- Understanding the legality of charging interest on overdue invoices

- Legal considerations

- Factors to consider when charging interest on overdue invoices

- Steps to take when implementing interest charges on overdue invoices

- Question-answer:

- Is it legal to charge interest on overdue invoices?

- What is the maximum interest rate that can be charged on overdue invoices?

- Can I charge interest on overdue invoices if it is not stated in the contract?

- What are the consequences of charging excessive interest on overdue invoices?

- Can I waive the right to charge interest on overdue invoices?

- Is it legal to charge interest on overdue invoices?

- What is the maximum interest rate that can be charged on overdue invoices?

When it comes to running a business, one of the most frustrating aspects can be dealing with overdue invoices. Not only does it disrupt your cash flow, but it can also create tension between you and your clients. In an effort to encourage prompt payment, many businesses choose to charge interest on overdue invoices. However, the legality of this practice can vary depending on the jurisdiction.

In some countries, charging interest on overdue invoices is perfectly legal and even common practice. This is because it serves as a deterrent for clients who might otherwise delay payment. By imposing a financial penalty, businesses can incentivize their clients to pay on time and avoid any additional costs.

On the other hand, there are jurisdictions where charging interest on overdue invoices is not allowed or heavily regulated. These regulations are in place to protect consumers and ensure fair business practices. In such cases, businesses may need to explore alternative methods for encouraging prompt payment, such as offering discounts for early payment or implementing stricter credit terms.

It is important for businesses to familiarize themselves with the laws and regulations regarding charging interest on overdue invoices in their specific jurisdiction. This can help them avoid any legal issues and ensure that their invoicing practices are in compliance with the law. Consulting with a legal professional or seeking advice from a local business association can provide valuable guidance in navigating this complex area of business law.

Understanding the legality of charging interest on overdue invoices

When it comes to invoicing, one common issue that businesses face is dealing with overdue payments. In order to encourage timely payments, many businesses consider charging interest on overdue invoices. However, it is important to understand the legality of this practice before implementing it.

Charging interest on overdue invoices is generally legal, but there are certain legal considerations that businesses need to be aware of. First and foremost, it is crucial to have a clear and well-documented payment policy in place. This policy should outline the terms and conditions of payment, including any interest charges that may be applied to overdue invoices.

Another important legal consideration is to ensure that the interest rate being charged is reasonable and within the legal limits set by the jurisdiction. Some jurisdictions have specific laws that govern the maximum interest rates that can be charged on overdue invoices. It is important to familiarize yourself with these laws and ensure compliance to avoid any legal issues.

Factors such as the nature of the business relationship, the industry norms, and the amount of the overdue invoice can also impact the legality of charging interest. It is important to consider these factors and assess whether charging interest is appropriate and fair in each specific case.

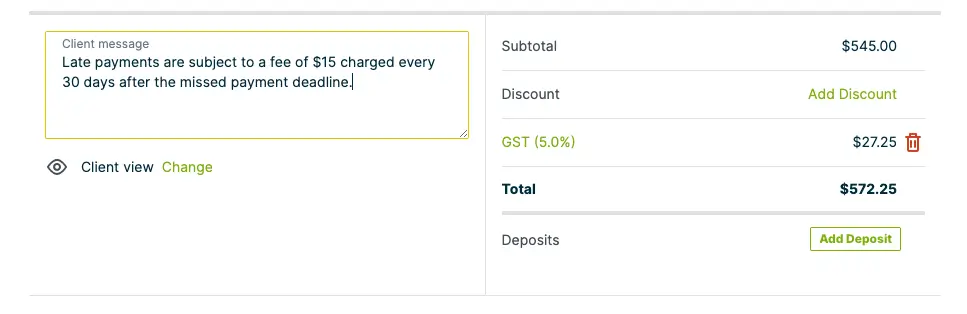

Implementing interest charges on overdue invoices should also involve certain steps to ensure legality. Firstly, it is important to clearly communicate the payment terms and any potential interest charges to the customer. This can be done through written agreements, contracts, or even prominently displaying the payment terms on the invoice itself.

Additionally, it is important to consistently apply the interest charges to all overdue invoices. Treating all customers equally and fairly can help avoid any claims of discrimination or unfair practices.

Legal considerations

When it comes to charging interest on overdue invoices, there are several legal considerations that businesses need to be aware of. While it is generally legal to charge interest on overdue invoices, there are certain regulations and guidelines that must be followed to ensure compliance with the law.

One important legal consideration is the maximum interest rate that can be charged on overdue invoices. This rate varies depending on the jurisdiction and may be set by state or federal laws. It is important for businesses to research and understand the applicable interest rate limits in their specific location.

Another legal consideration is the requirement to clearly communicate the interest charges to the customer. Businesses should include information about the interest rate, calculation method, and any additional fees or penalties in their terms and conditions or contract with the customer. This ensures transparency and helps to avoid any potential disputes or misunderstandings.

Additionally, businesses should be aware of any specific regulations or restrictions that apply to their industry. Some industries, such as financial services or healthcare, may have additional regulations regarding the charging of interest on overdue invoices. It is important to consult with legal professionals or industry associations to ensure compliance with any industry-specific requirements.

Finally, businesses should also consider the potential impact on customer relationships and reputation. While charging interest on overdue invoices can help to incentivize timely payment, it is important to strike a balance between enforcing payment and maintaining positive customer relationships. Businesses should consider implementing clear and fair policies for charging interest, as well as providing options for customers to resolve payment issues or negotiate alternative payment arrangements.

| Key Legal Considerations: |

|---|

| Research and understand applicable interest rate limits |

| Clearly communicate interest charges to customers |

| Be aware of industry-specific regulations |

| Consider impact on customer relationships and reputation |

By taking these legal considerations into account, businesses can ensure that they are charging interest on overdue invoices in a legally compliant and fair manner.

