- Understanding Living Trusts in California

- What is a Living Trust?

- How Does a Living Trust Work in California?

- Benefits of Having a Living Trust in California

- Evicting a Tenant Under a Living Trust in California

- Can a Living Trust Evict a Tenant in California?

- Legal Process for Evicting a Tenant Under a Living Trust in California

- Question-answer:

- What is a living trust in California?

- Can a living trust be used to evict someone in California?

- What are the legal procedures for evicting a tenant in California?

- Can a living trust affect the eviction process in California?

Evicting a tenant can be a complex and challenging process, especially when it comes to dealing with a living trust. In California, the laws surrounding eviction under a living trust can be confusing and require a thorough understanding of the legal requirements.

A living trust is a legal document that allows an individual, known as the trustor, to transfer their assets to a trustee to manage on behalf of the beneficiaries. When it comes to rental properties, the trustor may choose to hold the property in a living trust for various reasons, such as estate planning or asset protection.

However, if the trustor wishes to evict a tenant from a property held in a living trust, there are specific steps that must be followed. It’s important to note that the trustee, not the trustor, has the legal authority to initiate and carry out the eviction process.

Before proceeding with an eviction, the trustee must first review the terms of the living trust to determine if there are any specific provisions regarding tenant eviction. If the trust document does not address eviction, the trustee must then follow the standard eviction process outlined by California law.

Overall, evicting a tenant under a living trust in California requires careful attention to detail and adherence to the legal requirements. It’s crucial for both trustors and trustees to consult with an experienced attorney to ensure they are following the correct procedures and protecting their rights throughout the eviction process.

Understanding Living Trusts in California

A living trust is a legal document that allows individuals in California to transfer their assets into a trust during their lifetime. The trust is managed by a trustee, who is responsible for distributing the assets to the beneficiaries according to the terms of the trust.

One of the main advantages of a living trust in California is that it allows individuals to avoid probate. Probate is the legal process through which a deceased person’s assets are distributed to their heirs. It can be time-consuming, expensive, and public. By creating a living trust, individuals can ensure that their assets are distributed privately and efficiently.

In California, a living trust can be revocable or irrevocable. A revocable living trust can be changed or revoked by the individual who created it, while an irrevocable living trust cannot be changed or revoked without the consent of the beneficiaries.

Creating a living trust in California involves several steps. First, the individual must create a trust document that outlines the terms of the trust, including the assets to be included and the beneficiaries. Next, the individual must transfer the assets into the trust, which may involve changing the ownership of property or re-titling financial accounts. Finally, the individual must appoint a trustee to manage the trust and distribute the assets according to the terms of the trust.

There are several benefits to having a living trust in California. First, as mentioned earlier, it allows individuals to avoid probate. Second, it provides privacy, as the terms of the trust and the distribution of assets are not made public. Third, it can help individuals plan for incapacity, as the trustee can step in and manage the assets if the individual becomes unable to do so. Finally, it can help individuals minimize estate taxes, as assets held in a living trust are not subject to probate.

What is a Living Trust?

A living trust, also known as a revocable trust or inter vivos trust, is a legal document that allows individuals to transfer their assets into a trust during their lifetime. The trust is managed by a trustee, who is responsible for distributing the assets to the beneficiaries according to the terms of the trust.

Unlike a will, which only takes effect after the individual’s death, a living trust is effective immediately and can be changed or revoked at any time during the individual’s lifetime. This flexibility is one of the main advantages of a living trust.

A living trust can hold various types of assets, including real estate, bank accounts, investments, and personal property. By transferring assets into the trust, individuals can avoid probate, which is the legal process of distributing assets after death. This can save time and money for the beneficiaries and provide privacy, as the details of the trust do not become public record.

In California, a living trust is a popular estate planning tool, as it allows individuals to maintain control over their assets while providing for the smooth transfer of those assets to their beneficiaries. It is important to consult with an attorney experienced in estate planning to ensure that a living trust is properly created and executed according to California law.

How Does a Living Trust Work in California?

A living trust is a legal document that allows individuals to transfer their assets into a trust during their lifetime. In California, a living trust is a popular estate planning tool that offers several benefits, including avoiding probate, maintaining privacy, and providing flexibility in managing assets.

When creating a living trust in California, the individual, known as the grantor, transfers ownership of their assets to the trust. The grantor also designates a trustee who will manage the trust and distribute the assets according to the grantor’s instructions.

One of the key advantages of a living trust in California is that it allows assets to bypass probate. Probate is the legal process of distributing a deceased person’s assets, which can be time-consuming and expensive. By placing assets in a living trust, they can be distributed to beneficiaries without going through probate, saving time and money.

