- Understanding Superseded 1040 Forms

- What is a Superseded 1040 Form?

- When Can You File a Superseded 1040 Form?

- Steps to File a Superseded 1040 Form

- Gather the Necessary Documents

- Question-answer:

- What is a superseded 1040?

- How do I know if I need to file a superseded 1040?

- Can I file a superseded 1040 online?

- What happens if I don’t file a superseded 1040?

- Can I file a superseded 1040 for previous tax years?

When it comes to filing your taxes, it’s important to get it right the first time. However, mistakes happen, and sometimes you need to make changes to your tax return after it has been filed. This is where a superseded 1040 form comes into play.

A superseded 1040 form allows you to correct errors or make changes to your original tax return. It is important to note that you can only file a superseded 1040 if you have already filed your original tax return. This means that if you haven’t filed your taxes yet, you cannot use a superseded 1040 form.

So, how do you file a superseded 1040? First, you need to obtain a copy of the superseded 1040 form from the Internal Revenue Service (IRS) website or by contacting the IRS directly. Once you have the form, you will need to fill it out with the correct information and make any necessary changes to your original tax return.

It’s important to keep in mind that filing a superseded 1040 does not guarantee that the IRS will accept your changes. The IRS will review your amended return and determine whether or not to accept the changes. If your changes are accepted, the IRS will process your amended return and issue any additional refunds or payments owed to you.

Understanding Superseded 1040 Forms

A superseded 1040 form refers to a revised version of the standard 1040 form that has been replaced by a newer version. The Internal Revenue Service (IRS) periodically updates the 1040 form to reflect changes in tax laws and regulations. These updates may include changes to tax rates, deductions, credits, and other relevant information.

When a new version of the 1040 form is released, it supersedes the previous version. This means that taxpayers should use the most recent version of the form when filing their taxes. However, there may be situations where a taxpayer needs to file a superseded 1040 form.

One common reason for filing a superseded 1040 form is if the taxpayer made a mistake on their original tax return and needs to correct it. In this case, the taxpayer would need to file an amended return using the superseded 1040 form. The amended return allows the taxpayer to make changes to their original return, such as correcting errors, adding missed deductions, or updating personal information.

Another reason for filing a superseded 1040 form is if the taxpayer receives new information after filing their original return. For example, if the taxpayer receives a corrected W-2 form or a 1099 form after filing their taxes, they may need to file a superseded 1040 form to reflect the updated information.

It’s important to note that not all changes require the use of a superseded 1040 form. Minor errors or changes can often be corrected by filing an amended return using Form 1040X. However, if the changes are significant or if the taxpayer needs to update their entire tax return, a superseded 1040 form may be necessary.

When filing a superseded 1040 form, it’s important to gather all the necessary documents and information. This includes any new or corrected forms, as well as any supporting documentation for the changes being made. It’s also important to carefully review the instructions for the superseded 1040 form to ensure that all required information is provided and that the form is filled out correctly.

What is a Superseded 1040 Form?

A superseded 1040 form refers to a revised version of the standard 1040 form that has been replaced by a newer version. The Internal Revenue Service (IRS) periodically updates the 1040 form to reflect changes in tax laws and regulations. When a new version of the 1040 form is released, the previous version becomes superseded.

The superseded 1040 form contains outdated information and may not accurately reflect the current tax laws. Therefore, it is important to use the most recent version of the 1040 form when filing your taxes. Filing an outdated superseded 1040 form can result in errors and delays in processing your tax return.

It is crucial to stay updated with the latest tax forms and instructions provided by the IRS. The IRS website is the best source for obtaining the most recent versions of tax forms, including the 1040 form. By using the correct and current version of the 1040 form, you can ensure that your tax return is accurate and in compliance with the latest tax laws.

| Key Points about Superseded 1040 Forms: |

|---|

| 1. Superseded 1040 forms are older versions of the standard 1040 form. |

| 2. They have been replaced by newer versions due to changes in tax laws. |

| 3. Using a superseded 1040 form can lead to errors and delays in processing your tax return. |

| 4. It is important to use the most recent version of the 1040 form provided by the IRS. |

| 5. The IRS website is the best source for obtaining the latest tax forms and instructions. |

By understanding what a superseded 1040 form is and the importance of using the most recent version, you can ensure that your tax return is accurate and filed correctly. It is always recommended to consult with a tax professional or refer to the IRS website for any questions or concerns regarding tax forms and filing requirements.

When Can You File a Superseded 1040 Form?

A superseded 1040 form can be filed when you need to correct errors or make changes to a previously filed tax return. This can happen if you realize you made a mistake on your original return, or if you receive new information that affects your tax liability.

There are several situations in which you may need to file a superseded 1040 form:

- If you made a mistake on your original return, such as entering the wrong income amount or forgetting to claim a deduction, you can file a superseded 1040 form to correct the error.

- If you receive new information after filing your original return that affects your tax liability, such as a corrected W-2 form or a revised 1099 form, you can file a superseded 1040 form to update your return.

- If you filed your original return before the IRS announced changes to tax laws or regulations, you can file a superseded 1040 form to take advantage of the new rules.

It’s important to note that you can only file a superseded 1040 form within a certain timeframe. Generally, you have three years from the original due date of the return or two years from the date you paid the tax, whichever is later, to file a superseded 1040 form.

When filing a superseded 1040 form, it’s important to include all necessary documentation to support the changes or corrections you are making. This may include updated forms, receipts, or other relevant documents.

Once you have completed the superseded 1040 form, you should mail it to the IRS at the address specified in the instructions. It’s recommended to send the form via certified mail to ensure it is received and processed by the IRS.

Overall, filing a superseded 1040 form can help you correct errors or make changes to your tax return. It’s important to understand the specific circumstances in which you can file a superseded 1040 form and to follow the proper procedures to ensure your changes are properly processed by the IRS.

