- Understanding the Basics

- What is an LLC?

- How Does an LLC Work?

- Can an LLC Have Employees?

- Employing People with an LLC

- Hiring Employees for an LLC

- Employee Classification for an LLC

- Question-answer:

- Can an LLC have employees?

- What are the advantages of having employees with an LLC?

- What are the legal requirements for hiring employees with an LLC?

- Are there any limitations or restrictions on hiring employees with an LLC?

- What are the tax implications of having employees with an LLC?

- Can an LLC have employees?

- What are the benefits of having employees with an LLC?

When starting a business, many entrepreneurs choose to form a limited liability company (LLC) due to its flexibility and liability protection. However, one common question that arises is whether an LLC can have employees. The answer is yes, an LLC can have employees, but there are certain considerations and requirements that need to be taken into account.

First and foremost, it is important to understand that an LLC is a separate legal entity from its owners, known as members. This means that the LLC can enter into contracts, own property, and hire employees in its own name. The LLC is responsible for paying its employees, withholding taxes, and complying with employment laws.

When hiring employees, the LLC must follow the same procedures and requirements as any other employer. This includes obtaining an employer identification number (EIN) from the Internal Revenue Service (IRS), verifying the employee’s eligibility to work in the United States, and complying with federal and state employment laws such as minimum wage and overtime requirements.

It is also important to note that the LLC’s members are not considered employees of the company. Instead, they are considered self-employed individuals or owners of the business. As such, they are not subject to the same employment taxes and regulations as employees. However, members can still receive compensation from the LLC in the form of guaranteed payments or distributions of profits.

Understanding the Basics

Before delving into the topic of whether an LLC can have employees, it is important to understand the basics of what an LLC is and how it works.

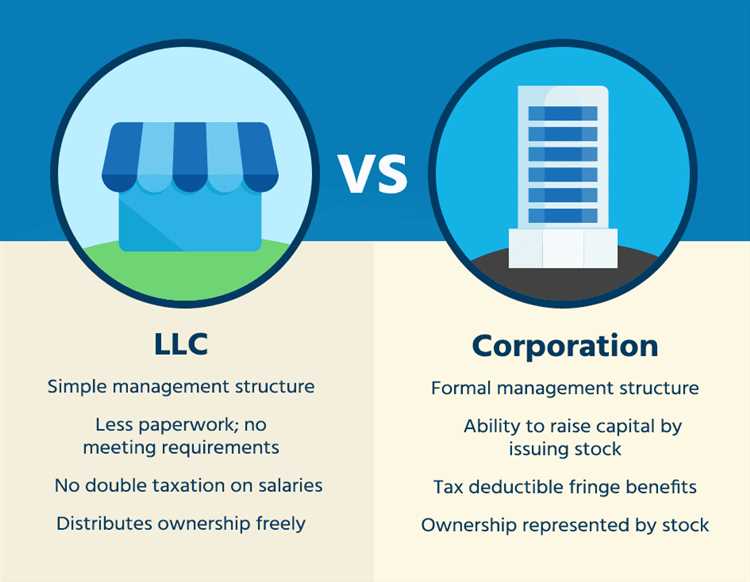

An LLC, or Limited Liability Company, is a type of business structure that combines the benefits of a corporation and a partnership. It provides limited liability protection to its owners, known as members, while also offering flexibility in terms of management and taxation.

Unlike a corporation, an LLC is not considered a separate legal entity. Instead, it is treated as a pass-through entity for tax purposes, meaning that the profits and losses of the business pass through to the members’ personal tax returns. This allows for the avoidance of double taxation.

One of the key advantages of an LLC is the limited liability protection it offers. This means that the personal assets of the members are generally protected from the debts and liabilities of the business. However, it is important to note that this protection can be pierced under certain circumstances, such as if the members engage in fraudulent or illegal activities.

Another important aspect of an LLC is its flexibility in terms of management. Unlike a corporation, which has a more rigid management structure with a board of directors and officers, an LLC can be managed by its members or by appointed managers. This allows for greater control and decision-making power for the owners.

When it comes to taxation, an LLC has several options. By default, an LLC is taxed as a partnership, meaning that the profits and losses are passed through to the members’ personal tax returns. However, an LLC can also choose to be taxed as a corporation by filing an election with the Internal Revenue Service (IRS).

Now that we have a basic understanding of what an LLC is and how it works, we can explore the question of whether an LLC can have employees. This will be discussed in the following sections.

What is an LLC?

An LLC, or Limited Liability Company, is a type of business structure that combines the benefits of a corporation and a partnership. It provides limited liability protection to its owners, known as members, while also allowing for flexibility in management and taxation.

Unlike a corporation, an LLC is not considered a separate legal entity. Instead, it is treated as a pass-through entity for tax purposes, meaning that the profits and losses of the business are passed through to the members and reported on their individual tax returns.

