- Understanding the Difference

- Employee vs. Self-Employed

- Benefits and Drawbacks

- Benefits:

- Drawbacks:

- Can You Be Both?

- Dual Employment

- Tax Implications

- Question-answer:

- What does it mean to be on payroll?

- Can you be on payroll and self-employed at the same time?

- What are the advantages of being on payroll?

- What are the advantages of being self-employed?

- How can someone be both on payroll and self-employed?

- What does it mean to be on payroll?

Being on payroll and self-employed at the same time may seem like a contradiction, but it is actually possible to have both work arrangements. Many individuals find themselves in this situation due to various reasons, such as having a part-time job while running their own business or freelancing on the side.

Being on payroll means that you are an employee of a company and receive a regular salary or wages. This typically involves working set hours, following company policies, and having taxes and other deductions automatically taken out of your paycheck. On the other hand, being self-employed means that you work for yourself and are responsible for finding clients or customers, setting your own rates, and managing your own business expenses.

So, how can someone be on payroll and self-employed at the same time? The key is to have separate sources of income and to properly manage your tax obligations. For example, you may have a part-time job where you are on payroll, receiving a regular paycheck, and also have your own business where you are self-employed. In this case, you would need to report your income from both sources and pay the appropriate taxes.

It is important to note that being on payroll and self-employed can have different implications for things like benefits, retirement savings, and liability. As an employee, you may be eligible for benefits such as health insurance, paid time off, and retirement plans offered by your employer. However, as a self-employed individual, you would need to take care of these things on your own.

Understanding the Difference

Being on payroll and being self-employed are two different employment statuses that have distinct characteristics and implications. It is important to understand the difference between the two to determine your rights, responsibilities, and financial obligations.

When you are on payroll, you are considered an employee of a company or organization. This means that you work for someone else and receive a regular salary or wage in exchange for your services. As an employee, you are entitled to certain benefits and protections, such as paid leave, health insurance, and retirement plans. Your employer is responsible for deducting taxes from your paycheck and contributing to social security and other government programs on your behalf.

On the other hand, being self-employed means that you work for yourself and are responsible for finding clients or customers to provide your services or products to. As a self-employed individual, you have more control over your work and can set your own rates and hours. However, you are also responsible for managing your own business expenses, taxes, and insurance. Self-employed individuals do not receive benefits from an employer and must make their own arrangements for healthcare, retirement savings, and other benefits.

The main difference between being on payroll and being self-employed is the level of control and responsibility. As an employee, you have less control over your work and are subject to the rules and regulations set by your employer. As a self-employed individual, you have more freedom and flexibility in how you conduct your business, but you also bear the full responsibility for its success or failure.

It is important to carefully consider the advantages and disadvantages of each employment status before making a decision. Being on payroll provides stability and benefits, but may limit your earning potential and flexibility. Being self-employed offers more control and potential for higher income, but also requires more effort and responsibility.

Employee vs. Self-Employed

When it comes to employment, there are two main categories: being an employee or being self-employed. Each category has its own set of advantages and disadvantages, and it’s important to understand the differences between the two.

As an employee, you work for a company or organization and receive a regular salary or wage. You have a set schedule and typically work under the supervision of a manager or supervisor. You may be entitled to benefits such as health insurance, paid time off, and retirement plans. However, as an employee, you have less control over your work and may have limited opportunities for growth and advancement.

On the other hand, being self-employed means that you work for yourself and have more control over your work. You are responsible for finding clients or customers, setting your own rates or prices, and managing your own business. You have the flexibility to choose when and where you work, and you have the potential to earn more money than as an employee. However, being self-employed also comes with its own challenges. You are responsible for all aspects of your business, including marketing, accounting, and customer service. You may also have irregular income and no benefits.

Deciding whether to be an employee or self-employed depends on your personal preferences, skills, and goals. Some people prefer the stability and benefits of being an employee, while others thrive on the independence and potential for higher earnings that come with being self-employed. It’s important to carefully consider your options and weigh the pros and cons before making a decision.

Benefits and Drawbacks

Being both on payroll and self-employed can have its benefits and drawbacks. Let’s take a closer look at each:

Benefits:

1. Financial Stability: Being on payroll provides a steady income stream, ensuring a stable financial situation. This can be especially beneficial for individuals who rely on a consistent paycheck to cover their expenses.

2. Employee Benefits: Being on payroll often comes with additional benefits such as health insurance, retirement plans, paid time off, and other perks provided by the employer. These benefits can contribute to a better quality of life and financial security.

