- Understanding the Impact of an Eviction on Homebuying

- How an Eviction Can Affect Your Credit Score

- The Role of Evictions in Mortgage Applications

- Exploring Alternative Financing Options

- Steps to Take if You Have an Eviction on Your Record

- Rebuilding Your Credit Score

- Working with a Housing Counselor

- Question-answer:

- Can I buy a house if I have been evicted in the past?

- How can I improve my chances of buying a house with an eviction on my record?

- Will a previous eviction prevent me from getting a mortgage?

- Can I buy a house with an eviction if I have a co-signer?

- Are there any government programs that can help me buy a house with an eviction on my record?

- Can I buy a house if I have been evicted in the past?

- What can I do if I want to buy a house but have an eviction on my record?

Having an eviction on your record can make it difficult to find a new place to live, let alone buy a house. However, it’s not impossible. While an eviction can certainly make the process more challenging, there are still options available for those who have experienced this setback.

Understanding the Impact of an Eviction

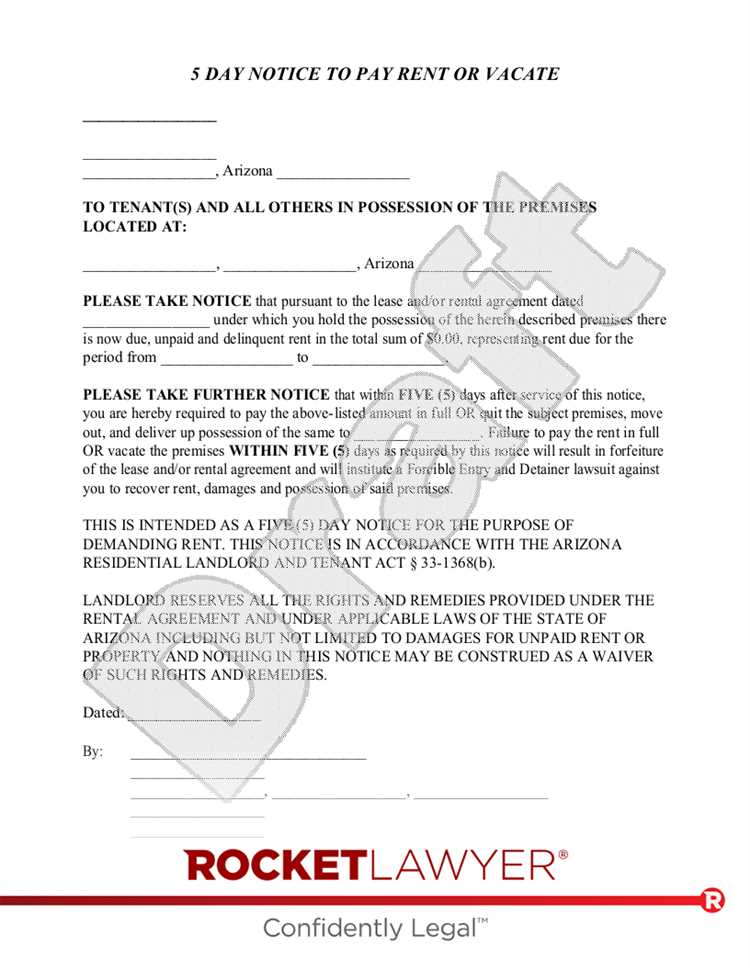

An eviction is a legal process that occurs when a tenant is forced to leave a rental property due to non-payment of rent, violation of the lease agreement, or other reasons. This can have a negative impact on your credit score and rental history, making it harder to secure housing in the future.

However, it’s important to note that an eviction does not necessarily disqualify you from buying a house. Lenders take various factors into consideration when evaluating loan applications, and while an eviction may raise red flags, it’s not an automatic disqualification.

Exploring Your Options

If you have an eviction on your record and are looking to buy a house, there are a few options you can consider. First, you can work on improving your credit score and rental history. Paying off any outstanding debts, establishing a positive payment history, and demonstrating responsible financial behavior can help mitigate the impact of an eviction.

Additionally, you can try to find a lender who specializes in working with individuals who have less-than-perfect credit or rental histories. These lenders may be more willing to work with you and offer more flexible loan terms.

Seeking Professional Guidance

Buying a house with an eviction can be a complex process, and it’s important to seek professional guidance. Consider consulting with a real estate agent or a mortgage broker who can help you navigate the challenges and explore your options.

Remember, while an eviction may present obstacles, it doesn’t mean that homeownership is completely out of reach. With the right approach and guidance, you can still achieve your goal of buying a house.

