- Benefits of Switching

- Increased Accuracy

- Cost Savings

- Flexibility

- Considerations before Switching

- Record Keeping

- Question-answer:

- Can I switch from using mileage to actual expenses for my business?

- What are the advantages of switching from mileage to actual expenses?

- Are there any disadvantages to switching from mileage to actual expenses?

- Can I switch from using actual expenses to mileage?

- How do I calculate my actual expenses for my business vehicle?

- Can I switch from using mileage to actual expenses for my business?

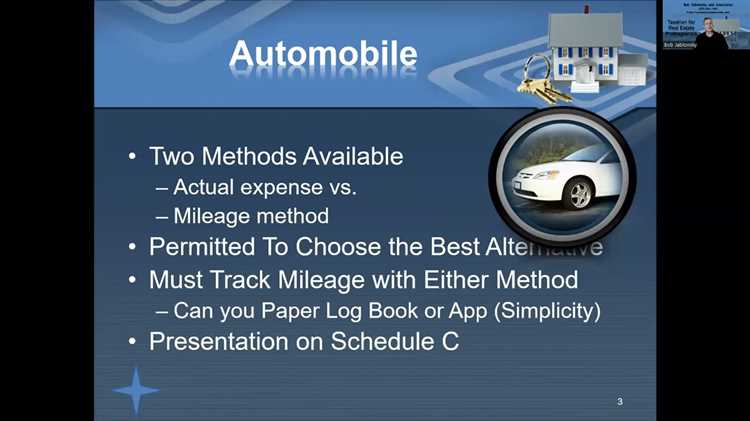

When it comes to deducting business expenses, one of the most common methods used by self-employed individuals is the mileage deduction. This method allows you to deduct a certain amount for each mile driven for business purposes. However, there may be instances where switching from the mileage deduction to deducting actual expenses can be more beneficial.

The mileage deduction is a simple and straightforward method. You keep track of the number of miles driven for business purposes and multiply it by the standard mileage rate set by the IRS. This rate takes into account the average cost of gas, maintenance, and depreciation of a vehicle. While this method is convenient, it may not always accurately reflect the actual expenses incurred.

Switching to deducting actual expenses allows you to claim a wider range of expenses related to your vehicle. This includes not only gas and maintenance but also insurance, registration fees, lease payments, and even depreciation. By keeping detailed records of these expenses, you can potentially claim a higher deduction and reduce your overall tax liability.

However, switching from the mileage deduction to deducting actual expenses requires careful consideration. You need to weigh the benefits of claiming a higher deduction against the additional record-keeping and documentation required. It is important to keep accurate and detailed records of all your vehicle-related expenses to support your deduction in case of an audit.

Benefits of Switching

Switching from mileage to actual expenses can offer several benefits for individuals or businesses. Here are some of the advantages:

Increased Accuracy: By tracking actual expenses, you can have a more accurate representation of the costs associated with using a vehicle for business purposes. This can help you make better financial decisions and allocate resources more effectively.

Cost Savings: Switching to actual expenses can potentially save you money. While mileage deductions are based on a standard rate per mile, actual expenses allow you to deduct the full cost of operating the vehicle, including fuel, maintenance, insurance, and depreciation. Depending on your situation, this could result in higher deductions and lower tax liability.

Flexibility: Actual expenses give you more flexibility in terms of the types of deductions you can claim. For example, if you use your vehicle for both business and personal purposes, you can allocate expenses based on the percentage of business use. This can be beneficial if you have a high percentage of business use or if your vehicle expenses vary significantly from month to month.

Record Keeping: Switching to actual expenses requires more detailed record keeping compared to mileage deductions. However, this can also be an advantage as it forces you to keep better track of your vehicle-related expenses. Having accurate records can help you in case of an audit and ensure that you are claiming the correct deductions.

Overall, switching from mileage to actual expenses can provide more accurate financial information, potential cost savings, increased flexibility, and improved record keeping. However, it is important to carefully consider your specific situation and consult with a tax professional to determine if this switch is beneficial for you.

