- Understanding Wage Theft

- What is Wage Theft?

- Common Forms of Wage Theft

- Consequences of Wage Theft

- Know Your Rights

- Question-answer:

- What is wage theft?

- How common is wage theft?

- What are my rights as an employee?

- What can I do if my employer is stealing my wages?

- What kind of damages can I recover if I sue for wage theft?

- What is wage theft?

- How can I know if I am a victim of wage theft?

Wage theft is a serious issue that affects many workers across various industries. It occurs when employers fail to pay their employees the wages they are owed, whether it be through unpaid overtime, minimum wage violations, or illegal deductions from their paychecks. If you believe you have been a victim of wage theft, it is important to know your rights and understand the legal options available to you.

One of the first steps you can take if you suspect wage theft is to gather evidence of the violation. This can include pay stubs, time records, and any other documentation that supports your claim. It is also important to keep a record of any conversations or interactions with your employer regarding your wages. This evidence will be crucial if you decide to pursue legal action.

Depending on the specific circumstances of your case, you may have several legal options available to you. One option is to file a complaint with the appropriate government agency, such as the Department of Labor or your state’s labor department. These agencies can investigate your claim and potentially recover the wages you are owed on your behalf.

Another option is to file a lawsuit against your employer. This can be done individually or as part of a class action lawsuit, depending on the number of employees affected by the wage theft. In a lawsuit, you may be able to recover not only the unpaid wages, but also additional damages such as liquidated damages, attorney’s fees, and interest.

It is important to note that wage theft laws vary by state, so it is crucial to consult with an experienced employment attorney who can guide you through the legal process and help you understand your rights. They can assess the strength of your case, advise you on the best course of action, and represent you in negotiations or in court if necessary.

Remember, you have the right to be paid for the work you have done. If you believe you have been a victim of wage theft, don’t hesitate to take action and seek the compensation you deserve.

Understanding Wage Theft

Wage theft is a serious issue that affects many workers across various industries. It refers to the illegal practices employers use to underpay or deny workers their rightful wages. This can include not paying overtime, withholding tips, misclassifying employees as independent contractors, and more.

Wage theft can take many forms, making it important for workers to understand their rights and legal options. By understanding wage theft, workers can better protect themselves and take appropriate action if they believe their wages have been stolen.

One common form of wage theft is unpaid overtime. The Fair Labor Standards Act (FLSA) requires employers to pay eligible employees one and a half times their regular rate of pay for any hours worked over 40 in a workweek. However, some employers may try to avoid paying overtime by misclassifying employees or manipulating their hours. It is important for workers to keep track of their hours and ensure they are being properly compensated for any overtime worked.

Another form of wage theft is tip theft. In industries where tipping is common, such as restaurants and hospitality, employers may unlawfully withhold or take a portion of employees’ tips. The FLSA prohibits employers from keeping employees’ tips for themselves or distributing them to non-tipped employees. Workers should be aware of their rights regarding tips and report any violations to the appropriate authorities.

Misclassification is another common tactic used by employers to commit wage theft. By classifying workers as independent contractors instead of employees, employers can avoid providing benefits, overtime pay, and other protections guaranteed to employees. It is important for workers to understand the criteria for employee classification and challenge any misclassification that may be occurring.

Consequences of wage theft can be severe for workers. Not only does it result in financial hardship, but it can also lead to a loss of trust and job security. Workers who experience wage theft may struggle to make ends meet and face difficulties in providing for themselves and their families. By understanding wage theft and their rights, workers can take legal action to recover their stolen wages and hold employers accountable.

What is Wage Theft?

Wage theft refers to the illegal practice of employers not paying their employees the wages they are entitled to. It is a violation of labor laws and can occur in various forms, including:

1. Minimum Wage Violations: Employers paying their workers less than the legally mandated minimum wage.

2. Overtime Violations: Employers not paying their employees the required overtime rate for hours worked beyond the standard 40-hour workweek.

