- Understanding Self-Trusteeship

- What is Self-Trusteeship?

- Benefits of Self-Trusteeship

- Challenges of Self-Trusteeship

- Considerations for Self-Trusteeship

- Legal Requirements for Self-Trusteeship

- Question-answer:

- What is self-trusteeship?

- What are the benefits of self-trusteeship?

- Are there any limitations to self-trusteeship?

- What are the legal requirements for self-trusteeship?

- Can self-trusteeship be revoked or modified?

- What is self-trusteeship?

- What are the advantages of self-trusteeship?

Trusteeship is a concept that has been around for centuries, allowing individuals to entrust their assets and affairs to a designated trustee. However, in today’s world, where self-reliance and independence are highly valued, the idea of being your own trustee is gaining traction.

Being your own trustee means taking control of your own financial and legal matters, making decisions that align with your values and goals. It requires a deep understanding of the responsibilities and obligations that come with trusteeship, as well as the ability to navigate complex legal and financial systems.

While the idea of self-trusteeship may seem daunting, it offers a range of benefits. By being your own trustee, you have the freedom to make decisions without having to consult or rely on others. You can tailor your financial and legal strategies to suit your unique circumstances and objectives, ensuring that your assets are managed in a way that aligns with your values.

However, self-trusteeship also comes with its challenges. It requires a high level of knowledge and expertise in areas such as estate planning, tax law, and investment management. It also requires a strong sense of responsibility and discipline to ensure that you are fulfilling your fiduciary duties and acting in the best interests of yourself and any beneficiaries.

Understanding Self-Trusteeship

Self-trusteeship is a concept that involves an individual acting as their own trustee, managing their own assets and making decisions on behalf of themselves. It is a form of self-governance and self-reliance, where individuals take control of their financial affairs and estate planning without relying on external trustees or professionals.

Self-trusteeship empowers individuals to have full control over their assets and allows them to make decisions based on their own values and priorities. It eliminates the need for intermediaries and provides a sense of autonomy and independence.

One of the key aspects of self-trusteeship is the ability to create and manage a trust. A trust is a legal entity that holds assets on behalf of beneficiaries. In the case of self-trusteeship, the individual acts as both the grantor (the person who creates the trust) and the trustee (the person who manages the trust).

By acting as their own trustee, individuals can customize the terms of the trust to align with their specific needs and goals. They have the flexibility to determine how their assets are distributed, when they are distributed, and to whom they are distributed. This level of control allows individuals to ensure that their assets are managed and distributed in accordance with their wishes.

Self-trusteeship also provides individuals with the opportunity to educate themselves about financial matters and estate planning. By taking on the role of trustee, individuals are forced to become knowledgeable about legal and financial concepts, such as tax planning, investment management, and asset protection. This knowledge can be empowering and can help individuals make informed decisions about their financial future.

However, self-trusteeship is not without its challenges. It requires individuals to take on significant responsibilities and to stay informed about changes in laws and regulations that may affect their trust. It also requires individuals to have a certain level of financial literacy and the ability to manage their assets effectively.

Overall, self-trusteeship offers individuals the opportunity to have full control over their financial affairs and estate planning. It allows them to customize their trust to align with their specific needs and goals, and it empowers them to make informed decisions about their financial future. While it may come with challenges, self-trusteeship can provide individuals with a sense of autonomy and independence that is not always possible with traditional trusteeship.

What is Self-Trusteeship?

Self-trusteeship refers to the concept of an individual acting as their own trustee in managing their assets and making decisions regarding their financial affairs. In traditional trust arrangements, a trustee is appointed to manage and administer assets on behalf of a beneficiary. However, self-trusteeship allows individuals to take on the role of trustee themselves, giving them greater control and autonomy over their assets.

Self-trusteeship can be established through various legal mechanisms, such as creating a revocable living trust or setting up a self-directed IRA. These structures enable individuals to hold and manage their assets while still enjoying the benefits of trust-like protections.

By becoming their own trustee, individuals can make decisions regarding their assets without the need for third-party involvement. They have the authority to buy, sell, or transfer assets, as well as make investment decisions. This level of control can be particularly appealing to individuals who value independence and want to have a hands-on approach to managing their financial affairs.

