- Understanding the Non-Employee 1099 Form

- What is a Non-Employee 1099 Form?

- Who Needs to File a Non-Employee 1099 Form?

- Gathering the Necessary Information

- Collecting Contractor Information

- Question-answer:

- What is a non-employee 1099 form?

- Who needs to file a non-employee 1099 form?

- What information is required to file a non-employee 1099 form?

- When is the deadline for filing a non-employee 1099 form?

- What are the consequences of not filing a non-employee 1099 form?

- What is a non-employee 1099 form?

As a business owner, it’s important to understand your tax obligations when working with contract workers. One of these obligations is filing a 1099 form for non-employee workers. This form is used to report income earned by individuals who are not your employees but have provided services to your business.

Filing a 1099 for contract workers can be a complex process, but with the right guidance, it can be done efficiently and accurately. This step-by-step guide will walk you through the process, ensuring that you meet all the necessary requirements and avoid any potential penalties.

Step 1: Gather the necessary information

Before you can file a 1099 for your contract workers, you’ll need to gather some important information. This includes the worker’s name, address, and social security number or taxpayer identification number. You should also have a record of the total amount paid to the worker during the tax year.

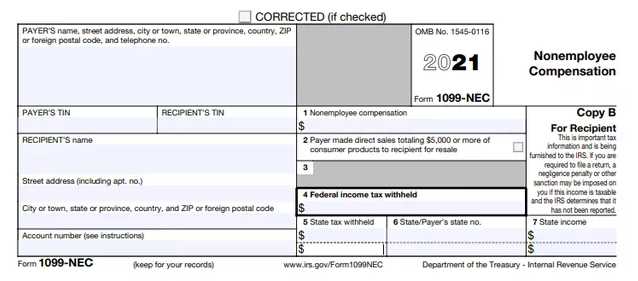

Step 2: Determine the correct 1099 form

There are different types of 1099 forms, depending on the type of income being reported. For contract workers, you’ll need to use Form 1099-NEC (Nonemployee Compensation). This form is specifically designed for reporting payments made to non-employee workers.

Step 3: Fill out the 1099 form

Once you have the necessary information and the correct form, you can start filling out the 1099. Make sure to accurately enter the worker’s information, including their name, address, and social security number or taxpayer identification number. You’ll also need to enter the total amount paid to the worker in Box 1 of the form.

Step 4: Send copies to the worker and the IRS

After completing the 1099 form, you’ll need to send copies to both the contract worker and the IRS. The worker should receive their copy by January 31st of the following year, while the IRS copy should be sent by the end of February if filing by paper or by the end of March if filing electronically.

Step 5: Keep records for your business

It’s important to keep copies of all 1099 forms you file for contract workers, as well as any supporting documentation. These records will be useful in case of an audit or if you need to reference them in the future.

By following this step-by-step guide, you can ensure that you fulfill your tax obligations when working with contract workers. Filing a 1099 for non-employee workers is an important part of staying compliant with the IRS and maintaining the financial health of your business.

Understanding the Non-Employee 1099 Form

The Non-Employee 1099 form is an important document used for reporting payments made to contractors or freelancers who are not considered employees. It is a tax form that businesses use to report income paid to non-employees, such as independent contractors, consultants, or vendors.

The purpose of the Non-Employee 1099 form is to provide the Internal Revenue Service (IRS) with information about the income earned by non-employees, which they must report on their individual tax returns. This form helps the IRS ensure that individuals are accurately reporting their income and paying the appropriate amount of taxes.

The Non-Employee 1099 form contains various sections that need to be filled out accurately. These sections include the payer’s information, the recipient’s information, and the amount of income paid to the non-employee. It also includes boxes for reporting any federal income tax withheld and any state income tax withheld, if applicable.

It is important for businesses to understand the requirements and guidelines for filing the Non-Employee 1099 form. Failure to file the form or inaccurately reporting the information can result in penalties and fines from the IRS.

Businesses must gather the necessary information from the non-employees in order to complete the Non-Employee 1099 form. This includes the contractor’s name, address, and taxpayer identification number (TIN), which is typically their Social Security number or employer identification number (EIN).

Overall, understanding the Non-Employee 1099 form is crucial for businesses that work with contractors or freelancers. It ensures compliance with tax regulations and helps maintain accurate records of payments made to non-employees. By properly completing and filing the form, businesses can avoid penalties and ensure that non-employees are reporting their income correctly.

| Section | Description |

|---|---|

| Payer’s Information | Includes the name, address, and taxpayer identification number (TIN) of the business or individual making the payment. |

| Recipient’s Information | Includes the name, address, and taxpayer identification number (TIN) of the contractor or freelancer receiving the payment. |

| Income Paid | Includes the total amount of income paid to the non-employee during the tax year. |

| Federal Income Tax Withheld | Includes any federal income tax that was withheld from the payment to the non-employee. |

| State Income Tax Withheld | Includes any state income tax that was withheld from the payment to the non-employee, if applicable. |

What is a Non-Employee 1099 Form?

A Non-Employee 1099 Form, also known as a 1099-MISC form, is a tax document used to report income earned by individuals who are not employees of a company. It is typically used to report payments made to independent contractors, freelancers, and other non-employees.

The Non-Employee 1099 Form is issued by businesses or individuals who have paid $600 or more to a non-employee during the tax year for services rendered. This form is used to report the income to the Internal Revenue Service (IRS) and the individual receiving the payment.

The form includes important information such as the recipient’s name, address, and taxpayer identification number (TIN), as well as the amount of income paid. It also includes information about any federal income tax withheld from the payment.