Increased Accuracy

Switching from mileage to actual expenses can provide increased accuracy in tracking and reporting business expenses. When using the mileage method, you rely on estimating the number of miles driven for business purposes and applying a standard mileage rate to calculate the deductible expenses. However, this method may not accurately reflect the actual costs incurred.

By switching to actual expenses, you have the opportunity to track and deduct the specific costs associated with using your vehicle for business purposes. This includes expenses such as fuel, maintenance and repairs, insurance, registration fees, and depreciation. By recording and deducting these actual expenses, you can have a more accurate representation of the true costs of using your vehicle for business.

Increased accuracy in tracking expenses can be beneficial for several reasons. Firstly, it ensures compliance with tax regulations by providing a more precise record of deductible expenses. This can help avoid potential audits or penalties due to inaccurate reporting.

Secondly, increased accuracy allows for better financial planning and budgeting. By knowing the exact costs associated with using your vehicle for business, you can make more informed decisions regarding your business expenses and allocate resources accordingly.

Lastly, increased accuracy can provide a clearer picture of the profitability of your business. By accurately tracking and deducting the actual expenses related to your vehicle, you can assess the true costs of operating your business and determine its overall profitability.

Cost Savings

Switching from mileage to actual expenses can result in significant cost savings for individuals and businesses. By tracking and deducting actual expenses, you can potentially reduce your tax liability and increase your overall savings.

One of the main cost savings benefits of switching to actual expenses is the ability to deduct a wider range of expenses. While mileage deductions are limited to the standard mileage rate set by the IRS, actual expenses can include a variety of costs such as fuel, maintenance, repairs, insurance, and even depreciation. By accurately tracking and deducting these expenses, you can potentially save more money on your taxes.

Additionally, switching to actual expenses allows you to take advantage of tax deductions for business-related expenses that are not directly related to mileage. For example, if you use your vehicle for business purposes and also have a home office, you may be able to deduct a portion of your home office expenses, such as rent or utilities, as part of your overall vehicle expenses.

Furthermore, by tracking actual expenses, you have the opportunity to identify areas where you can cut costs and save money. For example, if you notice that your vehicle maintenance expenses are high, you can explore ways to reduce these costs, such as finding more affordable repair shops or performing regular maintenance yourself. This proactive approach to managing expenses can lead to long-term cost savings.

Overall, switching from mileage to actual expenses can result in significant cost savings by allowing you to deduct a wider range of expenses, take advantage of additional tax deductions, and identify areas where you can cut costs. However, it is important to carefully consider the potential benefits and drawbacks before making the switch, as it may not be the best option for everyone.

Flexibility

Switching from mileage to actual expenses can provide greater flexibility for individuals and businesses. Instead of being limited to a fixed reimbursement rate per mile, actual expenses allow for a more accurate reflection of the costs incurred during travel.

With actual expenses, individuals and businesses have the flexibility to claim deductions for various costs associated with their vehicles, such as fuel, maintenance, repairs, insurance, and depreciation. This means that if the cost of fuel increases or if there are significant repairs needed, the reimbursement amount can be adjusted accordingly.

Furthermore, actual expenses also allow for flexibility in terms of the types of vehicles that can be used for business purposes. While mileage reimbursement typically applies only to personal vehicles, actual expenses can be claimed for a wider range of vehicles, including leased or rented cars, trucks, or even motorcycles.

Additionally, switching to actual expenses can provide flexibility in terms of the distance traveled. With mileage reimbursement, individuals and businesses are often limited to a specific rate per mile, regardless of the actual distance traveled. However, with actual expenses, the reimbursement is based on the actual costs incurred, allowing for a more accurate reflection of the distance traveled.

Considerations before Switching

Before making the decision to switch from mileage to actual expenses for your business, there are several important considerations to keep in mind:

1. Cost Analysis: It is crucial to conduct a thorough cost analysis to determine if switching to actual expenses will be financially beneficial for your business. Consider factors such as the cost of maintaining and repairing your vehicle, fuel expenses, insurance premiums, and depreciation.