Self-trusteeship also allows individuals to tailor their trust arrangements to their specific needs and goals. They can customize the terms of the trust, such as determining how assets are distributed upon their death or incapacity. This flexibility can be advantageous in situations where individuals have unique circumstances or specific wishes for the management of their assets.

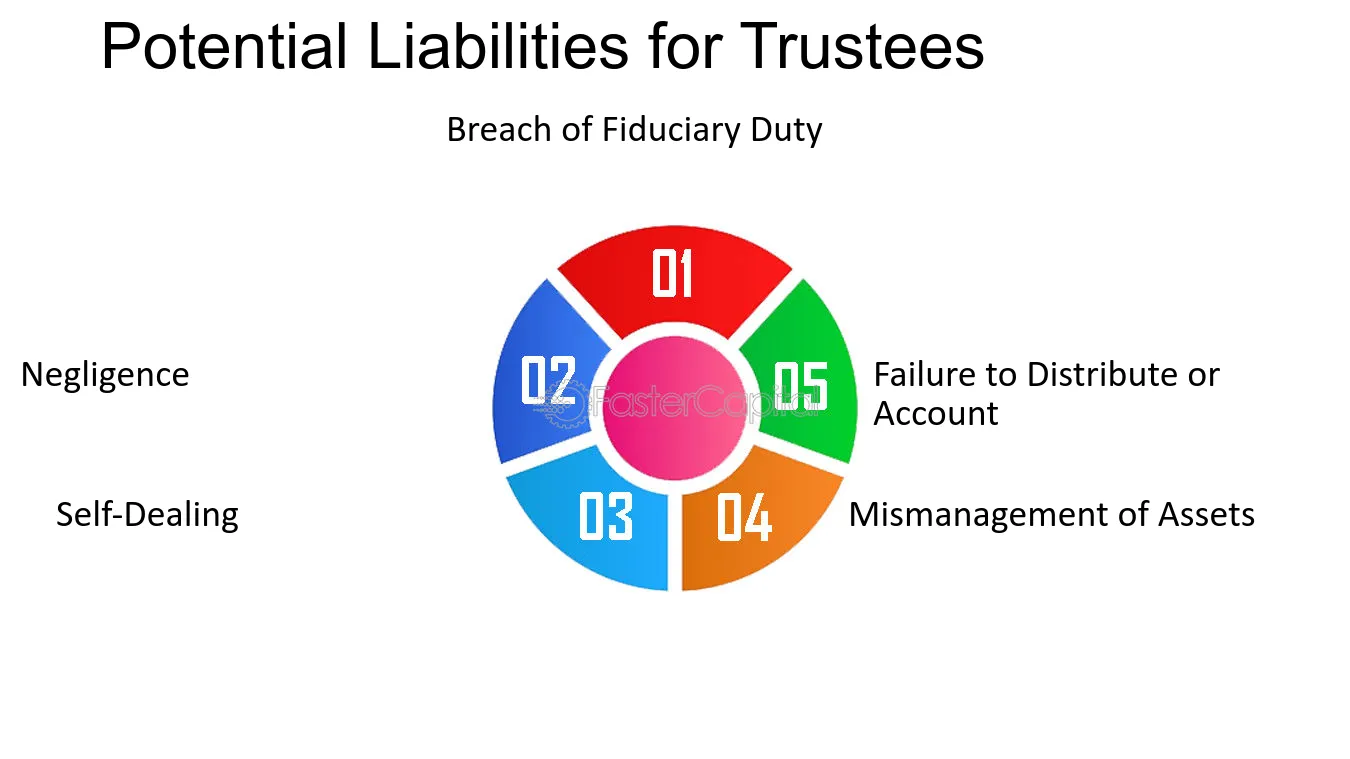

However, it is important to note that self-trusteeship comes with its own set of responsibilities and challenges. Individuals acting as their own trustees must ensure they comply with legal requirements and fulfill their fiduciary duties. They must act in the best interests of the beneficiaries and make decisions that align with the trust’s objectives.

Overall, self-trusteeship offers individuals the opportunity to have greater control and flexibility over their assets. It allows them to actively participate in the management of their financial affairs and tailor their trust arrangements to their specific needs and goals.

