- Understanding Independent Contractor Agreements

- Definition and Purpose

- Key Elements of Independent Contractor Agreements

- Legal Requirements for Independent Contractor Agreements

- Classification Criteria

- Question-answer:

- What are independent contractor agreements?

- What should be included in an independent contractor agreement?

- What standards should independent contractor agreements be held to?

- What are the consequences of not having a written independent contractor agreement?

- Can an independent contractor agreement be modified or terminated?

- What are independent contractor agreements?

Independent contractor agreements are a crucial aspect of the modern workforce. As more and more individuals choose to work independently, it is essential to establish clear standards and guidelines for these agreements. These standards not only protect the rights and interests of both parties involved but also ensure fair and ethical practices in the business world.

One of the primary standards that independent contractor agreements should be held to is clarity and specificity. It is crucial for these agreements to clearly outline the scope of work, deliverables, and timelines. This ensures that both parties have a clear understanding of their responsibilities and expectations, minimizing the potential for misunderstandings or disputes.

Another important standard is the protection of intellectual property rights. Independent contractors often work on projects that involve the creation of original work or the use of confidential information. Therefore, it is essential for these agreements to include provisions that protect the intellectual property rights of both parties. This can include clauses on ownership, confidentiality, and non-disclosure.

Furthermore, independent contractor agreements should also adhere to fair compensation standards. It is crucial for these agreements to clearly outline the payment terms, including the rate of pay, invoicing procedures, and payment schedule. This ensures that independent contractors are fairly compensated for their work and that there is transparency in the financial aspect of the agreement.

Understanding Independent Contractor Agreements

An independent contractor agreement is a legally binding contract between a company or individual hiring a contractor and the contractor themselves. It outlines the terms and conditions of the working relationship, including the scope of work, payment terms, and any other relevant details.

Independent contractor agreements are commonly used when a company needs to hire a contractor for a specific project or task. Unlike an employee, an independent contractor is not considered an employee of the company and is responsible for their own taxes, insurance, and other business expenses.

These agreements are important because they help define the relationship between the hiring party and the contractor. They establish the expectations and responsibilities of both parties, ensuring that both parties are on the same page and understand their obligations.

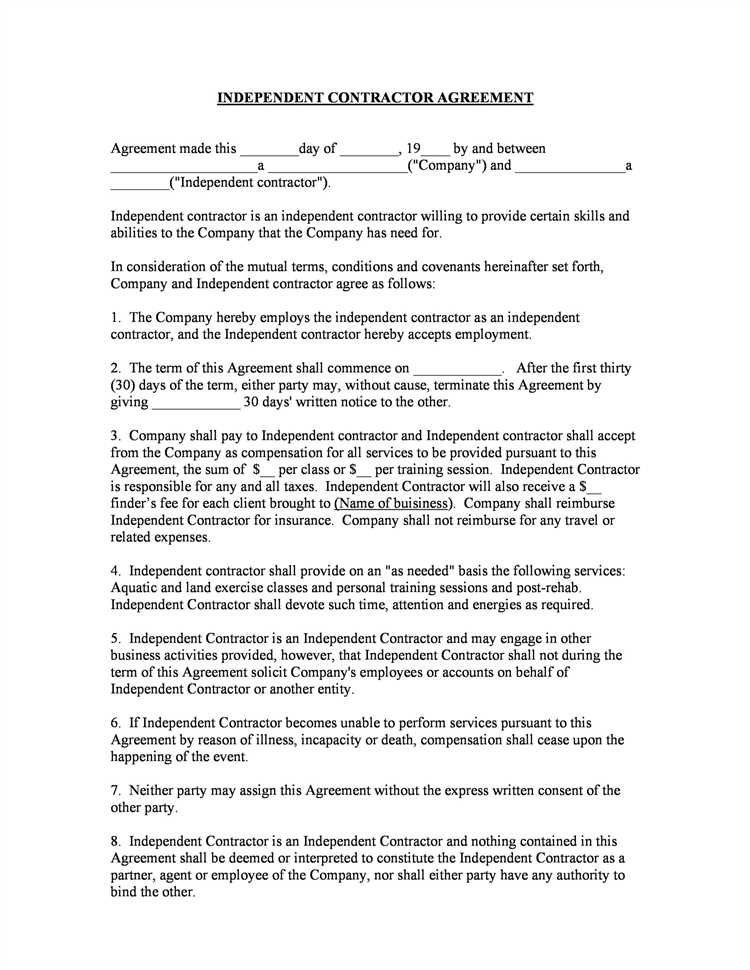

Key elements of an independent contractor agreement include:

- Identification of the parties involved

- Description of the scope of work

- Payment terms and schedule

- Confidentiality and non-disclosure agreements

- Intellectual property rights

- Termination clauses

- Dispute resolution mechanisms

It is important for both parties to carefully review and negotiate the terms of the agreement to ensure that their interests are protected. The agreement should be clear, concise, and specific to avoid any misunderstandings or disputes in the future.

