- Understanding the Consequences of Driving Without Insurance

- Legal Ramifications

- Financial Consequences

- What to Do If Your Car Gets Repossessed

- Contact Your Lender

- Explore Your Options

- Seek Legal Advice

- Question-answer:

- What happens if I don’t have car insurance?

- Can my car be repossessed if I miss a payment on my insurance?

- What should I do if my car is repossessed due to no insurance?

- Can I get my car back if it is repossessed for no insurance?

- What are the consequences of driving without insurance?

- What happens if I don’t have car insurance?

- Can my car be repossessed if I miss a few insurance payments?

Car insurance is a legal requirement in most countries, and for good reason. It provides financial protection in case of accidents, theft, or damage to your vehicle. But what happens if you fail to maintain insurance coverage? Can your car be repossessed?

The short answer is yes, your car can be repossessed for no insurance. When you finance or lease a car, the lender or leasing company usually requires you to maintain comprehensive and collision insurance. This is to protect their investment in case of an accident or damage to the vehicle.

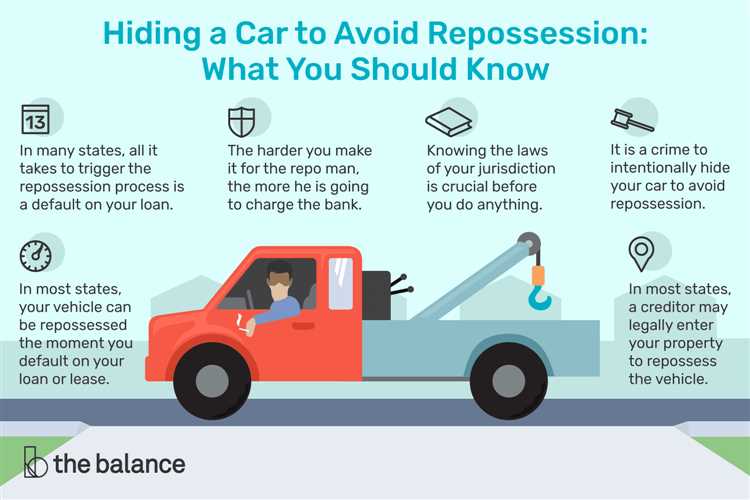

If you fail to maintain insurance coverage, you are in breach of your loan or lease agreement. This gives the lender or leasing company the right to repossess the car. They can do this without warning and without a court order in most cases.

It’s important to note that the laws regarding car repossession for no insurance vary by state and country. Some jurisdictions may require the lender to provide notice and give you an opportunity to obtain insurance before repossessing the vehicle. However, in many cases, the lender can repossess the car immediately if they discover you have no insurance.

So, if you’re thinking of canceling your car insurance or letting it lapse, think again. Not only are you putting yourself at financial risk in case of an accident or damage to your vehicle, but you could also lose your car altogether. It’s always best to maintain proper insurance coverage to protect yourself and your investment.

Understanding the Consequences of Driving Without Insurance

Driving without insurance can have serious consequences both legally and financially. It is important to understand these consequences to avoid any unnecessary trouble.

1. Legal Ramifications: Driving without insurance is illegal in most states. If you are caught driving without insurance, you may face fines, license suspension, and even jail time. Additionally, your vehicle may be impounded, and you may be required to pay towing and storage fees.

2. Financial Consequences: If you are involved in an accident without insurance, you will be personally responsible for any damages or injuries caused. This means that you may have to pay for medical bills, property damage, and legal fees out of your own pocket. Without insurance, you are also at risk of being sued by the other party involved in the accident.

3. Difficulty Obtaining Insurance in the Future: Driving without insurance can make it difficult for you to obtain insurance coverage in the future. Insurance companies may view you as a high-risk driver and charge you higher premiums or deny coverage altogether. This can make it more expensive and challenging for you to get insured in the future.

4. Impact on Your Driving Record: Driving without insurance can also have a negative impact on your driving record. Insurance companies and potential employers may view this as a red flag and question your responsibility and reliability. This can affect your ability to get affordable insurance rates and may even impact your employment prospects.

5. Peace of Mind: Having insurance provides you with peace of mind knowing that you are financially protected in case of an accident. It ensures that you are not personally liable for any damages or injuries and can help you avoid legal trouble.

It is crucial to understand the consequences of driving without insurance and to always maintain proper coverage. Make sure to research and choose the right insurance policy that meets your needs and budget. Remember, driving without insurance is not worth the risk.

Legal Ramifications

Driving without insurance can have serious legal consequences. In most states, it is illegal to operate a motor vehicle without proper insurance coverage. If you are caught driving without insurance, you may face fines, license suspension, and even jail time.

