- Section 1: Understanding the 1099 Form

- What is a 1099 Form?

- Who Needs to File a 1099 Form?

- Why is it Important to File a 1099 Form?

- Section 2: Steps to File a 1099 Form

- Gather the Necessary Information

- Fill out the 1099 Form

- Question-answer:

- What is a 1099 form?

- Who needs to file a 1099 form?

- What information is needed to file a 1099 form?

- When is the deadline to file a 1099 form?

- What happens if I don’t file a 1099 form?

- What is a 1099 form?

- Who needs to file a 1099 form?

As a business owner, it’s important to understand your tax obligations when hiring contract employees. One key requirement is filing a 1099 form for each contract employee you pay over a certain threshold. This form is used to report the income you paid to the contract employee, allowing the IRS to track their tax liability.

Filing a 1099 form may seem daunting, but with this step-by-step guide, you’ll be able to navigate the process with ease. First, gather all the necessary information about your contract employee, including their full name, address, and Social Security number or taxpayer identification number. It’s crucial to ensure this information is accurate and up to date to avoid any issues.

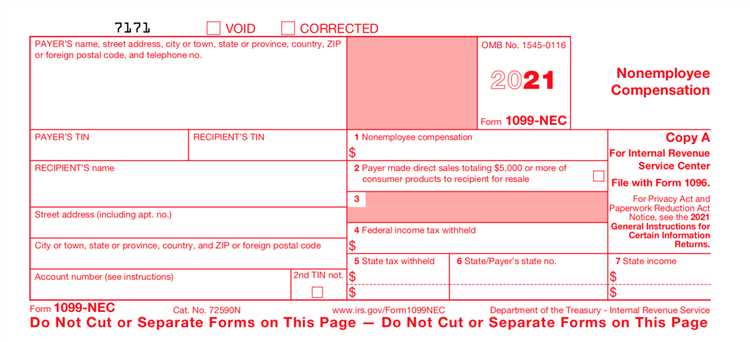

Next, you’ll need to obtain a copy of the 1099 form. This form can be downloaded from the IRS website or obtained from an office supply store. Make sure you have enough copies for each contract employee you need to file for. The 1099 form consists of several parts, including the payer’s information, the recipient’s information, and the income details.

Once you have the form, fill in the payer’s information, which includes your business name, address, and taxpayer identification number. Double-check this information for accuracy. Then, move on to the recipient’s information section and enter your contract employee’s details. Again, accuracy is crucial here, so take the time to verify the information.

After completing the recipient’s information, you’ll need to report the income you paid to the contract employee. This includes any fees, commissions, or other forms of compensation. Be sure to include all relevant income, as failing to do so may result in penalties or fines. Once you’ve entered the income details, double-check everything to ensure accuracy.

Finally, you’ll need to distribute copies of the 1099 form. Send Copy B to the contract employee by January 31st of the following year, and file Copy A with the IRS by the end of February. It’s important to meet these deadlines to avoid any penalties or late fees. Keep a copy of Copy A for your records.

By following this step-by-step guide, you’ll be able to file a 1099 form for your contract employees accurately and efficiently. Remember to keep copies of all forms and documentation for your records, as they may be required in the event of an audit. If you have any questions or need further assistance, consult with a tax professional or visit the IRS website for additional resources.

Section 1: Understanding the 1099 Form

The 1099 form is a tax document used to report income received by individuals who are not employees. It is typically used to report income earned by independent contractors, freelancers, and other self-employed individuals. The form is named after the IRS code section that requires its use.

What is a 1099 Form?

A 1099 form is an information return that is used to report various types of income, such as non-employee compensation, interest, dividends, and rental income. It is similar to a W-2 form, which is used to report income earned by employees.

Who Needs to File a 1099 Form?

Businesses and individuals who have paid $600 or more to a non-employee during the tax year are required to file a 1099 form. This includes payments made to independent contractors, freelancers, and other self-employed individuals. It is important to note that the $600 threshold applies to each individual payment, not the total amount paid to the non-employee throughout the year.

Why is it Important to File a 1099 Form?

Filing a 1099 form is important for several reasons. First, it helps the IRS track income that is not reported on a W-2 form. This helps ensure that individuals are accurately reporting their income and paying the appropriate amount of taxes. Second, failing to file a 1099 form when required can result in penalties and fines from the IRS. It is important to comply with the tax laws and meet all filing requirements to avoid these penalties.

What is a 1099 Form?

A 1099 form is a tax document used to report income received by individuals who are not employees. It is typically used to report income earned from freelance work, contract work, or other types of self-employment. The form is named after the IRS form number 1099, which is used to report various types of income.

The 1099 form is similar to the W-2 form that employees receive from their employers, but there are some key differences. While the W-2 form is used to report income earned as an employee, the 1099 form is used to report income earned as an independent contractor or self-employed individual.

The 1099 form includes information such as the recipient’s name, address, and Social Security number or taxpayer identification number. It also includes the amount of income earned and any taxes withheld, if applicable.

