- What is Contract Freelance?

- Definition of Contract Freelance

- Benefits of Contract Freelance

- How Turbotax Defines Contract Freelance

- Turbotax’s Criteria for Contract Freelance

- How Turbotax Helps Contract Freelancers

- Question-answer:

- What is Turbotax’s definition of contract freelance?

- How does Turbotax differentiate between contract freelance and regular employment?

- What are the tax implications for contract freelancers?

- Are contract freelancers eligible for any benefits?

- What are some common challenges faced by contract freelancers?

- What is Turbotax’s definition of contract freelance?

- How does Turbotax differentiate between contract freelance and regular employment?

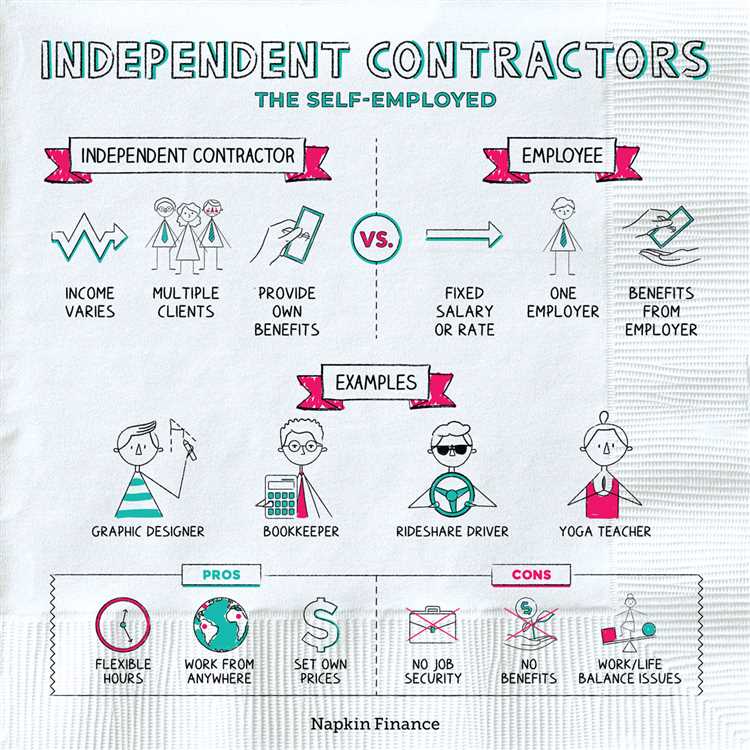

Contract freelance is a term that has gained significant popularity in recent years, as more and more individuals are choosing to work independently rather than being tied to a traditional 9-to-5 job. Turbotax, the popular tax preparation software, provides a clear definition of what it means to be a contract freelancer.

Turbotax defines contract freelance as an individual who works on a project-by-project basis for multiple clients, rather than being employed by a single company. This type of work arrangement offers flexibility and autonomy, allowing individuals to choose the projects they want to work on and set their own schedules.

Contract freelancers are responsible for managing their own taxes, as they are not considered employees and do not have taxes withheld from their paychecks. They are required to report their income and expenses on their tax returns and may be eligible for various deductions and credits related to their freelance work.

It is important for contract freelancers to keep detailed records of their income and expenses throughout the year, as this will help them accurately report their earnings and take advantage of any tax benefits they may be eligible for. Turbotax provides tools and resources to assist contract freelancers in navigating the complexities of self-employment taxes and ensuring they are in compliance with tax laws.

By understanding Turbotax’s definition of contract freelance and utilizing their tax preparation software, contract freelancers can confidently navigate the tax implications of their work and maximize their tax savings.

What is Contract Freelance?

Contract freelance refers to a type of work arrangement where individuals are hired on a contractual basis to provide specific services or complete projects for a company or client. Unlike traditional employment, contract freelancers are not considered employees and are not entitled to benefits such as health insurance or paid time off.

Contract freelancers are typically self-employed and have the flexibility to choose their own clients and projects. They often work remotely and are responsible for managing their own taxes, invoicing, and business expenses. This type of work arrangement is common in industries such as graphic design, writing, programming, and consulting.

Contract freelance offers several benefits for both the freelancer and the client. For freelancers, it provides the opportunity to work on a variety of projects, gain experience, and have more control over their work schedule. It also allows them to potentially earn a higher income compared to traditional employment.

For clients, hiring contract freelancers can be cost-effective as they only pay for the specific services or projects they need. It also allows them to access a wider pool of talent and expertise without the long-term commitment of hiring a full-time employee.

