- Understanding Depreciation

- What is Depreciation?

- How Does Depreciation Work?

- Why Accelerate Depreciation?

- Methods for Accelerating Depreciation

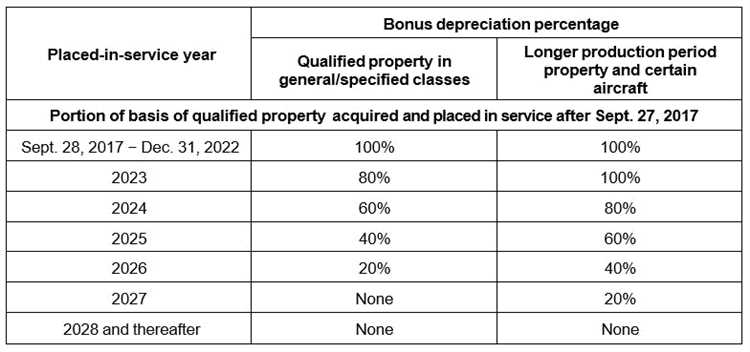

- Bonus Depreciation

- Section 179 Deduction

- Question-answer:

- What is accelerated depreciation on a building?

- How does accelerated depreciation work?

- What are the benefits of accelerated depreciation?

- Are there any limitations to accelerated depreciation?

- How can I determine if accelerated depreciation is right for my building?

- What is accelerated depreciation on a building?

Depreciation is a term that is often associated with the decline in value of an asset over time. When it comes to buildings, depreciation can have a significant impact on the financial health of a business. However, there is a way to accelerate the depreciation on a building, which can provide tax benefits and help businesses save money.

Accelerating depreciation involves taking advantage of certain tax laws and regulations that allow businesses to deduct a larger portion of the building’s value in the early years of ownership. This can be particularly beneficial for businesses that are looking to offset their taxable income and reduce their overall tax liability.

One of the key factors in accelerating depreciation on a building is determining the useful life of the asset. The useful life is the estimated period of time that the building will be in service before it becomes obsolete or no longer useful. By accurately determining the useful life, businesses can calculate the depreciation expense and take advantage of the tax benefits.

It’s important to note that accelerating depreciation on a building requires careful planning and adherence to tax laws. Businesses should consult with tax professionals or accountants who specialize in depreciation to ensure that they are following the correct procedures and maximizing their tax savings.

Understanding Depreciation

Depreciation is a concept in accounting that refers to the decrease in value of an asset over time. It is a way to allocate the cost of an asset over its useful life. In the case of a building, depreciation is used to account for the wear and tear, obsolescence, and other factors that cause the building to lose value.

Depreciation is important for businesses because it allows them to spread out the cost of an asset over its useful life, rather than taking a large expense in the year of purchase. This helps to match expenses with revenues, providing a more accurate picture of the financial health of the business.

There are several methods for calculating depreciation, including straight-line depreciation, declining balance depreciation, and sum-of-the-years’-digits depreciation. Each method has its own advantages and disadvantages, and the choice of method depends on factors such as the asset’s useful life and the business’s accounting policies.

Depreciation can be accelerated in certain situations, such as when a business wants to take a larger expense in the early years of an asset’s life. This can be beneficial for tax purposes, as it allows the business to reduce its taxable income and lower its tax liability.

One method for accelerating depreciation is bonus depreciation, which allows businesses to deduct a larger percentage of the cost of an asset in the year of purchase. Another method is the Section 179 deduction, which allows businesses to expense the full cost of certain assets in the year of purchase, up to a specified limit.

Understanding depreciation is essential for businesses to properly account for the value of their assets and to make informed financial decisions. By accurately calculating and recording depreciation, businesses can ensure that their financial statements reflect the true value of their assets and provide a clear picture of their financial performance.

What is Depreciation?

Depreciation is a financial concept that refers to the decrease in value of an asset over time. It is a way to account for the wear and tear, obsolescence, and aging of an asset. In the context of a building, depreciation is used to allocate the cost of the building over its useful life.

Depreciation is an important concept in accounting and taxation. It allows businesses to spread out the cost of an asset over its useful life, rather than deducting the entire cost in the year of purchase. This helps to match expenses with revenues and provides a more accurate representation of the financial health of a business.

There are various methods for calculating depreciation, including straight-line depreciation, declining balance depreciation, and sum-of-the-years’ digits depreciation. Each method has its own advantages and disadvantages, and the choice of method depends on factors such as the asset’s useful life and expected pattern of usage.

