- Can You Apply for EIN Before LLC? Explained

- Understanding the EIN and LLC

- What is an EIN?

- What is an LLC?

- Applying for an EIN before LLC

- Is it possible to apply for an EIN before forming an LLC?

- Benefits of applying for an EIN before LLC formation

- Question-answer:

- Can I apply for an EIN before forming an LLC?

- What is an EIN and why do I need it for my LLC?

- How do I apply for an EIN before forming an LLC?

- What are the benefits of applying for an EIN before forming an LLC?

- Is there a fee to apply for an EIN before forming an LLC?

- Can I apply for an EIN before forming an LLC?

When starting a business, there are many important steps to take, and one of them is obtaining an Employer Identification Number (EIN). An EIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify your business for tax purposes. It is often required when opening a business bank account, hiring employees, or filing tax returns.

One common question that arises is whether you can apply for an EIN before forming your Limited Liability Company (LLC). The answer is yes, you can apply for an EIN before LLC formation. In fact, it is recommended to apply for an EIN early in the process to ensure a smooth transition once your LLC is formed.

By applying for an EIN before LLC formation, you can secure your business’s identification number and avoid any delays in obtaining it later. This allows you to start establishing your business’s credit history, open a bank account, and hire employees if needed. It also helps you stay organized and ensures that you are ready to operate your business as soon as your LLC is officially formed.

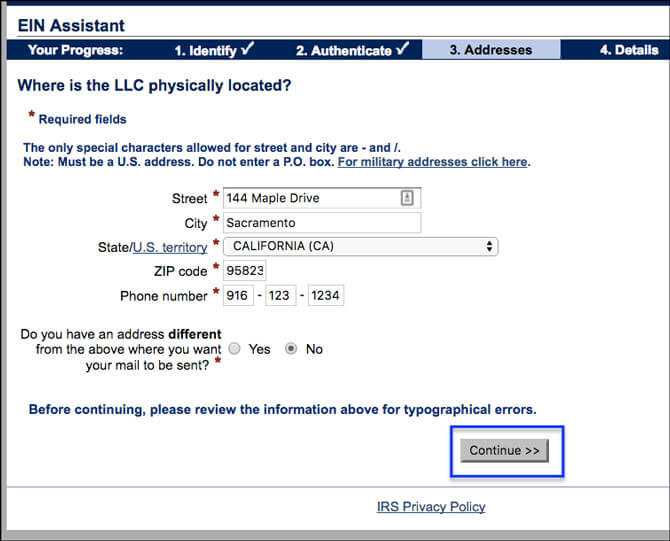

Applying for an EIN before LLC formation is a straightforward process. You can apply online through the IRS website or by mail. The application requires basic information about your business, such as its legal name, address, and the responsible party’s Social Security Number or Individual Taxpayer Identification Number. Once your application is submitted, you will receive your EIN immediately if applying online or within a few weeks if applying by mail.

Can You Apply for EIN Before LLC? Explained

When starting a business, one of the first steps is to determine the legal structure of the company. Many entrepreneurs choose to form a limited liability company (LLC) due to its flexibility and liability protection. However, before forming an LLC, it is important to consider whether you can apply for an Employer Identification Number (EIN) beforehand.

An EIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity for tax purposes. It is often required when opening a business bank account, hiring employees, or filing tax returns. While it is possible to apply for an EIN before forming an LLC, it is not always necessary or recommended.

One of the main benefits of applying for an EIN before LLC formation is that it allows you to establish a separate tax identity for your business. This can be advantageous if you plan to start conducting business activities or hiring employees before officially forming the LLC. Having an EIN can also help you build business credit and establish credibility with vendors and clients.

However, applying for an EIN before LLC formation is not mandatory. If you are not planning to engage in business activities or hire employees until after forming the LLC, you can wait until the LLC is officially established to apply for an EIN. In fact, some entrepreneurs prefer to wait until the LLC is formed to ensure that the business structure is finalized before obtaining an EIN.

It is important to note that the process of applying for an EIN is relatively simple and can be done online through the IRS website. You will need to provide information about the business, such as its legal name, address, and the responsible party’s Social Security Number or Individual Taxpayer Identification Number.

Understanding the EIN and LLC

When starting a business, it is important to understand the different aspects and requirements involved. Two key components that entrepreneurs need to be familiar with are the Employer Identification Number (EIN) and the Limited Liability Company (LLC).

An EIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity for tax purposes. It is often referred to as a business’s social security number. The EIN is used to file tax returns, open business bank accounts, and hire employees.

An LLC, on the other hand, is a legal structure that provides limited liability protection to its owners, known as members. This means that the members’ personal assets are protected from the company’s debts and liabilities. An LLC can have one or multiple members, and it offers flexibility in terms of management and taxation.