Turbotax, a popular tax preparation software, provides assistance and guidance for contract freelancers in managing their taxes. They offer resources and tools to help freelancers understand their tax obligations, track their income and expenses, and maximize their deductions. Turbotax’s support for contract freelancers can help simplify the tax filing process and ensure compliance with tax laws.

Definition of Contract Freelance

Contract freelance refers to a type of employment arrangement where individuals work on a project basis for a specific period of time. In this arrangement, freelancers are hired by companies or individuals to complete a specific task or project, and they are not considered as employees of the hiring party.

Contract freelancers are typically self-employed and have the freedom to choose their own clients and projects. They are responsible for managing their own workload, setting their own rates, and determining their own working hours. Unlike traditional employees, contract freelancers do not receive benefits such as health insurance, paid time off, or retirement plans from the hiring party.

Contract freelancers are often hired for their specialized skills and expertise in a particular field. They may work in various industries such as graphic design, web development, writing, consulting, and more. The duration of a contract freelance arrangement can vary depending on the nature of the project, ranging from a few weeks to several months or even years.

One of the key advantages of contract freelance is the flexibility it offers. Freelancers have the ability to work from anywhere and choose the projects that align with their interests and skills. They also have the potential to earn a higher income compared to traditional employees, as they can negotiate their rates based on the value they bring to the project.

However, contract freelancers also face certain challenges. They are responsible for finding their own clients and projects, which requires marketing and networking skills. They also need to manage their own finances, including invoicing, tax payments, and retirement planning.

Benefits of Contract Freelance

Contract freelance work offers numerous benefits for both individuals and businesses. Here are some of the key advantages:

1. Flexibility:

Contract freelancers have the freedom to choose when and where they work. They can set their own schedules and take on projects that align with their interests and skills. This flexibility allows them to achieve a better work-life balance and pursue other personal or professional endeavors.

2. Variety of Projects:

Contract freelancers have the opportunity to work on a wide range of projects with different clients. This variety keeps the work interesting and allows freelancers to continuously learn and develop new skills. It also provides exposure to different industries and networks, which can lead to future opportunities.

3. Higher Earning Potential:

Contract freelancers often have the potential to earn more than traditional employees. They can negotiate their rates and take on multiple projects simultaneously, increasing their income. Additionally, freelancers can deduct business expenses from their taxes, further maximizing their earnings.

4. Independence:

Contract freelancers have the autonomy to make their own decisions and be their own boss. They have control over the type of work they do, the clients they work with, and the direction of their career. This independence can lead to a greater sense of fulfillment and satisfaction in their work.

5. Skill Development:

Contract freelancers have the opportunity to continuously develop and refine their skills. They can choose projects that align with their interests and goals, allowing them to focus on areas they want to grow in. This ongoing skill development enhances their expertise and makes them more marketable in the freelance marketplace.

6. Networking Opportunities:

Contract freelancers have the chance to build a diverse network of clients and industry professionals. This network can provide valuable connections, referrals, and future job opportunities. Networking also allows freelancers to learn from others, collaborate on projects, and stay updated on industry trends.

How Turbotax Defines Contract Freelance

Turbotax defines contract freelance as a type of employment where individuals work on a project-by-project basis for various clients. These individuals are not considered employees of the clients, but rather independent contractors who provide services or complete tasks for a set fee.

Contract freelancers are responsible for managing their own business operations, including finding clients, negotiating contracts, and setting their own rates. They have the freedom to choose the projects they want to work on and the flexibility to work from anywhere.

Turbotax recognizes that contract freelancers have different tax obligations compared to traditional employees. They are required to report their income and expenses on a Schedule C form, which is part of their personal tax return. This form allows them to deduct business expenses, such as office supplies, travel expenses, and professional fees, from their taxable income.

Turbotax also understands that contract freelancers may have multiple sources of income and may need to pay estimated taxes throughout the year. They provide guidance and tools to help freelancers calculate and pay their estimated taxes to avoid penalties and interest.

In addition, Turbotax offers support for contract freelancers who may need to file additional forms, such as a 1099-MISC form, to report income from clients. They provide step-by-step instructions and ensure that freelancers are aware of their tax obligations and deadlines.

Overall, Turbotax defines contract freelance as a unique type of employment that requires individuals to take on the responsibilities of running their own business and managing their taxes. They provide the necessary tools and guidance to help freelancers navigate the complexities of tax filing and ensure compliance with the IRS regulations.

Turbotax’s Criteria for Contract Freelance

Turbotax has specific criteria for determining whether someone qualifies as a contract freelancer. These criteria are important for accurately reporting income and expenses related to contract freelance work. Here are the key factors that Turbotax considers:

- Control: Turbotax looks at the level of control the freelancer has over their work. If the freelancer has the freedom to choose when, where, and how to complete their work, they are more likely to be considered a contract freelancer.

