- Can You Be the Trustee of Your Own Trust?

- Exploring the Possibilities

- Understanding Trusts

- Benefits of Being Your Own Trustee

- Considerations and Limitations

- Question-answer:

- What is a trust?

- Can I be the trustee of my own trust?

- What are the advantages of being the trustee of my own trust?

- Are there any disadvantages to being the trustee of my own trust?

- Can I name a co-trustee to help me manage my trust?

- What is a trust?

- Can I be the trustee of my own trust?

Creating a trust is a common estate planning strategy that allows individuals to protect and manage their assets for the benefit of themselves and their loved ones. One important decision that needs to be made when setting up a trust is choosing a trustee. Typically, a trustee is an individual or a professional entity responsible for managing the trust and carrying out its terms. However, many people wonder if they can be the trustee of their own trust. In this article, we will explore the possibilities and considerations of acting as your own trustee.

First and foremost, it is important to understand the role of a trustee. A trustee has a fiduciary duty to act in the best interests of the trust and its beneficiaries. This includes managing the trust assets, making investment decisions, distributing income and principal, and keeping accurate records. Being a trustee requires a certain level of financial knowledge, organizational skills, and time commitment.

So, can you be the trustee of your own trust? The answer is generally yes. In many cases, individuals choose to be the trustee of their own trust, especially if they have a revocable living trust. A revocable living trust is a popular estate planning tool that allows individuals to maintain control over their assets during their lifetime and avoid probate upon their death. By acting as the trustee of your own revocable living trust, you can retain full control over your assets and make changes to the trust as needed.

However, there are some important considerations to keep in mind. While being the trustee of your own trust offers flexibility and control, it also comes with responsibilities and potential drawbacks. As the trustee, you are personally liable for any mistakes or mismanagement of the trust assets. Additionally, if you become incapacitated or pass away, there needs to be a successor trustee in place to take over the management of the trust. It is important to carefully consider your own abilities, circumstances, and the complexity of your trust before deciding to act as your own trustee.

Can You Be the Trustee of Your Own Trust?

When it comes to managing a trust, one important question that often arises is whether or not you can be the trustee of your own trust. The answer to this question depends on the type of trust you have and the laws of your jurisdiction.

In many cases, it is possible for an individual to serve as the trustee of their own trust. This is known as a “revocable living trust” or a “grantor trust.” In this type of trust, the person who creates the trust (known as the grantor) can also serve as the trustee. This allows the grantor to maintain control over their assets and make changes to the trust as needed.

Being the trustee of your own trust can offer several benefits. First and foremost, it allows you to maintain control over your assets and make decisions about how they are managed and distributed. It also allows for flexibility, as you can make changes to the trust as your circumstances or wishes change.

However, there are also considerations and limitations to being your own trustee. One important consideration is the potential for conflicts of interest. As the trustee, you have a fiduciary duty to act in the best interests of the beneficiaries of the trust. This can sometimes create conflicts if your own interests are in conflict with those of the beneficiaries.

Additionally, being your own trustee may not be suitable for everyone. It requires a certain level of financial and legal knowledge to effectively manage a trust. If you do not feel comfortable or confident in your ability to fulfill the duties of a trustee, it may be advisable to appoint a professional trustee or co-trustee to assist you.

Exploring the Possibilities

When it comes to managing a trust, one of the key decisions you need to make is whether you can be the trustee of your own trust. This decision can have significant implications for the control and management of your assets.

Being the trustee of your own trust offers a range of possibilities. First and foremost, it allows you to maintain full control over your assets. As the trustee, you have the power to make decisions regarding the management and distribution of the trust property. This can be particularly beneficial if you have specific wishes or preferences for how your assets should be handled.

Furthermore, being your own trustee can provide you with a sense of security and peace of mind. You know that you are the one in charge of your assets and that you have the final say in any decisions related to the trust. This can be especially important if you have concerns about the competence or reliability of potential external trustees.

Another advantage of being your own trustee is the flexibility it offers. You have the freedom to adapt and modify the trust as your circumstances change. This can be particularly useful if you anticipate significant life events or changes in your financial situation. Being your own trustee allows you to easily make adjustments to the trust to ensure it continues to align with your goals and objectives.

