- Adding a Beneficiary to I Bonds: Everything You Need to Know

- Understanding the Process

- Eligibility Requirements

- Required Documentation

- Submitting the Request

- Question-answer:

- Can I add a beneficiary to my I Bonds?

- How do I add a beneficiary to my I Bonds?

- Is there a limit to the number of beneficiaries I can add to my I Bonds?

- Can I change the beneficiary on my I Bonds?

- What happens if I don’t designate a beneficiary for my I Bonds?

- What are I Bonds?

When it comes to investing in I Bonds, many people wonder if they can add a beneficiary to their account. Adding a beneficiary can provide peace of mind, knowing that your loved ones will be taken care of in the event of your passing. However, the rules for adding a beneficiary to I Bonds are not as straightforward as you might think.

So, can you add a beneficiary to I Bonds?

The answer is no. Unlike other types of investments, such as retirement accounts or life insurance policies, I Bonds do not allow you to designate a beneficiary. This means that if you were to pass away, your I Bonds would become part of your estate and would be distributed according to your will or the laws of intestate succession.

But why don’t I Bonds allow beneficiaries?

The reason for this is that I Bonds are considered non-transferable securities. This means that they cannot be transferred to another person during your lifetime or after your death. The U.S. Department of the Treasury, which issues I Bonds, has set these rules in place to ensure the integrity and security of the savings bond program.

However, there are ways to ensure that your loved ones can access your I Bonds after your passing.

One option is to include your I Bonds in your will. By specifying in your will that your I Bonds should go to a particular person or people, you can ensure that they will receive the funds. It’s important to keep your will up to date and to communicate your wishes to your loved ones so that they know what to expect.

Another option is to consider converting your I Bonds to electronic form. By doing so, you can make it easier for your loved ones to access the funds after your passing. Electronic I Bonds can be held in a TreasuryDirect account, which allows for easy transfer of the bonds to a beneficiary.

Adding a Beneficiary to I Bonds: Everything You Need to Know

Adding a beneficiary to your I Bonds is an important step in ensuring that your investment is protected and can be passed on to your loved ones in the event of your death. Here is everything you need to know about adding a beneficiary to your I Bonds:

- Why add a beneficiary?

- Who can be a beneficiary?

- How to add a beneficiary?

- What happens after adding a beneficiary?

- Can you change or remove a beneficiary?

- What happens to the I Bonds after your death?

By adding a beneficiary to your I Bonds, you can designate who will receive the funds in the event of your death. This can provide peace of mind knowing that your investment will be passed on according to your wishes.

When adding a beneficiary to your I Bonds, you can choose anyone you wish, including family members, friends, or organizations. It is important to consider who you trust to handle your financial affairs and make sure to update your beneficiary designation if your circumstances change.

Adding a beneficiary to your I Bonds is a simple process. You will need to complete the necessary forms provided by the Treasury Department and submit them to the appropriate authorities. The forms will require you to provide information about yourself, the beneficiary, and the percentage of the investment that each beneficiary will receive.

Once you have added a beneficiary to your I Bonds, the Treasury Department will update their records accordingly. It is important to keep a copy of the beneficiary designation forms for your records and inform your beneficiary of their designation.

Yes, you can change or remove a beneficiary at any time by completing new beneficiary designation forms. It is important to review and update your beneficiary designation if your circumstances change, such as a marriage, divorce, or the birth of a child.

In the event of your death, the I Bonds will be transferred to your designated beneficiary. They will need to provide the necessary documentation to claim the funds and follow the instructions provided by the Treasury Department.

Adding a beneficiary to your I Bonds is a simple yet crucial step in protecting your investment and ensuring that your loved ones are taken care of. By understanding the process and following the necessary steps, you can have peace of mind knowing that your investment will be passed on according to your wishes.

Understanding the Process

Adding a beneficiary to your I Bonds involves a straightforward process that can provide peace of mind for you and your loved ones. Here’s what you need to know:

Step 1: Determine Eligibility

Before adding a beneficiary to your I Bonds, you need to ensure that you meet the eligibility requirements. These requirements may vary depending on your specific situation, so it’s important to review them carefully.

Step 2: Gather Required Documentation

Once you’ve confirmed your eligibility, you’ll need to gather the necessary documentation to support your request. This may include identification documents, proof of relationship, and any other relevant paperwork.

Step 3: Submitting the Request

After you’ve gathered all the required documentation, you can submit your request to add a beneficiary to your I Bonds. This can typically be done online or through mail, depending on the options provided by the issuing authority.

Step 4: Review and Confirmation

Once your request is submitted, it will be reviewed by the issuing authority. They will verify the information provided and ensure that all necessary documentation is included. If everything is in order, you will receive confirmation that your beneficiary has been successfully added to your I Bonds.

Step 5: Periodic Review and Updates

It’s important to periodically review your beneficiary designation and make updates as needed. Life circumstances can change, and it’s crucial to ensure that your I Bonds reflect your current wishes.

By understanding the process of adding a beneficiary to your I Bonds, you can take the necessary steps to protect your loved ones and ensure that your assets are distributed according to your wishes. Don’t hesitate to reach out to the issuing authority or seek professional advice if you have any questions or concerns.

