed forms, you will need to attach the supporting documentation, such as receipts and invoices, to prove the purchase and cost of the tools.

- File your taxes: Once you have completed the necessary forms and attached the supporting documentation, you can file your taxes. Make sure to double-check all the information before submitting your tax return.

It is important to note that claiming work-related tools deductions may require additional documentation or proof, depending on your specific situation. Consulting with a tax professional or using tax software can help ensure that you are claiming the deductions correctly and maximizing your tax savings.

By following these steps and keeping accurate records, you can successfully claim work-related tools deductions and potentially reduce your taxable income.

Question-answer:

Can I deduct the cost of tools I use for work on my taxes?

Yes, you may be able to deduct the cost of tools you use for work on your taxes. The IRS allows for certain work-related expenses to be deducted, including the cost of tools that are necessary for your job.

What types of tools can I write off on my taxes?

You can write off the cost of tools that are necessary for your job. This can include a wide range of tools, such as power tools, hand tools, computer software, and even work-related subscriptions or memberships.

Do I need to keep receipts for the tools I want to write off?

Yes, it is important to keep receipts for the tools you want to write off. The IRS requires documentation for any expenses you claim on your taxes, so it is important to keep track of your receipts and other records related to your work-related tools.

Can I deduct the full cost of the tools in one year?

It depends on the cost of the tools and the specific tax laws in your country. In some cases, you may be able to deduct the full cost of the tools in one year. In other cases, you may need to depreciate the cost of the tools over a number of years.

What if I use the tools for personal use as well as for work?

If you use the tools for both personal and work purposes, you may still be able to deduct a portion of the cost on your taxes. However, you will need to determine the percentage of time that the tools are used for work and only deduct that portion of the cost.

Can I deduct the cost of tools I use for work on my taxes?

Yes, you may be able to deduct the cost of tools you use for work on your taxes. The IRS allows for certain work-related expenses to be deducted, including the cost of tools that are necessary for your job.

What types of tools can I write off on my taxes?

You can write off the cost of tools that are necessary for your job. This can include a wide range of tools, such as power tools, hand tools, computer software, and even work-related subscriptions or memberships.