3. Employment Protection: Being an employee offers certain legal protections, such as protection against unfair dismissal and access to workers’ compensation in case of work-related injuries. These protections can provide peace of mind and security.

Drawbacks:

1. Limited Flexibility: Being on payroll means adhering to a set schedule and following the employer’s rules and regulations. This can limit the flexibility and autonomy that self-employment offers.

2. Limited Earning Potential: While being on payroll provides a stable income, it may not offer the same earning potential as self-employment. Self-employed individuals have the opportunity to set their own rates and potentially earn more based on their skills and market demand.

3. Self-Employment Taxes: Self-employed individuals are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. This can result in higher tax obligations compared to being solely on payroll.

4. Lack of Benefits: Self-employed individuals do not have access to employer-provided benefits such as health insurance or retirement plans. They must bear the costs and responsibilities of these benefits on their own.

Overall, being both on payroll and self-employed can provide a balance between stability and flexibility, but it also comes with its own set of challenges. It’s important to carefully consider the benefits and drawbacks before deciding on this dual employment arrangement.

Can You Be Both?

Many people wonder if it’s possible to be both on payroll and self-employed at the same time. The answer is yes, it is possible to have dual employment and be both an employee and self-employed.

Dual employment refers to the situation where an individual works for an employer as a regular employee and also has their own business or freelance work on the side. This means that they receive a regular salary from their employer and also earn income from their self-employment activities.

Being both on payroll and self-employed can have its advantages. It provides a stable income from the regular job while also allowing for additional income from the self-employment activities. This can be especially beneficial for individuals who are just starting their own business and need a steady source of income to support themselves.

However, there are also drawbacks to being both on payroll and self-employed. It can be challenging to balance the responsibilities and time commitments of both roles. It may require working long hours and managing multiple projects simultaneously. Additionally, there may be conflicts of interest or confidentiality issues that need to be carefully navigated.

From a tax perspective, being both on payroll and self-employed can have implications. It’s important to understand the tax obligations and requirements for both roles. This may include filing separate tax returns, paying self-employment taxes, and keeping track of business expenses.

Dual Employment

Dual employment refers to a situation where an individual is employed by two different employers simultaneously. In this case, the person is both on the payroll of one employer and self-employed with another.

There are various reasons why someone might choose to have dual employment. It could be a way to diversify income streams, gain additional skills and experience, or simply pursue different interests. However, it’s important to understand the implications and considerations that come with this arrangement.

One of the main benefits of dual employment is the ability to have multiple sources of income. This can provide financial stability and security, especially if one job is more seasonal or subject to fluctuations. Additionally, having dual employment can offer a wider range of opportunities for career growth and development.

However, there are also drawbacks to consider. Dual employment can be demanding and time-consuming, as it requires balancing responsibilities and commitments from both employers. It may also lead to conflicts of interest or potential legal issues, especially if there are non-compete agreements or confidentiality clauses in place.

From a tax perspective, dual employment can have implications as well. It’s important to accurately report all income and expenses related to both jobs, as well as understand the tax obligations and deductions that apply to each employment status. Seeking professional advice from a tax expert or accountant is recommended to ensure compliance with tax laws and regulations.

Overall, dual employment can be a viable option for individuals who are able to manage the challenges and benefits that come with it. It offers the opportunity to have multiple income streams and pursue different interests simultaneously. However, it’s crucial to carefully consider the implications and seek professional advice to ensure compliance with legal and tax requirements.

