- Section 1: Renting Out Your Home

- Option 1: Renting Out Your Entire Home

- Option 2: Renting Out a Portion of Your Home

- Option 3: Renting Out Your Home Temporarily

- Section 2: Renting an Apartment While Owning a Home

- Option 1: Renting an Apartment as a Second Home

- Question-answer:

- Can I rent an apartment if I already own a home?

- What are the advantages of renting an apartment if you already own a home?

- Are there any disadvantages to renting an apartment if you already own a home?

- Can I rent out my home while renting an apartment?

- What should I consider before deciding to rent an apartment if I already own a home?

- Can I rent an apartment if I already own a home?

Are you a homeowner who is considering renting an apartment? You may be wondering if it’s possible to rent an apartment while still owning a home. The good news is that it is indeed possible, and there are several options available to you.

One option is to rent out your home and use the rental income to cover the cost of renting an apartment. This can be a great way to generate additional income while still having a place to live. However, it’s important to consider the responsibilities that come with being a landlord, such as finding tenants, maintaining the property, and dealing with any issues that may arise.

Another option is to temporarily rent out your home and rent an apartment in the meantime. This can be a good option if you’re planning to travel or if you need a temporary place to live while renovating your home. Renting an apartment can provide you with a convenient and hassle-free living arrangement during this time.

Alternatively, you may choose to keep your home and rent an apartment as a second residence. This can be a great option if you want to have a place to stay in a different city or if you’re looking for a change of scenery. Renting an apartment can give you the flexibility to explore new areas and experience a different lifestyle.

Overall, renting an apartment while owning a home is definitely possible. It’s important to carefully consider your options and determine what will work best for your individual situation. Whether you choose to rent out your home, temporarily rent it out, or keep it as a second residence, renting an apartment can provide you with a variety of benefits and opportunities.

Section 1: Renting Out Your Home

When you own a home but are considering renting an apartment, there are several options to explore. One of the first options is to rent out your own home. This can be a great way to generate additional income while still having a place to live.

Option 1: Renting Out Your Entire Home

If you are open to the idea of temporarily moving out of your home, you can rent out the entire property. This option allows you to become a landlord and collect rent from tenants. However, it’s important to consider the responsibilities that come with being a landlord, such as maintaining the property, finding tenants, and handling any issues that may arise.

Option 2: Renting Out a Portion of Your Home

If you’re not comfortable with the idea of renting out your entire home, you can consider renting out a portion of it. This could be a basement, a spare bedroom, or even a separate unit within your home. Renting out a portion of your home can provide you with extra income while still allowing you to maintain your privacy and personal space.

Option 3: Renting Out Your Home Temporarily

If you’re not ready to commit to a long-term rental situation, you can explore the option of renting out your home temporarily. This could be done while you’re on vacation, traveling for work, or even during a short-term relocation. Renting out your home temporarily can help cover your expenses while you’re away and ensure that your property is not sitting vacant.

Overall, renting out your home can be a viable option if you’re considering renting an apartment while still owning a home. It’s important to carefully consider your options and weigh the pros and cons before making a decision. Renting out your home can provide you with additional income, but it also comes with responsibilities and potential challenges. By exploring your options and understanding the rental market in your area, you can make an informed decision that suits your needs and financial goals.

Option 1: Renting Out Your Entire Home

If you own a home and are considering renting it out, there are several options available to you. One option is to rent out your entire home, which can be a great way to generate income and cover your mortgage payments.

Before renting out your home, there are a few things you should consider. First, you’ll need to determine if you’re legally allowed to rent out your property. Some homeowners associations or local zoning laws may have restrictions on renting out homes. It’s important to check with your local government or a real estate attorney to ensure you’re in compliance with any regulations.

Once you’ve determined that you can legally rent out your home, you’ll need to decide how to market your property. You can list your home for rent on various online platforms, such as Craigslist or Airbnb, or you can work with a real estate agent to find a tenant. It’s important to thoroughly screen potential tenants to ensure they are responsible and reliable.

When renting out your entire home, you’ll need to consider the financial implications. You’ll need to determine how much rent to charge, taking into account factors such as the location, size, and condition of your home. It’s also important to factor in any expenses, such as property taxes, insurance, and maintenance costs.

Additionally, you’ll need to decide if you’ll manage the property yourself or hire a property management company. Managing the property yourself can save you money, but it also requires time and effort. A property management company can handle tasks such as finding tenants, collecting rent, and handling maintenance issues, but they will charge a fee for their services.

Before renting out your entire home, it’s important to familiarize yourself with landlord-tenant laws in your area. These laws govern the rights and responsibilities of both landlords and tenants and can vary from state to state. It’s important to understand your obligations as a landlord and ensure you’re in compliance with all applicable laws.