It is important for businesses to accurately complete and file the Non-Employee 1099 Form to ensure compliance with tax laws and to provide the necessary information to the IRS and the recipient of the payment. Failure to file the form or filing an incorrect form can result in penalties and fines.

Overall, the Non-Employee 1099 Form is a crucial document for businesses and individuals who have engaged the services of non-employees and need to report the income paid to them. It helps to ensure transparency and accountability in the tax reporting process.

Who Needs to File a Non-Employee 1099 Form?

When it comes to filing taxes, it’s important to understand who needs to file a Non-Employee 1099 Form. This form is used to report income paid to non-employees, such as independent contractors, freelancers, and other self-employed individuals. If you have paid $600 or more to a non-employee for services rendered during the tax year, you are required to file a Non-Employee 1099 Form.

It’s important to note that the $600 threshold applies to the total amount paid to the non-employee throughout the year, not just a single payment. For example, if you paid a contractor $400 for a project in January and then paid them an additional $300 for another project in July, you would still need to file a Non-Employee 1099 Form because the total amount paid to the contractor exceeds $600.

Additionally, it’s important to keep in mind that the Non-Employee 1099 Form is not just for individuals. If you are a business entity, such as a corporation or partnership, and you have paid $600 or more to a non-employee, you are also required to file this form.

Filing a Non-Employee 1099 Form is an important part of fulfilling your tax obligations and ensuring compliance with the Internal Revenue Service (IRS). Failure to file this form when required can result in penalties and fines. Therefore, it’s crucial to accurately determine whether you need to file a Non-Employee 1099 Form and to do so in a timely manner.

| Who needs to file a Non-Employee 1099 Form? | Examples |

|---|---|

| Individuals | Self-employed individuals, freelancers, independent contractors |

| Business entities | Corporations, partnerships |

By understanding the requirements for filing a Non-Employee 1099 Form, you can ensure that you are meeting your tax obligations and avoiding any potential penalties. It’s always a good idea to consult with a tax professional or utilize tax software to ensure accurate and timely filing.

Gathering the Necessary Information

Before filing a non-employee 1099 form for contract workers, it is important to gather all the necessary information. This will ensure that the form is filled out accurately and completely. Here are the key pieces of information you will need:

- Contractor’s full name: Make sure to have the contractor’s legal name, as it appears on their official documents.

- Contractor’s address: Include the contractor’s current mailing address.

- Contractor’s taxpayer identification number: This can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

- Contractor’s business name (if applicable): If the contractor operates under a business name, make sure to include it.

- Contractor’s business address (if applicable): If the contractor has a separate business address, include it here.

- Total amount paid to the contractor: This includes all payments made to the contractor during the tax year, including any reimbursements or non-cash payments.

- Date of payment: For each payment made to the contractor, include the date it was made.

- Description of services provided: Provide a brief description of the services the contractor provided.

It is important to gather this information accurately and completely to ensure that the non-employee 1099 form is filed correctly. Failure to include any of the required information may result in penalties or delays in processing.

Collecting Contractor Information

When filing a Non-Employee 1099 form, it is crucial to gather all the necessary information about the contractors you have worked with. This information will be used to accurately report their earnings to the IRS.

Here are the key details you need to collect from each contractor:

1. Full Name: Obtain the contractor’s full legal name, including their first name, middle name (if applicable), and last name. Make sure to spell their name correctly and use the same format as it appears on their official identification documents.

2. Social Security Number (SSN) or Employer Identification Number (EIN): Contractors are required to provide either their SSN or EIN for tax reporting purposes. The SSN is a nine-digit number issued by the Social Security Administration, while the EIN is a nine-digit number assigned by the IRS to businesses and other entities.

3. Address: Collect the contractor’s mailing address, including the street address, city, state, and ZIP code. Ensure that the address is current and accurate to avoid any issues with delivering important tax documents.

4. Phone Number: Obtain the contractor’s contact number, preferably a mobile phone number, to facilitate communication if needed.

5. Email Address: Request the contractor’s email address to send important tax-related documents, such as the 1099 form, and to communicate any updates or changes.

6. Tax Classification: Determine the contractor’s tax classification, whether they are an individual or a business entity. This information is crucial for correctly reporting their earnings and determining the appropriate tax treatment.

It is essential to collect this information from each contractor before the tax filing deadline to ensure timely and accurate reporting. Keep the information securely stored and easily accessible for future reference.

Remember, accurate and complete contractor information is vital for complying with IRS regulations and avoiding potential penalties or audits. Take the time to gather all the necessary details to ensure a smooth and hassle-free tax filing process.

Question-answer:

What is a non-employee 1099 form?

A non-employee 1099 form is a tax form used to report income paid to individuals who are not employees of a company, such as independent contractors or freelancers.

Who needs to file a non-employee 1099 form?

Any business or individual who has paid $600 or more to a non-employee contractor or freelancer during the tax year needs to file a non-employee 1099 form.

What information is required to file a non-employee 1099 form?

To file a non-employee 1099 form, you will need the contractor’s name, address, and Social Security number or taxpayer identification number. You will also need to report the total amount paid to the contractor during the tax year.

When is the deadline for filing a non-employee 1099 form?

The deadline for filing a non-employee 1099 form is January 31st of the year following the tax year in which the payments were made. However, if you are filing electronically, the deadline is extended to March 31st.

What are the consequences of not filing a non-employee 1099 form?

If you fail to file a non-employee 1099 form or if you file it late, you may be subject to penalties and fines imposed by the IRS. The penalties can range from $50 to $270 per form, depending on how late the form is filed.

What is a non-employee 1099 form?

A non-employee 1099 form is a tax form used to report income paid to contract workers or freelancers who are not considered employees. It is used to report income earned by individuals who are not on the company’s payroll.