One of the main advantages of forming an LLC is the limited liability protection it offers. This means that the personal assets of the members are generally protected from the debts and liabilities of the business. In the event of a lawsuit or bankruptcy, the members’ personal assets are not at risk.

Another benefit of an LLC is the flexibility it provides in terms of management. Unlike a corporation, which has a board of directors and officers, an LLC can be managed by its members or by appointed managers. This allows for a more streamlined decision-making process and can be beneficial for small businesses.

In terms of taxation, an LLC has the option to be taxed as a sole proprietorship, partnership, S corporation, or C corporation. This flexibility allows the members to choose the most advantageous tax structure for their business.

In summary, an LLC is a business structure that combines the benefits of a corporation and a partnership. It provides limited liability protection to its members, flexibility in management, and options for tax treatment. It is a popular choice for small businesses and entrepreneurs looking for a flexible and protective business structure.

How Does an LLC Work?

An LLC, or Limited Liability Company, is a type of business structure that combines the benefits of a corporation and a partnership. It provides limited liability protection to its owners, known as members, while also allowing for flexibility in management and taxation.

One of the key features of an LLC is that it separates the personal assets of the members from the company’s liabilities. This means that if the LLC faces legal action or debt, the members’ personal assets are generally protected. However, it’s important to note that this protection can be pierced in certain circumstances, such as if the members engage in fraudulent or illegal activities.

LLCs are governed by an operating agreement, which outlines the rights and responsibilities of the members, as well as the rules for managing the company. This agreement is not required by law in all states, but it is highly recommended to have one in place to avoid potential disputes and conflicts.

In terms of taxation, an LLC has flexibility. By default, an LLC is considered a pass-through entity, which means that the profits and losses of the company are passed through to the members’ personal tax returns. However, an LLC can also choose to be taxed as a corporation if it is more advantageous for the business.

When it comes to decision-making and management, an LLC can be managed by its members or by appointed managers. This flexibility allows for different levels of involvement and control within the company.

Overall, an LLC provides a balance of liability protection, flexibility, and tax advantages. It is a popular choice for small businesses and startups due to its simplicity and ease of operation.

Can an LLC Have Employees?

Yes, an LLC can have employees. Unlike a sole proprietorship or a partnership, an LLC is a separate legal entity that can hire employees. This is one of the advantages of forming an LLC, as it allows the business owner to separate their personal assets from the business assets.

When an LLC hires employees, it must comply with all applicable employment laws and regulations. This includes paying the employees at least the minimum wage, providing benefits such as health insurance and retirement plans, and withholding and paying payroll taxes.

One important consideration for an LLC with employees is the classification of those employees. The IRS has specific guidelines for determining whether a worker is an employee or an independent contractor. It is important for an LLC to correctly classify its workers to avoid potential legal and tax issues.

Another consideration is the liability of the LLC for the actions of its employees. Generally, an LLC is not personally liable for the actions of its employees, as long as those actions were taken within the scope of their employment. However, if an employee acts outside the scope of their employment or engages in illegal activities, the LLC may still be held liable.

Employing People with an LLC

When it comes to employing people with an LLC, there are a few important considerations to keep in mind. While an LLC is a popular choice for small business owners due to its flexibility and limited liability protection, it is important to understand the rules and regulations surrounding hiring employees.

Firstly, it is important to determine whether your LLC is eligible to have employees. In most cases, an LLC can have employees, but there may be certain restrictions depending on the state in which the LLC is registered. It is important to consult with an attorney or a business advisor to ensure compliance with all applicable laws and regulations.

Once you have determined that your LLC can have employees, it is important to understand the process of hiring and classifying employees. This includes determining whether the individuals you hire should be classified as employees or independent contractors. The classification of workers has important implications for tax purposes and legal obligations, so it is important to make the correct determination.

When hiring employees for an LLC, it is important to follow all applicable employment laws and regulations. This includes complying with minimum wage laws, providing workers’ compensation insurance, and adhering to anti-discrimination laws. It is also important to establish clear employment contracts and policies to protect both the LLC and its employees.

Additionally, an LLC that employs people may be required to withhold and remit payroll taxes on behalf of its employees. This includes federal income tax, Social Security tax, and Medicare tax. It is important to understand and fulfill all tax obligations to avoid penalties and legal issues.

Hiring Employees for an LLC

When it comes to hiring employees for an LLC, there are a few important considerations to keep in mind. While an LLC is a popular choice for small businesses due to its flexibility and limited liability protection, it is important to understand the legal and financial implications of hiring employees.

First and foremost, it is crucial to determine whether your LLC is eligible to hire employees. In most cases, an LLC can hire employees just like any other business entity. However, there may be certain restrictions or requirements depending on the state in which your LLC is registered. It is advisable to consult with an attorney or a professional who specializes in employment law to ensure compliance with all applicable regulations.

