- Understanding the Impact of Owed Taxes on Starting a Business

- Assessing Your Tax Debt

- Exploring Business Structures

- Seeking Professional Advice

- Managing Tax Obligations as a Business Owner

- Question-answer:

- What are the consequences of starting a business when you owe taxes?

- Can I start a business if I owe back taxes?

- Can I start a business if I owe taxes?

- What are the consequences of starting a business when you owe taxes?

Starting a business can be an exciting and rewarding venture, but it can also come with its fair share of challenges. One of the biggest challenges that aspiring entrepreneurs may face is dealing with tax obligations. If you owe taxes to the government, it’s important to understand how this can impact your new business and what steps you can take to navigate this situation.

First and foremost, it’s crucial to address any outstanding tax debts before starting your business. Ignoring or neglecting your tax obligations can lead to serious consequences, including penalties, fines, and even legal action. It’s always best to be proactive and transparent with the tax authorities to avoid any potential issues down the line.

When starting a business while owing taxes, it’s essential to develop a solid financial plan. This plan should include a strategy for paying off your tax debts while also managing the day-to-day expenses of your new venture. It may be necessary to allocate a portion of your business income towards your tax obligations to ensure that you stay on track and avoid falling further into debt.

Additionally, seeking professional advice from a tax accountant or a business advisor can be immensely helpful. These experts can provide guidance on how to structure your business, manage your finances, and navigate the complexities of tax laws. They can also help you explore any available tax relief options or negotiate with the tax authorities on your behalf.

Starting a business when you owe taxes can be challenging, but it’s not impossible. By addressing your tax obligations head-on, developing a solid financial plan, and seeking professional advice, you can set yourself up for success and ensure that your new venture thrives despite any tax-related hurdles.

Understanding the Impact of Owed Taxes on Starting a Business

Starting a business can be an exciting and rewarding venture, but it’s important to understand the potential impact of owed taxes on your new endeavor. Failing to address your tax debt can have serious consequences for your business, including legal issues and financial difficulties. Here are some key points to consider:

- Legal Consequences: If you owe taxes to the government, it’s crucial to address this issue before starting a business. Unresolved tax debt can lead to legal action, such as liens on your assets or even the seizure of your business. It’s important to work with the appropriate tax authorities to develop a plan for repayment or negotiate a settlement.

- Financial Challenges: Owed taxes can create significant financial challenges for a new business. It’s important to consider how your tax debt will impact your cash flow and ability to meet other financial obligations. Unresolved tax debt can result in penalties and interest, which can further strain your finances. It’s essential to develop a realistic budget and financial plan that takes into account your tax obligations.

- Creditworthiness: Unresolved tax debt can also have a negative impact on your creditworthiness. This can make it difficult to secure financing or obtain favorable terms for loans or credit lines. It’s important to address your tax debt and work towards resolving it in order to maintain a good credit standing.

- Reputation: Owed taxes can also affect your reputation as a business owner. If word gets out that you have unresolved tax debt, it can damage your credibility and make it harder to attract customers or business partners. It’s important to address your tax obligations and demonstrate your commitment to responsible financial management.

- Compliance: As a business owner, it’s essential to comply with all tax laws and regulations. Failing to address your tax debt can lead to further non-compliance issues and potential legal consequences. It’s important to work with a tax professional or accountant who can help you navigate the complexities of tax compliance and ensure that you meet all your obligations.

Overall, it’s crucial to understand the impact of owed taxes on starting a business. By addressing your tax debt and developing a plan for repayment, you can avoid legal issues, financial difficulties, and damage to your reputation. Seek professional advice and take proactive steps to manage your tax obligations as a responsible business owner.

Assessing Your Tax Debt

Before starting a business, it is crucial to assess your tax debt and understand the impact it may have on your new venture. Ignoring or underestimating your tax obligations can lead to serious consequences, including penalties, fines, and even legal action. Here are some steps to help you assess your tax debt:

1. Gather all necessary documents:

Start by collecting all relevant documents, such as tax returns, W-2 forms, 1099 forms, and any other financial records related to your income and expenses. This will give you a clear picture of your current tax situation.