However, it is important to note that being your own trustee also comes with certain considerations and limitations. One key consideration is the potential for conflicts of interest. As the trustee, you have a fiduciary duty to act in the best interests of the trust beneficiaries. This duty may conflict with your personal interests, and it is important to navigate these conflicts carefully to avoid any legal or ethical issues.

Additionally, being your own trustee requires a certain level of knowledge and expertise in trust administration. You need to be familiar with the legal and financial responsibilities that come with being a trustee. If you are not comfortable or confident in your ability to fulfill these duties, it may be advisable to seek professional assistance or consider appointing a co-trustee.

Understanding Trusts

A trust is a legal arrangement where a person, known as the settlor, transfers their assets to a trustee, who manages those assets for the benefit of the beneficiaries. Trusts are commonly used for estate planning purposes, as they allow individuals to control how their assets are distributed after their death.

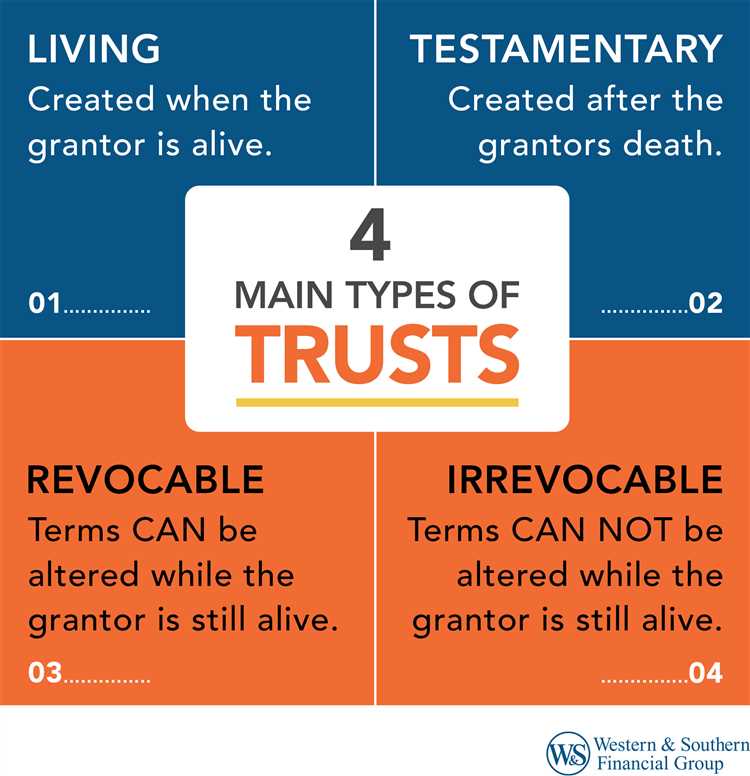

There are different types of trusts, including revocable trusts and irrevocable trusts. Revocable trusts can be changed or revoked by the settlor during their lifetime, while irrevocable trusts cannot be modified or terminated without the consent of the beneficiaries.

Trusts offer several benefits, such as asset protection, privacy, and avoiding probate. By placing assets in a trust, individuals can protect them from creditors and lawsuits. Trusts also provide privacy, as the details of the trust and its assets are not made public like they would be in a will. Additionally, assets held in a trust can bypass the probate process, which can be time-consuming and costly.

However, there are also considerations and limitations to being the trustee of your own trust. As the trustee, you have a fiduciary duty to act in the best interests of the beneficiaries. This means you must manage the trust assets prudently and make decisions that benefit the beneficiaries. If you fail to fulfill your fiduciary duty, you could be held personally liable for any losses suffered by the trust.

Furthermore, being the trustee of your own trust may limit your ability to take advantage of certain tax planning strategies. For example, if you are the trustee of a revocable trust, the assets in the trust are still considered part of your estate for tax purposes. This could result in higher estate taxes upon your death.

Benefits of Being Your Own Trustee

Being your own trustee can offer several benefits when it comes to managing your trust. Here are some advantages to consider:

1. Control:

By serving as your own trustee, you retain full control over the management and distribution of your trust assets. You can make decisions based on your own judgment and preferences, without having to rely on someone else’s decisions.

