- Understanding Revocable Trusts

- What is a Revocable Trust?

- Benefits of a Revocable Trust

- Limitations of a Revocable Trust

- Options for Changing a Revocable Trust

- Amending a Revocable Trust

- Question-answer:

- What is a revocable trust?

- Can I change the terms of a revocable trust?

- What are the options for changing a revocable trust?

- Do I need a lawyer to change a revocable trust?

- What happens if I don’t change my revocable trust?

- What is a revocable trust?

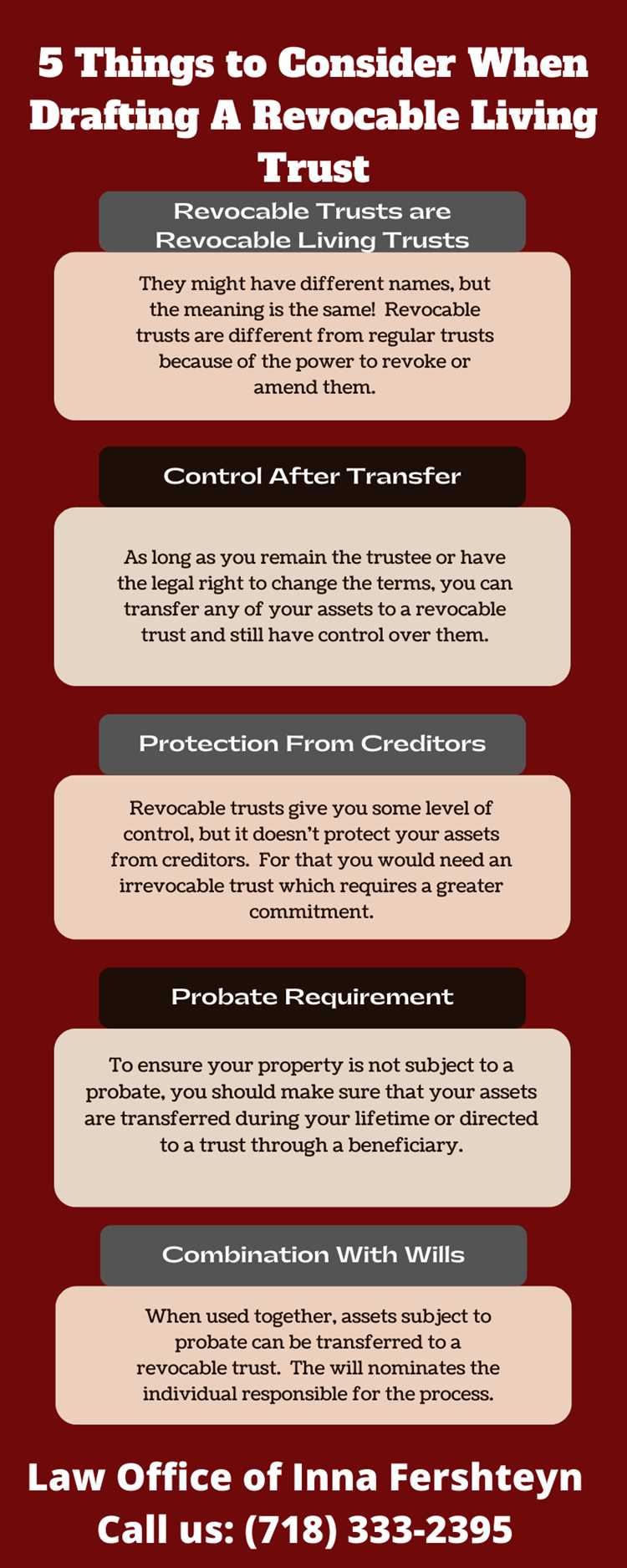

A revocable trust, also known as a living trust, is a legal document that allows you to manage your assets during your lifetime and determine how they will be distributed after your death. One of the key benefits of a revocable trust is its flexibility, as it can be modified or revoked at any time during your lifetime.

However, there may come a time when you need to make changes to your revocable trust. Perhaps your financial situation has changed, or you have had a change of heart regarding your beneficiaries. Whatever the reason, it is important to understand your options when it comes to changing a revocable trust.

One option is to simply revoke the existing trust and create a new one. This can be a relatively straightforward process, but it does require some time and effort. You will need to draft a new trust document, transfer your assets into the new trust, and update any beneficiary designations or other related documents.

Another option is to amend the existing trust. This involves making changes to specific provisions within the trust document, rather than revoking the entire trust. Amending a trust can be a more efficient option if you only need to make minor changes, such as updating a beneficiary or changing the distribution percentages.

It is important to note that changing a revocable trust should be done with the guidance of an experienced estate planning attorney. They can help you navigate the legal requirements and ensure that your changes are properly executed. Additionally, they can provide valuable advice and guidance based on your specific circumstances.

