- Understanding Unemployment Benefits for Part-Time Workers

- Eligibility Criteria for Unemployment Benefits

- How Part-Time Employment Affects Unemployment Benefits

- Steps to Apply for Unemployment Benefits after Losing a Part-Time Job

- Question-answer:

- Can I collect unemployment if I lose my part-time job?

- What are the eligibility requirements for collecting unemployment benefits?

- How much money can I receive in unemployment benefits if I lose my part-time job?

- What should I do if I lose my part-time job and want to collect unemployment benefits?

- Are there any alternatives to collecting unemployment benefits if I lose my part-time job?

- Can I collect unemployment if I lose my part-time job?

Unemployment benefits are designed to provide financial assistance to individuals who have lost their jobs and are actively seeking new employment. However, the eligibility for unemployment benefits can vary depending on the type of job you had and the circumstances surrounding your job loss. If you have recently lost a part-time job, you may be wondering if you are eligible to collect unemployment benefits.

The answer to this question depends on several factors, including the state in which you live and the reason for your job loss. In general, individuals who lose a part-time job may be eligible for unemployment benefits if they meet certain criteria. These criteria typically include having earned a minimum amount of wages during a specific base period and being able and available to work.

It is important to note that each state has its own specific requirements and regulations regarding unemployment benefits. Some states may have stricter eligibility criteria for part-time workers, while others may have more lenient requirements. Additionally, the reason for your job loss can also impact your eligibility. For example, if you were fired for misconduct or voluntarily quit your part-time job without good cause, you may not be eligible for unemployment benefits.

If you have lost a part-time job and are unsure about your eligibility for unemployment benefits, it is recommended that you contact your state’s unemployment office or visit their website for more information. They will be able to provide you with specific details about the eligibility requirements in your state and guide you through the application process.

Understanding Unemployment Benefits for Part-Time Workers

Unemployment benefits are not only available for full-time workers, but also for part-time workers who have lost their jobs. It is important for part-time workers to understand how unemployment benefits work and what they are entitled to in order to navigate the process effectively.

Eligibility Criteria for Unemployment Benefits

In order to qualify for unemployment benefits as a part-time worker, there are certain eligibility criteria that need to be met. These criteria may vary depending on the state, but generally include the following:

- Minimum earnings: Part-time workers must have earned a minimum amount of wages during a specific period of time, known as the base period.

- Reason for job loss: Part-time workers must have lost their job through no fault of their own. This means that if they were laid off, their position was eliminated, or their employer went out of business, they may be eligible for benefits.

- Availability and willingness to work: Part-time workers must be available and willing to accept suitable employment opportunities. This means that they should actively be seeking new employment and not turning down suitable job offers.

How Part-Time Employment Affects Unemployment Benefits

When a part-time worker applies for unemployment benefits, their part-time earnings may affect the amount of benefits they receive. In most states, part-time earnings are deducted from the weekly benefit amount. If a part-time worker earns more than a certain threshold, they may not be eligible for benefits for that week.

It is important for part-time workers to report their earnings accurately and timely to the unemployment office to avoid any potential penalties or overpayments. Failure to report earnings can result in the loss of benefits or even legal consequences.

Steps to Apply for Unemployment Benefits after Losing a Part-Time Job

If a part-time worker has lost their job and wants to apply for unemployment benefits, they should follow these steps:

- Check eligibility: Review the eligibility criteria for unemployment benefits in their state to determine if they meet the requirements.

- Gather necessary documents: Collect all the necessary documents, such as proof of earnings and job loss, to support their application.

- File a claim: File an unemployment claim with the state’s unemployment office. This can usually be done online or by phone.

- Provide accurate information: Provide accurate and complete information on the application, including details about their previous employment and earnings.

- Follow up: Follow up with the unemployment office to ensure that their claim is being processed and to provide any additional information if requested.

By understanding the eligibility criteria, how part-time employment affects benefits, and the steps to apply for unemployment benefits, part-time workers can navigate the process more effectively and ensure they receive the financial support they are entitled to.

