- Understanding Car Repossession

- What is Car Repossession?

- How Does Car Repossession Work?

- Consequences of Car Repossession

- Car Repossession with Santander

- Santander’s Repossession Policy

- Question-answer:

- What happens if I miss a car payment with Santander?

- How many car payments can I miss before Santander repossesses my car?

- What should I do if I can’t make my car payment to Santander?

- Will missing a car payment with Santander affect my credit score?

- Can I get my repossessed car back from Santander?

- What happens if I miss a car payment with Santander?

When you finance a car through Santander Consumer USA, it’s important to understand the consequences of missing car payments. Falling behind on your car loan can lead to repossession, where the lender takes back the vehicle due to non-payment. Santander is one of the largest auto lenders in the United States, and they have specific guidelines regarding missed payments and repossession.

While the exact number of car payments you can miss before repossession with Santander may vary depending on your specific loan agreement, it’s generally recommended to avoid missing any payments. Santander typically considers a missed payment as a serious delinquency, and they may initiate repossession proceedings after just one missed payment.

It’s important to note that Santander may also consider other factors when deciding whether to repossess a vehicle. These factors can include the length of delinquency, the total amount owed on the loan, and the borrower’s overall payment history. If you find yourself struggling to make your car payments, it’s crucial to communicate with Santander and explore options such as loan modifications or deferment to avoid repossession.

Repossession can have significant consequences for your credit score and financial future. It’s always best to stay on top of your car payments and reach out to your lender if you’re facing financial difficulties. By taking proactive steps and working with Santander, you may be able to find a solution that allows you to keep your vehicle and avoid repossession.

Understanding Car Repossession

Car repossession is the process by which a lender takes back possession of a vehicle from a borrower who has failed to make their loan payments. It is a legal action that lenders can take when borrowers default on their car loans.

When a borrower fails to make their car loan payments, the lender has the right to repossess the vehicle. This means that they can take the car back and sell it to recoup the remaining balance on the loan. Repossession can occur after just one missed payment, although the specific timeline may vary depending on the lender and the terms of the loan agreement.

Repossession can be a stressful and difficult experience for borrowers. Not only do they lose their vehicle, but they may also face additional financial consequences. The lender may charge fees for the repossession process, and the borrower may still be responsible for paying off the remaining balance on the loan even after the car is sold.

It’s important for borrowers to understand the consequences of car repossession and to take steps to avoid it if possible. This may include making timely payments, communicating with the lender if there are financial difficulties, or exploring options for refinancing or modifying the loan.

Overall, understanding car repossession is crucial for borrowers who are at risk of defaulting on their car loans. By knowing the process and potential consequences, borrowers can make informed decisions and take proactive steps to protect their vehicles and financial well-being.

What is Car Repossession?

Car repossession is a legal process in which a lender takes back possession of a vehicle from a borrower who has failed to make the required loan payments. When a borrower finances a car through a lender, such as a bank or a dealership, they enter into a contractual agreement to make regular payments over a specified period of time. If the borrower fails to make these payments, the lender has the right to repossess the vehicle.

Repossession typically occurs when a borrower is in default on their loan, meaning they have missed multiple payments or have violated the terms of the loan agreement. The lender may also repossess the car if the borrower fails to maintain proper insurance coverage or if the vehicle is used for illegal activities.

Once the lender decides to repossess the car, they will typically hire a repossession company to locate and take possession of the vehicle. The repossession company may use various methods to locate the car, such as tracking devices or skip tracing techniques. Once the car is located, the repossession company will tow it away and return it to the lender.

After the car is repossessed, the lender will typically sell it at an auction to recoup the remaining balance of the loan. If the sale of the car does not cover the full amount owed, the borrower may still be responsible for the remaining balance, known as a deficiency balance. In some cases, the lender may pursue legal action to collect this balance.

Car repossession can have serious consequences for the borrower. It can negatively impact their credit score, making it difficult to obtain future loans or credit. Additionally, the borrower may lose their means of transportation, which can have a significant impact on their daily life and ability to work.

It is important for borrowers to understand the terms of their loan agreement and make their payments on time to avoid car repossession. If they are facing financial difficulties, it is recommended to communicate with the lender and explore options such as loan modifications or refinancing to avoid repossession.

| Pros | Cons |

|---|---|

| Allows lenders to recover unpaid debts | Negative impact on borrower’s credit score |

| Can serve as a deterrent for borrowers to default on their loans | Borrower may lose their means of transportation |

| May result in the borrower being responsible for a deficiency balance | Legal action may be taken to collect the remaining balance |

How Does Car Repossession Work?

Car repossession is a legal process that occurs when a borrower fails to make timely payments on their car loan. When a borrower falls behind on their payments, the lender has the right to repossess the vehicle in order to recover the remaining balance owed on the loan.