It is important to note that individuals who receive a 1099 form are responsible for reporting this income on their tax return and paying any applicable taxes. Unlike employees, who have taxes withheld from their paychecks, individuals who receive a 1099 form are responsible for calculating and paying their own taxes.

Overall, the 1099 form is an important tool for both individuals and the IRS to accurately report and track income earned by independent contractors and self-employed individuals.

Who Needs to File a 1099 Form?

Any individual or business that has paid $600 or more to a contract employee or non-employee during the tax year is required to file a 1099 form. This includes businesses, self-employed individuals, and freelancers who have hired independent contractors or subcontractors to perform services for them.

It is important to note that the requirement to file a 1099 form applies only to payments made for services rendered, not for goods or products. If you have paid a contract employee for services such as consulting, professional fees, or rent, you will need to file a 1099 form.

Additionally, if you have made payments to an attorney, you are required to file a 1099 form regardless of the amount paid. This is because attorneys are considered to be in the business of providing services, and any payment made to them must be reported.

It is crucial to accurately determine whether you need to file a 1099 form for a contract employee. Failing to do so can result in penalties and fines from the Internal Revenue Service (IRS). Therefore, it is recommended to consult with a tax professional or refer to the IRS guidelines to ensure compliance with the filing requirements.

Why is it Important to File a 1099 Form?

Filing a 1099 form is important for both the payer and the recipient of the income. Here are a few reasons why it is crucial to file a 1099 form:

1. Compliance with IRS Regulations: The Internal Revenue Service (IRS) requires businesses to report certain types of income paid to contractors and freelancers. Filing a 1099 form ensures that you are in compliance with these regulations and avoids any potential penalties or fines.

2. Accurate Record-Keeping: Filing a 1099 form helps you maintain accurate records of the payments made to contract employees. This documentation can be useful for tax purposes, audits, and financial reporting.

3. Tax Deductions: By filing a 1099 form, you can claim tax deductions for the payments made to contract employees. These deductions can help reduce your overall tax liability and potentially save your business money.

4. Avoiding Misclassification: Filing a 1099 form helps ensure that contract employees are properly classified as independent contractors rather than employees. Misclassifying workers can lead to legal issues and potential liabilities for your business.

5. Building Trust with Contractors: Filing a 1099 form demonstrates professionalism and transparency in your business dealings. It shows that you value your contract employees and are committed to fulfilling your tax obligations.

6. Facilitating Financial Planning: By accurately reporting income through a 1099 form, contract employees can better plan their finances and meet their own tax obligations. This can help foster positive relationships between your business and your contractors.

7. Contributing to the Overall Economy: Filing a 1099 form ensures that income earned by contract employees is properly accounted for in the overall economy. This data is used by government agencies and economists to analyze economic trends and make informed policy decisions.

Section 2: Steps to File a 1099 Form

Once you have a clear understanding of what a 1099 form is and who needs to file it, you can proceed with the steps to file the form. Here is a step-by-step guide to help you through the process:

Step 1: Gather the Necessary Information

Before you can fill out the 1099 form, you need to gather all the necessary information. This includes the contractor’s name, address, and Social Security number or Employer Identification Number (EIN). You will also need to know the total amount paid to the contractor during the tax year.

Step 2: Fill out the 1099 Form

Once you have all the required information, you can start filling out the 1099 form. The form consists of several boxes that need to be completed accurately. Here is a breakdown of the key boxes:

Box 1: Rents

If you paid rent to the contractor, enter the total amount paid in this box.

Box 2: Royalties

If you paid royalties to the contractor, enter the total amount paid in this box.

Box 3: Other Income

If you paid the contractor for services other than rent or royalties, enter the total amount paid in this box.

Box 4: Federal Income Tax Withheld

If you withheld any federal income tax from the contractor’s payments, enter the total amount withheld in this box.

Box 5: Fishing Boat Proceeds

If you made payments to a crew member of a fishing boat, enter the total amount paid in this box.

Box 6: Medical and Health Care Payments

If you made payments to the contractor for medical or health care services, enter the total amount paid in this box.

Box 7: Nonemployee Compensation

This is the most commonly used box for reporting payments to contractors. Enter the total amount paid to the contractor for their services in this box.

Box 8: Substitute Payments in Lieu of Dividends or Interest

If you made substitute payments to the contractor instead of dividends or interest, enter the total amount paid in this box.

Box 9: Payer Made Direct Sales of $5,000 or More

If you made direct sales of $5,000 or more to the contractor, enter the total amount in this box.

Box 10: Crop Insurance Proceeds

If you made payments to the contractor as crop insurance proceeds, enter the total amount paid in this box.

Box 11: Excess Golden Parachute Payments

If you made excess golden parachute payments to the contractor, enter the total amount paid in this box.

Box 12: Section 409A Deferrals

If you made deferrals under Section 409A to the contractor, enter the total amount deferred in this box.