Eligibility Criteria for Unemployment Benefits

When it comes to receiving unemployment benefits, there are certain eligibility criteria that individuals must meet. These criteria are put in place to ensure that the benefits are given to those who truly need them. Here are some of the key factors that determine eligibility for unemployment benefits:

1. Employment Status:

To be eligible for unemployment benefits, individuals must have been employed and have lost their job through no fault of their own. This means that if you voluntarily quit your job or were fired for misconduct, you may not be eligible for benefits.

2. Earnings Requirements:

In order to qualify for unemployment benefits, individuals must have earned a certain amount of wages during a specific period of time, known as the “base period”. The base period is typically the first four out of the last five completed calendar quarters before the individual filed for benefits. The exact earnings requirements vary by state.

3. Availability for Work:

To receive unemployment benefits, individuals must be able and available to work. This means that they must be actively seeking employment and willing to accept suitable job offers. Individuals who are unable to work due to illness or disability may not be eligible for benefits.

4. Job Search Requirements:

Many states require individuals to actively search for work while receiving unemployment benefits. This may involve submitting job applications, attending job fairs, or participating in job training programs. Failure to meet these job search requirements may result in a loss of benefits.

5. Reporting Requirements:

Individuals receiving unemployment benefits are typically required to report any income they earn while receiving benefits. This includes income from part-time or temporary work. Failure to report income accurately may result in penalties or a loss of benefits.

It is important to note that eligibility criteria for unemployment benefits can vary by state. It is recommended to check with your state’s unemployment office or website for specific information regarding eligibility requirements and how to apply for benefits.

How Part-Time Employment Affects Unemployment Benefits

When it comes to receiving unemployment benefits, part-time employment can have an impact on the amount of benefits you are eligible to receive. The rules and regulations regarding part-time employment and unemployment benefits vary from state to state, so it is important to familiarize yourself with the specific guidelines in your state.

In general, if you are working part-time while receiving unemployment benefits, your benefits may be reduced. This is because unemployment benefits are typically calculated based on your previous earnings, and part-time employment can increase your income, which may result in a decrease in benefits.

Each state has its own formula for calculating how part-time earnings affect unemployment benefits. Some states have a specific threshold, where if you earn above a certain amount, your benefits will be reduced or eliminated. Other states may use a percentage-based system, where your benefits are reduced by a certain percentage for every dollar you earn above a certain threshold.

It is important to report any part-time earnings while receiving unemployment benefits. Failure to report your earnings accurately can result in penalties, including having to repay any benefits you were not eligible to receive. Most states require you to report your earnings on a weekly or biweekly basis, and some may require documentation, such as pay stubs or a letter from your employer, to verify your earnings.

Additionally, it is important to note that part-time employment can also affect your eligibility for unemployment benefits. In some states, if you are working a certain number of hours or earning above a certain threshold, you may no longer be considered unemployed and therefore may not be eligible for benefits.

If you are unsure about how part-time employment will affect your unemployment benefits, it is recommended to contact your state’s unemployment office or consult with an employment attorney. They can provide you with the specific information and guidance you need to understand how your part-time employment will impact your benefits.

| Pros | Cons |

|---|---|

| Additional income | Possible reduction in benefits |

| Opportunity to gain new skills | Potential loss of eligibility for benefits |

| Networking opportunities | Reporting and documentation requirements |

Steps to Apply for Unemployment Benefits after Losing a Part-Time Job

Applying for unemployment benefits after losing a part-time job can be a daunting process, but it is important to understand the steps involved to ensure a smooth application. Here are the key steps to follow:

1. Gather necessary documents:

Before starting the application process, gather all the necessary documents that may be required. This may include identification documents, proof of employment, pay stubs, and any other relevant paperwork.

2. Research eligibility requirements:

It is crucial to research and understand the eligibility requirements for unemployment benefits in your specific state. Each state may have different criteria, so make sure you meet all the necessary qualifications before proceeding.