The process of car repossession typically begins with the lender sending the borrower a notice of default. This notice informs the borrower that they are in breach of their loan agreement and gives them a certain amount of time to bring their payments up to date. If the borrower fails to do so, the lender can then proceed with repossession.

Once the lender has decided to repossess the vehicle, they will typically hire a repossession agent to locate and take possession of the car. The repossession agent may use various methods to find the vehicle, such as tracking devices or surveillance. Once the vehicle is located, the agent will take possession of it, often without the borrower’s knowledge or consent.

After the vehicle has been repossessed, the lender will typically sell it at auction in order to recoup some of the outstanding debt. The proceeds from the sale are applied towards the remaining balance on the loan, including any fees associated with the repossession process. If the sale of the vehicle does not cover the full amount owed, the borrower may still be responsible for paying the remaining balance.

It is important to note that car repossession laws vary by state, so the specific process and requirements may differ depending on where you live. Additionally, some lenders may have specific policies and procedures in place for repossession, so it is important to review your loan agreement and consult with legal counsel if necessary.

Consequences of Car Repossession

Car repossession can have serious consequences for the borrower. Here are some of the potential outcomes:

- Negative impact on credit score: When a car is repossessed, it is reported to the credit bureaus, which can significantly lower the borrower’s credit score. This can make it difficult to obtain future loans or credit cards, and may result in higher interest rates.

- Loss of transportation: Losing a car to repossession means losing a reliable mode of transportation. This can make it challenging to commute to work, run errands, or take care of daily responsibilities.

- Additional fees and costs: In addition to losing the car, the borrower may be responsible for paying repossession fees, storage fees, and other related costs. These expenses can quickly add up and further strain the borrower’s finances.

- Difficulty obtaining future financing: After a repossession, it can be challenging to secure financing for another vehicle in the future. Lenders may view the borrower as high-risk and may require a larger down payment or charge higher interest rates.

- Emotional stress: Dealing with car repossession can be emotionally distressing. It can lead to feelings of embarrassment, shame, and frustration. The loss of a car can also disrupt daily routines and cause additional stress in the borrower’s life.

It is important for borrowers to understand the potential consequences of car repossession and to take steps to avoid it whenever possible. This may include communicating with the lender, exploring alternative payment options, or seeking financial assistance if needed.

Car Repossession with Santander

When it comes to car repossession, Santander is one of the major lenders that borrowers need to be aware of. Santander is a well-known financial institution that provides auto loans to individuals across the United States. However, if you fail to make your car payments on time, Santander has the right to repossess your vehicle.

Car repossession occurs when a borrower defaults on their loan and fails to make the required payments. In this case, Santander has the legal right to take possession of the vehicle in order to recover the outstanding debt. It is important to note that car repossession is a last resort for lenders and is typically only pursued after multiple missed payments.

When Santander decides to repossess a vehicle, they will typically send a repossession agent to collect the car. The agent will locate the vehicle and take possession of it, often without the borrower’s knowledge. It is important to understand that Santander does not need a court order to repossess a vehicle, as the terms of the loan agreement grant them this right.

Once Santander has repossessed the vehicle, they will typically sell it at an auction in order to recoup the outstanding debt. The proceeds from the sale will be used to cover the remaining balance on the loan, as well as any additional fees associated with the repossession process. If the sale of the vehicle does not cover the full amount owed, the borrower may still be responsible for the remaining balance.

Car repossession can have serious consequences for borrowers. Not only will the borrower lose their vehicle, but it can also have a negative impact on their credit score. A repossession will stay on the borrower’s credit report for up to seven years, making it difficult to obtain future loans or credit. Additionally, the borrower may still be responsible for any remaining balance on the loan after the sale of the vehicle.

If you find yourself in a situation where you are unable to make your car payments, it is important to contact Santander as soon as possible. They may be able to work with you to find a solution, such as modifying your loan terms or setting up a repayment plan. It is always better to communicate with your lender and try to find a resolution before the situation escalates to repossession.

Santander’s Repossession Policy

When it comes to car repossession, Santander has a specific policy in place to handle such situations. If a borrower fails to make their car payments on time, Santander may initiate the repossession process. However, before taking such action, Santander typically provides the borrower with multiple opportunities to catch up on their payments and avoid repossession.

Once a borrower falls behind on their car payments, Santander will usually send out a series of notices and reminders to inform the borrower of their delinquency. These notices may be sent via mail, email, or phone calls. It is important for borrowers to respond to these communications and communicate with Santander to discuss their financial situation.

If the borrower fails to respond or make arrangements to catch up on their payments, Santander may proceed with repossession. They will typically hire a repossession agency to locate and retrieve the vehicle. The agency will then tow the vehicle to a designated storage facility.

Once the vehicle is repossessed, Santander will notify the borrower of the repossession and provide them with information on how to retrieve their personal belongings from the vehicle. The borrower will also be informed of the outstanding balance on their loan, including any fees associated with the repossession process.

