- Step 1: Research and Understand the W2 Contract Employment Model

- What is a W2 Contract Employee?

- Benefits and Drawbacks of Being a W2 Contract Employee

- How W2 Contract Employment Differs from Other Employment Models

- Step 2: Find W2 Contract Employment Opportunities

- Searching for W2 Contract Jobs Online

- Question-answer:

- What is a W2 contract employee?

- How can I become a W2 contract employee?

- What are the benefits of being a W2 contract employee?

- What are the tax implications of being a W2 contract employee?

Are you tired of the traditional 9-to-5 job and looking for more flexibility in your career? Becoming a W2 contract employee might be the perfect solution for you. This type of employment offers the benefits of both being an independent contractor and having the stability of a regular paycheck. In this step-by-step guide, we will walk you through the process of becoming a W2 contract employee and help you navigate the ins and outs of this unique employment arrangement.

First, let’s clarify what it means to be a W2 contract employee. Unlike a traditional employee, who receives a W2 form at the end of the year, a W2 contract employee is hired on a contract basis. This means that you will have a specific start and end date for your employment, and you will be paid as a regular employee with taxes withheld from your paycheck. This arrangement offers the benefits of a steady income and access to employee benefits, while still allowing for flexibility and independence.

The first step to becoming a W2 contract employee is to identify your skills and expertise. What are you good at? What services can you offer to potential clients or employers? Take some time to assess your strengths and determine what type of work you want to pursue as a contract employee. This will help you narrow down your job search and target the right opportunities.

Once you have identified your skills, it’s time to start looking for contract work. There are several ways to find contract opportunities, including online job boards, networking events, and freelance platforms. Update your resume and create a compelling cover letter that highlights your experience and skills as a contract employee. Be proactive in reaching out to potential clients or employers and showcase how you can add value to their projects or teams.

When you land a contract opportunity, it’s important to negotiate the terms of your employment. This includes discussing the duration of the contract, the scope of work, and the compensation package. Be clear about your expectations and make sure both parties are on the same page before signing any contracts. It’s also a good idea to consult with a lawyer or contract specialist to ensure that the terms are fair and legally binding.

As a W2 contract employee, it’s crucial to stay organized and keep track of your work hours, expenses, and invoices. Set up a system to manage your finances and maintain accurate records of your earnings and expenses. This will make tax season much easier and help you stay on top of your financial obligations.

Step 1: Research and Understand the W2 Contract Employment Model

Before diving into the world of W2 contract employment, it is important to research and understand what this employment model entails. W2 contract employment refers to a type of employment where individuals work on a contract basis for a company, but are classified as W2 employees rather than independent contractors.

Unlike independent contractors who are responsible for paying their own taxes and benefits, W2 contract employees are considered employees of the company they work for. This means that the company is responsible for withholding taxes from their paycheck and providing them with certain benefits such as health insurance, retirement plans, and paid time off.

One of the key benefits of being a W2 contract employee is the stability and security it offers. Unlike independent contractors who may have to constantly search for new clients and projects, W2 contract employees typically have a steady stream of work and a consistent income. They also have access to benefits that are typically only available to traditional employees.

However, there are also some drawbacks to being a W2 contract employee. One of the main drawbacks is that W2 contract employees do not have as much control over their work as independent contractors. They may have to adhere to specific work hours and follow company policies and procedures. Additionally, they may not have as much flexibility in choosing the projects they work on.

It is also important to understand how W2 contract employment differs from other employment models. W2 contract employment is different from being a full-time employee, as W2 contract employees are not typically eligible for the same benefits and protections as full-time employees. It is also different from being an independent contractor, as W2 contract employees have a closer relationship with the company they work for and are subject to more oversight and control.

What is a W2 Contract Employee?

A W2 contract employee is an individual who is hired by a company on a temporary basis to work on a specific project or assignment. Unlike traditional employees, who are hired on a permanent basis, W2 contract employees are typically hired for a fixed period of time or until the completion of a specific project.

W2 contract employees are considered to be independent contractors, which means that they are not entitled to the same benefits and protections as traditional employees. They are responsible for paying their own taxes and are not eligible for benefits such as health insurance, retirement plans, or paid time off.

However, being a W2 contract employee also has its advantages. One of the main benefits is the flexibility it offers. W2 contract employees have the freedom to choose the projects they want to work on and the companies they want to work for. They also have the ability to negotiate their own rates and terms of employment.

Another advantage of being a W2 contract employee is the opportunity to gain valuable experience and skills. Since W2 contract employees often work on a variety of projects for different companies, they have the chance to expand their knowledge and expertise in their field.