2. Calculate your outstanding tax debt:

Once you have gathered all the necessary documents, calculate your outstanding tax debt. This includes any unpaid taxes, penalties, and interest that may have accrued over time. Be thorough and accurate in your calculations to ensure you have a complete understanding of your tax debt.

3. Review payment options:

After calculating your tax debt, review the available payment options. The IRS offers various payment plans, such as installment agreements, where you can pay off your debt over time. It is important to understand the terms and conditions of each payment option and choose the one that best suits your financial situation.

4. Seek professional advice:

If you are unsure about how to assess your tax debt or navigate the payment options, it is advisable to seek professional advice. A tax professional or accountant can help you understand your tax obligations, explore potential deductions or credits, and guide you through the process of resolving your tax debt.

5. Develop a repayment plan:

Once you have a clear understanding of your tax debt and have explored the available payment options, develop a repayment plan. This plan should outline how you will pay off your tax debt over time, taking into consideration your current income, expenses, and other financial obligations. Stick to the plan to ensure you stay on track and avoid further penalties.

6. Stay organized and proactive:

Finally, it is essential to stay organized and proactive in managing your tax obligations as a business owner. Keep accurate records of your income and expenses, file your tax returns on time, and make timely payments towards your tax debt. By staying on top of your tax responsibilities, you can avoid future issues and focus on growing your business.

Assessing your tax debt is a crucial step in starting a business. By understanding your tax obligations and taking proactive measures to address them, you can ensure a solid financial foundation for your new venture.

Exploring Business Structures

When starting a business, it is important to consider the different business structures available to you. The choice of business structure can have significant implications for your tax obligations, so it is crucial to explore your options and choose the structure that best suits your needs.

There are several common business structures to consider:

| Structure | Description |

|---|---|

| Sole Proprietorship | A sole proprietorship is the simplest form of business structure. It is owned and operated by a single individual, and the individual is personally responsible for all aspects of the business, including taxes. |

| Partnership | A partnership is a business structure in which two or more individuals share ownership and responsibility for the business. Each partner is personally responsible for their share of the business’s taxes. |

