- Understanding Irrevocable Trusts

- What is an Irrevocable Trust?

- Benefits and Drawbacks of Irrevocable Trusts

- Options for Modifying or Terminating an Irrevocable Trust

- Judicial Modification

- Question-answer:

- What is an irrevocable trust?

- Can you undo an irrevocable trust?

- What is decanting?

- What is trust modification?

- When can a court terminate or modify an irrevocable trust?

Creating an irrevocable trust is a significant decision that can have long-lasting effects on your estate planning. However, life is unpredictable, and circumstances may change over time. If you find yourself in a situation where you need to modify or revoke an irrevocable trust, you may be wondering if it is even possible.

While the term “irrevocable” suggests that the trust cannot be changed, there are certain circumstances in which it may be possible to undo or modify the terms of an irrevocable trust. However, it is important to note that undoing an irrevocable trust is not a straightforward process and may require legal intervention.

One option to consider is seeking the consent of all the beneficiaries and the trustee to modify or revoke the trust. If all parties involved agree to the changes, it may be possible to amend the trust document. However, this can be a complex and time-consuming process, as it requires the cooperation of all parties and may involve court approval.

Another option is to explore the possibility of using a trust decanting or trust modification. Trust decanting involves transferring the assets from the original irrevocable trust to a new trust with modified terms. This can be a useful strategy if the original trust does not allow for modifications or if the beneficiaries are not willing to consent to changes.

It is important to consult with an experienced estate planning attorney who can guide you through the process and help you explore your options. They can review the terms of the trust, assess your specific circumstances, and advise you on the best course of action. Keep in mind that the laws surrounding irrevocable trusts can vary by jurisdiction, so it is crucial to seek legal advice that is specific to your state.

While undoing an irrevocable trust may be challenging, it is not impossible. By understanding your options and working with a knowledgeable attorney, you can navigate the complexities of trust modification and find a solution that aligns with your changing needs and circumstances.

Understanding Irrevocable Trusts

An irrevocable trust is a legal arrangement in which a person, known as the grantor, transfers assets to a trustee for the benefit of one or more beneficiaries. Once the trust is established, the grantor cannot make changes to it or revoke it without the consent of the beneficiaries and the trustee.