Renting out your entire home can be a profitable venture, but it’s important to carefully consider all aspects before making a decision. By doing your research and planning ahead, you can ensure a successful and smooth rental experience.

Option 2: Renting Out a Portion of Your Home

If you own a home and are considering renting it out, but don’t want to give up the entire property, renting out a portion of your home can be a great option. This allows you to generate rental income while still maintaining some privacy and control over your living space.

There are a few different ways you can go about renting out a portion of your home. One option is to rent out a single room or a few rooms within your home. This is a popular choice for homeowners who have extra space and want to make some extra money. You can advertise the rooms for rent and screen potential tenants to find the right fit for your home.

Another option is to create a separate living space within your home, such as a basement apartment or an accessory dwelling unit (ADU). This involves converting a part of your home into a self-contained living space with its own entrance, kitchen, and bathroom. Renting out this separate unit can provide you with a steady rental income while still allowing you to maintain your privacy in the rest of your home.

When renting out a portion of your home, it’s important to consider the legal and financial implications. You may need to check local zoning laws and obtain any necessary permits or licenses. You should also consult with a lawyer or real estate professional to ensure you are following all the necessary regulations and protecting your rights as a landlord.

Additionally, you will need to determine the rental price for the portion of your home you are renting out. This can be based on factors such as the size and condition of the space, the location, and the current rental market. It’s a good idea to research similar rental properties in your area to get an idea of what you can charge.

Overall, renting out a portion of your home can be a smart financial move. It allows you to generate rental income while still maintaining some control over your living space. Just be sure to do your research, follow the necessary legal steps, and set a fair rental price to ensure a successful and profitable rental experience.

Option 3: Renting Out Your Home Temporarily

If you own a home and are considering renting it out temporarily, there are a few things you should know. Renting out your home can be a great way to earn some extra income, especially if you’re not currently living in the property. Whether you’re going on an extended vacation, traveling for work, or simply have an extra property that you’re not using, renting it out can help cover the costs of your mortgage and other expenses.

Before you decide to rent out your home temporarily, there are a few important factors to consider. First, you’ll need to check with your local government or homeowners association to ensure that renting out your property is allowed. Some areas have restrictions or regulations on short-term rentals, so it’s important to do your research beforehand.

Once you’ve determined that renting out your home is permitted, you’ll need to decide how long you want to rent it out for. Temporary rentals can range from a few weeks to several months, depending on your needs and the demand in your area. Consider factors such as the time of year, local events, and the rental market in your area when deciding on the duration of your rental.

Next, you’ll need to prepare your home for renters. This includes cleaning and decluttering the space, making any necessary repairs or updates, and ensuring that the property is safe and secure. You may also want to consider hiring a property management company to handle the rental process, including finding tenants, collecting rent, and addressing any issues that may arise.

When it comes to finding tenants for your temporary rental, there are several options available. You can list your property on vacation rental websites, such as Airbnb or VRBO, or you can work with a local real estate agent who specializes in short-term rentals. Be sure to thoroughly screen potential tenants, including conducting background checks and verifying their references, to ensure that they will be responsible and respectful of your property.

Finally, it’s important to consider the financial implications of renting out your home temporarily. You’ll need to determine an appropriate rental price that covers your expenses and allows you to make a profit. You’ll also need to factor in any additional costs, such as insurance or taxes, that may be associated with renting out your property.

Section 2: Renting an Apartment While Owning a Home

While it may seem unconventional, there are situations where renting an apartment while owning a home can be a practical choice. Whether you need a temporary living arrangement or simply want a change of scenery, renting an apartment can offer flexibility and convenience.

Option 1: Renting an Apartment as a Second Home

If you own a home and have the financial means, renting an apartment as a second home can be an attractive option. This allows you to have a separate space for yourself or your family members, providing privacy and independence. It can also serve as a vacation home or a place to stay when you’re visiting a different city or country.

Renting an apartment as a second home can be beneficial if you frequently travel for work or have multiple properties in different locations. It eliminates the need to constantly pack and unpack your belongings, making your life more convenient and hassle-free.

However, it’s important to consider the financial implications of renting an apartment as a second home. You’ll need to factor in the cost of rent, utilities, and maintenance expenses. Additionally, you may need to hire a property management company to oversee the apartment while you’re away.

Before making a decision, evaluate your budget and determine if renting an apartment as a second home aligns with your financial goals and lifestyle.

Overall, renting an apartment while owning a home can provide flexibility and convenience in certain situations. Whether you choose to rent an apartment as a second home or explore other options, it’s essential to carefully consider your needs and financial circumstances before making a decision.