Factors to consider when charging interest on overdue invoices

When deciding to charge interest on overdue invoices, there are several important factors that need to be considered. These factors can help determine the legality and effectiveness of implementing interest charges. Here are some key considerations:

1. Legal requirements:

Before charging interest on overdue invoices, it is crucial to understand the legal requirements and regulations in your jurisdiction. Different countries and states may have specific laws regarding interest rates, maximum charges, and disclosure requirements. Familiarize yourself with these laws to ensure compliance and avoid any legal issues.

2. Clear payment terms:

Having clear payment terms in your contracts or agreements is essential when charging interest on overdue invoices. Clearly state the payment due date, the interest rate, and any penalties for late payments. This will help set expectations and provide a basis for charging interest if the payment is not made on time.

3. Consistency:

Consistency is key when implementing interest charges on overdue invoices. Treat all customers equally and apply the same interest rate and penalties to everyone. This helps maintain fairness and avoids any potential discrimination claims.

4. Communication:

Effective communication with your customers is crucial when charging interest on overdue invoices. Clearly communicate your payment terms and the consequences of late payments. Send reminders and follow-up emails to ensure that customers are aware of their obligations and the potential interest charges they may incur.

5. Flexibility:

While charging interest on overdue invoices can be an effective way to encourage timely payments, it is important to be flexible in certain situations. Consider the circumstances of your customers and be willing to negotiate payment plans or waive interest charges in exceptional cases. This can help maintain good relationships with your customers and avoid any unnecessary disputes.

6. Documentation:

Keep detailed records of all communication, payment reminders, and any agreements made with customers regarding interest charges. This documentation can be valuable in case of disputes or legal issues. It provides evidence of your efforts to collect payment and ensures transparency in your dealings with customers.

By considering these factors, you can make informed decisions when charging interest on overdue invoices. Remember to consult with legal professionals if you have any doubts or questions regarding the legality of implementing interest charges in your specific jurisdiction.

Steps to take when implementing interest charges on overdue invoices

Implementing interest charges on overdue invoices can be a complex process, but by following these steps, you can ensure that you are doing so legally and effectively:

- Review your contracts and agreements: Before implementing interest charges, carefully review your contracts and agreements with your clients. Ensure that there are provisions that allow you to charge interest on overdue invoices.

- Notify your clients: Once you have confirmed that your contracts allow for interest charges, notify your clients in writing about the new policy. Clearly explain the terms and conditions, including the interest rate, how it will be calculated, and when it will be applied.

- Update your invoicing system: Make sure that your invoicing system is capable of calculating and applying interest charges on overdue invoices. This may require updating your software or working with your accounting team to implement the necessary changes.

- Monitor and track overdue invoices: Keep a close eye on your accounts receivable and identify any overdue invoices. Regularly review your aging reports to stay on top of outstanding payments.

- Send reminders and follow-up: Send reminders to clients with overdue invoices, clearly stating the amount owed and the interest charges that have been applied. Follow up with phone calls or emails to ensure that the client is aware of the situation and to encourage prompt payment.

- Enforce the policy: If a client continues to ignore or delay payment, take appropriate action to enforce the policy. This may include sending a final demand letter, engaging a collections agency, or pursuing legal action if necessary.

- Review and adjust: Regularly review the effectiveness of your interest charges policy. Analyze the impact on your cash flow and client relationships. Make adjustments as needed to ensure that the policy is fair and reasonable for both parties.

By following these steps, you can implement interest charges on overdue invoices in a legally compliant and efficient manner. Remember to consult with legal and financial professionals to ensure that you are following all applicable laws and regulations.

Question-answer:

Is it legal to charge interest on overdue invoices?

Yes, it is generally legal to charge interest on overdue invoices. However, the specific laws regarding interest rates and penalties may vary depending on the country and jurisdiction.

What is the maximum interest rate that can be charged on overdue invoices?

The maximum interest rate that can be charged on overdue invoices varies depending on the country and jurisdiction. It is important to consult the local laws or seek legal advice to determine the specific maximum interest rate that can be charged in a particular area.

Can I charge interest on overdue invoices if it is not stated in the contract?

Whether you can charge interest on overdue invoices if it is not stated in the contract depends on the laws of the country and jurisdiction. In some cases, there may be default interest rates set by law that can be applied even if not explicitly stated in the contract. It is advisable to consult the local laws or seek legal advice to determine the specific requirements in such situations.

What are the consequences of charging excessive interest on overdue invoices?

The consequences of charging excessive interest on overdue invoices can vary depending on the country and jurisdiction. In some cases, it may be considered usury or predatory lending, which can lead to legal penalties and potential lawsuits. It is important to ensure that the interest rates charged are within the legal limits to avoid any legal consequences.

Can I waive the right to charge interest on overdue invoices?

Yes, it is possible to waive the right to charge interest on overdue invoices. However, it is important to do so explicitly and in writing to avoid any misunderstandings or disputes in the future. It is advisable to consult legal counsel to ensure that the waiver is properly documented and enforceable.

Is it legal to charge interest on overdue invoices?

Yes, it is generally legal to charge interest on overdue invoices. However, the legality and the specific interest rate that can be charged may vary depending on the country and the terms agreed upon in the contract between the parties involved.

What is the maximum interest rate that can be charged on overdue invoices?

The maximum interest rate that can be charged on overdue invoices varies depending on the country and the terms agreed upon in the contract. In some countries, there may be specific laws or regulations that limit the interest rate that can be charged. It is important to check the local laws and regulations or consult with a legal professional to determine the maximum allowable interest rate.