3. Misclassification: Employers misclassifying employees as independent contractors to avoid providing benefits and protections entitled to employees.

4. Off-the-Clock Work: Employers requiring employees to work off-the-clock without compensating them for their time.

5. Wage Theft from Tips: Employers unlawfully keeping a portion or all of their employees’ tips.

6. Failure to Pay for Work-Related Expenses: Employers not reimbursing employees for work-related expenses, such as uniforms, tools, or travel costs.

Wage theft can have severe consequences for workers, including financial hardship, inability to meet basic needs, and increased vulnerability to poverty. It is important for employees to be aware of their rights and legal options to address wage theft and hold employers accountable.

If you believe you have been a victim of wage theft, it is advisable to consult with an employment attorney who specializes in wage and hour laws to understand your rights and pursue appropriate legal action.

Common Forms of Wage Theft

Wage theft is a serious issue that affects many workers across various industries. It can take different forms, all of which involve employers not paying their employees the wages they are owed. Here are some common forms of wage theft:

- Minimum wage violations: Employers may pay their workers less than the legally mandated minimum wage. This can occur by paying employees a lower hourly rate or not paying them for all the hours worked.

- Overtime violations: Employers may fail to pay their employees the required overtime rate for any hours worked beyond the standard 40-hour workweek. This can include not paying overtime at all or misclassifying employees as exempt from overtime pay.

- Off-the-clock work: Some employers may require their employees to perform work-related tasks before or after their scheduled shifts without compensating them for this time. This can include activities such as setting up equipment, cleaning, or attending meetings.

- Tip theft: In industries where tipping is common, employers may unlawfully withhold or take a portion of their employees’ tips. This can include requiring employees to share tips with non-tipped workers or keeping a portion of the tips for themselves.

- Misclassification: Employers may misclassify their employees as independent contractors to avoid paying them certain benefits and protections, such as minimum wage, overtime pay, and unemployment insurance.

- Unpaid breaks: Some employers may not provide their employees with the required breaks or meal periods, or they may deduct time for breaks that were not taken from their employees’ pay.

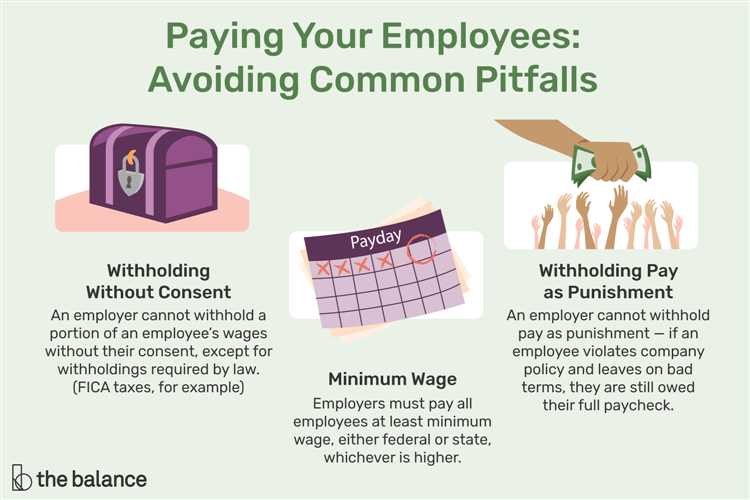

- Illegal deductions: Employers may make unauthorized deductions from their employees’ paychecks, such as for uniforms, tools, or damages, which can result in employees receiving less than the agreed-upon wages.

These are just a few examples of the common forms of wage theft that workers may experience. It is important for employees to be aware of their rights and take action if they believe they have been victims of wage theft. By understanding the different forms of wage theft, workers can better protect themselves and seek the compensation they deserve.

Consequences of Wage Theft

Wage theft is a serious offense that can have significant consequences for both employers and employees. When employers engage in wage theft, they not only violate the law but also harm their employees and the economy as a whole.