2. Time and Effort: Switching to actual expenses requires more time and effort compared to simply tracking mileage. You will need to keep detailed records of all vehicle-related expenses, including receipts and invoices. This can be time-consuming and may require additional administrative work.

3. Accuracy: While switching to actual expenses can provide increased accuracy in terms of tracking your vehicle-related costs, it also requires meticulous record-keeping. Any errors or omissions in your records can lead to inaccurate deductions and potential issues with the IRS.

4. IRS Guidelines: It is essential to familiarize yourself with the IRS guidelines regarding the deduction of actual vehicle expenses. Make sure you understand the specific requirements and documentation needed to claim these deductions correctly.

5. Business Needs: Consider whether switching to actual expenses aligns with your business needs and goals. If your business requires frequent travel or has high vehicle-related expenses, switching may be a more suitable option. However, if your business has minimal vehicle usage, sticking with the mileage deduction may be more practical.

6. Consultation: It is advisable to consult with a tax professional or accountant before making the switch. They can provide valuable insights and guidance based on your specific business situation and help you make an informed decision.

By carefully considering these factors, you can determine whether switching from mileage to actual expenses is the right choice for your business. Remember to weigh the potential benefits against the additional time, effort, and record-keeping requirements involved.

Record Keeping

When switching from mileage to actual expenses for tax purposes, it is important to maintain accurate and detailed records. Keeping organized records will help ensure that you can substantiate your expenses and deductions if you are ever audited by the IRS.

Here are some tips for effective record keeping:

1. Keep all receipts: Save receipts for all expenses related to your vehicle, including gas, oil changes, repairs, insurance, and registration fees. These receipts will serve as proof of your expenses and can be used to calculate your deductions.

2. Maintain a mileage log: Even though you are switching to actual expenses, it is still important to track your mileage. This will help you determine the percentage of business use for your vehicle, which is necessary for calculating your deductions. Keep a detailed log of your business-related trips, including the date, starting and ending locations, purpose of the trip, and number of miles driven.

3. Separate personal and business expenses: It is crucial to keep your personal and business expenses separate. Use a separate credit card or bank account for business-related expenses to make it easier to track and document your deductions.

4. Use technology: Consider using mileage tracking apps or expense management software to help streamline the record-keeping process. These tools can automatically track your mileage, categorize expenses, and generate reports for tax purposes.

5. Retain records for at least three years: The IRS generally has three years from the date you filed your tax return to audit your records. Therefore, it is recommended to keep all relevant records for at least three years in case of an audit.

By following these record-keeping practices, you can ensure that you are prepared for tax season and have the necessary documentation to support your deductions. Remember, accurate record keeping is essential when switching from mileage to actual expenses.

Question-answer:

Can I switch from using mileage to actual expenses for my business?

Yes, you can switch from using mileage to actual expenses for your business. However, you need to keep in mind that once you make the switch, you cannot switch back to using mileage for the same vehicle in future years.

What are the advantages of switching from mileage to actual expenses?

Switching from mileage to actual expenses allows you to deduct all of your vehicle-related expenses, such as gas, insurance, repairs, and maintenance. This can result in a higher deduction than using the standard mileage rate.

Are there any disadvantages to switching from mileage to actual expenses?

One disadvantage of switching from mileage to actual expenses is that it requires more record-keeping. You will need to keep track of all your vehicle-related expenses and maintain detailed records to support your deductions.

Can I switch from using actual expenses to mileage?

No, once you switch from using actual expenses to mileage, you cannot switch back to using actual expenses for the same vehicle in future years. However, you can choose to use mileage for one vehicle and actual expenses for another.

How do I calculate my actual expenses for my business vehicle?

To calculate your actual expenses for your business vehicle, you need to add up all of your vehicle-related expenses, such as gas, insurance, repairs, maintenance, and depreciation. You can then deduct the percentage of these expenses that are related to your business use of the vehicle.

Can I switch from using mileage to actual expenses for my business?

Yes, you can switch from using mileage to actual expenses for your business. However, you need to keep in mind that once you make the switch, you cannot switch back to using mileage for the same vehicle in future years.