If the borrower wishes to reclaim their vehicle, they will need to contact Santander and make arrangements to pay off the outstanding balance. This may include paying the full amount owed or negotiating a repayment plan. Once the outstanding balance is settled, the borrower can retrieve their vehicle from the storage facility.

If the borrower is unable to reclaim their vehicle or fails to make arrangements to settle the outstanding balance, Santander may proceed with selling the vehicle at an auction. The proceeds from the sale will be used to cover the remaining balance on the loan. If there is a surplus, it may be returned to the borrower, but if there is a deficit, the borrower may still be responsible for paying the remaining amount.

It is important for borrowers to understand Santander’s repossession policy and take proactive steps to avoid repossession. This may include communicating with Santander, exploring options for loan modification or refinancing, or seeking financial assistance if needed. By staying informed and taking action, borrowers can potentially avoid the consequences of car repossession.

Question-answer:

What happens if I miss a car payment with Santander?

If you miss a car payment with Santander, they will typically send you a notice reminding you to make the payment. If you continue to miss payments, they may eventually repossess your vehicle.

How many car payments can I miss before Santander repossesses my car?

There is no set number of car payments you can miss before Santander repossesses your car. It ultimately depends on the terms of your loan agreement and the specific actions taken by Santander. However, it is generally recommended to make your payments on time to avoid repossession.

What should I do if I can’t make my car payment to Santander?

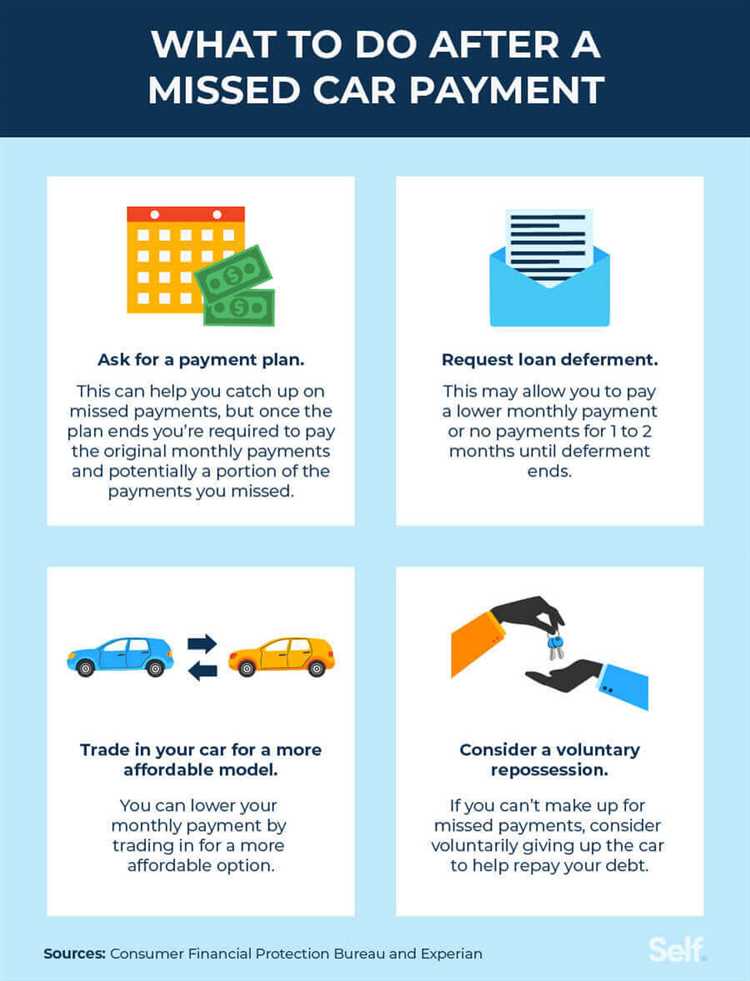

If you are unable to make your car payment to Santander, it is important to contact them as soon as possible. They may be able to work out a solution, such as a temporary payment plan or a deferment. Ignoring the issue will only make it worse and increase the chances of repossession.

Will missing a car payment with Santander affect my credit score?

Yes, missing a car payment with Santander can have a negative impact on your credit score. Late payments and repossession can be reported to the credit bureaus, which can lower your credit score and make it more difficult to obtain credit in the future.

Can I get my repossessed car back from Santander?

If your car has been repossessed by Santander, you may have the option to get it back by paying off the remaining balance on your loan, including any fees and charges. However, it is important to act quickly, as the longer you wait, the more difficult it may be to retrieve your vehicle.

What happens if I miss a car payment with Santander?

If you miss a car payment with Santander, they will typically send you a notice reminding you to make the payment. If you continue to miss payments, they may eventually repossess your vehicle.