- Understanding Long Term Disability and Unemployment Benefits

- What is Long Term Disability?

- What are Unemployment Benefits?

- Can You Collect Unemployment After Long Term Disability Ends?

- Factors to Consider

- Applying for Unemployment Benefits

- Question-answer:

- Can I collect unemployment benefits after my long-term disability runs out?

- What happens if my long-term disability runs out and I can’t find a job?

- Can I apply for unemployment benefits if I am still receiving long-term disability payments?

- What should I do if my long-term disability runs out and I am still unable to work?

- Are there any other benefits I can apply for if my long-term disability runs out?

- Can I collect unemployment benefits after my long-term disability runs out?

- What happens if my long-term disability runs out and I am still unable to work?

Long term disability insurance provides financial support to individuals who are unable to work due to a disabling condition. However, there may come a time when the benefits from long term disability insurance run out, leaving individuals in a difficult financial situation. In such cases, many people wonder if they can collect unemployment benefits as a form of financial assistance.

Unemployment benefits are typically provided to individuals who have lost their jobs through no fault of their own and are actively seeking employment. However, the eligibility criteria for unemployment benefits may vary depending on the state and the specific circumstances of the individual.

When it comes to collecting unemployment after long term disability runs out, the answer is not straightforward. In some cases, individuals may be eligible for unemployment benefits if they are able and available to work, actively seeking employment, and meet the other eligibility requirements set by their state’s unemployment insurance program.

It is important to note that each state has its own rules and regulations regarding unemployment benefits, and the eligibility criteria can vary. Some states may consider individuals who are unable to work due to a disability as not being able and available to work, which may disqualify them from receiving unemployment benefits. However, other states may have more lenient rules and may consider individuals with disabilities as eligible for unemployment benefits if they are actively seeking employment.

Understanding Long Term Disability and Unemployment Benefits

Long term disability (LTD) benefits and unemployment benefits are two different types of financial assistance that individuals may be eligible for in certain situations. It is important to understand the differences between these benefits and how they can potentially interact with each other.

What is Long Term Disability?

Long term disability benefits are typically provided through private insurance policies or employer-sponsored plans. These benefits are designed to provide income replacement for individuals who are unable to work due to a qualifying disability. The duration of these benefits can vary depending on the specific policy or plan, but they are generally intended to provide financial support for an extended period of time.

What are Unemployment Benefits?

Unemployment benefits, on the other hand, are provided by the government to individuals who have lost their jobs through no fault of their own. These benefits are intended to provide temporary financial assistance while the individual searches for new employment. The duration and amount of unemployment benefits can vary depending on the state and individual circumstances.

Can You Collect Unemployment After Long Term Disability Ends?

Whether or not you can collect unemployment benefits after your long term disability benefits end depends on several factors. Each state has its own rules and regulations regarding eligibility for unemployment benefits, so it is important to consult the specific guidelines for your state.

Some states may consider individuals who are still unable to work due to a disability as eligible for unemployment benefits, while others may require that the individual is actively seeking and available for work. It is also possible that the receipt of long term disability benefits may impact your eligibility for unemployment benefits, as these benefits are typically considered income.

Applying for Unemployment Benefits

If you believe you may be eligible for unemployment benefits after your long term disability benefits end, it is important to follow the appropriate application process in your state. This typically involves submitting an application and providing documentation to support your claim.

It is recommended to consult with an attorney or a representative from your state’s unemployment office to fully understand the eligibility requirements and application process for unemployment benefits in your specific situation.

What is Long Term Disability?

Long term disability refers to a type of insurance coverage that provides financial protection to individuals who are unable to work due to a disability. This disability can be either physical or mental and can result from an injury, illness, or other medical condition.

Long term disability insurance typically pays a percentage of the individual’s pre-disability income on a monthly basis. The specific amount and duration of the benefits can vary depending on the terms of the insurance policy.

Long term disability insurance is often offered as part of an employee benefits package, but individuals can also purchase it independently. It is designed to provide income replacement and financial stability for individuals who are unable to work for an extended period of time.

It is important to note that long term disability insurance is different from short term disability insurance, which typically covers a shorter period of time, such as a few weeks or months.

Overall, long term disability insurance serves as a safety net for individuals who experience a disability and are unable to earn a regular income. It helps to alleviate financial stress and provides a source of income to cover living expenses and medical costs during the period of disability.