Depreciation is also used for tax purposes. The tax code allows businesses to deduct a portion of the cost of an asset each year as a depreciation expense. This reduces the taxable income of the business and can result in significant tax savings.

Overall, depreciation is a crucial concept in finance and accounting. It helps businesses accurately account for the decrease in value of their assets over time and provides a more accurate picture of their financial performance. Understanding depreciation is essential for businesses and individuals alike, as it can have a significant impact on their financial statements and tax liabilities.

How Does Depreciation Work?

Depreciation is a method used to allocate the cost of an asset over its useful life. It is an accounting concept that recognizes the fact that assets lose value over time due to wear and tear, obsolescence, or other factors.

Depreciation works by spreading the cost of an asset over its useful life, allowing businesses to recover the cost of the asset gradually. This is important because it matches the expense of the asset with the revenue it generates. Without depreciation, businesses would have to expense the entire cost of an asset in the year it is purchased, which could distort their financial statements and make it difficult to accurately assess their profitability.

There are several methods of calculating depreciation, including straight-line depreciation, declining balance depreciation, and units of production depreciation. Each method has its own advantages and disadvantages, and businesses can choose the method that best suits their needs.

For example, straight-line depreciation evenly spreads the cost of an asset over its useful life, while declining balance depreciation front-loads the depreciation expense, reflecting the fact that assets tend to lose value more rapidly in their early years. Units of production depreciation, on the other hand, bases depreciation on the actual usage or production of the asset.

Depreciation is typically recorded in a company’s financial statements as an expense, reducing the value of the asset on the balance sheet. The accumulated depreciation is also recorded as a separate line item on the balance sheet, showing the total depreciation expense incurred over the life of the asset.

It’s important to note that depreciation is a non-cash expense, meaning it does not involve an actual outflow of cash. Instead, it is a way to allocate the cost of an asset over its useful life for accounting purposes.

Overall, depreciation is a crucial concept in accounting that allows businesses to accurately reflect the value of their assets over time and match the expense of those assets with the revenue they generate. By understanding how depreciation works, businesses can make informed decisions about their investments and financial reporting.

Why Accelerate Depreciation?

Accelerating depreciation on a building can provide several benefits for businesses. By taking advantage of accelerated depreciation methods, businesses can reduce their taxable income and increase their cash flow. This can be particularly advantageous for businesses that are looking to reinvest in their operations or expand their facilities.

One of the main reasons to accelerate depreciation is to take advantage of the time value of money. By depreciating the value of a building faster, businesses can deduct a larger portion of the building’s cost in the earlier years of its useful life. This means that businesses can reduce their taxable income and save on taxes in the short term, allowing them to have more cash on hand to invest in other areas of their business.

Accelerating depreciation can also help businesses to recover the cost of their building more quickly. By depreciating the building at a faster rate, businesses can recoup their investment in a shorter period of time. This can be particularly beneficial for businesses that are looking to sell their building or refinance their mortgage in the future, as it allows them to have a higher equity value in the property.

Furthermore, accelerating depreciation can provide businesses with a competitive advantage. By reducing their taxable income, businesses can lower their overall tax liability and potentially have a lower tax rate. This can make them more competitive in the market, as they can offer lower prices or invest more in research and development.

Overall, accelerating depreciation on a building can be a strategic financial decision for businesses. It can help them to reduce their tax liability, increase their cash flow, recover their investment more quickly, and gain a competitive advantage in the market. However, it is important for businesses to consult with a tax professional or accountant to determine the best depreciation method for their specific situation.

Methods for Accelerating Depreciation

Accelerating depreciation on a building can provide significant tax benefits for property owners. There are several methods that can be used to accelerate depreciation and maximize tax savings. These methods include:

| Method | Description |

|---|---|

| Bonus Depreciation | This method allows property owners to deduct a certain percentage of the cost of a building in the year it is placed in service. The bonus depreciation percentage varies depending on the tax year, but it can be a substantial deduction. |

| Section 179 Deduction | The Section 179 deduction allows property owners to deduct the full cost of qualifying property, including buildings, in the year it is placed in service. This deduction is subject to certain limits, but it can provide a significant upfront tax benefit. |

Both bonus depreciation and the Section 179 deduction can be used in combination with regular depreciation methods to further accelerate the deduction of building costs. Regular depreciation methods, such as the Modified Accelerated Cost Recovery System (MACRS), allow property owners to deduct a portion of the building’s cost over a period of several years.