Option 1: Renting an Apartment as a Second Home

If you own a home but are considering renting an apartment as a second home, there are a few things you should know. Renting an apartment while owning a home can provide you with flexibility and convenience, whether you’re looking for a temporary living situation or a permanent second residence.

When renting an apartment as a second home, it’s important to consider your budget and financial situation. Make sure you can afford both your mortgage payments on your primary home and the rent for the apartment. Take into account any additional expenses such as utilities, maintenance fees, and insurance.

Another factor to consider is the location of the apartment. Choose an apartment that is convenient for you in terms of commute, amenities, and proximity to your primary home. Consider the neighborhood, safety, and access to public transportation or major highways.

Before renting an apartment, it’s essential to review the lease agreement carefully. Understand the terms and conditions, including the duration of the lease, rent amount, security deposit, and any restrictions or rules set by the landlord or property management. Ensure that the lease allows for your specific situation of renting as a second home.

When renting an apartment as a second home, you may also need to consider the logistics of managing two properties. This includes coordinating maintenance and repairs for both your primary home and the apartment, as well as managing any rental agreements or tenant issues if you decide to rent out your primary home.

Lastly, it’s important to consult with a real estate professional or financial advisor to ensure that renting an apartment as a second home aligns with your long-term goals and financial plans. They can provide guidance on the legal and financial implications of renting out your primary home or renting an apartment as a second home.

| Pros | Cons |

|---|---|

| Flexibility and convenience | Additional financial responsibilities |

| Potential rental income | Logistical challenges of managing two properties |

| Opportunity for a second residence | Reviewing and understanding lease agreements |

| Consulting with professionals for guidance |

Question-answer:

Can I rent an apartment if I already own a home?

Yes, you can rent an apartment even if you already own a home. Many people choose to rent an apartment for various reasons, such as downsizing, relocating, or wanting a change of scenery.

What are the advantages of renting an apartment if you already own a home?

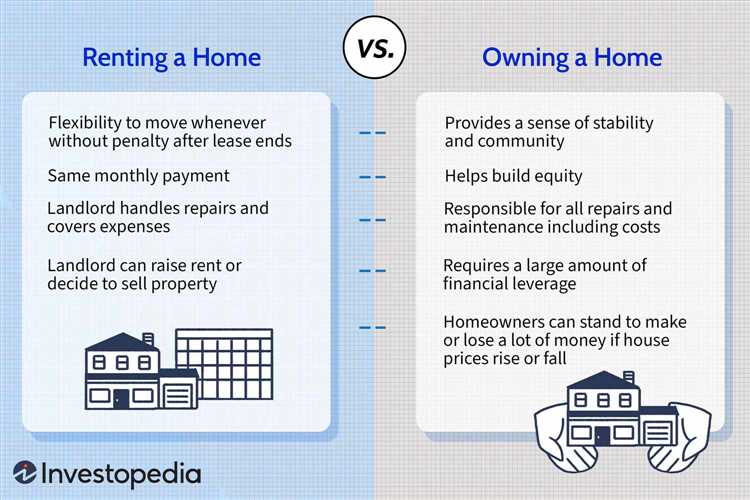

There are several advantages to renting an apartment if you already own a home. Firstly, it provides flexibility and freedom to move to a new location without the hassle of selling your home. Additionally, renting an apartment can be more affordable than owning a home, as you don’t have to worry about property taxes, maintenance costs, and mortgage payments.

Are there any disadvantages to renting an apartment if you already own a home?

While there are advantages to renting an apartment if you already own a home, there are also some disadvantages to consider. One major disadvantage is the loss of potential equity that comes with owning a home. When you rent, you are essentially paying someone else’s mortgage instead of building equity in your own property. Additionally, you may have less control over the living space and restrictions on making changes or renovations.

Can I rent out my home while renting an apartment?

Yes, it is possible to rent out your home while renting an apartment. This can be a good option if you want to generate rental income from your home while living in a different location. However, it’s important to check with local laws and regulations, as some areas may have restrictions on renting out properties.

What should I consider before deciding to rent an apartment if I already own a home?

Before deciding to rent an apartment if you already own a home, there are several factors to consider. Firstly, think about your long-term goals and whether renting aligns with them. Consider the financial implications, such as the cost of rent versus mortgage payments, as well as the potential loss of equity. Additionally, think about the practical aspects, such as the location, size, and amenities of the apartment you are considering.

Can I rent an apartment if I already own a home?

Yes, you can rent an apartment even if you already own a home. Many people choose to rent an apartment for various reasons, such as downsizing, relocating, or wanting a change of scenery.