Overall, being a W2 contract employee can be a rewarding career choice for those who value flexibility and variety in their work. It allows individuals to work on different projects, gain valuable experience, and have the freedom to choose their own terms of employment.

Benefits and Drawbacks of Being a W2 Contract Employee

Being a W2 contract employee has its own set of benefits and drawbacks. It is important to consider these factors before deciding to pursue this type of employment. Here are some of the key advantages and disadvantages:

Benefits:

1. Flexibility: One of the biggest advantages of being a W2 contract employee is the flexibility it offers. You have the freedom to choose when and where you work, allowing you to create a schedule that suits your needs and lifestyle.

2. Higher Earning Potential: W2 contract employees often have the opportunity to earn more money compared to traditional employees. Since you are responsible for your own taxes and benefits, you can negotiate higher rates for your services.

3. Variety of Projects: As a W2 contract employee, you have the chance to work on a variety of projects with different clients. This can provide you with valuable experience and help you expand your skill set.

4. Independence: W2 contract employees have more independence and autonomy in their work. You have the ability to make decisions and take ownership of your projects without having to go through layers of management.

Drawbacks:

1. Lack of Job Security: Unlike traditional employees, W2 contract employees do not have the same level of job security. Your contract can end at any time, and you may need to constantly search for new projects or clients.

2. No Benefits: W2 contract employees are responsible for their own benefits, such as health insurance and retirement plans. This can be a significant financial burden, especially if you have dependents or pre-existing health conditions.

3. Self-Employment Taxes: As a W2 contract employee, you are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. This can result in a higher tax liability compared to traditional employees.

4. Limited Employee Protections: W2 contract employees do not have the same legal protections as traditional employees. You may not be eligible for unemployment benefits or protection against wrongful termination.

It is important to carefully weigh these benefits and drawbacks before deciding to become a W2 contract employee. Consider your personal circumstances, financial goals, and risk tolerance to make an informed decision.

How W2 Contract Employment Differs from Other Employment Models

W2 contract employment is a unique employment model that differs from other traditional employment models in several ways. Here are some key differences:

- Employment Status: In W2 contract employment, individuals are considered employees of the contracting company, rather than independent contractors or freelancers. This means that they are entitled to certain benefits and protections that are not typically available to independent contractors.

- Benefits: W2 contract employees are eligible for certain benefits, such as health insurance, retirement plans, and paid time off, which are typically provided by the contracting company. These benefits are not typically available to independent contractors, who are responsible for obtaining their own benefits.

- Tax Withholding: One of the key differences between W2 contract employment and other employment models is the way taxes are handled. In W2 contract employment, the contracting company withholds taxes from the employee’s paycheck and is responsible for paying them to the government. This simplifies the tax process for the employee, as they do not have to worry about making quarterly tax payments or calculating self-employment taxes.

- Job Security: W2 contract employment typically offers more job security compared to other employment models, such as freelance or gig work. W2 contract employees have a formal employment agreement with the contracting company and are often hired for longer-term projects or ongoing work. This provides a level of stability and predictability that may not be present in other employment models.

- Control and Independence: While W2 contract employees are considered employees of the contracting company, they still have a certain level of control and independence in their work. They may have more flexibility in terms of their work schedule and may have the ability to work remotely. However, they are still expected to adhere to the policies and guidelines set by the contracting company.

Overall, W2 contract employment offers a unique blend of benefits and stability compared to other employment models. It provides individuals with the advantages of being an employee, such as benefits and job security, while still allowing for a certain level of control and independence in their work.

Step 2: Find W2 Contract Employment Opportunities

Once you have researched and understood the W2 contract employment model, the next step is to find W2 contract employment opportunities. Here are some tips to help you in your search:

1. Networking:

Reach out to your professional network and let them know that you are looking for W2 contract employment. Attend industry events, join professional organizations, and connect with people on professional networking platforms like LinkedIn. Networking can often lead to hidden job opportunities.

2. Online Job Boards:

Utilize online job boards that specifically cater to W2 contract employment. These platforms allow you to search for jobs based on your skills, experience, and location. Some popular job boards for W2 contract employment include Indeed, Monster, and Dice.

3. Staffing Agencies:

Contact staffing agencies that specialize in placing W2 contract employees. These agencies have established relationships with companies that regularly hire contract workers. They can help match your skills and experience with suitable job opportunities.

4. Company Websites:

Visit the websites of companies that you are interested in working for. Many companies list their job openings on their websites, including W2 contract positions. Check their careers or job opportunities page for any available contract positions.