It’s important to note that the decision to accelerate depreciation should be made in consultation with a tax professional. The specific tax benefits and limitations of each method can vary depending on the property owner’s individual circumstances.

Bonus Depreciation

Bonus depreciation is a tax incentive that allows businesses to deduct a larger portion of the cost of an asset in the year it is placed in service. This can be particularly beneficial for businesses that are looking to accelerate their depreciation deductions and reduce their taxable income.

Under the current tax laws, businesses can take advantage of bonus depreciation to deduct up to 100% of the cost of qualifying assets in the year they are acquired. This is a significant increase from the previous limit of 50%. Qualifying assets include new or used property with a recovery period of 20 years or less, such as machinery, equipment, furniture, and vehicles.

One of the key advantages of bonus depreciation is that it allows businesses to immediately recoup a larger portion of their investment in an asset. This can help to free up cash flow and provide businesses with additional funds to reinvest in their operations or pursue growth opportunities.

Additionally, bonus depreciation can help to reduce a business’s tax liability. By deducting a larger portion of the asset’s cost in the year it is placed in service, businesses can lower their taxable income and potentially move into a lower tax bracket.

It’s important to note that bonus depreciation is not available for all assets. Certain types of property, such as real estate and intangible assets, do not qualify for bonus depreciation. Additionally, the asset must be used for business purposes and not for personal use.

To take advantage of bonus depreciation, businesses must elect to use it on their tax return. This is done by including Form 4562, Depreciation and Amortization, with their tax filing. The form provides detailed instructions on how to calculate and claim the bonus depreciation deduction.

Section 179 Deduction

The Section 179 Deduction is a tax provision that allows businesses to deduct the full cost of qualifying equipment and software purchases in the year they are placed in service, rather than depreciating them over several years. This deduction was created to encourage businesses to invest in new equipment and technology, stimulating economic growth.

To qualify for the Section 179 Deduction, the equipment or software must be used for business purposes more than 50% of the time. It must also be purchased or financed and put into service within the tax year for which the deduction is being claimed.

The Section 179 Deduction has certain limits. For the tax year 2021, businesses can deduct up to $1,050,000 of the cost of qualifying equipment and software. However, this deduction begins to phase out once the total cost of the equipment and software exceeds $2,620,000.

One of the advantages of the Section 179 Deduction is that it allows businesses to take the full deduction upfront, rather than spreading it out over several years through depreciation. This can provide immediate tax savings and help businesses manage their cash flow.

It’s important to note that the Section 179 Deduction can only be used to offset taxable income. If a business has a net loss for the year, the deduction cannot be used to create a tax refund. However, any unused deduction can be carried forward to future years.

It’s also worth mentioning that the Section 179 Deduction can be used for both new and used equipment and software, as long as they meet the qualifying criteria. This can be beneficial for businesses looking to upgrade their technology or equipment without incurring the full cost.

Question-answer:

What is accelerated depreciation on a building?

Accelerated depreciation on a building is a tax strategy that allows property owners to deduct a larger portion of the building’s value over a shorter period of time. This can result in significant tax savings for the property owner.

How does accelerated depreciation work?

Accelerated depreciation works by allowing property owners to take larger deductions in the early years of owning a building, and smaller deductions in the later years. This is done by using a depreciation method that assigns a higher percentage of the building’s value to the early years.

What are the benefits of accelerated depreciation?

The benefits of accelerated depreciation include reduced tax liability in the early years of owning a building, increased cash flow, and the ability to reinvest the tax savings into the property or other investments.

Are there any limitations to accelerated depreciation?

Yes, there are limitations to accelerated depreciation. The IRS has specific rules and guidelines that must be followed, and not all buildings or property types are eligible for accelerated depreciation. Additionally, there may be recapture rules if the property is sold before the end of its useful life.

How can I determine if accelerated depreciation is right for my building?

Determining if accelerated depreciation is right for your building depends on various factors, such as the building’s value, its useful life, and your tax situation. It is recommended to consult with a tax professional who can evaluate your specific circumstances and provide guidance on whether accelerated depreciation is a viable strategy for you.

What is accelerated depreciation on a building?

Accelerated depreciation on a building is a tax strategy that allows property owners to deduct a larger portion of the building’s value over a shorter period of time. This can result in significant tax savings for the property owner.