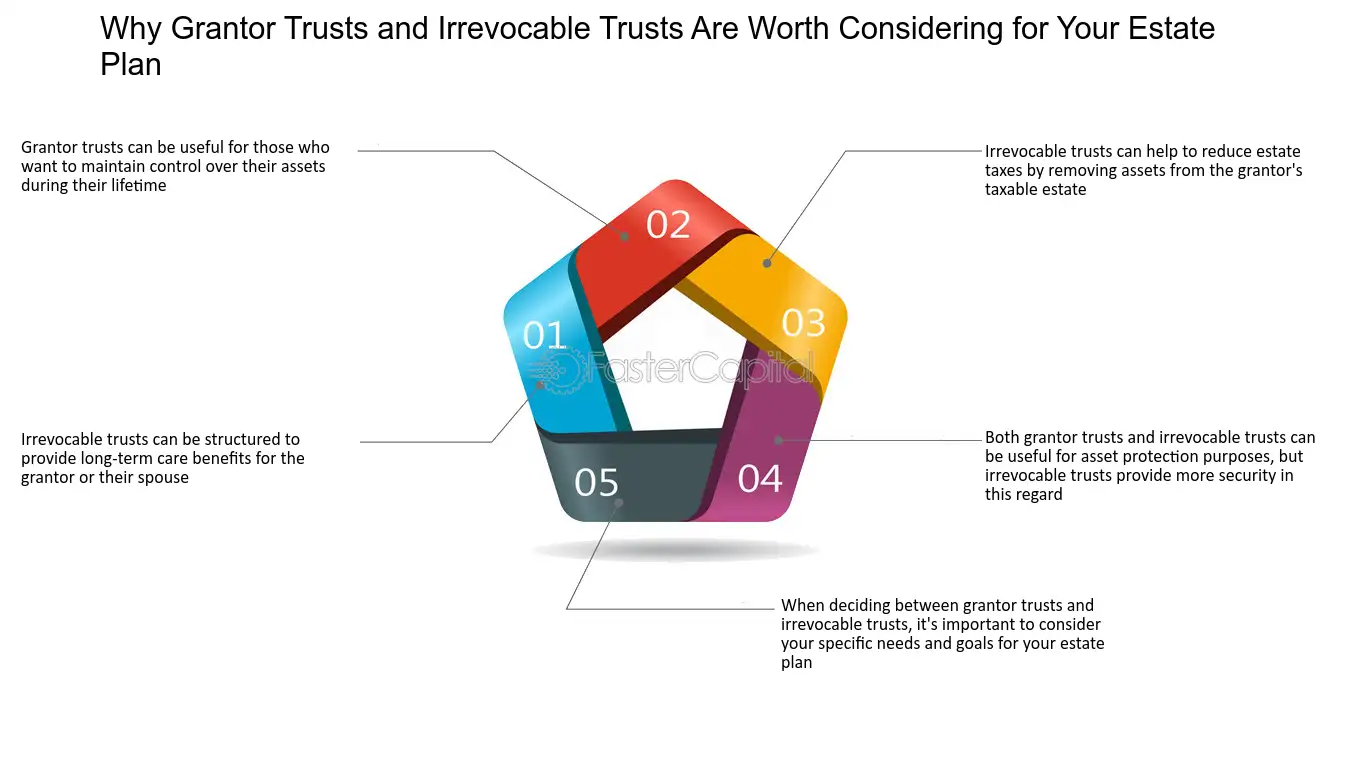

Irrevocable trusts are commonly used for estate planning purposes, as they offer several benefits. Firstly, assets placed in an irrevocable trust are typically not considered part of the grantor’s estate for tax purposes, which can help reduce estate taxes. Additionally, irrevocable trusts can provide asset protection, as the assets are no longer owned by the grantor and are therefore shielded from creditors.

However, it’s important to carefully consider the drawbacks of irrevocable trusts before establishing one. One major drawback is the loss of control over the assets placed in the trust. Once the assets are transferred, the grantor cannot access or use them without the consent of the trustee. This lack of control can be problematic if the grantor’s financial situation changes or if they need to access the assets for any reason.

Another potential drawback is the inability to modify or terminate the trust. Irrevocable trusts are designed to be permanent, and changing or revoking them can be difficult. In some cases, it may be possible to modify or terminate an irrevocable trust through a process known as judicial modification, but this typically requires a court order and can be time-consuming and expensive.

Overall, understanding irrevocable trusts is crucial before deciding to establish one. While they offer benefits such as tax savings and asset protection, they also come with limitations and potential drawbacks. It’s important to consult with a qualified estate planning attorney to determine if an irrevocable trust is the right choice for your individual circumstances.

What is an Irrevocable Trust?

An irrevocable trust is a legal arrangement in which a person, known as the grantor, transfers assets to a trustee. Once the assets are transferred, the grantor no longer has control over them and cannot make changes to the trust without the consent of the beneficiaries or a court order.

Irrevocable trusts are commonly used for estate planning purposes, as they can provide various benefits such as asset protection, tax advantages, and the ability to avoid probate. These trusts are often created to ensure that assets are preserved and distributed according to the grantor’s wishes, even after their death.

One of the key features of an irrevocable trust is that it cannot be easily undone or revoked. This means that once the trust is established, the grantor cannot simply change their mind and take back the assets. The trust becomes a separate legal entity, and the grantor relinquishes control over the assets.

While the lack of control may seem restrictive, it can also provide significant advantages. For example, assets held in an irrevocable trust may be protected from creditors, lawsuits, and estate taxes. Additionally, the trust can help ensure that the assets are managed and distributed in a responsible manner, as specified by the grantor.

It’s important to carefully consider the implications of establishing an irrevocable trust, as it is a long-term commitment. Once the trust is created, it generally cannot be modified or terminated without the consent of the beneficiaries or a court order. However, there are certain circumstances in which modifications or terminations may be possible, such as changes in tax laws or unforeseen circumstances.

Benefits and Drawbacks of Irrevocable Trusts

An irrevocable trust is a legal arrangement that cannot be modified or terminated without the consent of the beneficiaries. While this type of trust offers several benefits, it also comes with some drawbacks that should be considered before creating one.

Benefits:

1. Asset protection: One of the main advantages of an irrevocable trust is that it provides a high level of asset protection. Once assets are transferred into the trust, they are no longer considered part of the grantor’s estate and are protected from creditors and legal claims.

2. Estate tax reduction: Irrevocable trusts can be used as an effective estate planning tool to reduce estate taxes. By transferring assets into the trust, the grantor can remove them from their taxable estate, potentially saving a significant amount of money in estate taxes.

3. Medicaid planning: Irrevocable trusts can also be used for Medicaid planning purposes. By transferring assets into the trust, individuals can potentially qualify for Medicaid benefits while still preserving some of their assets for their loved ones.

4. Control over distribution: With an irrevocable trust, the grantor can have control over how and when the assets are distributed to the beneficiaries. This can be particularly useful in situations where the beneficiaries are not yet mature enough to handle large sums of money.

Drawbacks:

1. Loss of control: Once assets are transferred into an irrevocable trust, the grantor loses control over them. The trust becomes its own legal entity, and decisions regarding the assets are made by the trustee. This lack of control can be a drawback for some individuals.

2. Limited access to assets: Since the grantor no longer owns the assets in the trust, they may have limited access to them. This can be problematic if the grantor needs to use the assets for personal or financial reasons.

3. Difficulty in modifying or terminating: As the name suggests, irrevocable trusts are difficult to modify or terminate. In most cases, the consent of all beneficiaries is required, which can be challenging to obtain. This lack of flexibility can be a drawback if circumstances change in the future.