Benefits of Self-Trusteeship

Self-trusteeship offers several benefits to individuals who choose to manage their own trust:

- Control: Being your own trustee gives you complete control over your trust assets and how they are managed. You can make decisions based on your own values and priorities.

- Flexibility: As the trustee, you have the flexibility to adapt your trust to changing circumstances. You can modify the terms of the trust or make adjustments as needed.

- Cost Savings: By acting as your own trustee, you can avoid the fees associated with hiring a professional trustee. This can result in significant cost savings over time.

- Privacy: Self-trusteeship allows you to maintain a higher level of privacy. You do not have to disclose personal information to a third-party trustee, as you would with a professional trustee.

- Knowledge and Expertise: Managing your own trust can provide an opportunity to gain knowledge and expertise in estate planning and trust administration. This can be empowering and give you a sense of accomplishment.

- Family Involvement: Self-trusteeship can promote family involvement and communication. By involving family members in the management of the trust, you can foster a sense of responsibility and unity.

- Continuity: Being your own trustee ensures continuity in the management of your trust. You do not have to rely on the availability or competence of an external trustee.

While self-trusteeship offers many benefits, it is important to carefully consider the challenges and legal requirements associated with managing your own trust. Consulting with an estate planning attorney can help you make an informed decision about whether self-trusteeship is the right choice for you.

Challenges of Self-Trusteeship

While self-trusteeship can offer many benefits, it also comes with its fair share of challenges. Here are some of the main challenges individuals may face when taking on the role of their own trustee:

| 1. Lack of Expertise | Being your own trustee means taking on the responsibilities typically handled by professionals in the field. This can be challenging if you lack the necessary expertise and knowledge in areas such as financial management, legal matters, and estate planning. |

| 2. Time Commitment | Managing a trust requires time and effort. As a self-trustee, you will need to dedicate significant time to understand and fulfill your trustee duties. This can be particularly challenging if you already have a busy schedule or lack the necessary time management skills. |

| 3. Emotional Attachment | As the trustee of your own trust, you may find it challenging to make objective decisions when it comes to managing your assets. Emotional attachment to certain assets or sentimental value can cloud your judgment and potentially lead to biased decision-making. |

| 4. Legal Compliance | Managing a trust involves adhering to various legal requirements and regulations. As a self-trustee, you will need to stay updated on these laws and ensure that you are in compliance. Failing to do so can result in legal consequences and potential financial loss. |

| 5. Accountability | As a self-trustee, you are solely responsible for the management and distribution of trust assets. This level of accountability can be daunting, especially if you make mistakes or face challenges along the way. It is crucial to be prepared for the weight of this responsibility. |

Despite these challenges, many individuals still choose self-trusteeship for its potential benefits. However, it is important to carefully consider these challenges and assess whether you have the necessary skills, knowledge, and resources to effectively manage your own trust.

Considerations for Self-Trusteeship

Self-trusteeship is a complex and multifaceted concept that requires careful consideration before embarking on this path. Here are some important considerations to keep in mind:

1. Understanding the Responsibilities: As a self-trustee, you will be responsible for managing and administering your own trust. This includes making investment decisions, distributing assets, and ensuring compliance with legal and tax requirements. It is crucial to have a clear understanding of these responsibilities and be prepared to fulfill them.

2. Knowledge and Expertise: Managing a trust requires a certain level of knowledge and expertise in areas such as finance, law, and taxation. It is important to assess your own knowledge and skills in these areas and determine if you have the necessary expertise to effectively manage your trust. If not, you may need to seek professional advice or consider alternative options.

3. Time Commitment: Being a self-trustee can be time-consuming, especially if you have a complex trust structure or a large number of assets. It is important to evaluate your availability and willingness to dedicate the necessary time and effort to fulfill your trustee duties. If you have other commitments or limited time availability, you may need to reconsider self-trusteeship or explore options for delegating certain tasks.

4. Objectivity and Impartiality: As a self-trustee, it is important to maintain objectivity and act in the best interests of the trust beneficiaries. This can be challenging when you are also a beneficiary of the trust. It is crucial to be aware of potential conflicts of interest and take steps to ensure that your decisions are fair and impartial.

5. Succession Planning: Self-trusteeship requires careful consideration of succession planning. You need to have a plan in place for the future management of the trust in case of your incapacity or death. This may involve appointing a successor trustee or establishing mechanisms for the transfer of trustee responsibilities.

