- Understanding Home Equity Loans

- What is a Home Equity Loan?

- How Does a Home Equity Loan Work?

- Benefits of a Home Equity Loan

- Getting a Home Equity Loan with a Cosigner

- What is a Cosigner?

- Question-answer:

- What is a home equity loan?

- Can you get a home equity loan with a cosigner?

- What are the benefits of having a cosigner for a home equity loan?

- What are the risks of having a cosigner for a home equity loan?

- How can I find a cosigner for a home equity loan?

When it comes to obtaining a home equity loan, having a cosigner can make a significant difference. A cosigner is someone who agrees to take on the responsibility of repaying the loan if the primary borrower is unable to do so. This added layer of security can increase your chances of getting approved for a home equity loan, especially if you have a less-than-perfect credit history or a high debt-to-income ratio.

Having a cosigner can help you qualify for a larger loan amount or secure a lower interest rate. Lenders are more likely to approve your application if they see that you have a cosigner with a strong credit history and stable income. This is because the cosigner’s financial stability reduces the risk for the lender, making them more willing to extend credit to you.

However, it’s important to choose your cosigner wisely. Ideally, your cosigner should have a good credit score, a low debt-to-income ratio, and a stable source of income. They should also be someone you trust and have a strong relationship with, as they will be equally responsible for repaying the loan. It’s crucial to have open and honest communication with your cosigner about your financial situation and your ability to make timely loan payments.

Understanding Home Equity Loans

A home equity loan is a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. Equity is the difference between the current market value of the home and the outstanding balance on the mortgage. Home equity loans are often used for major expenses such as home renovations, medical bills, or debt consolidation.

When you take out a home equity loan, you are essentially using your home as collateral. This means that if you fail to repay the loan, the lender has the right to foreclose on your home and sell it to recoup their losses. Because of this, it is important to carefully consider whether a home equity loan is the right choice for your financial situation.

Home equity loans typically have fixed interest rates and repayment terms, which can make them a more predictable and stable option compared to other types of loans. The interest rates on home equity loans are often lower than those on credit cards or personal loans, making them an attractive option for borrowers looking to consolidate high-interest debt.

One of the key benefits of a home equity loan is that the interest you pay may be tax-deductible. However, it is important to consult with a tax professional to understand the specific tax implications in your situation.

Before taking out a home equity loan, it is important to carefully consider your financial situation and determine if you have the ability to repay the loan. It is also important to shop around and compare offers from different lenders to ensure you are getting the best terms and interest rates.

What is a Home Equity Loan?

A home equity loan is a type of loan that allows homeowners to borrow money against the equity they have built up in their home. Equity is the difference between the current market value of the home and the outstanding balance on the mortgage.

Home equity loans are secured loans, meaning that the borrower uses their home as collateral. This means that if the borrower fails to repay the loan, the lender has the right to foreclose on the home and sell it to recover their money.

Home equity loans are typically used for major expenses, such as home renovations, medical bills, or debt consolidation. They can provide homeowners with a large sum of money upfront, which is repaid over a fixed period of time with regular monthly payments.

Interest rates on home equity loans are usually lower than other types of loans because they are secured by the value of the home. However, the interest rates can vary depending on factors such as the borrower’s credit score and the loan-to-value ratio.

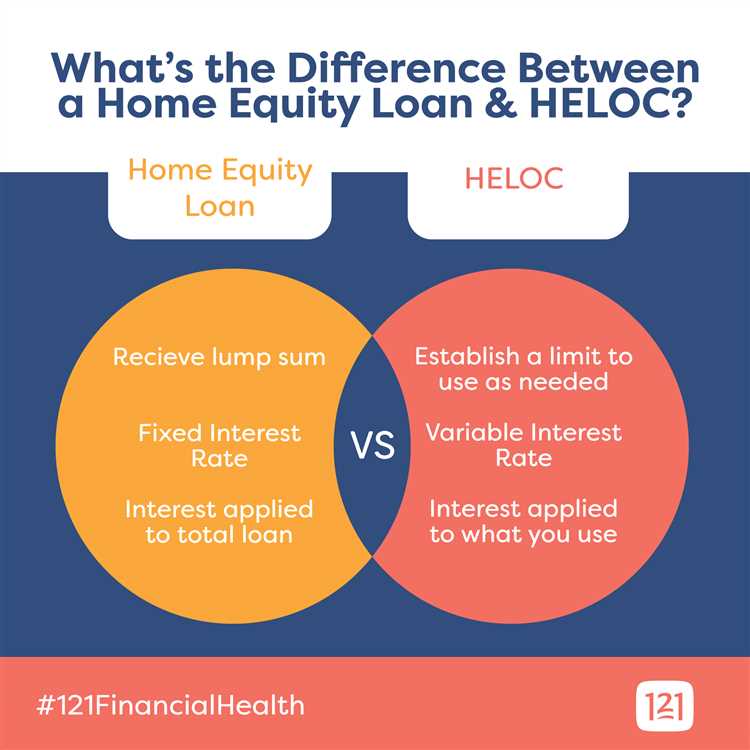

It’s important to note that a home equity loan is different from a home equity line of credit (HELOC). While a home equity loan provides a lump sum of money upfront, a HELOC works more like a credit card, allowing the borrower to borrow and repay funds as needed within a certain limit.

Overall, a home equity loan can be a useful financial tool for homeowners who need access to a large amount of money and have built up equity in their home. However, it’s important to carefully consider the terms and conditions of the loan and ensure that the borrower can comfortably afford the monthly payments.

How Does a Home Equity Loan Work?

A home equity loan is a type of loan that allows homeowners to borrow money against the equity they have built up in their home. Equity is the difference between the current market value of the home and the amount still owed on the mortgage.