Understanding Revocable Trusts

A revocable trust, also known as a living trust or a revocable living trust, is a legal document that allows an individual, known as the grantor or settlor, to transfer their assets into a trust during their lifetime. The grantor retains control over the trust and can make changes or revoke it entirely at any time.

Revocable trusts are commonly used as an estate planning tool to manage and distribute assets upon the grantor’s death. They offer several benefits, including privacy, flexibility, and the ability to avoid probate.

One of the key features of a revocable trust is that it allows the grantor to maintain control over their assets while providing for the seamless transfer of those assets to beneficiaries after their death. This control allows the grantor to make changes to the trust as their circumstances or wishes change.

Revocable trusts are often used to avoid the probate process, which can be time-consuming and expensive. When assets are held in a revocable trust, they do not go through probate upon the grantor’s death, which can save both time and money for the beneficiaries.

Another advantage of a revocable trust is privacy. Unlike a will, which becomes a public record upon probate, a revocable trust allows for the distribution of assets to remain private. This can be particularly beneficial for individuals who value their privacy or have complex family dynamics.

However, revocable trusts also have limitations. While they offer flexibility during the grantor’s lifetime, they do not provide asset protection from creditors or lawsuits. Additionally, assets held in a revocable trust are still considered part of the grantor’s estate for tax purposes.

What is a Revocable Trust?

A revocable trust, also known as a living trust or a revocable living trust, is a legal document that allows an individual, known as the grantor or settlor, to transfer their assets into a trust during their lifetime. The grantor retains control over the trust and can make changes or revoke it entirely at any time.

A revocable trust is a popular estate planning tool because it offers flexibility and control. It allows the grantor to manage their assets and plan for the distribution of their estate after their death. Unlike a will, a revocable trust avoids probate, which can be a lengthy and costly process.

One of the key features of a revocable trust is that it can be changed or amended. This means that if the grantor’s circumstances or wishes change, they have the ability to modify the terms of the trust. They can add or remove beneficiaries, change distribution percentages, or even revoke the trust entirely.

Revocable trusts are often used to provide for the grantor’s loved ones after their death. The trust can specify how assets should be distributed and can include provisions for minor children, disabled beneficiaries, or individuals with special needs. It can also be used to minimize estate taxes and protect assets from creditors.

It’s important to note that a revocable trust is not the same as an irrevocable trust. An irrevocable trust cannot be changed or revoked once it is established, while a revocable trust can be modified or revoked by the grantor.

In summary, a revocable trust is a flexible estate planning tool that allows the grantor to retain control over their assets during their lifetime. It offers the ability to make changes or revoke the trust entirely, providing peace of mind and ensuring that the grantor’s wishes are carried out.

Benefits of a Revocable Trust

A revocable trust, also known as a living trust, offers several benefits to individuals who choose to establish one:

- Probate avoidance: One of the main advantages of a revocable trust is that it allows assets to pass directly to beneficiaries without going through the probate process. This can save time, money, and provide privacy for the family.

- Flexibility: Unlike an irrevocable trust, a revocable trust can be modified or revoked at any time during the grantor’s lifetime. This provides flexibility in case the grantor’s circumstances or wishes change.

- Asset management: A revocable trust allows the grantor to maintain control over their assets while they are alive and competent. The grantor can act as the trustee and manage the trust assets, or appoint a successor trustee to handle the management if needed.

- Disability planning: A revocable trust can include provisions for managing the grantor’s assets in the event of their incapacity or disability. This can help ensure that their financial affairs are taken care of without the need for a court-appointed guardian or conservator.

- Privacy: Unlike a will, which becomes a public record upon probate, a revocable trust allows for the distribution of assets to remain private. This can be beneficial for individuals who prefer to keep their financial affairs confidential.

- Continuity of asset management: A revocable trust can provide for the seamless transfer of asset management to a successor trustee upon the grantor’s death or incapacity. This can help avoid any disruption in the management and distribution of assets.

Overall, a revocable trust offers individuals the ability to maintain control over their assets, avoid probate, and provide for the smooth transition of asset management in the event of incapacity or death. It is a flexible estate planning tool that can be customized to meet the specific needs and goals of the grantor.

Limitations of a Revocable Trust

A revocable trust, also known as a living trust, offers many benefits, but it also has its limitations. It’s important to understand these limitations before deciding to establish a revocable trust.

1. No asset protection: One of the main limitations of a revocable trust is that it does not provide asset protection. Since the trust is revocable, the assets held in the trust are still considered part of your personal estate. This means that creditors can still go after these assets to satisfy any outstanding debts or claims.