Now, the question arises: Can you apply for an EIN before forming an LLC? The answer is yes. It is possible to apply for an EIN before LLC formation. In fact, many entrepreneurs choose to obtain an EIN early in the business planning process.

There are several benefits to applying for an EIN before LLC formation. Firstly, it allows you to separate your personal and business finances from the start. By having a separate EIN, you can open a business bank account and establish credit under your business’s name. This not only helps with organization but also enhances your professional image.

Secondly, having an EIN can make it easier to apply for business licenses and permits. Many states require an EIN to issue these documents, so having one in place can streamline the process.

Lastly, obtaining an EIN early on can help you establish your business’s identity and credibility. It shows that you are serious about your venture and have taken the necessary steps to comply with tax regulations.

What is an EIN?

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses for tax purposes. It is also known as a Federal Tax Identification Number (FTIN) or a Taxpayer Identification Number (TIN).

The EIN is used to identify businesses, trusts, estates, and other entities for tax filing and reporting purposes. It is similar to a Social Security number for individuals. The EIN is required for various activities, such as opening a business bank account, hiring employees, filing tax returns, and applying for business licenses.

When applying for an EIN, the IRS will ask for information about the business, such as its legal name, address, and type of entity. The EIN is issued immediately upon successful completion of the application process.

It is important to note that an EIN is not transferable and is unique to each business entity. If a business undergoes a change in ownership or structure, a new EIN may be required.

Overall, the EIN plays a crucial role in the identification and taxation of businesses, providing a means for the IRS to track and monitor their activities.

What is an LLC?

An LLC, or Limited Liability Company, is a type of business entity that combines the limited liability protection of a corporation with the flexibility and tax benefits of a partnership. It is a popular choice for small businesses and startups because it offers the owners, known as members, protection from personal liability for the company’s debts and obligations.

One of the key advantages of an LLC is that it allows for pass-through taxation. This means that the company’s profits and losses are passed through to the members, who report them on their individual tax returns. This avoids the double taxation that can occur with a corporation, where the company’s profits are taxed at the corporate level and then again when distributed to shareholders as dividends.

Another benefit of an LLC is its flexibility in terms of management and ownership. Unlike a corporation, which has a more rigid structure with shareholders, directors, and officers, an LLC can be managed by its members or by appointed managers. Additionally, an LLC can have a single member or multiple members, allowing for greater flexibility in ownership arrangements.

When forming an LLC, the owners must file articles of organization with the appropriate state agency and pay the necessary fees. The articles of organization typically include information such as the LLC’s name, address, purpose, and the names and addresses of the members. Once the LLC is formed, it must comply with certain ongoing requirements, such as filing annual reports and maintaining proper records.

In summary, an LLC is a flexible and advantageous business entity that provides limited liability protection and pass-through taxation for its members. It offers the benefits of a corporation without the same level of complexity and formalities. If you are considering starting a small business or startup, forming an LLC may be a suitable option to protect your personal assets and enjoy tax benefits.

Applying for an EIN before LLC

When starting a business, one of the first steps is to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique nine-digit number assigned to businesses for tax purposes. It is often required when opening a business bank account, hiring employees, or filing tax returns.

While it is common to apply for an EIN after forming a Limited Liability Company (LLC), it is possible to apply for an EIN before LLC formation. This can be beneficial for several reasons.

Firstly, applying for an EIN before LLC formation allows you to establish your business identity early on. It shows that you are serious about starting a business and can help you build credibility with potential partners, investors, and customers.

Secondly, obtaining an EIN before LLC formation can streamline the process of opening a business bank account. Most banks require an EIN to open a business account, and having it in place beforehand can save time and effort.

Additionally, applying for an EIN before LLC formation can help you separate your personal and business finances from the start. This is important for legal and tax purposes, as it ensures that your personal assets are protected in case of any liabilities or legal issues related to your business.

To apply for an EIN before LLC formation, you can visit the IRS website and complete the online application. The process is relatively straightforward and typically takes only a few minutes. You will need to provide information about your business, such as its legal name, address, and the type of entity you plan to form (in this case, an LLC).

Once you receive your EIN, it is important to keep it safe and use it responsibly. You will need to provide it to banks, government agencies, and other entities for various purposes, so it is crucial to keep it confidential and secure.

Is it possible to apply for an EIN before forming an LLC?

Yes, it is possible to apply for an Employer Identification Number (EIN) before forming a Limited Liability Company (LLC). In fact, many entrepreneurs choose to apply for an EIN before they officially establish their LLC.

An EIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity for tax purposes. It is often required when opening a business bank account, hiring employees, or filing tax returns.