When a homeowner applies for a home equity loan, the lender will assess the value of the property and the amount of equity the homeowner has. Based on this assessment, the lender will determine the maximum amount that can be borrowed.

Once the loan is approved, the homeowner will receive a lump sum of money, which can be used for any purpose. The loan is typically repaid over a fixed period of time, with regular monthly payments. The interest rate on a home equity loan is usually lower than other types of loans, as the loan is secured by the value of the home.

If the homeowner fails to make the required payments, the lender has the right to foreclose on the property and sell it to recover the outstanding balance. Therefore, it is important for homeowners to carefully consider their ability to repay the loan before taking out a home equity loan.

Home equity loans can be a useful financial tool for homeowners who need to access a large amount of money for a specific purpose, such as home renovations or debt consolidation. However, it is important to remember that borrowing against the equity in your home puts your property at risk, so it is important to use the funds responsibly and make timely payments.

Benefits of a Home Equity Loan

A home equity loan offers several benefits to homeowners who have built up equity in their property. Here are some of the key advantages:

1. Lower Interest Rates:

One of the main benefits of a home equity loan is that it typically comes with lower interest rates compared to other types of loans, such as personal loans or credit cards. This can result in significant savings over the life of the loan.

2. Access to Large Amounts of Money:

With a home equity loan, homeowners can borrow a large sum of money based on the equity they have built up in their property. This can be particularly useful for major expenses, such as home renovations, medical bills, or debt consolidation.

3. Flexible Repayment Terms:

Home equity loans often come with flexible repayment terms, allowing homeowners to choose a repayment schedule that fits their financial situation. This can include options for fixed monthly payments or interest-only payments for a certain period of time.

4. Potential Tax Benefits:

In some cases, the interest paid on a home equity loan may be tax-deductible. Homeowners should consult with a tax professional to determine if they qualify for any tax benefits.

5. Improving Credit Score:

By making regular payments on a home equity loan, homeowners can improve their credit score. This can be beneficial for future borrowing needs, as a higher credit score can result in better loan terms and interest rates.

6. Quick Access to Funds:

Unlike other types of loans, the approval process for a home equity loan is often faster and more streamlined. This means homeowners can access the funds they need quickly, making it an ideal option for urgent financial needs.

Overall, a home equity loan can provide homeowners with a cost-effective way to access funds for various purposes while taking advantage of the equity they have built up in their property.

Getting a Home Equity Loan with a Cosigner

When applying for a home equity loan, having a cosigner can greatly increase your chances of approval. A cosigner is someone who agrees to take on the responsibility of repaying the loan if the primary borrower is unable to do so. This provides the lender with an added layer of security, as they have someone else to turn to for repayment.

Having a cosigner can be especially beneficial if you have a low credit score or a high debt-to-income ratio. Lenders are more likely to approve your loan application if you have a cosigner with a strong credit history and a stable income. This is because the cosigner’s financial stability reassures the lender that the loan will be repaid on time.

However, it’s important to choose your cosigner wisely. The ideal cosigner is someone who has a good credit score, a steady income, and a strong relationship with you. It could be a family member, a close friend, or a trusted colleague. Before asking someone to be your cosigner, make sure they understand the responsibilities involved and are willing to take on the risk.

When applying for a home equity loan with a cosigner, both you and your cosigner will need to provide financial documentation, such as pay stubs, tax returns, and bank statements. The lender will evaluate both your financial situations to determine if you qualify for the loan. Keep in mind that if you default on the loan, it will not only affect your credit score but also your cosigner’s.

It’s important to note that not all lenders accept cosigners for home equity loans. Before applying, do your research and find lenders who are willing to work with cosigners. Compare their terms and conditions, interest rates, and fees to find the best option for you.

What is a Cosigner?

A cosigner is a person who agrees to take on the responsibility of repaying a loan if the primary borrower is unable to do so. They essentially act as a guarantor for the loan, providing an additional level of security for the lender.

When it comes to home equity loans, having a cosigner can be beneficial for borrowers who may not meet the lender’s requirements on their own. This could be due to a low credit score, insufficient income, or a high debt-to-income ratio.

By having a cosigner, borrowers can increase their chances of getting approved for a home equity loan and potentially secure more favorable terms, such as a lower interest rate or higher loan amount.

However, it’s important to note that being a cosigner comes with its own risks and responsibilities. If the primary borrower defaults on the loan, the cosigner will be responsible for repaying the remaining balance. This can have a negative impact on the cosigner’s credit score and financial situation.

Before agreeing to become a cosigner, it’s crucial for individuals to carefully consider their own financial stability and ability to take on the loan repayment if necessary. They should also thoroughly review the terms and conditions of the loan agreement to fully understand their obligations as a cosigner.

Question-answer:

What is a home equity loan?

A home equity loan is a type of loan that allows homeowners to borrow money using the equity they have built up in their home as collateral.

Can you get a home equity loan with a cosigner?

Yes, it is possible to get a home equity loan with a cosigner. A cosigner is someone who agrees to take on the responsibility of repaying the loan if the primary borrower is unable to do so.

What are the benefits of having a cosigner for a home equity loan?

Having a cosigner for a home equity loan can increase your chances of getting approved for the loan, especially if you have a low credit score or a high debt-to-income ratio. It can also help you secure a lower interest rate and better loan terms.

What are the risks of having a cosigner for a home equity loan?

The main risk of having a cosigner for a home equity loan is that if you default on the loan, the cosigner will be responsible for repaying the loan. This can strain your relationship with the cosigner and negatively impact their credit score.

How can I find a cosigner for a home equity loan?

Finding a cosigner for a home equity loan can be challenging, as it requires finding someone who is willing to take on the financial responsibility of the loan. It is important to choose a cosigner who has a good credit score and a stable income.