Additionally, it is crucial to comply with any legal requirements when drafting an independent contractor agreement. This includes ensuring that the contractor is properly classified as an independent contractor and not an employee, as misclassification can lead to legal and financial consequences for both parties.

Definition and Purpose

An independent contractor agreement is a legally binding contract between a company or individual (the “client”) and an independent contractor. An independent contractor is a self-employed individual or business entity that provides services to the client on a contract basis. The purpose of an independent contractor agreement is to establish the terms and conditions of the working relationship between the client and the independent contractor.

The agreement defines the scope of work, payment terms, intellectual property rights, confidentiality obligations, and other important provisions. It is essential to have a clear and comprehensive independent contractor agreement to protect the interests of both parties and avoid any misunderstandings or disputes.

The definition of an independent contractor may vary depending on the jurisdiction and the specific laws and regulations governing the relationship between the client and the contractor. Generally, an independent contractor is considered to have control over how the work is performed, is responsible for their own taxes and benefits, and is not entitled to the same legal protections and benefits as an employee.

The purpose of hiring an independent contractor is often to access specialized skills or expertise on a temporary or project basis. Independent contractors can provide flexibility and cost savings for businesses, as they are not subject to the same obligations and expenses as employees. However, it is important to properly classify workers as independent contractors to comply with legal requirements and avoid potential legal and financial consequences.

Overall, the definition and purpose of an independent contractor agreement are to establish a clear and mutually beneficial working relationship between the client and the independent contractor, while ensuring compliance with applicable laws and regulations.

Key Elements of Independent Contractor Agreements

When drafting an independent contractor agreement, it is important to include certain key elements to ensure that both parties are clear on their rights and responsibilities. These elements help define the relationship between the hiring party and the independent contractor, and protect both parties in case of any disputes or misunderstandings.

1. Scope of Work: The agreement should clearly outline the specific tasks and services that the independent contractor will be responsible for. This includes a detailed description of the work to be performed, any deadlines or milestones, and any specific deliverables that are expected.

2. Payment Terms: The agreement should specify how and when the independent contractor will be paid for their services. This includes the agreed-upon rate or fee, any additional expenses that will be reimbursed, and the payment schedule (e.g., hourly, weekly, monthly).

3. Intellectual Property: If the independent contractor will be creating any intellectual property as part of their work, such as software code or creative content, the agreement should address who will own the rights to that intellectual property. This may involve assigning the rights to the hiring party or granting a license to use the intellectual property.

4. Confidentiality: To protect sensitive information, the agreement should include provisions regarding confidentiality. This may include a non-disclosure agreement (NDA) that prohibits the independent contractor from sharing any confidential or proprietary information they may come across during the course of their work.

5. Termination: The agreement should outline the conditions under which either party can terminate the contract. This includes any notice periods that must be given, any penalties or fees for early termination, and any obligations that must be fulfilled upon termination.

6. Indemnification: To protect against any claims or liabilities, the agreement should include an indemnification clause. This clause states that the independent contractor will be responsible for any damages or losses that may arise from their work, and that they will indemnify and hold harmless the hiring party from any claims or lawsuits.

7. Governing Law and Jurisdiction: The agreement should specify the governing law and jurisdiction that will apply in case of any disputes. This helps determine which laws will be used to interpret the agreement and which courts will have jurisdiction over any legal proceedings.

By including these key elements in an independent contractor agreement, both parties can ensure that their rights and responsibilities are clearly defined, and that they are protected in case of any disagreements or issues that may arise during the course of the contract.

Legal Requirements for Independent Contractor Agreements

When entering into an independent contractor agreement, it is important to ensure that the agreement complies with all legal requirements. Failure to meet these requirements can result in legal consequences and potential liability for both parties involved.

Here are some key legal requirements that should be considered when drafting an independent contractor agreement:

- Clear Identification of the Parties: The agreement should clearly identify the independent contractor and the hiring party. This includes providing their legal names, addresses, and contact information.