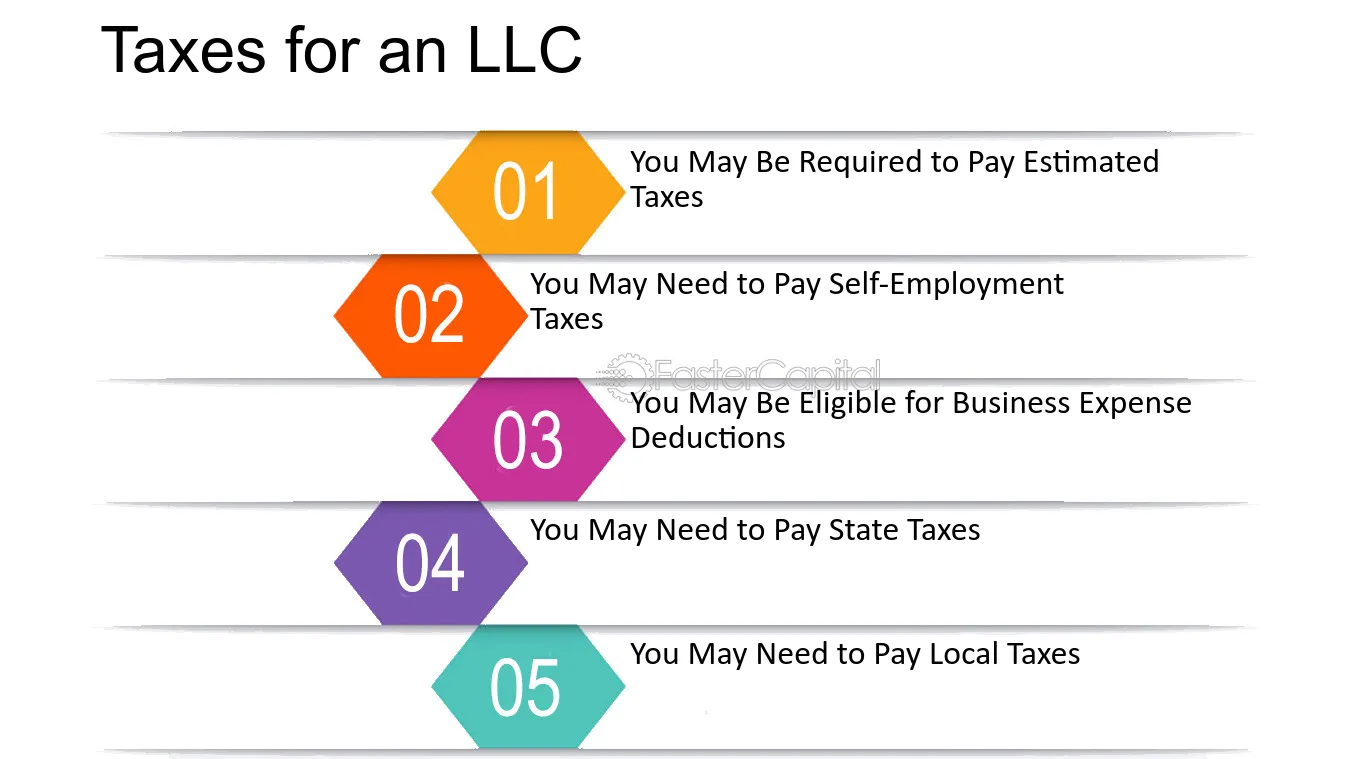

| Limited Liability Company (LLC) | An LLC is a hybrid business structure that combines the limited liability protection of a corporation with the flexibility and tax advantages of a partnership. The owners of an LLC, known as members, are not personally responsible for the company’s taxes. |

| Corporation | A corporation is a separate legal entity from its owners. It offers limited liability protection to its shareholders, meaning they are not personally responsible for the company’s taxes. However, corporations are subject to double taxation, as both the company and its shareholders are taxed on profits. |

When choosing a business structure, it is important to consider factors such as liability protection, tax implications, and the complexity of formation and operation. It is recommended to consult with a tax professional or an attorney to determine the best structure for your specific situation.

Additionally, it is important to note that regardless of the business structure you choose, you will still have tax obligations as a business owner. These obligations may include filing regular tax returns, paying estimated taxes, and keeping accurate records of your business’s income and expenses. Failure to meet these obligations can result in penalties and legal consequences.

Seeking Professional Advice

When starting a business while owing taxes, it is crucial to seek professional advice to ensure that you are making informed decisions and taking the necessary steps to address your tax obligations. A tax professional, such as a certified public accountant (CPA) or a tax attorney, can provide valuable guidance and help you navigate the complexities of starting a business while dealing with tax debt.

Here are some reasons why seeking professional advice is essential:

- Expertise: Tax professionals have in-depth knowledge and expertise in tax laws and regulations. They can assess your specific tax situation, understand the implications of your tax debt on your business, and provide tailored advice based on your circumstances.

- Tax Planning: A tax professional can help you develop a tax plan for your business that takes into account your outstanding tax debt. They can advise you on strategies to minimize your tax liability, maximize deductions, and ensure compliance with tax laws.

- Negotiating with the IRS: If you owe taxes to the Internal Revenue Service (IRS), a tax professional can represent you in negotiations with the IRS. They can help you explore options such as installment agreements, offers in compromise, or other tax relief programs that may be available to you.

- Business Structure: A tax professional can assist you in choosing the most suitable business structure for your situation, considering factors such as your tax debt, liability protection, and future growth plans. They can explain the tax implications of different business structures, such as sole proprietorship, partnership, corporation, or limited liability company (LLC).