2. No tax advantages: Another limitation of a revocable trust is that it does not offer any tax advantages. The assets held in the trust are still subject to estate taxes upon your death. However, a revocable trust can help simplify the probate process, which may result in some cost savings.

3. Limited privacy: While a revocable trust can help avoid probate, it does not provide the same level of privacy as other estate planning tools. When a revocable trust becomes irrevocable upon your death, it becomes a public document that can be accessed by anyone. This means that the details of your assets and beneficiaries can become public knowledge.

4. Inflexibility: Once a revocable trust becomes irrevocable, it cannot be changed or amended. This lack of flexibility can be a limitation if your circumstances or wishes change in the future. In contrast, a will can be easily updated or revoked as needed.

5. Cost: Establishing and maintaining a revocable trust can be more expensive compared to other estate planning options. There are costs associated with creating the trust document, transferring assets into the trust, and ongoing administrative expenses. It’s important to consider these costs when deciding if a revocable trust is the right choice for you.

While a revocable trust offers many benefits, it’s important to weigh these limitations against your specific needs and goals. Consulting with an estate planning attorney can help you determine if a revocable trust is the best option for your individual circumstances.

Options for Changing a Revocable Trust

When it comes to changing a revocable trust, there are several options available to you. Whether you want to make minor adjustments or completely overhaul the trust, here are some options to consider:

| Option | Description |

|---|---|

| Amending the Trust | One option is to amend the revocable trust. This involves making changes to specific provisions or adding new provisions to the trust document. Amending the trust allows you to modify certain aspects without revoking the entire trust. |

| Restating the Trust | If you want to make more extensive changes to the trust, you may consider restating the trust. This involves creating a new trust document that incorporates the desired changes. The original trust is revoked, and the new trust takes its place. |

| Revoking and Creating a New Trust | In some cases, it may be necessary to revoke the existing revocable trust and create a new one. This option is typically chosen when the desired changes are significant and cannot be achieved through amendments or restatements. |

| Trust Protector | Another option is to appoint a trust protector. A trust protector is a third-party individual or entity who has the authority to make changes to the trust as specified in the trust document. This option allows for flexibility and ensures that the trust can be modified if circumstances change in the future. |

Before making any changes to a revocable trust, it is important to consult with an experienced estate planning attorney. They can guide you through the process and help you determine the best option for your specific situation. Keep in mind that changing a revocable trust may have legal and tax implications, so it is crucial to seek professional advice.

Amending a Revocable Trust

Amending a revocable trust is a process that allows the grantor to make changes to the trust document during their lifetime. There are several reasons why someone might want to amend their revocable trust, such as changes in personal circumstances, changes in tax laws, or changes in estate planning goals.

When amending a revocable trust, it is important to follow the proper legal procedures to ensure that the changes are valid and enforceable. The specific requirements for amending a revocable trust may vary depending on the jurisdiction, so it is advisable to consult with an attorney who specializes in estate planning.

One option for amending a revocable trust is to execute a trust amendment. A trust amendment is a separate document that is used to modify specific provisions of the original trust. This document must be signed and witnessed in accordance with the legal requirements of the jurisdiction.

Another option for amending a revocable trust is to execute a trust restatement. A trust restatement is a new trust document that replaces the original trust in its entirety. This document must also be signed and witnessed in accordance with the legal requirements.

When amending a revocable trust, it is important to consider the potential impact on other estate planning documents, such as wills, powers of attorney, and healthcare directives. Changes to the revocable trust may necessitate corresponding changes to these documents to ensure consistency and avoid conflicts.

It is also important to communicate any changes to the revocable trust to the beneficiaries and other interested parties. This can help to avoid confusion and potential disputes in the future.

Question-answer:

What is a revocable trust?

A revocable trust, also known as a living trust, is a legal document that allows you to transfer your assets into a trust during your lifetime. You can make changes or revoke the trust at any time.

Can I change the terms of a revocable trust?

Yes, you can change the terms of a revocable trust. Since you have control over the trust during your lifetime, you can amend or modify it as you see fit.

What are the options for changing a revocable trust?

There are several options for changing a revocable trust. You can amend the trust document, add or remove beneficiaries, change the distribution of assets, or even revoke the trust entirely.

Do I need a lawyer to change a revocable trust?

While it is not required to have a lawyer to change a revocable trust, it is highly recommended. A lawyer can ensure that the changes are made correctly and in accordance with the law.

What happens if I don’t change my revocable trust?

If you don’t change your revocable trust, the terms and provisions of the trust will remain the same. This means that the assets will be distributed according to the original terms of the trust.

What is a revocable trust?

A revocable trust is a legal arrangement where an individual, known as the grantor, transfers their assets into a trust, which is managed by a trustee. The grantor retains the ability to make changes or revoke the trust during their lifetime.