- Payment: Turbotax examines how the freelancer is paid. If the freelancer receives a flat fee or project-based payment, they are more likely to be classified as a contract freelancer. On the other hand, if the freelancer receives a regular salary or hourly wage, they may be considered an employee.

- Relationship: Turbotax considers the nature of the relationship between the freelancer and the client. If the freelancer works for multiple clients and has a temporary or project-based relationship with each client, they are more likely to be seen as a contract freelancer.

- Tools and Equipment: Turbotax takes into account whether the freelancer uses their own tools and equipment to complete their work. If the freelancer provides their own tools and equipment, they are more likely to be classified as a contract freelancer.

- Profit and Loss: Turbotax looks at whether the freelancer has the opportunity to make a profit or incur a loss. If the freelancer has the potential to earn more money by working efficiently or taking on additional projects, they are more likely to be considered a contract freelancer.

It’s important for freelancers to understand Turbotax’s criteria for contract freelance in order to accurately report their income and expenses. By meeting these criteria, freelancers can ensure that they are correctly classified and take advantage of the tax benefits available to them.

How Turbotax Helps Contract Freelancers

Turbotax is a popular tax preparation software that offers a range of tools and resources to help contract freelancers manage their taxes effectively. Here are some ways Turbotax can assist contract freelancers:

| 1. Easy Tax Filing | Turbotax provides a user-friendly interface that simplifies the tax filing process for contract freelancers. It guides users through each step, ensuring that all necessary information is included and calculations are accurate. |

| 2. Deduction Maximization | Turbotax helps contract freelancers identify and maximize deductions that they may be eligible for. It asks relevant questions and prompts users to provide necessary documentation to ensure that no deductions are missed. |

| 3. Income Tracking | Turbotax allows contract freelancers to easily track their income throughout the year. It provides a clear overview of earnings and expenses, making it easier to stay organized and ensure accurate reporting. |

| 4. Tax Deadline Reminders | Turbotax sends timely reminders to contract freelancers about upcoming tax deadlines. This helps freelancers stay on top of their tax obligations and avoid penalties for late filing. |

| 5. Expert Support | Turbotax offers access to expert support for contract freelancers who may have questions or need assistance with their taxes. Users can reach out to tax professionals for personalized guidance and advice. |

| 6. Audit Support | In the event of an audit, Turbotax provides contract freelancers with support and guidance. It helps users understand the audit process, gather necessary documentation, and respond to inquiries from tax authorities. |

| 7. Mobile Accessibility | Turbotax offers a mobile app that allows contract freelancers to manage their taxes on the go. Users can easily access their tax information, make updates, and file their taxes from their smartphones or tablets. |

Overall, Turbotax is a valuable tool for contract freelancers, providing them with the resources and support they need to navigate the complexities of tax filing and ensure compliance with tax regulations.

Question-answer:

What is Turbotax’s definition of contract freelance?

Turbotax defines contract freelance as a type of employment where individuals work on a project-by-project basis for different clients. They are not considered employees of the clients and are responsible for their own taxes and benefits.

How does Turbotax differentiate between contract freelance and regular employment?

Turbotax differentiates contract freelance from regular employment by the nature of the work arrangement. In contract freelance, individuals are not considered employees and have more flexibility in choosing their projects and clients. Regular employment, on the other hand, involves a traditional employer-employee relationship with set hours and benefits.

What are the tax implications for contract freelancers?

Contract freelancers are responsible for paying their own taxes, including self-employment taxes. They may also be eligible for certain deductions and credits related to their business expenses. It is important for contract freelancers to keep track of their income and expenses throughout the year to accurately report their earnings to the IRS.

Are contract freelancers eligible for any benefits?

Contract freelancers are not typically eligible for benefits such as health insurance, retirement plans, or paid time off from their clients. However, they have the freedom to negotiate their rates and choose the projects they want to work on.

What are some common challenges faced by contract freelancers?

Some common challenges faced by contract freelancers include irregular income, difficulty in finding clients, managing their own taxes and finances, and lack of job security. It is important for contract freelancers to have a strong network, good financial planning, and the ability to market themselves effectively to overcome these challenges.

What is Turbotax’s definition of contract freelance?

Turbotax defines contract freelance as a type of employment where individuals work on a project-by-project basis for different clients. They are not considered employees of the clients and are responsible for their own taxes and benefits.

How does Turbotax differentiate between contract freelance and regular employment?

Turbotax differentiates between contract freelance and regular employment based on the nature of the work arrangement. Contract freelancers work independently and are not bound by long-term contracts or employer-employee relationships. They have more flexibility in choosing their projects and clients.