- Compliance: Starting a business involves various tax obligations, such as obtaining an employer identification number (EIN), registering for state and local taxes, and filing tax returns. A tax professional can guide you through these compliance requirements and ensure that you meet all your tax obligations as a business owner.

Remember, seeking professional advice is an investment in your business’s success and can help you avoid costly mistakes or legal issues related to your tax debt. It is important to choose a reputable and experienced tax professional who understands your unique situation and can provide the guidance you need.

By working with a tax professional, you can gain peace of mind knowing that you are taking the necessary steps to address your tax debt while starting and running a successful business.

Managing Tax Obligations as a Business Owner

As a business owner, it is crucial to understand and effectively manage your tax obligations. Failing to do so can result in penalties, fines, and even legal consequences. Here are some key steps to help you manage your tax obligations:

| Step | Description |

|---|---|

| 1 | Keep Accurate Records |

| 2 | Separate Business and Personal Expenses |

| 3 | Understand Tax Deadlines |

| 4 | Pay Estimated Taxes |

| 5 | Hire a Professional Accountant |

| 6 | Stay Informed About Tax Laws and Changes |

Keeping accurate records is essential for managing your tax obligations. This includes maintaining detailed financial statements, receipts, and invoices. By having organized records, you can easily track your income and expenses, making it easier to file your taxes accurately.

It is also important to separate your business and personal expenses. This means having separate bank accounts and credit cards for your business. Mixing personal and business expenses can complicate your tax filings and may raise red flags with the tax authorities.

Understanding tax deadlines is crucial to avoid late filing penalties. Make sure you are aware of the due dates for filing your tax returns and paying any taxes owed. Consider setting reminders or using accounting software to help you stay on top of these deadlines.

As a business owner, you may be required to pay estimated taxes throughout the year. This is especially true if you are self-employed or have a business that generates significant income. Consult with a tax professional to determine if you need to make estimated tax payments and how much you should pay.

Hiring a professional accountant can greatly assist you in managing your tax obligations. They can help you navigate complex tax laws, maximize deductions, and ensure accurate and timely filing of your tax returns. A qualified accountant can also provide valuable advice on tax planning strategies to minimize your tax liability.

Lastly, it is crucial to stay informed about tax laws and changes that may affect your business. Tax laws are constantly evolving, and it is important to stay up to date to ensure compliance and take advantage of any available tax benefits. Consider subscribing to tax newsletters, attending seminars, or consulting with a tax professional to stay informed.

By following these steps and effectively managing your tax obligations, you can avoid unnecessary penalties and ensure the financial health and success of your business.

Question-answer:

What are the consequences of starting a business when you owe taxes?

If you owe taxes and start a business, there are several consequences you should be aware of. First, the IRS can place a tax lien on your business assets, which can make it difficult to obtain financing or sell your business. Second, the IRS can garnish your business income to satisfy your tax debt. Finally, if you fail to pay your taxes, the IRS can take legal action against you, which may result in fines, penalties, or even imprisonment.

Can I start a business if I owe back taxes?

Yes, you can start a business if you owe back taxes. However, it is important to understand the consequences and take steps to address your tax debt. You should consider working with a tax professional to develop a plan for paying off your back taxes and ensuring compliance with your future tax obligations. It is also important to keep accurate records and separate your personal and business finances to avoid any potential issues.

Can I start a business if I owe taxes?

Yes, you can start a business even if you owe taxes. However, it is important to understand that your tax debt may have an impact on your business operations and financial situation. It is recommended to consult with a tax professional to understand your options and develop a plan to manage your tax debt while starting a business.

What are the consequences of starting a business when you owe taxes?

Starting a business when you owe taxes can have several consequences. Firstly, the IRS may place a tax lien on your business assets, which can make it difficult to obtain financing or sell your assets. Additionally, the IRS may garnish your business income to satisfy your tax debt. It is important to address your tax debt and work out a payment plan with the IRS to avoid these consequences.