4. Potential tax consequences: While irrevocable trusts offer tax benefits, they can also have potential tax consequences. Income generated by the trust may be subject to income taxes, and there may be gift tax implications when assets are transferred into the trust.

It is important to carefully consider the benefits and drawbacks of irrevocable trusts before creating one. Consulting with a qualified estate planning attorney can help individuals make informed decisions based on their specific circumstances.

Options for Modifying or Terminating an Irrevocable Trust

While irrevocable trusts are designed to be permanent and unchangeable, there are still some options available for modifying or terminating them under certain circumstances. It is important to note that these options may vary depending on the specific laws and regulations of the jurisdiction in which the trust was created.

1. Consent of all beneficiaries: In some cases, if all beneficiaries of the trust agree, it may be possible to modify or terminate the trust. This typically requires written consent from each beneficiary and may also require court approval.

2. Trustee’s power to modify: The trust document itself may grant the trustee the power to modify or terminate the trust under certain conditions. This power is often referred to as a “trustee’s power of appointment” and can be used to make changes to the trust as long as it is within the scope of the trustee’s authority.

3. Judicial modification: If the trust cannot be modified or terminated through the consent of all beneficiaries or the trustee’s power of appointment, it may be possible to seek a court order for judicial modification. This typically requires demonstrating a significant change in circumstances or that the trust’s purpose can no longer be achieved.

4. Decanting: Some jurisdictions allow for a process called “decanting,” which involves transferring the assets of one trust into a new trust with different terms. This can be used as a way to modify or terminate the original trust without going through the court system.

5. Non-judicial settlement agreements: In certain situations, the beneficiaries and trustees of an irrevocable trust may be able to reach a non-judicial settlement agreement to modify or terminate the trust. This agreement must be in writing and signed by all parties involved.

6. Charitable trust modification: If the irrevocable trust is a charitable trust, it may be possible to modify or terminate the trust with the approval of the state attorney general or a court. This typically requires demonstrating that the modification or termination is in the best interest of the charitable purpose.

It is important to consult with an experienced attorney who specializes in trust law to understand the specific options available for modifying or terminating an irrevocable trust in your jurisdiction. They can provide guidance and help navigate the legal process to ensure that any changes made to the trust are done in accordance with the law.

Judicial Modification

Judicial modification is one option available for modifying or terminating an irrevocable trust. This process involves seeking approval from a court to make changes to the terms of the trust that would otherwise be considered irrevocable.

There are several reasons why someone might seek judicial modification of an irrevocable trust. One common reason is a change in circumstances that makes the original terms of the trust impractical or no longer in the best interests of the beneficiaries. For example, if the trust was created to provide for the education of minor children, but they have now reached adulthood and no longer require financial support, a court may consider modifying the trust to redirect the funds to other beneficiaries or purposes.

In order to seek judicial modification, the party requesting the change must demonstrate to the court that there has been a significant change in circumstances that justifies the modification. This may involve providing evidence of financial hardship, changes in family dynamics, or other relevant factors. The court will then evaluate the request and determine whether the proposed modification is appropriate.

It is important to note that judicial modification is not always guaranteed. The court will consider the original intent of the trust creator, the interests of the beneficiaries, and any potential negative consequences of the modification. If the court determines that the modification would go against the original intent of the trust or would harm the beneficiaries, it may deny the request for modification.

Overall, judicial modification provides a potential avenue for making changes to an irrevocable trust when the original terms are no longer practical or in the best interests of the beneficiaries. However, it is a complex legal process that requires careful consideration and the guidance of an experienced attorney.

Question-answer:

What is an irrevocable trust?

An irrevocable trust is a legal arrangement where the grantor transfers assets to a trustee, who manages the assets for the benefit of the beneficiaries. Once the trust is established, it cannot be modified or revoked without the consent of all parties involved.

Can you undo an irrevocable trust?

Undoing an irrevocable trust is generally difficult, but not impossible. There are a few options available, such as decanting, trust modification, or seeking court approval to terminate or modify the trust. However, these options may have certain limitations and requirements.

What is decanting?

Decanting is a process where the assets of an irrevocable trust are transferred to a new trust with different terms. This allows for changes to be made to the trust without needing the consent of all beneficiaries. However, decanting is not available in all jurisdictions and may have specific requirements.

What is trust modification?

Trust modification involves seeking court approval to make changes to an irrevocable trust. This usually requires demonstrating a significant change in circumstances or the need to correct a mistake in the trust document. The court will consider the best interests of the beneficiaries when deciding whether to approve the modification.

When can a court terminate or modify an irrevocable trust?

A court may terminate or modify an irrevocable trust if all parties involved consent to the changes, if the trust’s purpose has become impossible to achieve, if there is a change in circumstances that frustrates the trust’s purpose, or if the trust was created based on fraud or undue influence. However, the specific requirements and grounds for modification or termination vary by jurisdiction.