Once you have determined that your LLC can hire employees, you will need to follow the necessary steps to do so. This includes obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) and registering with the appropriate state agencies for tax and employment purposes.

When hiring employees, it is important to properly classify them for tax and legal purposes. This includes determining whether an individual should be classified as an employee or an independent contractor. The classification will depend on various factors, such as the level of control the LLC has over the individual’s work and the degree of independence the individual has in performing their duties. It is crucial to correctly classify employees to avoid potential legal and financial consequences.

Additionally, when hiring employees for an LLC, it is important to comply with all federal and state employment laws. This includes adhering to minimum wage requirements, providing workers’ compensation insurance, and complying with anti-discrimination and workplace safety regulations. Failure to comply with these laws can result in penalties and legal consequences for the LLC.

Furthermore, it is important to establish clear employment policies and procedures for your LLC. This includes creating an employee handbook that outlines the expectations, rights, and responsibilities of both the LLC and its employees. Having clear policies in place can help prevent misunderstandings and disputes in the future.

Employee Classification for an LLC

When it comes to employing people with an LLC, it is important to understand the different employee classifications that exist. The classification of employees can have significant legal and financial implications for both the LLC and the individuals involved.

There are generally two main classifications for employees in an LLC: W-2 employees and 1099 contractors. Each classification has its own set of rules and requirements that must be followed.

W-2 employees are considered traditional employees. They are hired by the LLC and receive a regular salary or hourly wage. The LLC is responsible for withholding taxes from their paychecks, providing benefits, and complying with employment laws and regulations. W-2 employees are typically subject to more control and direction from the LLC, and they may have a long-term working relationship with the company.

On the other hand, 1099 contractors are considered independent contractors. They are hired by the LLC to perform specific tasks or projects on a contract basis. Unlike W-2 employees, 1099 contractors are responsible for paying their own taxes and providing their own benefits. They have more control over how and when they complete their work and may have multiple clients or projects at the same time.

It is crucial for an LLC to correctly classify its workers to avoid legal and financial consequences. Misclassifying employees as contractors can result in penalties and back taxes, while misclassifying contractors as employees can lead to additional tax liabilities and compliance issues.

To determine the proper classification, the IRS uses a set of criteria that considers factors such as the level of control, the relationship between the worker and the LLC, and the nature of the work being performed. It is recommended for LLCs to consult with legal and tax professionals to ensure proper classification and compliance with all applicable laws and regulations.

| Employee Classification | W-2 Employees | 1099 Contractors |

|---|---|---|

| Control and Direction | LLC has more control and direction over the work | Contractor has more control over how and when the work is done |

| Taxes and Benefits | LLC withholds taxes and provides benefits | Contractor is responsible for paying taxes and providing benefits |

| Working Relationship | Long-term working relationship with the LLC | Contractual relationship for specific tasks or projects |

Question-answer:

Can an LLC have employees?

Yes, an LLC can have employees. Unlike a sole proprietorship or a partnership, an LLC is a separate legal entity, which means it can hire employees and be treated as an employer.

What are the advantages of having employees with an LLC?

Having employees with an LLC can provide several advantages. Firstly, it allows the LLC to expand its operations and take on more work. Secondly, it can help distribute the workload and increase productivity. Additionally, having employees can also help the LLC establish a more professional image and build credibility with clients and customers.

What are the legal requirements for hiring employees with an LLC?

When hiring employees with an LLC, there are several legal requirements that need to be met. These include obtaining an Employer Identification Number (EIN) from the IRS, registering with the appropriate state agencies for tax and employment purposes, complying with federal and state labor laws, and maintaining proper records and documentation related to employment.

Are there any limitations or restrictions on hiring employees with an LLC?

While an LLC can have employees, there may be certain limitations or restrictions depending on the state and industry. For example, some states may require LLCs to have a certain number of members before they can hire employees. Additionally, certain professions or industries may have specific licensing or certification requirements that need to be met before hiring employees.

What are the tax implications of having employees with an LLC?

Having employees with an LLC can have various tax implications. The LLC will be responsible for withholding and paying payroll taxes, such as Social Security and Medicare taxes, as well as federal and state income taxes on behalf of its employees. The LLC may also be eligible for certain tax deductions or credits related to employment expenses.

Can an LLC have employees?

Yes, an LLC can have employees. While LLCs are typically owned and operated by their members, they can also hire employees to help run the business.

What are the benefits of having employees with an LLC?

Having employees with an LLC can provide several benefits. Firstly, it allows the LLC to delegate tasks and responsibilities, freeing up the members to focus on other aspects of the business. Additionally, having employees can help the LLC expand and grow by increasing its capacity to handle more work. Finally, having employees can also provide a sense of legitimacy and professionalism to the LLC.