Eligibility Requirements

In order to add a beneficiary to your I Bonds, you must meet certain eligibility requirements. These requirements include:

1. Ownership: You must be the sole owner of the I Bonds in order to add a beneficiary. If the I Bonds are jointly owned, both owners must agree to add a beneficiary.

2. Age: You must be at least 18 years old to add a beneficiary to your I Bonds.

3. Relationship: The beneficiary must be a person or entity that is eligible to receive the I Bonds upon your death. This can include a spouse, child, grandchild, or other family member.

4. Documentation: You will need to provide documentation to prove your eligibility and the relationship between you and the beneficiary. This may include birth certificates, marriage certificates, or other legal documents.

5. Consent: If the beneficiary is a minor or incapacitated, you will need to provide consent from a legal guardian or representative.

6. Submission: Once you have met all the eligibility requirements and gathered the necessary documentation, you can submit a request to add a beneficiary to your I Bonds. This can typically be done online or through mail.

It is important to carefully review the eligibility requirements and ensure that you meet all the necessary criteria before adding a beneficiary to your I Bonds. This will help ensure that your wishes are carried out and that your loved ones are taken care of in the event of your death.

Required Documentation

When adding a beneficiary to I Bonds, there are certain documents that you will need to provide. These documents are necessary to verify the identity of both the bond owner and the beneficiary. The required documentation includes:

1. Proof of Identity: You will need to provide a valid government-issued identification document, such as a driver’s license or passport, for both the bond owner and the beneficiary. This document should include a clear photograph and the full legal name of the individual.

2. Social Security Numbers: You will need to provide the Social Security numbers of both the bond owner and the beneficiary. This is important for tax reporting purposes and to ensure that the correct individuals are associated with the bonds.

3. Relationship Documentation: If the beneficiary is not a spouse or a child, you may need to provide additional documentation to establish the relationship between the bond owner and the beneficiary. This could include a marriage certificate, birth certificate, or legal adoption papers.

4. Power of Attorney Documentation: If you are adding a beneficiary on behalf of someone else, such as a parent or a loved one who is unable to do it themselves, you may need to provide power of attorney documentation. This document grants you the legal authority to act on their behalf.

5. Bond Ownership Documentation: You will need to provide proof of ownership for the I Bonds that you wish to add a beneficiary to. This could include physical bond certificates or electronic statements from the TreasuryDirect website.

It is important to gather all the required documentation before submitting your request to add a beneficiary to I Bonds. Missing or incomplete documentation may result in delays or rejection of your request. Make sure to double-check the requirements and provide accurate and up-to-date information to ensure a smooth process.

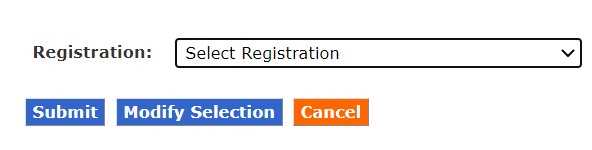

Submitting the Request

Once you have gathered all the necessary documentation and determined your eligibility, you can proceed with submitting the request to add a beneficiary to your I Bonds. Here are the steps you need to follow:

- Download the appropriate form: To submit a request, you will need to download and fill out Form PD F 1851-1, which is the “Request to Reissue United States Savings Bonds” form.

- Provide your information: Fill out the form with your personal information, including your name, address, and Social Security number.

- Provide beneficiary information: Fill out the beneficiary section of the form with the name, address, and Social Security number of the person you want to add as a beneficiary.

- Sign the form: Sign the form to certify that the information provided is accurate and complete.

- Submit the form: Once you have completed and signed the form, you can submit it to the Treasury Retail Securities Site nearest to you. You can find the nearest location on the official website of the U.S. Department of the Treasury.

- Wait for processing: After submitting the form, you will need to wait for the Treasury to process your request. This can take several weeks, so be patient.

- Confirmation: Once your request has been processed, you will receive a confirmation letter from the Treasury. This letter will confirm that the beneficiary has been successfully added to your I Bonds.

It is important to keep a copy of the completed form and the confirmation letter for your records. If you have any questions or need further assistance, you can contact the Treasury Retail Securities Site or the Bureau of the Fiscal Service for guidance.

Question-answer:

Can I add a beneficiary to my I Bonds?

Yes, you can add a beneficiary to your I Bonds. This allows you to designate someone to receive the funds in the event of your death.

How do I add a beneficiary to my I Bonds?

To add a beneficiary to your I Bonds, you need to fill out Form PD F 4000. This form can be obtained from the TreasuryDirect website or by contacting the Bureau of the Fiscal Service.

Is there a limit to the number of beneficiaries I can add to my I Bonds?

No, there is no limit to the number of beneficiaries you can add to your I Bonds. You can designate multiple individuals or organizations to receive the funds.

Can I change the beneficiary on my I Bonds?

Yes, you can change the beneficiary on your I Bonds at any time. You will need to fill out Form PD F 4000 and submit it to the Bureau of the Fiscal Service.

What happens if I don’t designate a beneficiary for my I Bonds?

If you don’t designate a beneficiary for your I Bonds, the funds will be paid to your estate in the event of your death. It is recommended to designate a beneficiary to ensure the funds go to the intended recipient.

What are I Bonds?

I Bonds are a type of savings bond issued by the U.S. Department of the Treasury. They are a low-risk investment option that offers a fixed interest rate combined with an inflation rate adjustment.