2. Flexibility:

As the trustee of your own trust, you have the flexibility to make changes to the trust document or the trust’s provisions as your circumstances or wishes change. This allows you to adapt the trust to meet your evolving needs and goals.

3. Privacy:

When you are your own trustee, you can keep your financial affairs private. Unlike when you appoint a third-party trustee, there is no need to disclose sensitive information to someone else.

4. Cost savings:

By acting as your own trustee, you can avoid paying fees to a professional trustee. This can result in significant cost savings over time, especially for long-term trusts.

5. Familiarity:

As the creator of the trust, you are likely to have a deep understanding of your assets, beneficiaries, and overall goals. Being your own trustee allows you to leverage this familiarity and make decisions that align with your intentions.

6. Speed and efficiency:

When you are the trustee of your own trust, you can make decisions quickly and efficiently, without having to wait for approval from a third party. This can be particularly beneficial in situations where time is of the essence.

7. Continuity:

By being your own trustee, you ensure that there is no disruption in the management of your trust in the event of a trustee’s resignation, incapacity, or death. This can provide peace of mind and ensure that your wishes are carried out seamlessly.

While being your own trustee offers numerous benefits, it is important to carefully consider the responsibilities and limitations that come with this role. Consulting with a legal professional can help you make an informed decision and ensure that your trust is properly managed.

Considerations and Limitations

While it is possible to be the trustee of your own trust, there are several considerations and limitations to keep in mind.

1. Legal Requirements: Being your own trustee means that you are responsible for ensuring that you comply with all legal requirements related to trusts. This includes understanding and following the laws and regulations governing trusts in your jurisdiction.

2. Fiduciary Duties: As a trustee, you have fiduciary duties to the beneficiaries of the trust. This means that you must act in their best interests and manage the trust assets prudently. It is important to understand the scope of these duties and to fulfill them diligently.

3. Objectivity: Being your own trustee may present challenges in maintaining objectivity. It can be difficult to make impartial decisions when you are also a beneficiary of the trust. It is important to be aware of this potential conflict of interest and to make decisions that are in the best interest of all beneficiaries.

4. Succession Planning: If you are the sole trustee of your trust, you need to have a plan in place for what will happen in the event of your incapacity or death. This may involve appointing a successor trustee who can step in and manage the trust according to your wishes.

5. Complexity: Depending on the nature of your trust and its assets, being your own trustee can be complex and time-consuming. It may require a significant amount of knowledge and expertise to effectively manage the trust and its investments.

6. Professional Advice: It is always advisable to seek professional advice when setting up and managing a trust. An attorney or financial advisor can provide guidance and ensure that you are meeting all legal requirements and fulfilling your fiduciary duties.

Question-answer:

What is a trust?

A trust is a legal arrangement where a person, known as the trustee, holds and manages assets on behalf of another person or group of people, known as the beneficiaries.

Can I be the trustee of my own trust?

Yes, it is possible to be the trustee of your own trust. This is known as a self-trusteed trust or a revocable living trust.

What are the advantages of being the trustee of my own trust?

Being the trustee of your own trust allows you to maintain control over your assets and make decisions about how they are managed and distributed. It also allows for flexibility in making changes to the trust as your circumstances change.

Are there any disadvantages to being the trustee of my own trust?

One disadvantage is that if you become incapacitated or pass away, there may not be a successor trustee in place to manage the trust. It can also be time-consuming and require a good understanding of trust laws and regulations.

Can I name a co-trustee to help me manage my trust?

Yes, you can name a co-trustee to help you manage your trust. This can be a family member, friend, or a professional trustee. Having a co-trustee can provide additional support and expertise in managing the trust.

What is a trust?

A trust is a legal arrangement where a person, known as the trustee, holds and manages assets on behalf of another person or group of people, known as the beneficiaries.

Can I be the trustee of my own trust?

Yes, it is possible to be the trustee of your own trust. This is known as a self-trusteed trust or a revocable living trust. Being the trustee allows you to maintain control over your assets while still enjoying the benefits of a trust.