For employees, the consequences of wage theft can be devastating. When workers are not paid the wages they are owed, it can lead to financial hardship, making it difficult to pay bills, buy groceries, and provide for their families. Wage theft can also result in a loss of trust and job satisfaction, as employees feel undervalued and taken advantage of by their employers.

Furthermore, wage theft can have long-term effects on an employee’s financial stability. When workers are not paid their full wages, they may struggle to save for retirement, pay off debts, or invest in their future. This can have a ripple effect on their overall financial well-being and limit their opportunities for upward mobility.

From an economic perspective, wage theft can have negative consequences as well. When employers engage in wage theft, they gain an unfair advantage over their competitors who are following the law and paying their employees properly. This can create an uneven playing field and lead to a decline in overall business ethics.

Additionally, wage theft can result in a loss of tax revenue for the government. When employees are not paid their full wages, they may not be able to contribute as much to the economy through spending and paying taxes. This can have a detrimental effect on government programs and services that rely on tax revenue to function.

Know Your Rights

As an employee, it is crucial to be aware of your rights when it comes to wage theft. Understanding your rights can help you protect yourself and take appropriate legal action if necessary. Here are some key rights you should know:

- Right to Minimum Wage: Every worker is entitled to receive at least the minimum wage set by federal or state law. If your employer is paying you less than the minimum wage, it is considered wage theft.

- Right to Overtime Pay: If you work more than 40 hours in a week, you are entitled to receive overtime pay, which is typically 1.5 times your regular hourly rate. Your employer cannot deny you this additional compensation.

- Right to Meal and Rest Breaks: Depending on your state’s labor laws, you may have the right to take meal and rest breaks during your work shift. Your employer cannot force you to work through these breaks without proper compensation.

- Right to Accurate Paycheck: Your employer is required to provide you with a detailed and accurate paycheck that clearly states your earnings, deductions, and hours worked. If you notice any discrepancies, it could be a sign of wage theft.

- Right to File a Complaint: If you believe you have been a victim of wage theft, you have the right to file a complaint with the appropriate government agency, such as the Department of Labor. They can investigate your case and take legal action against your employer if necessary.

- Right to Legal Representation: If you decide to pursue legal action against your employer for wage theft, you have the right to hire an attorney who specializes in employment law. They can guide you through the legal process and help you fight for your rights.

Knowing your rights is essential in protecting yourself from wage theft. If you suspect that your employer is engaging in wage theft, it is important to gather evidence, keep records of your hours worked and wages earned, and consult with an attorney to explore your legal options.

Question-answer:

What is wage theft?

Wage theft refers to the illegal practice of employers not paying their employees the wages they are owed. This can include not paying minimum wage, not paying overtime, withholding tips, or not paying at all.

How common is wage theft?

Wage theft is unfortunately quite common. According to a study by the Economic Policy Institute, workers in the United States lose billions of dollars each year due to wage theft.

What are my rights as an employee?

As an employee, you have the right to be paid at least the minimum wage, to receive overtime pay if you work more than 40 hours per week, to be paid for all the hours you work, and to keep your tips if you are a tipped employee.

What can I do if my employer is stealing my wages?

If your employer is stealing your wages, you have several legal options. You can file a complaint with your state labor department, hire an attorney to file a lawsuit on your behalf, or join a class-action lawsuit if other employees are also affected.

What kind of damages can I recover if I sue for wage theft?

If you sue for wage theft and are successful, you may be able to recover the unpaid wages you are owed, as well as additional damages such as liquidated damages, attorney’s fees, and interest on the unpaid wages.

What is wage theft?

Wage theft refers to the illegal practice of employers not paying their employees the wages they are owed. This can include not paying minimum wage, not paying overtime, withholding tips, or not paying at all.

How can I know if I am a victim of wage theft?

If you suspect that you are a victim of wage theft, there are several signs to look out for. These include not receiving your full paycheck, not being paid for overtime work, not receiving tips, or being paid less than the minimum wage. It is important to keep track of your hours worked and compare them to your pay stubs to identify any discrepancies.