Understanding the Impact of an Eviction on Homebuying

An eviction can have a significant impact on your ability to buy a house. When you apply for a mortgage, lenders will review your credit history and financial background to assess your risk as a borrower. An eviction on your record raises red flags and can make it more difficult to secure a loan.

Firstly, an eviction indicates that you have had trouble meeting your financial obligations in the past. Lenders want to see a consistent history of on-time payments and responsible financial behavior. An eviction suggests that you may be a higher risk borrower, as it shows a failure to meet your rental obligations.

Secondly, an eviction can negatively affect your credit score. When you are evicted, it is likely that your landlord will report the eviction to the credit bureaus. This can result in a significant drop in your credit score, making it harder to qualify for a mortgage. A lower credit score can also lead to higher interest rates, increasing the overall cost of your loan.

Additionally, an eviction can make it challenging to find a landlord who is willing to rent to you in the future. Many landlords conduct background checks and may be hesitant to rent to someone with a history of eviction. This can limit your housing options and make it more difficult to find a suitable place to live.

It is important to note that while an eviction can have a negative impact on your homebuying prospects, it is not impossible to buy a house with an eviction on your record. There are alternative financing options available, such as FHA loans, that may be more lenient towards borrowers with past evictions. Working with a housing counselor can also provide guidance and support in navigating the homebuying process.

How an Eviction Can Affect Your Credit Score

When it comes to your credit score, an eviction can have a significant impact. Your credit score is a numerical representation of your creditworthiness, and it is used by lenders to determine whether or not to approve your loan applications. A low credit score can make it difficult to secure financing for a variety of purposes, including buying a house.

When you have an eviction on your record, it is a red flag for lenders. It indicates that you have failed to meet your financial obligations in the past, which makes you a higher risk borrower. As a result, lenders may be hesitant to approve your mortgage application or may offer you less favorable terms, such as a higher interest rate or a larger down payment.

In addition to affecting your ability to secure a mortgage, an eviction can also lower your credit score. Late or missed rent payments can be reported to credit bureaus, and these negative marks can stay on your credit report for up to seven years. The presence of an eviction on your credit report can significantly lower your credit score, making it even more challenging to obtain financing for a home.

It’s important to note that not all evictions will have the same impact on your credit score. If you were evicted due to non-payment of rent or other financial reasons, it is likely to have a more significant negative effect on your credit score compared to an eviction for other reasons, such as lease violations.

If you have an eviction on your record and are looking to improve your credit score, there are steps you can take. First, make sure to pay all of your bills on time moving forward. This includes rent, utilities, and any other financial obligations. Consistently making on-time payments will help rebuild your credit history and show lenders that you are now a responsible borrower.

Additionally, you can work with a housing counselor who can provide guidance on improving your credit score and navigating the homebuying process. They can help you understand your options and develop a plan to address any credit issues you may have.

The Role of Evictions in Mortgage Applications

When applying for a mortgage, lenders will carefully review your financial history and creditworthiness to determine if you are a suitable candidate for a loan. One crucial factor that lenders consider is your rental history, including any past evictions.

Having an eviction on your record can significantly impact your chances of getting approved for a mortgage. Lenders view evictions as a red flag, indicating a potential risk in your ability to make timely payments. It raises concerns about your financial stability and responsibility as a borrower.

During the mortgage application process, lenders will typically request a copy of your rental history, which includes information about any evictions. They will review this information to assess your risk level and determine the terms of your loan, such as the interest rate and down payment requirements.

If you have a recent eviction on your record, it can be challenging to secure a traditional mortgage. However, each lender has different criteria and policies regarding evictions, so it’s essential to explore alternative financing options.

Some lenders may be more lenient towards applicants with evictions if they can demonstrate a stable income, a good credit score, and a reasonable explanation for the eviction. It’s crucial to be transparent about your eviction and provide any supporting documentation that can help strengthen your case.

Additionally, working with a housing counselor can be beneficial in navigating the mortgage application process with an eviction on your record. They can provide guidance, help you understand your options, and assist in finding lenders who may be more willing to work with you.

It’s important to note that even if you are approved for a mortgage with an eviction on your record, you may face higher interest rates and stricter loan terms. This is because lenders consider you a higher risk borrower due to the eviction.

Exploring Alternative Financing Options

If you have an eviction on your record and are looking to buy a house, traditional financing options may be limited. However, there are alternative financing options that you can explore.

One option is to look for a seller who is willing to offer seller financing. With seller financing, the seller acts as the lender and you make monthly payments directly to them. This can be a good option if you have a stable income and can demonstrate your ability to make regular payments.

Another option is to consider rent-to-own agreements. With a rent-to-own agreement, you rent a property with the option to buy it at a later date. A portion of your monthly rent payments goes towards building equity in the property, which can be used as a down payment when you are ready to purchase the home.