3. File an application:

Once you have gathered all the required documents and confirmed your eligibility, it’s time to file an application for unemployment benefits. This can usually be done online through the state’s unemployment website or by visiting a local unemployment office.

4. Provide accurate information:

When filling out the application, make sure to provide accurate and honest information. Any false or misleading information can result in delays or even denial of benefits.

5. Wait for a decision:

After submitting your application, you will need to wait for a decision from the unemployment office. This process may take some time, so be patient. If additional information is required, make sure to provide it promptly.

6. Attend any required interviews or meetings:

Depending on your state’s requirements, you may be asked to attend interviews or meetings to discuss your eligibility further. Make sure to attend these appointments and provide any requested documentation.

7. Receive benefits:

If your application is approved, you will start receiving unemployment benefits. These benefits are typically paid on a weekly or bi-weekly basis, and the amount will depend on your previous earnings and the regulations of your state.

8. Continue to meet eligibility requirements:

Once you start receiving benefits, it is important to continue meeting the eligibility requirements set by your state. This may include actively seeking employment, reporting any income earned, and attending any required job search or training programs.

By following these steps, you can navigate the process of applying for unemployment benefits after losing a part-time job. Remember to stay informed, provide accurate information, and comply with all the requirements to ensure a successful application.

Question-answer:

Can I collect unemployment if I lose my part-time job?

Yes, you may be eligible to collect unemployment benefits if you lose your part-time job. However, eligibility requirements vary by state, so it’s important to check with your state’s unemployment office to determine if you qualify.

What are the eligibility requirements for collecting unemployment benefits?

The eligibility requirements for collecting unemployment benefits vary by state, but generally, you must have lost your job through no fault of your own, be actively seeking new employment, and meet certain income and work history requirements. It’s best to check with your state’s unemployment office for specific details.

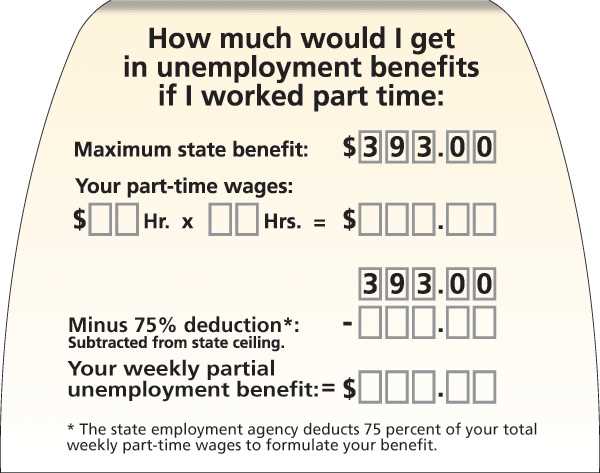

How much money can I receive in unemployment benefits if I lose my part-time job?

The amount of money you can receive in unemployment benefits if you lose your part-time job depends on your previous earnings and the laws of your state. Each state has a maximum weekly benefit amount, and your benefit amount is typically a percentage of your previous earnings. It’s best to check with your state’s unemployment office to get an accurate estimate of how much you may receive.

What should I do if I lose my part-time job and want to collect unemployment benefits?

If you lose your part-time job and want to collect unemployment benefits, you should start by contacting your state’s unemployment office. They will be able to provide you with the necessary information and guide you through the application process. It’s important to file your claim as soon as possible to avoid any delays in receiving benefits.

Are there any alternatives to collecting unemployment benefits if I lose my part-time job?

If you lose your part-time job and are not eligible for unemployment benefits, there may be alternative options available to you. These can include finding another part-time job, applying for government assistance programs, or exploring freelance or gig work opportunities. It’s important to explore all available options and resources to help support yourself financially.

Can I collect unemployment if I lose my part-time job?

Yes, you may be eligible to collect unemployment benefits if you lose your part-time job. However, eligibility requirements vary by state, so it’s important to check with your state’s unemployment office to determine if you qualify.