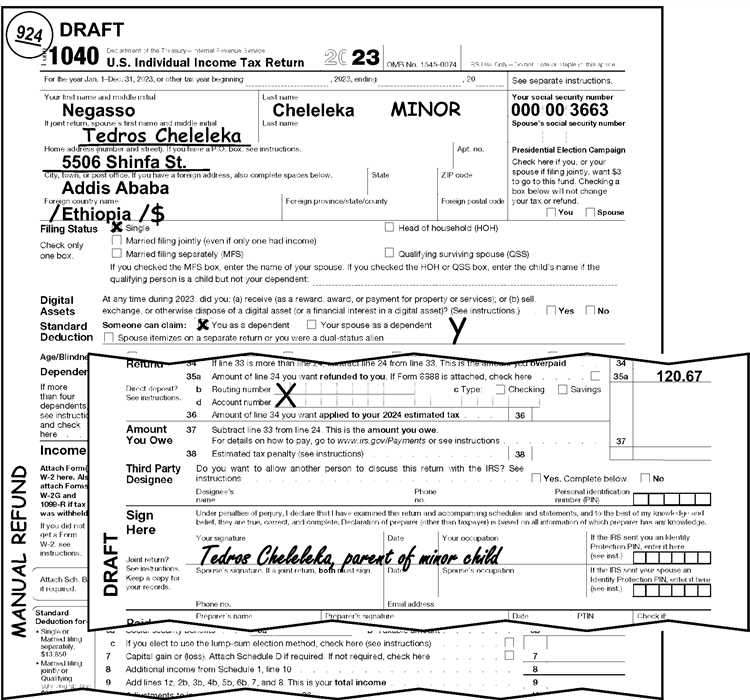

Steps to File a Superseded 1040 Form

When it comes to filing a superseded 1040 form, there are several steps you need to follow. These steps will ensure that you complete the process correctly and avoid any potential issues with the IRS. Here is a step-by-step guide to help you file a superseded 1040 form:

Step 1: Review the original 1040 form

Before you begin filing the superseded 1040 form, it’s important to review the original 1040 form that you previously filed. This will help you identify any errors or changes that need to be made.

Step 2: Obtain the correct superseded 1040 form

Next, you’ll need to obtain the correct superseded 1040 form. This can be done by visiting the IRS website or contacting the IRS directly. Make sure you have the most up-to-date version of the form.

Step 3: Fill out the superseded 1040 form

Once you have the correct form, carefully fill it out with the updated information. Be sure to double-check all the details to ensure accuracy.

Step 4: Attach any necessary documents

Depending on your specific situation, you may need to attach additional documents to support the changes you are making on the superseded 1040 form. This could include things like W-2 forms, 1099 forms, or other relevant documentation.

Step 5: Submit the superseded 1040 form

After completing the form and attaching any necessary documents, it’s time to submit the superseded 1040 form to the IRS. You can do this by mailing it to the appropriate IRS address or by filing it electronically through the IRS website.

Step 6: Keep a copy for your records

Once you have submitted the superseded 1040 form, be sure to make a copy for your records. This will serve as proof that you have filed the form and can be useful in case of any future inquiries or audits.

By following these steps, you can successfully file a superseded 1040 form and ensure that your tax information is accurate and up to date. Remember to consult with a tax professional if you have any questions or need further assistance.

Gather the Necessary Documents

Before you can file a superseded 1040 form, it is important to gather all the necessary documents. These documents will help you accurately complete the form and ensure that you are providing the correct information to the IRS.

Here is a list of the documents you will need:

| Document | Description |

|---|---|

| Previous year’s tax return | You will need a copy of your previous year’s tax return to reference any information that may be required for the superseded form. |

| W-2 forms | If you were employed during the tax year, you will need your W-2 forms from each employer. These forms provide information about your wages, tips, and other compensation. |

| 1099 forms | If you received income from sources other than employment, such as freelance work or rental income, you will need any 1099 forms that were issued to you. |

| Receipts and records | If you are claiming deductions or credits, you will need to gather any receipts or records that support your claims. This may include receipts for medical expenses, charitable donations, or business expenses. |

| Bank statements | You may need to provide bank statements to verify any income or expenses that are not documented by other forms or receipts. |

| Other relevant documents | Depending on your individual tax situation, there may be other documents that are necessary to complete the superseded 1040 form. This could include documents related to investments, retirement accounts, or rental properties. |

By gathering all of these documents before you begin filling out the superseded 1040 form, you can ensure that you have all the necessary information at hand and avoid any delays or errors in the filing process.

Question-answer:

What is a superseded 1040?

A superseded 1040 is a revised version of the original 1040 tax form that replaces the previous version. It is used when there are errors or changes that need to be made to the original form.

How do I know if I need to file a superseded 1040?

If you have already filed your original 1040 tax form and later discover errors or changes that need to be made, you may need to file a superseded 1040. It is important to review your original form carefully and consult with a tax professional if you are unsure.

Can I file a superseded 1040 online?

No, you cannot file a superseded 1040 online. The IRS only accepts paper filings for superseded forms. You will need to complete the revised form and mail it to the appropriate IRS address.

What happens if I don’t file a superseded 1040?

If you do not file a superseded 1040 when necessary, the errors or changes on your original form may not be corrected. This could result in incorrect tax calculations and potential penalties or interest charges from the IRS. It is important to file the revised form as soon as possible to avoid any issues.

Can I file a superseded 1040 for previous tax years?

No, you cannot file a superseded 1040 for previous tax years. The superseded form is only used to correct errors or changes on the most recent tax year’s form. If you need to make changes to a previous year’s form, you will need to file an amended return using Form 1040X.