| Benefits | Drawbacks |

|---|---|

| – Multiple sources of income | – Demanding and time-consuming |

| – Wider range of career opportunities | – Potential conflicts of interest |

| – Tax implications and obligations |

Tax Implications

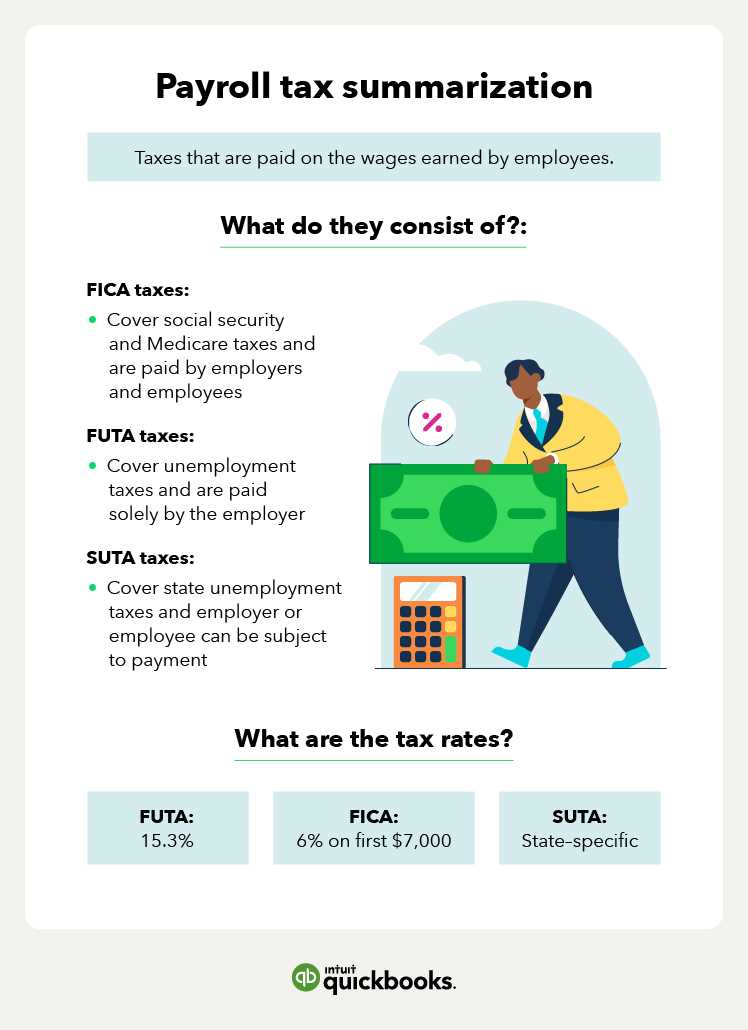

When it comes to being both on payroll and self-employed, there are important tax implications to consider. The tax rules for employees and self-employed individuals differ significantly, so it’s crucial to understand how your tax obligations may change if you have dual employment.

As an employee, your employer is responsible for withholding income taxes from your paycheck and paying their portion of Social Security and Medicare taxes. You will receive a W-2 form at the end of the year, which summarizes your earnings and the taxes withheld. This makes the tax filing process relatively straightforward for employees.

On the other hand, self-employed individuals are responsible for paying their own income taxes and self-employment taxes. Self-employment taxes include both the employer and employee portions of Social Security and Medicare taxes. You will need to make estimated tax payments throughout the year and file an annual tax return, typically using Schedule C or Schedule C-EZ.

When you have dual employment, you will need to navigate both tax systems. This means you may need to make estimated tax payments for your self-employment income while also having taxes withheld from your paycheck as an employee. It’s important to carefully track your income and expenses to accurately report your earnings and deductions on your tax return.

Additionally, having dual employment can affect your eligibility for certain tax deductions and credits. For example, if you have a retirement plan through your employer, you may be limited in the amount you can contribute to a self-employed retirement plan, such as a SEP IRA or Solo 401(k). It’s essential to consult with a tax professional to ensure you are maximizing your tax benefits and meeting all your obligations.

| Employee | Self-Employed |

|---|---|

| Taxes withheld by employer | Responsible for paying own taxes |

| Receive W-2 form | File annual tax return with Schedule C or Schedule C-EZ |

| Employer pays portion of Social Security and Medicare taxes | Responsible for both employer and employee portions of Social Security and Medicare taxes |

| May have limitations on retirement plan contributions | May have additional retirement plan options |

Question-answer:

What does it mean to be on payroll?

Being on payroll means that you are an employee of a company and receive regular wages or salary from that company.

Can you be on payroll and self-employed at the same time?

Yes, it is possible to be on payroll and self-employed at the same time. This is known as having a dual status, where you work as an employee for one company and also have your own self-employed business.

What are the advantages of being on payroll?

Being on payroll provides stability and security as you receive a regular paycheck, benefits such as health insurance and retirement plans, and legal protections as an employee.

What are the advantages of being self-employed?

Being self-employed allows for more flexibility and control over your work, the ability to set your own rates and hours, and the potential for higher earnings. You also have the opportunity to deduct business expenses and take advantage of tax benefits.

How can someone be both on payroll and self-employed?

Someone can be both on payroll and self-employed by working as an employee for one company and also running their own business on the side. This could involve freelancing, consulting, or any other type of self-employed work.

What does it mean to be on payroll?

Being on payroll means that you are an employee of a company and receive regular wages or salary from that company. You are subject to income tax withholding, and the company may also deduct other taxes and benefits from your paycheck.