Another benefit of a living trust is privacy. Unlike a will, which becomes a public record upon death, a living trust remains private. This means that the details of the trust, including the assets and beneficiaries, are not disclosed to the public.

A living trust also provides flexibility in managing assets. The grantor can retain control over the assets during their lifetime and can make changes to the trust as needed. They can add or remove assets, change beneficiaries, or even revoke the trust entirely if desired.

It’s important to note that a living trust only covers assets that have been transferred to the trust. Any assets that are not included in the trust will still need to go through probate. Therefore, it’s crucial to properly fund the trust by transferring ownership of assets to ensure they are protected.

Benefits of Having a Living Trust in California

A living trust is a legal document that allows individuals to transfer their assets into a trust during their lifetime. In California, having a living trust can provide several benefits:

1. Avoiding Probate:

One of the main advantages of having a living trust in California is that it allows your assets to bypass the probate process. Probate can be time-consuming, expensive, and public. By placing your assets in a living trust, they can be distributed to your beneficiaries without the need for probate court involvement.

2. Privacy:

Unlike a will, which becomes a public record upon probate, a living trust allows for privacy. The details of your assets and beneficiaries remain confidential, providing a higher level of privacy for you and your loved ones.

3. Flexibility and Control:

A living trust gives you the flexibility to make changes or revoke the trust during your lifetime. You can add or remove assets, change beneficiaries, or appoint a new trustee as needed. This level of control allows you to adapt your estate plan to your changing circumstances.

4. Incapacity Planning:

A living trust can also provide protection in the event of your incapacity. If you become unable to manage your affairs, the successor trustee named in your trust can step in and manage your assets on your behalf, avoiding the need for a court-appointed conservatorship.

5. Avoiding Ancillary Probate:

If you own property in multiple states, having a living trust can help you avoid ancillary probate. By placing all your out-of-state properties in the trust, you can ensure that they are distributed according to your wishes without the need for separate probate proceedings in each state.

6. Continuity of Asset Management:

A living trust provides for the seamless transfer of asset management. If you become incapacitated or pass away, the successor trustee can step in immediately and continue managing the trust assets without interruption. This ensures that your assets are protected and managed according to your wishes.

7. Minimizing Estate Taxes:

While estate taxes may not be a concern for everyone, a living trust can help minimize estate taxes for those with larger estates. By utilizing certain estate planning strategies within the trust, you can potentially reduce the tax burden on your beneficiaries.

Evicting a Tenant Under a Living Trust in California

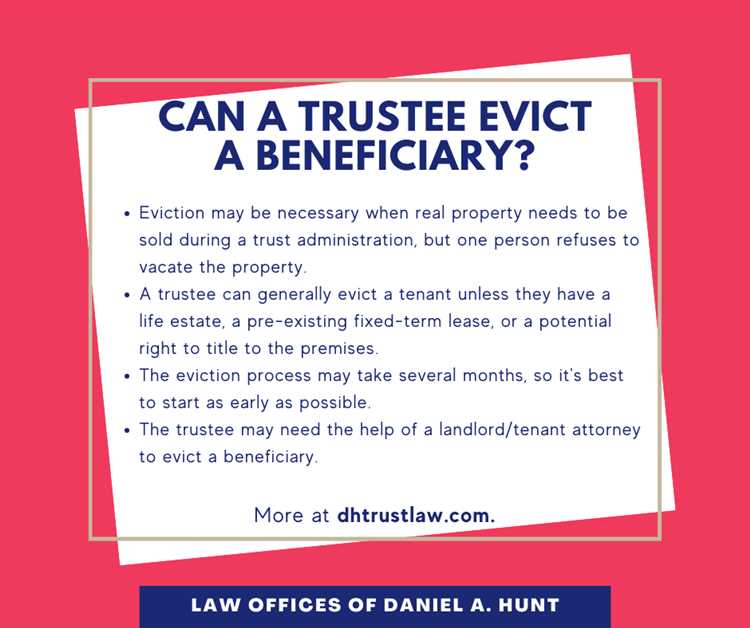

Evicting a tenant under a living trust in California can be a complex process that requires careful attention to legal requirements and procedures. When a property is held in a living trust, the trustee has the authority to manage and make decisions regarding the property, including the ability to evict tenants.

Before proceeding with an eviction, it is important to review the terms of the living trust to ensure that the trustee has the power to evict tenants. The trust document should clearly outline the trustee’s authority in this regard. If the trust does not grant explicit eviction powers, the trustee may need to seek court approval before proceeding.