When you are pulled over by law enforcement and cannot provide proof of insurance, you may receive a citation. The specific penalties vary by state, but they can be quite severe. In some cases, you may be required to pay a hefty fine, which can range from a few hundred dollars to several thousand dollars.

In addition to fines, your driver’s license may be suspended or revoked. This means that you will not be able to legally drive for a certain period of time. The length of the suspension or revocation depends on the laws of your state and the severity of the offense.

Furthermore, driving without insurance can also result in increased insurance premiums in the future. Insurance companies view uninsured drivers as high-risk individuals, and they may raise your rates or refuse to provide coverage altogether. This can make it difficult and expensive to obtain insurance in the future.

In some cases, driving without insurance can even lead to criminal charges. If you are involved in an accident and do not have insurance, you may be held personally liable for any damages or injuries. This can result in a lawsuit and potentially significant financial consequences.

It is important to understand the legal ramifications of driving without insurance and to take the necessary steps to ensure that you are properly insured. This includes obtaining the required coverage and keeping it up to date. If you find yourself in a situation where your car has been repossessed due to lack of insurance, it is important to contact your lender and explore your options. Seeking legal advice can also be beneficial in understanding your rights and responsibilities.

Financial Consequences

Driving without insurance can have severe financial consequences. If you are caught driving without insurance, you may face hefty fines and penalties. The exact amount varies depending on the state you are in, but it can range from a few hundred dollars to several thousand dollars.

In addition to fines, you may also be required to pay for any damages or injuries that occur as a result of an accident. Without insurance, you will be personally responsible for covering these costs, which can quickly add up to a significant amount.

Furthermore, driving without insurance can also lead to higher insurance premiums in the future. Insurance companies view uninsured drivers as high-risk individuals, and as a result, they may charge higher rates or even refuse to provide coverage altogether. This can make it difficult and expensive to obtain insurance in the future.

Another financial consequence of driving without insurance is the potential for your vehicle to be repossessed. If you fail to maintain insurance on your car, your lender may have the right to repossess it. This means that you could lose your vehicle, and you will still be responsible for any remaining loan balance.

Additionally, if your car is repossessed, you may also be responsible for any fees associated with the repossession process. This can include towing fees, storage fees, and administrative fees. These costs can further add to your financial burden.

Overall, driving without insurance can have significant financial consequences. It is essential to maintain proper insurance coverage to protect yourself financially and avoid these potential pitfalls.

What to Do If Your Car Gets Repossessed

If your car has been repossessed due to non-payment of insurance, it is important to take immediate action to resolve the situation. Here are the steps you should follow:

| Contact Your Lender |

| As soon as you become aware that your car has been repossessed, contact your lender. They will be able to provide you with information on why the repossession occurred and what steps you can take to resolve the issue. |

| Explore Your Options |

| Once you have spoken to your lender, explore your options for getting your car back. This may include paying off the outstanding insurance balance, negotiating a new payment plan, or even surrendering the car and finding alternative transportation. |

| Seek Legal Advice |

| If you are unable to come to a resolution with your lender or if you believe that the repossession was unjust, it may be necessary to seek legal advice. An attorney specializing in consumer law can help you understand your rights and options. |

Remember, it is crucial to act quickly and responsibly if your car has been repossessed. Ignoring the situation or failing to communicate with your lender can lead to further legal and financial consequences. By taking the appropriate steps outlined above, you can work towards resolving the issue and potentially getting your car back.

Contact Your Lender

When your car gets repossessed due to lack of insurance, it is crucial to contact your lender as soon as possible. Your lender is the one who financed your car, and they have a vested interest in its well-being. By reaching out to them, you can start the process of resolving the situation and potentially getting your car back.

When contacting your lender, be prepared to provide them with all the necessary information regarding the repossession. This includes the date and time it occurred, the location, and any other relevant details. It is important to be honest and transparent with your lender to ensure a smooth communication process.

During the conversation, ask your lender about the specific steps you need to take to retrieve your car. They may require you to provide proof of insurance or make arrangements to reinstate your coverage. Additionally, they may inform you about any fees or penalties associated with the repossession.

It is important to remain calm and respectful when speaking with your lender. Remember that they are there to help you find a solution, and being cooperative can go a long way in resolving the situation. If you have any questions or concerns, do not hesitate to ask for clarification.

Keep in mind that contacting your lender is just the first step in the process. It is essential to follow their instructions and take the necessary actions to rectify the situation. This may involve obtaining insurance coverage, paying outstanding fees, or negotiating a repayment plan.