Applying for an EIN before forming an LLC can have several advantages. First, it allows you to separate your personal and business finances from the start. By obtaining an EIN, you can open a business bank account and conduct transactions under your business name, which can help establish credibility and professionalism.

Second, having an EIN can make it easier to apply for business licenses and permits. Many states and local governments require an EIN when applying for these documents. By obtaining an EIN early on, you can streamline the process of obtaining the necessary licenses and permits for your LLC.

Additionally, applying for an EIN before forming an LLC can help protect your personal information. Without an EIN, you may be required to provide your Social Security Number (SSN) for business-related activities. By using an EIN instead, you can keep your SSN private and reduce the risk of identity theft.

To apply for an EIN before forming an LLC, you can visit the IRS website and complete the online application. The process is relatively straightforward and can be completed in a matter of minutes. Once approved, you will receive your EIN immediately, allowing you to start using it for business purposes.

However, it’s important to note that obtaining an EIN does not automatically establish your LLC. You will still need to follow the necessary steps to officially form your LLC, such as filing the appropriate paperwork with your state’s Secretary of State office.

Benefits of applying for an EIN before LLC formation

When starting a business, one of the first steps is to decide on the legal structure, such as forming a Limited Liability Company (LLC). However, before officially forming the LLC, there are certain benefits to consider when applying for an Employer Identification Number (EIN) beforehand.

1. Establishing business identity: Applying for an EIN before LLC formation allows you to establish a unique identity for your business. The EIN serves as a tax identification number for your company, similar to a social security number for individuals. Having an EIN can help build credibility and professionalism, especially when dealing with clients, vendors, and financial institutions.

2. Separating personal and business finances: By obtaining an EIN before LLC formation, you can separate your personal and business finances from the start. This separation is crucial for maintaining the limited liability protection that an LLC offers. With an EIN, you can open a business bank account and keep your personal and business expenses separate, making it easier to track and manage your finances.

3. Hiring employees: If you plan to hire employees for your business, having an EIN is essential. It is required by the Internal Revenue Service (IRS) to report employment taxes and withholdings. By applying for an EIN before LLC formation, you can streamline the hiring process and ensure compliance with tax regulations from the beginning.

4. Building business credit: Applying for an EIN before LLC formation allows you to start building business credit. Having a separate EIN helps establish a credit history for your business, which can be beneficial when seeking loans, lines of credit, or other forms of financing in the future. Building business credit can also help your LLC establish a strong financial foundation and improve its chances of success.

5. Flexibility for future growth: Applying for an EIN before LLC formation provides flexibility for future growth and expansion. It allows you to establish a solid foundation for your business and be prepared for any changes or opportunities that may arise. With an EIN in place, you can easily adapt to new business ventures, partnerships, or changes in ownership structure without having to go through the process of obtaining an EIN later on.

Question-answer:

Can I apply for an EIN before forming an LLC?

Yes, you can apply for an EIN (Employer Identification Number) before forming an LLC. In fact, many people choose to apply for an EIN as the first step in the process of starting their LLC. This allows them to establish their business identity and begin conducting certain activities, such as opening a bank account or applying for business licenses, even before the LLC is officially formed.

What is an EIN and why do I need it for my LLC?

An EIN, or Employer Identification Number, is a unique nine-digit number assigned by the IRS to identify your business entity for tax purposes. You need an EIN for your LLC because it is required for various business activities, such as opening a bank account, hiring employees, filing tax returns, and obtaining business licenses and permits. It is essentially the social security number for your LLC.

How do I apply for an EIN before forming an LLC?

To apply for an EIN before forming an LLC, you can do so online through the IRS website. The application process is relatively simple and can be completed in a matter of minutes. You will need to provide basic information about your business, such as the name and address, as well as the name and social security number of the responsible party. Once your application is submitted, you will receive your EIN immediately.

What are the benefits of applying for an EIN before forming an LLC?

There are several benefits to applying for an EIN before forming an LLC. First, it allows you to establish your business identity and start conducting certain activities, such as opening a bank account or applying for business licenses, even before the LLC is officially formed. Second, it can help streamline the process of starting your LLC, as you will already have your EIN in place. Finally, it can provide a sense of professionalism and legitimacy to your business, as having an EIN is often seen as a sign of an established and serious business entity.

Is there a fee to apply for an EIN before forming an LLC?

No, there is no fee to apply for an EIN before forming an LLC. The application process is free of charge and can be done online through the IRS website. However, be cautious of third-party websites or services that may charge a fee to assist with the application process. It is recommended to apply directly through the IRS website to avoid any unnecessary fees.

Can I apply for an EIN before forming an LLC?

Yes, you can apply for an EIN (Employer Identification Number) before forming an LLC. In fact, many people choose to apply for an EIN as part of the process of starting their LLC. This allows them to have their EIN ready to go as soon as their LLC is officially formed.