- Scope of Work: The agreement should clearly outline the specific services or tasks that the independent contractor will be responsible for. This includes detailing the expected deliverables, deadlines, and any specific requirements or specifications.

- Payment Terms: The agreement should clearly state the compensation terms, including the rate of pay, method of payment, and any additional expenses or reimbursements that will be provided.

- Duration and Termination: The agreement should specify the duration of the engagement, whether it is for a specific project or an ongoing basis. It should also outline the conditions under which either party can terminate the agreement, including any notice periods or penalties.

- Independent Contractor Status: The agreement should clearly state that the independent contractor is not an employee of the hiring party and that they are responsible for their own taxes, insurance, and other legal obligations.

- Confidentiality and Non-Disclosure: If the independent contractor will have access to confidential information or trade secrets, the agreement should include provisions to protect this information and prevent its unauthorized disclosure.

- Intellectual Property: If the independent contractor will be creating any intellectual property during the engagement, the agreement should specify who will own the rights to this property and any licensing or usage rights.

- Indemnification and Liability: The agreement should include provisions to protect both parties from any claims, damages, or liabilities that may arise during the course of the engagement.

- Governing Law and Jurisdiction: The agreement should specify the governing law and jurisdiction that will apply in the event of any disputes or legal proceedings.

It is important to consult with legal counsel when drafting an independent contractor agreement to ensure that all necessary legal requirements are met and to protect the interests of both parties involved.

Classification Criteria

When determining whether a worker should be classified as an independent contractor, there are several criteria that are typically considered. These criteria help to establish the level of control that the hiring party has over the worker and the nature of the working relationship. The following are some common classification criteria:

1. Control:

The level of control that the hiring party has over the worker is a key factor in determining classification. If the hiring party has the right to control how, when, and where the work is performed, then the worker is more likely to be classified as an employee. On the other hand, if the worker has more autonomy and control over their work, they are more likely to be classified as an independent contractor.

2. Financial arrangement:

The financial arrangement between the hiring party and the worker is also an important factor. Independent contractors are typically paid a flat fee or project-based rate, while employees are usually paid a regular salary or hourly wage. Additionally, independent contractors are responsible for their own taxes and expenses, while employees have taxes and expenses deducted from their paychecks.

3. Relationship duration:

The duration of the working relationship is another consideration. Independent contractors are often hired for a specific project or a set period of time, while employees are typically hired for an ongoing, long-term basis. If the working relationship is indefinite or expected to continue indefinitely, it is more likely that the worker will be classified as an employee.

4. Skill level:

The skill level required for the work is also taken into account. Independent contractors are often hired for specialized or highly skilled work that requires a certain level of expertise. Employees, on the other hand, may be hired for more general or entry-level positions.

5. Integration:

The degree to which the worker is integrated into the hiring party’s business is another factor. Independent contractors are typically hired to perform a specific task or provide a specific service, while employees are often part of the hiring party’s regular operations and have a greater level of integration into the business.

It’s important to note that these criteria are not exhaustive and may vary depending on the jurisdiction and specific circumstances of the working relationship. Consulting with legal professionals can help ensure compliance with applicable laws and regulations.

Question-answer:

What are independent contractor agreements?

Independent contractor agreements are legal contracts between a company or individual and an independent contractor. These agreements outline the terms and conditions of the working relationship, including the scope of work, payment terms, and any other relevant details.

What should be included in an independent contractor agreement?

An independent contractor agreement should include the names and contact information of both parties, a description of the services to be provided, the payment terms and schedule, any confidentiality or non-disclosure agreements, and any other relevant terms and conditions.

What standards should independent contractor agreements be held to?

Independent contractor agreements should be held to certain standards to ensure fairness and legality. These standards include clearly defining the independent contractor relationship, ensuring that the contractor has control over how the work is performed, and complying with all applicable laws and regulations.

What are the consequences of not having a written independent contractor agreement?

Not having a written independent contractor agreement can lead to misunderstandings and disputes between the parties involved. It can also make it difficult to prove the terms of the working relationship in case of legal issues. It is always recommended to have a written agreement to protect the rights and interests of both parties.

Can an independent contractor agreement be modified or terminated?

Yes, an independent contractor agreement can be modified or terminated if both parties agree to the changes. It is important to have a clear process for modifying or terminating the agreement outlined in the original contract to avoid any confusion or disputes.

What are independent contractor agreements?

Independent contractor agreements are legal contracts between a company or individual and an independent contractor. These agreements outline the terms and conditions of the working relationship, including the scope of work, payment terms, and any other relevant details.