You can also explore government-backed loan programs, such as FHA loans. These loans are insured by the Federal Housing Administration and have less stringent credit requirements compared to traditional loans. While an eviction may still impact your eligibility, FHA loans may be more forgiving than other loan options.

Additionally, you can consider working with a credit union or community development financial institution (CDFI) that specializes in providing loans to individuals with less-than-perfect credit. These institutions may have more flexible lending criteria and be willing to work with you despite your eviction.

It’s important to note that alternative financing options may come with higher interest rates or additional fees. It’s crucial to carefully review the terms and conditions of any financing option before committing to ensure that it is a viable and affordable solution for you.

Remember, having an eviction on your record does not mean that you are completely disqualified from buying a house. By exploring alternative financing options and working on rebuilding your credit, you can increase your chances of becoming a homeowner.

Steps to Take if You Have an Eviction on Your Record

If you have an eviction on your record, it’s important to take steps to address the issue and improve your chances of buying a house in the future. Here are some steps you can take:

1. Understand the Reason for the Eviction:

Take the time to understand why you were evicted from your previous residence. This will help you identify any patterns or issues that need to be addressed before applying for a mortgage.

2. Rectify Any Outstanding Issues:

If there are any outstanding issues related to the eviction, such as unpaid rent or damages, make sure to address them as soon as possible. This may involve paying off any outstanding debts or negotiating with your previous landlord.

3. Build a Positive Rental History:

After an eviction, it’s important to demonstrate responsible rental behavior. Look for a new rental property and make sure to pay your rent on time, maintain the property, and be a good tenant. This will help rebuild your rental history and show future lenders that you are a reliable borrower.

4. Save for a Larger Down Payment:

If you have an eviction on your record, it may be more difficult to qualify for a mortgage. One way to improve your chances is to save for a larger down payment. A larger down payment can help offset any concerns lenders may have about your eviction and demonstrate your commitment to homeownership.

5. Work on Improving Your Credit Score:

An eviction can have a negative impact on your credit score. Take steps to improve your credit by paying off any outstanding debts, making all of your payments on time, and keeping your credit utilization low. This will help improve your creditworthiness and make you a more attractive borrower.

6. Seek Professional Help:

If you’re struggling to navigate the homebuying process with an eviction on your record, consider seeking help from a housing counselor. They can provide guidance and support, helping you understand your options and develop a plan to overcome any obstacles.

Remember, having an eviction on your record doesn’t mean you can’t buy a house in the future. By taking proactive steps and addressing any issues, you can improve your chances of becoming a homeowner.

Rebuilding Your Credit Score

Having an eviction on your record can have a significant impact on your credit score. However, it is not the end of the road. There are steps you can take to rebuild your credit and improve your chances of buying a house in the future.

1. Review your credit report: Start by obtaining a copy of your credit report from the major credit bureaus. Carefully review the report for any errors or inaccuracies related to the eviction. If you find any, dispute them with the credit bureaus to have them corrected.

2. Pay off outstanding debts: If you have any outstanding debts, prioritize paying them off. This will show lenders that you are taking steps to improve your financial situation and can be trusted with credit in the future.

3. Establish a positive payment history: One of the best ways to rebuild your credit is by making timely payments on your current bills and debts. Pay all your bills on time, including rent, utilities, and credit card payments. Consistently demonstrating responsible financial behavior will help improve your credit score over time.

4. Apply for a secured credit card: If your credit score is low, you may have difficulty getting approved for a traditional credit card. In this case, consider applying for a secured credit card. With a secured card, you will need to make a deposit that serves as your credit limit. Use the card responsibly and make timely payments to build a positive credit history.

5. Keep credit utilization low: Credit utilization refers to the amount of credit you are using compared to your total credit limit. Aim to keep your credit utilization below 30% to demonstrate responsible credit management. Paying off your balances in full each month can help keep your credit utilization low.

6. Avoid new credit applications: While it may be tempting to apply for new credit to improve your credit mix, it’s best to avoid doing so while you are rebuilding your credit. Multiple credit applications can negatively impact your credit score and make lenders wary of your financial stability.

7. Be patient: Rebuilding your credit takes time and patience. It won’t happen overnight, but with consistent effort and responsible financial behavior, you can gradually improve your credit score. Stay focused on your goal of buying a house and continue to make positive financial choices.

8. Seek guidance from a housing counselor: If you’re struggling to rebuild your credit or navigate the homebuying process, consider working with a housing counselor. They can provide guidance, resources, and support to help you achieve your goal of buying a house despite having an eviction on your record.