Once it has been established that the trustee has the authority to evict, the next step is to follow the legal process for eviction in California. This typically involves providing the tenant with a written notice to quit, which specifies the reason for the eviction and gives the tenant a certain amount of time to vacate the property.

If the tenant fails to comply with the notice to quit, the trustee can then file an unlawful detainer lawsuit in court. This lawsuit initiates the formal eviction process and allows the trustee to seek a court order for the tenant’s removal. It is important to note that the trustee must follow all applicable laws and regulations throughout the eviction process to ensure that the eviction is lawful.

During the eviction process, it is advisable for the trustee to consult with an attorney who specializes in landlord-tenant law. An attorney can provide guidance and assistance in navigating the legal complexities of evicting a tenant under a living trust in California.

Can a Living Trust Evict a Tenant in California?

When it comes to evicting a tenant in California, the question of whether a living trust can be used to initiate the eviction process often arises. The answer to this question is yes, a living trust can indeed be used to evict a tenant in California.

A living trust is a legal document that allows an individual, known as the trustor, to transfer their assets into a trust during their lifetime. The trustor appoints a trustee who is responsible for managing the assets held in the trust. In the case of rental properties, the trustor can transfer ownership of the property to the trust, making the trust the legal owner.

As the legal owner of the property, the living trust has the right to initiate eviction proceedings against a tenant who has violated the terms of their lease agreement. This includes situations where the tenant has failed to pay rent, caused damage to the property, or engaged in illegal activities on the premises.

However, it is important to note that the eviction process under a living trust in California follows the same legal procedures as any other eviction. The trustee must still provide the tenant with proper notice, file the necessary legal documents with the court, and attend any required hearings. The living trust does not grant the trustee any special powers or bypass the legal requirements for eviction.

It is also worth mentioning that the living trust must have the authority to manage real estate properties in order to initiate an eviction. This authority should be clearly stated in the trust document. If the trust does not have this authority, the trustee may need to seek court approval before proceeding with the eviction.

Legal Process for Evicting a Tenant Under a Living Trust in California

When it comes to evicting a tenant under a living trust in California, there is a specific legal process that must be followed. This process ensures that both the landlord and the tenant’s rights are protected and that the eviction is carried out in a fair and lawful manner.

The first step in the legal process is to provide the tenant with a written notice to quit or pay rent. This notice must clearly state the reason for the eviction and give the tenant a specific amount of time to either pay the rent owed or vacate the property. In California, the notice period is typically 3 days for non-payment of rent.

If the tenant fails to comply with the notice to quit or pay rent, the next step is to file an unlawful detainer lawsuit. This lawsuit is filed with the appropriate court in the county where the property is located. The landlord must provide evidence of the tenant’s non-compliance with the notice and request a judgment for possession of the property.

Once the lawsuit is filed, the tenant will be served with a copy of the complaint and summons. The tenant then has a specific amount of time to respond to the lawsuit, typically 5 days. If the tenant fails to respond, the landlord can request a default judgment and proceed with the eviction process.

If the tenant does respond to the lawsuit, a court hearing will be scheduled. At the hearing, both the landlord and the tenant will have the opportunity to present their case and provide evidence supporting their claims. The judge will then make a decision based on the evidence presented.

If the judge rules in favor of the landlord, a judgment for possession will be issued. The landlord can then obtain a writ of possession from the court, which allows the sheriff to physically remove the tenant from the property if they do not voluntarily vacate.

It is important to note that the eviction process can be complex and time-consuming. It is recommended to consult with an attorney who specializes in landlord-tenant law to ensure that all legal requirements are met and the eviction is carried out properly.

Question-answer:

What is a living trust in California?

A living trust in California is a legal document that allows an individual, known as the grantor, to transfer their assets into a trust during their lifetime. The grantor appoints a trustee to manage the trust and distribute the assets to the beneficiaries according to the terms of the trust.

Can a living trust be used to evict someone in California?

No, a living trust cannot be used to evict someone in California. The purpose of a living trust is to manage and distribute assets, not to evict tenants. Evictions are governed by landlord-tenant laws and require specific legal procedures.

What are the legal procedures for evicting a tenant in California?

The legal procedures for evicting a tenant in California include serving the tenant with a written notice, filing an unlawful detainer lawsuit, attending a court hearing, and obtaining a writ of possession if the court rules in favor of the landlord. It is important for landlords to follow these procedures carefully to avoid legal complications.

Can a living trust affect the eviction process in California?

No, a living trust does not directly affect the eviction process in California. The eviction process is based on landlord-tenant laws and the terms of the lease agreement. However, if the property is owned by a living trust, the trustee may need to take certain actions on behalf of the trust, such as filing the eviction lawsuit.