By contacting your lender promptly and working together to find a resolution, you increase your chances of getting your car back and avoiding further legal and financial consequences. Remember, communication is key in these situations, so stay proactive and keep the lines of communication open with your lender.

Explore Your Options

When your car has been repossessed due to lack of insurance, it’s important to explore your options to regain possession or resolve the situation. Here are some steps you can take:

1. Contact your lender: Reach out to your lender as soon as possible to discuss the situation. They may be willing to work with you to come up with a solution, such as reinstating your loan or setting up a payment plan.

2. Negotiate with the lender: If you’re unable to reinstate your loan or make immediate payments, try negotiating with your lender. They may be open to alternative arrangements, such as selling the car and using the proceeds to pay off the loan.

3. Consider legal assistance: If you’re facing difficulties in resolving the situation with your lender, it may be wise to seek legal advice. An attorney specializing in repossession and insurance laws can guide you through the process and help protect your rights.

4. Explore alternative transportation options: While you work on resolving the repossession issue, consider alternative transportation options. This could include using public transportation, carpooling, or renting a vehicle temporarily.

5. Review your insurance options: Take this opportunity to review your insurance options and find a policy that fits your needs and budget. It’s crucial to have adequate coverage to avoid future repossessions and legal consequences.

Remember, each situation is unique, and the options available to you may vary. It’s essential to act quickly and proactively to address the repossession and find a resolution that works for you.

Seek Legal Advice

If your car has been repossessed due to lack of insurance, it is important to seek legal advice to understand your rights and options. A lawyer specializing in car repossession cases can provide valuable guidance and help you navigate through the legal process.

When seeking legal advice, it is important to find a lawyer who has experience in handling car repossession cases and understands the specific laws and regulations in your jurisdiction. They will be able to assess your situation, review any relevant documents, and provide you with the best course of action.

A lawyer can help you understand if the repossession was conducted legally and if there are any grounds for disputing it. They can also guide you on how to negotiate with the lender to potentially recover your vehicle or minimize the financial consequences.

Additionally, a lawyer can help you explore any potential legal remedies or defenses that may be available to you. They can assist you in filing any necessary legal documents and represent you in court if the situation escalates.

Seeking legal advice is crucial to protect your rights and ensure that you are aware of all your options. It can help you make informed decisions and potentially improve your chances of resolving the situation in a favorable manner.

Remember, every case is unique, and the information provided here is general in nature. Consulting with a lawyer will provide you with personalized advice based on your specific circumstances.

Question-answer:

What happens if I don’t have car insurance?

If you don’t have car insurance, you are at risk of having your car repossessed. In many states, it is illegal to drive without insurance, and if you are caught, your car can be impounded. Additionally, if you have a loan or lease on your car, the lender or leasing company may require you to have insurance as part of the agreement. If you fail to maintain insurance, they have the right to repossess your car.

Can my car be repossessed if I miss a payment on my insurance?

No, your car cannot be repossessed solely for missing a payment on your insurance. However, if you fail to make your insurance payments and your policy is canceled, you will be driving without insurance, which is illegal in many states. If you are caught driving without insurance, your car can be impounded, and if you have a loan or lease on your car, the lender or leasing company may have the right to repossess it.

What should I do if my car is repossessed due to no insurance?

If your car is repossessed due to no insurance, you should contact the lender or leasing company immediately to discuss your options. They may require you to provide proof of insurance before they will release your car. You will also need to obtain insurance as soon as possible to avoid any further legal issues. It is important to address the situation promptly to minimize any potential consequences.

Can I get my car back if it is repossessed for no insurance?

Whether or not you can get your car back after it is repossessed for no insurance depends on the policies of the lender or leasing company. In some cases, they may require you to provide proof of insurance and pay any outstanding fees or fines before they will release your car. It is important to contact them as soon as possible to discuss your options and work towards getting your car back.

What are the consequences of driving without insurance?

The consequences of driving without insurance can vary depending on the state you live in. In many states, it is illegal to drive without insurance, and if you are caught, you can face fines, license suspension, and even jail time. Additionally, if you are involved in an accident without insurance, you may be personally responsible for any damages or injuries, which can result in significant financial hardship. It is always best to maintain proper car insurance to protect yourself and others on the road.

What happens if I don’t have car insurance?

If you don’t have car insurance, you may face legal consequences such as fines, license suspension, or even having your car repossessed.

Can my car be repossessed if I miss a few insurance payments?

Yes, if you miss a few insurance payments, your car can be repossessed. Insurance is a requirement for owning a car, and failing to maintain coverage can result in repossession.