5. Freelance Platforms:

Explore freelance platforms like Upwork, Freelancer, and Guru. While these platforms primarily focus on freelance work, they also offer W2 contract opportunities. Create a profile highlighting your skills and experience, and search for W2 contract projects that match your expertise.

6. Professional Associations:

Join professional associations related to your field of expertise. These associations often have job boards or career centers where members can find W2 contract employment opportunities. They may also host networking events or job fairs where you can connect with potential employers.

Remember to tailor your resume and cover letter to each job application, highlighting relevant skills and experience. Be proactive in your job search and follow up with potential employers. With persistence and the right approach, you can find rewarding W2 contract employment opportunities.

Searching for W2 Contract Jobs Online

When it comes to finding W2 contract jobs online, there are several strategies you can employ to increase your chances of success. Here are some tips to help you in your search:

| 1. Utilize Job Search Websites | Start by using popular job search websites that cater specifically to contract employment. These websites often have advanced search filters that allow you to narrow down your options based on location, industry, and job type. |

| 2. Join Online Job Boards and Forums | Joining online job boards and forums that focus on contract employment can be a great way to connect with other professionals in your field and stay updated on the latest job opportunities. These platforms often have dedicated sections for W2 contract jobs. |

| 3. Network on Professional Social Media Platforms | Utilize professional social media platforms like LinkedIn to expand your network and connect with recruiters and hiring managers who specialize in W2 contract employment. Make sure your profile is up-to-date and showcases your skills and experience. |

| 4. Attend Virtual Job Fairs and Networking Events | Virtual job fairs and networking events have become increasingly popular, especially in the current digital age. These events provide an opportunity to interact with potential employers and learn more about available W2 contract positions. |

| 5. Leverage Online Freelance Platforms | Consider leveraging online freelance platforms that offer W2 contract opportunities. These platforms connect freelancers with clients looking for specific skills and expertise. Be sure to create a compelling profile and showcase your portfolio. |

| 6. Set Up Job Alerts | Many job search websites and platforms allow you to set up job alerts based on your preferences. Take advantage of this feature to receive notifications whenever new W2 contract jobs matching your criteria are posted. |

Remember, finding W2 contract jobs online requires persistence and active engagement. Be proactive in your search, tailor your applications to each opportunity, and make sure to follow up with potential employers. With the right approach, you can find rewarding W2 contract employment that aligns with your skills and career goals.

Question-answer:

What is a W2 contract employee?

A W2 contract employee is an individual who is hired by a company on a contract basis but is treated as an employee for tax purposes. This means that the company withholds taxes from the employee’s paycheck and provides them with a W2 form at the end of the year.

How can I become a W2 contract employee?

To become a W2 contract employee, you need to find a company that is willing to hire you on a contract basis. You can search for job postings that specifically mention W2 contract positions or reach out to companies directly to inquire about contract opportunities. Once you have secured a contract position, you will need to provide the necessary documentation and complete any required paperwork to become an official W2 contract employee.

What are the benefits of being a W2 contract employee?

There are several benefits to being a W2 contract employee. Firstly, you have the flexibility to work on different projects and for different companies, allowing you to gain a diverse range of experience. Additionally, as a W2 contract employee, you are eligible for certain benefits such as health insurance, retirement plans, and paid time off, depending on the company’s policies. Lastly, being a W2 contract employee can often lead to higher hourly rates compared to being a traditional employee.

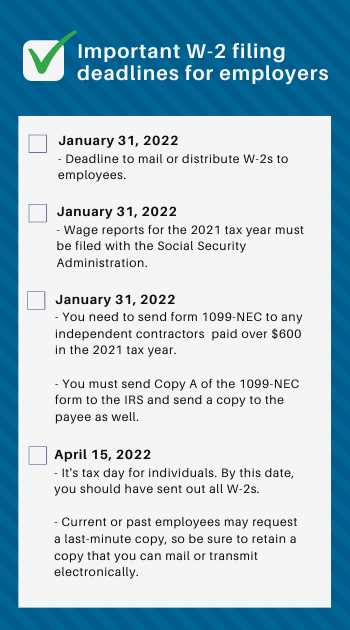

What are the tax implications of being a W2 contract employee?

As a W2 contract employee, taxes are withheld from your paycheck by the company you are contracted with. This means that you do not have to worry about setting aside money for taxes yourself. At the end of the year, you will receive a W2 form from the company, which you will use to file your taxes. It is important to note that as a W2 contract employee, you are not eligible for certain tax deductions that are available to self-employed individuals.