Box 13: Nonqualified Deferred Compensation

If you made nonqualified deferred compensation payments to the contractor, enter the total amount paid in this box.

Box 14: Gross Proceeds Paid to an Attorney

If you made payments to an attorney, enter the total amount paid in this box.

Make sure to double-check all the information you entered before submitting the form. Any errors or inaccuracies could lead to penalties or delays in processing.

Once you have completed the form, you will need to send Copy A to the IRS, Copy 1 to the state tax department (if applicable), and Copy B to the contractor. Keep Copy C for your records.

By following these steps, you can successfully file a 1099 form for a contract employee and fulfill your tax obligations as an employer or payer.

Gather the Necessary Information

Before you can fill out the 1099 form for your contract employee, you will need to gather some important information. This information is crucial for accurately reporting the income and ensuring compliance with tax regulations. Here are the key details you will need:

1. Employee Information: Collect the full name, address, and Social Security number (SSN) or taxpayer identification number (TIN) of your contract employee. Make sure to double-check the accuracy of this information to avoid any issues later on.

2. Payment Details: Keep track of the total amount you paid to the contract employee during the tax year. This includes any wages, salaries, bonuses, commissions, or other forms of compensation. It’s important to have accurate records of these payments to ensure proper reporting.

3. Tax Withholding Information: Determine whether you withheld any federal income tax, state income tax, or any other taxes from the contract employee’s payments. If you did withhold taxes, you will need to provide the total amount withheld and the dates of the withholding.

4. Other Income: If you provided any non-wage income to the contract employee, such as rent or royalties, you will need to gather the necessary information related to those payments as well. This includes the amount paid and the type of income.

5. Contractor Agreement: It’s a good idea to have a copy of the contract or agreement you have with the contract employee. This document can help support the information you provide on the 1099 form and ensure accuracy.

By gathering all the necessary information beforehand, you can streamline the process of filling out the 1099 form and avoid any potential errors or omissions. It’s important to keep accurate records and ensure compliance with tax regulations to avoid any penalties or audits.

Fill out the 1099 Form

Once you have gathered all the necessary information, it’s time to fill out the 1099 Form. The form consists of several sections and requires accurate and detailed information to be filled in correctly.

Start by entering your name and contact information in the designated fields at the top of the form. Make sure to provide your full legal name, address, and phone number.

Next, you will need to enter the recipient’s information. This includes their name, address, and taxpayer identification number (TIN). The TIN can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

After that, you will need to specify the type of income being reported. This can include non-employee compensation, rent, royalties, or other types of income. Select the appropriate box and enter the corresponding amount in the designated field.

If you are reporting non-employee compensation, you will also need to provide a description of the services or goods provided by the recipient. This helps the IRS determine the nature of the income and ensures accurate reporting.

Additionally, you may need to fill out other sections of the form depending on the specific circumstances. For example, if you withheld any federal income tax from the payments made to the recipient, you will need to report that amount in the appropriate section.

Once you have completed all the necessary sections of the form, double-check your entries for accuracy. Any mistakes or omissions could lead to penalties or delays in processing. It’s always a good idea to review the form before submitting it to ensure everything is filled out correctly.

Finally, sign and date the form to certify its accuracy. If you are filing the form electronically, you may need to use an electronic signature. If you are filing a paper form, make sure to use black ink and sign your full legal name.

After you have filled out the 1099 Form, you can submit it to the IRS. The deadline for filing the form is typically January 31st of the following year. Be sure to keep a copy of the form for your records.

Filing a 1099 Form for a contract employee may seem daunting at first, but by following these step-by-step instructions, you can ensure accurate and timely reporting. Remember, it’s important to file the form correctly to avoid penalties and comply with IRS regulations.

Question-answer:

What is a 1099 form?

A 1099 form is a tax form used to report income received by a contract employee or independent contractor. It is used to report income that is not subject to withholding taxes.

Who needs to file a 1099 form?

Any business or individual who has paid $600 or more to a contract employee or independent contractor during the tax year needs to file a 1099 form.

What information is needed to file a 1099 form?

To file a 1099 form, you will need the contract employee’s name, address, and Social Security number or taxpayer identification number. You will also need to know the total amount paid to the employee during the tax year.

When is the deadline to file a 1099 form?

The deadline to file a 1099 form is January 31st of the year following the tax year in which the income was paid. If the deadline falls on a weekend or holiday, the deadline is extended to the next business day.

What happens if I don’t file a 1099 form?

If you fail to file a 1099 form when required, you may be subject to penalties and fines from the Internal Revenue Service (IRS). It is important to file the form accurately and on time to avoid any potential issues.

What is a 1099 form?

A 1099 form is a tax form used to report income received by a contract employee or independent contractor. It is used to report income that is not subject to withholding taxes.

Who needs to file a 1099 form?

Any business or individual who has paid $600 or more to a contract employee or independent contractor during the tax year needs to file a 1099 form.