What are Unemployment Benefits?

Unemployment benefits are financial assistance provided by the government to individuals who have lost their jobs and are actively seeking new employment. These benefits are designed to provide temporary financial support to help individuals meet their basic needs while they search for a new job.

Unemployment benefits are typically funded through payroll taxes paid by employers. The specific amount and duration of benefits vary depending on the state in which the individual resides and the individual’s previous earnings.

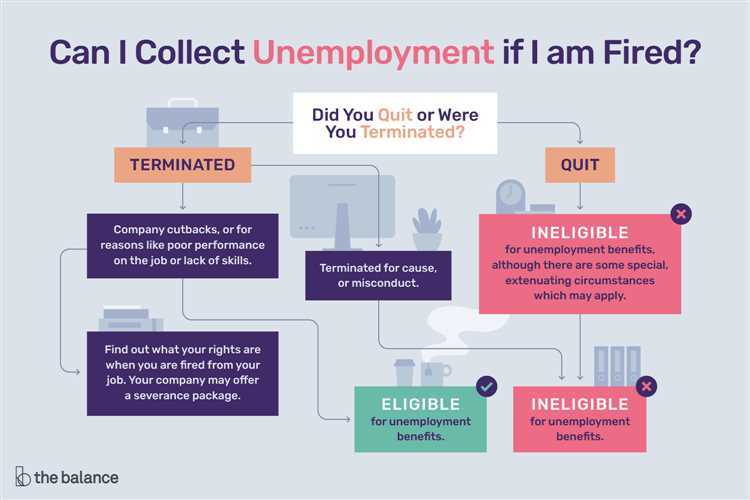

To qualify for unemployment benefits, individuals must meet certain eligibility requirements, such as being actively seeking employment, being able and available to work, and having lost their job through no fault of their own. Individuals who voluntarily quit their job or were terminated for misconduct may not be eligible for unemployment benefits.

Once approved for unemployment benefits, individuals typically receive a weekly or bi-weekly payment. The amount of the payment is based on the individual’s previous earnings and may be subject to a maximum limit set by the state.

It is important to note that unemployment benefits are intended to be temporary and are typically available for a limited period of time, such as 26 weeks. Individuals must actively search for new employment and report their job search activities to the state unemployment agency to continue receiving benefits.

Overall, unemployment benefits provide a safety net for individuals who have lost their jobs and are actively seeking new employment. These benefits help to bridge the financial gap during the job search process and provide individuals with some financial stability while they work towards finding a new job.

Can You Collect Unemployment After Long Term Disability Ends?

After your long term disability benefits run out, you may be wondering if you are eligible to collect unemployment benefits. The answer to this question depends on several factors.

Firstly, it is important to understand the difference between long term disability and unemployment benefits. Long term disability benefits are typically provided by an employer or through a private insurance policy and are designed to provide income replacement if you are unable to work due to a disability. Unemployment benefits, on the other hand, are provided by the government and are intended to provide temporary financial assistance to individuals who have lost their jobs through no fault of their own.

Whether or not you can collect unemployment after your long term disability ends will depend on the specific circumstances of your situation. One factor to consider is whether you are able and available to work. In order to qualify for unemployment benefits, you generally need to be actively seeking employment and able to accept suitable job offers. If you are still unable to work due to your disability, you may not meet these requirements and therefore may not be eligible for unemployment benefits.

Another factor to consider is the reason for the end of your long term disability benefits. If your benefits end because you have recovered from your disability and are able to return to work, you may be eligible for unemployment benefits if you are actively seeking employment. However, if your benefits end because you have reached the maximum duration allowed under your policy or because your disability is considered permanent, you may not be eligible for unemployment benefits.

It is important to note that eligibility for unemployment benefits is determined by the state in which you live. Each state has its own specific requirements and guidelines for determining eligibility. It is recommended that you contact your state’s unemployment office or visit their website to get accurate and up-to-date information regarding your eligibility for unemployment benefits after your long term disability ends.

Factors to Consider

When determining whether you can collect unemployment benefits after your long-term disability ends, there are several factors to consider:

- State Laws: Unemployment benefits are governed by state laws, so it’s important to understand the specific regulations in your state. Some states may allow individuals to collect both long-term disability and unemployment benefits, while others may have restrictions or limitations.