6. Legal and Regulatory Compliance: Self-trusteeship is subject to legal and regulatory requirements that vary depending on the jurisdiction. It is important to familiarize yourself with these requirements and ensure that you comply with all applicable laws and regulations. Failure to do so can have serious legal and financial consequences.

7. Professional Advice: Considering the complexities and potential risks involved in self-trusteeship, it is advisable to seek professional advice from attorneys, accountants, or financial advisors who specialize in trust management. They can provide guidance and help you navigate the legal and financial aspects of self-trusteeship.

By carefully considering these factors, you can make an informed decision about whether self-trusteeship is the right choice for you. It is important to weigh the benefits and challenges and assess your own capabilities and resources before taking on the role of a self-trustee.

Legal Requirements for Self-Trusteeship

When considering self-trusteeship, it is important to understand the legal requirements that come with this responsibility. While the specific requirements may vary depending on the jurisdiction, there are some common elements that individuals should be aware of.

Firstly, it is crucial to establish a legally valid trust document. This document should outline the terms and conditions of the trust, including the assets involved, the beneficiaries, and the powers and responsibilities of the trustee. It is recommended to consult with a legal professional to ensure that the trust document meets all necessary legal requirements.

In addition to the trust document, it is important to comply with any applicable laws and regulations. This may include filing necessary paperwork with the appropriate government agencies, such as the Internal Revenue Service (IRS) in the United States. Failure to comply with these legal requirements can result in penalties and legal consequences.

Another important legal requirement for self-trusteeship is the duty of loyalty and care. As a trustee, you have a fiduciary duty to act in the best interests of the beneficiaries and to manage the trust assets responsibly. This includes making informed decisions, avoiding conflicts of interest, and acting in good faith.

Furthermore, it is important to keep accurate and detailed records of all trust transactions and activities. This includes maintaining financial statements, tax records, and any other relevant documentation. These records may be subject to review by beneficiaries or government agencies, so it is essential to keep them organized and readily accessible.

Lastly, it is important to regularly review and update the trust document and any associated legal documents. Life circumstances and laws may change over time, so it is important to ensure that the trust remains valid and effective. This may involve consulting with a legal professional to make any necessary amendments or updates.

| Legal Requirements for Self-Trusteeship: |

|---|

| – Establish a legally valid trust document |

| – Comply with applicable laws and regulations |

| – Fulfill the duty of loyalty and care |

| – Keep accurate and detailed records |

| – Regularly review and update the trust document |

By understanding and fulfilling these legal requirements, individuals can confidently take on the role of their own trustee and effectively manage their trust assets.

Question-answer:

What is self-trusteeship?

Self-trusteeship is a legal arrangement where an individual acts as their own trustee, managing their own assets and making decisions on their behalf.

What are the benefits of self-trusteeship?

Self-trusteeship allows individuals to have full control over their assets and decision-making, without the need for a third-party trustee. It can also provide flexibility and privacy in managing one’s affairs.

Are there any limitations to self-trusteeship?

Yes, there are some limitations to self-trusteeship. For example, certain types of assets, such as retirement accounts, may require a designated trustee. Additionally, self-trusteeship may not be suitable for individuals who are not comfortable or capable of managing their own affairs.

What are the legal requirements for self-trusteeship?

The legal requirements for self-trusteeship may vary depending on the jurisdiction. Generally, it involves creating a trust document that outlines the individual’s role as trustee and the terms of the trust. It is advisable to consult with a legal professional to ensure compliance with local laws.

Can self-trusteeship be revoked or modified?

Yes, self-trusteeship can be revoked or modified. The individual acting as their own trustee has the power to make changes to the trust document, including appointing a new trustee or altering the terms of the trust. However, it is important to follow the legal procedures and requirements for making such changes.

What is self-trusteeship?

Self-trusteeship is a concept where an individual acts as their own trustee, managing their own assets and making decisions on behalf of themselves.

What are the advantages of self-trusteeship?

There are several advantages to self-trusteeship. Firstly, it allows individuals to have complete control over their assets and decision-making. They do not have to rely on a third party to manage their affairs. Additionally, self-trusteeship can save on costs, as there is no need to pay a professional trustee. It also provides a sense of independence and self-reliance.