Remember, while having an eviction on your record can make buying a house more challenging, it is not impossible. By taking proactive steps to rebuild your credit and demonstrating responsible financial behavior, you can improve your chances of becoming a homeowner in the future.

Working with a Housing Counselor

If you have experienced an eviction and are looking to buy a house, working with a housing counselor can be a valuable resource. A housing counselor is a professional who is trained to provide guidance and support to individuals and families seeking affordable housing options.

When you have an eviction on your record, it can be challenging to navigate the homebuying process. A housing counselor can help you understand your options and develop a plan to improve your chances of securing a mortgage.

One of the first steps a housing counselor will take is to review your credit history. They will assess the impact of the eviction on your credit score and identify any other negative factors that may affect your ability to obtain a mortgage. Based on this assessment, they can provide guidance on steps you can take to rebuild your credit.

In addition to credit repair, a housing counselor can also help you explore alternative financing options. They may be able to connect you with lenders who specialize in working with individuals who have experienced evictions. These lenders may have more flexible requirements and be willing to work with you despite your eviction history.

Working with a housing counselor can also provide you with valuable education and resources. They can help you understand the homebuying process, including the steps involved, the documents you will need to provide, and the costs associated with buying a home. This knowledge can empower you to make informed decisions and navigate the process more effectively.

Furthermore, a housing counselor can advocate on your behalf. They can help you communicate with landlords, mortgage lenders, and other housing professionals to address any concerns or challenges that may arise. Their expertise and experience can be invaluable in helping you overcome obstacles and achieve your goal of homeownership.

Overall, working with a housing counselor can be a crucial step in buying a house after experiencing an eviction. They can provide guidance, support, and resources to help you navigate the homebuying process and improve your chances of securing a mortgage. Don’t hesitate to reach out to a housing counselor in your area for assistance.

Question-answer:

Can I buy a house if I have been evicted in the past?

Yes, it is possible to buy a house even if you have been evicted in the past. However, having an eviction on your record can make it more difficult to qualify for a mortgage. Lenders typically look at your credit history and rental history when determining your eligibility for a loan. If you have a recent eviction on your record, it may be necessary to take steps to improve your credit and rental history before applying for a mortgage.

How can I improve my chances of buying a house with an eviction on my record?

If you have an eviction on your record and want to improve your chances of buying a house, there are a few steps you can take. First, work on improving your credit score by paying off any outstanding debts and making all of your payments on time. Second, try to establish a positive rental history by finding a new place to live and making all of your rent payments on time. Finally, save up for a larger down payment, as this can help offset any concerns lenders may have about your eviction.

Will a previous eviction prevent me from getting a mortgage?

A previous eviction does not necessarily prevent you from getting a mortgage, but it can make it more difficult. Lenders typically look at your credit history and rental history when determining your eligibility for a loan. If you have a recent eviction on your record, it may raise concerns for lenders about your ability to make timely payments. However, if you can demonstrate that you have taken steps to improve your credit and rental history since the eviction, you may still be able to qualify for a mortgage.

Can I buy a house with an eviction if I have a co-signer?

Having a co-signer can potentially help you buy a house with an eviction on your record. A co-signer is someone who agrees to take responsibility for the loan if you are unable to make the payments. Having a co-signer with a strong credit history and stable income can help offset any concerns lenders may have about your eviction. However, it is important to note that the co-signer will be equally responsible for the loan, so it is crucial to make all payments on time to protect their credit.

Are there any government programs that can help me buy a house with an eviction on my record?

There are no specific government programs that are designed to help individuals with evictions buy a house. However, there are various government-backed loan programs, such as FHA loans, that have more flexible eligibility requirements compared to conventional loans. These programs may be more willing to work with individuals who have a previous eviction on their record. It is important to research and speak with a mortgage lender to determine what options may be available to you.

Can I buy a house if I have been evicted in the past?

Yes, it is possible to buy a house even if you have been evicted in the past. However, having an eviction on your record can make it more challenging to qualify for a mortgage. Lenders typically look at your credit history and rental history when determining your eligibility for a loan. If you have a recent eviction, it may negatively impact your credit score and make it harder to get approved for a mortgage. However, there are still options available, such as working with a specialized lender or improving your credit before applying for a loan.

What can I do if I want to buy a house but have an eviction on my record?

If you want to buy a house but have an eviction on your record, there are several steps you can take to improve your chances of getting approved for a mortgage. First, you should work on improving your credit score by paying off any outstanding debts and making all of your payments on time. You can also try to negotiate with your previous landlord to have the eviction removed from your record or provide an explanation for the eviction to potential lenders. Additionally, you can consider working with a specialized lender who may be more willing to work with individuals who have a history of eviction.