- Ability to Work: To be eligible for unemployment benefits, you typically need to be able and available to work. If your long-term disability prevents you from working, you may not meet this requirement.

- Job Search Requirements: Most states require individuals receiving unemployment benefits to actively search for work. If your disability prevents you from actively seeking employment, you may not be eligible for unemployment benefits.

- Medical Documentation: Some states may require medical documentation to support your disability claim and eligibility for unemployment benefits. It’s important to gather any necessary medical records or documentation to support your case.

- Timing: The timing of your long-term disability and unemployment benefits can also impact your eligibility. If your long-term disability ends before you are able to find suitable employment, you may be eligible for unemployment benefits. However, if you find employment before your disability ends, you may no longer be eligible for unemployment benefits.

It’s important to consult with an attorney or a representative from your state’s unemployment office to fully understand your rights and eligibility for unemployment benefits after your long-term disability ends. They can provide guidance based on your specific circumstances and help you navigate the process.

Applying for Unemployment Benefits

When your long-term disability runs out and you find yourself in need of financial assistance, applying for unemployment benefits can be a viable option. However, there are certain factors to consider before submitting your application.

Firstly, it’s important to understand the eligibility requirements for unemployment benefits in your state. Each state has its own criteria, such as minimum earnings and work history, that you must meet in order to qualify. Research the specific requirements for your state and gather any necessary documentation to support your application.

Next, you will need to file your unemployment claim. This can typically be done online or by phone, depending on your state’s procedures. Be prepared to provide detailed information about your previous employment, including dates of employment, job titles, and reasons for separation from each job. It’s crucial to be honest and accurate in your application to avoid any potential issues or delays in receiving benefits.

After submitting your claim, you may be required to participate in a phone or in-person interview with a representative from the unemployment office. This interview is an opportunity for you to provide additional information and clarify any details regarding your eligibility. Be prepared to answer questions about your job search efforts and any income you may be receiving from other sources.

Once your application is approved, you will need to continue meeting the ongoing requirements to receive unemployment benefits. This typically includes actively seeking employment, registering with the state’s job service, and reporting any income you earn while receiving benefits. Failure to comply with these requirements may result in a loss of benefits.

It’s important to note that unemployment benefits are typically temporary and meant to provide temporary financial assistance while you search for new employment. If you are still unable to work due to a disability, you may need to explore other options, such as applying for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI).

Question-answer:

Can I collect unemployment benefits after my long-term disability runs out?

Yes, you may be eligible to collect unemployment benefits after your long-term disability runs out. However, eligibility requirements vary by state, so you should check with your state’s unemployment office for specific information.

What happens if my long-term disability runs out and I can’t find a job?

If your long-term disability runs out and you are unable to find a job, you may be eligible for other forms of assistance, such as Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). These programs provide financial support to individuals who are unable to work due to a disability.

Can I apply for unemployment benefits if I am still receiving long-term disability payments?

It depends on the state you live in and the specific circumstances of your case. Some states allow individuals to receive both unemployment benefits and long-term disability payments, while others may offset the amount of unemployment benefits based on the amount of disability payments received. You should contact your state’s unemployment office for more information.

What should I do if my long-term disability runs out and I am still unable to work?

If your long-term disability runs out and you are still unable to work, you should consider applying for other forms of assistance, such as Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). These programs provide financial support to individuals who are unable to work due to a disability. Additionally, you may want to seek legal advice to explore other options that may be available to you.

Are there any other benefits I can apply for if my long-term disability runs out?

If your long-term disability runs out, you may be eligible for other benefits such as Medicaid, Medicare, or other state-specific assistance programs. These programs provide healthcare coverage and financial support to individuals with low income or disabilities. It is recommended to contact your local social services office or a disability advocate for more information on the benefits you may be eligible for.

Can I collect unemployment benefits after my long-term disability runs out?

Yes, you may be eligible to collect unemployment benefits after your long-term disability runs out. However, eligibility requirements vary by state, so it is important to check with your state’s unemployment office to determine if you meet the criteria.

What happens if my long-term disability runs out and I am still unable to work?

If your long-term disability runs out and you are still unable to work, you may be eligible for other forms of assistance, such as Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). These programs provide financial support to individuals who are unable to work due to a disability. It is recommended to consult with a disability attorney or contact your local Social Security office to explore your options.