- Understanding the Difference Between an Employee and a Contractor

- Employee

- Contractor

- Can You Pay the Same Person as Both an Employee and a Contractor?

- Legal Considerations

- Tax Implications

- Question-answer:

- Can I hire someone as both an employee and a contractor?

- What are the benefits of hiring someone as both an employee and a contractor?

- What are the risks of hiring someone as both an employee and a contractor?

- How do I determine whether to hire someone as an employee or a contractor?

- What are the tax implications of hiring someone as both an employee and a contractor?

When it comes to hiring workers, businesses often face the question of whether they can pay the same person as both an employee and a contractor. This issue arises when a company wants to take advantage of the benefits of having a flexible workforce while also maintaining control over certain aspects of the work relationship.

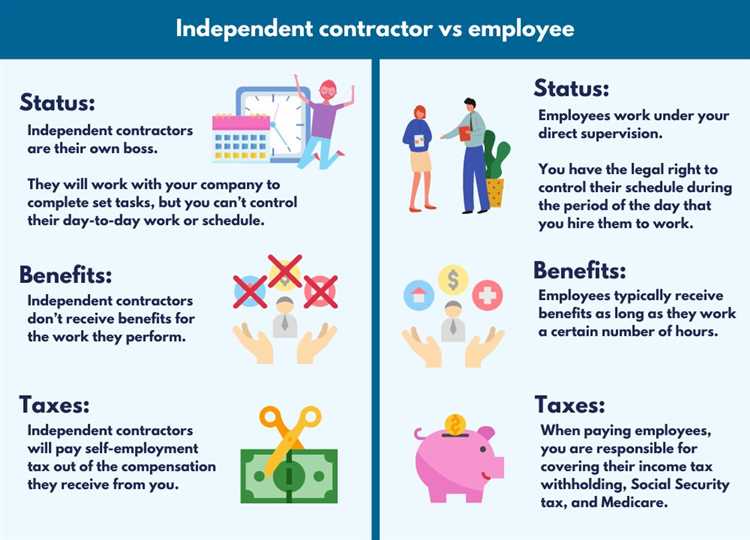

However, it is important to understand that there are distinct differences between an employee and a contractor. An employee is someone who works for a company on a regular basis, follows a set schedule, and is subject to the company’s control and direction. On the other hand, a contractor is an independent worker who is hired to complete a specific project or task and has more control over how the work is done.

While it may seem tempting to pay the same person as both an employee and a contractor to save on costs or simplify the hiring process, it is crucial to comply with the laws and regulations governing employment classification. Misclassifying workers can lead to legal consequences, such as fines and penalties, as well as potential lawsuits from workers seeking employee benefits.

Ultimately, the determination of whether a worker should be classified as an employee or a contractor depends on various factors, including the level of control exerted by the company, the nature of the work performed, and the degree of independence of the worker. It is advisable to consult with legal and tax professionals to ensure compliance with applicable laws and to avoid any potential legal issues.

Understanding the Difference Between an Employee and a Contractor

When it comes to hiring workers, it is important to understand the distinction between an employee and a contractor. While both may perform similar tasks, their legal status and the nature of their relationship with the employer differ significantly.

An employee is an individual who works under the direct control and supervision of an employer. They are typically hired for an indefinite period and are entitled to certain benefits and protections, such as minimum wage, overtime pay, and access to employee benefits. Employees are also subject to payroll taxes, and the employer is responsible for withholding and remitting these taxes on their behalf.

On the other hand, a contractor is an independent business entity or individual who provides services to a company on a contractual basis. Contractors have more autonomy and control over how they perform their work and are responsible for their own taxes, insurance, and benefits. They are usually hired for a specific project or a defined period and are paid a predetermined fee or rate for their services.

The distinction between an employee and a contractor is not always clear-cut and can vary depending on the specific circumstances of the working relationship. Factors such as the level of control exercised by the employer, the degree of independence of the worker, and the permanency of the relationship are taken into consideration when determining the classification.

It is crucial for employers to correctly classify their workers to ensure compliance with labor laws and tax regulations. Misclassifying workers can result in legal and financial consequences, including penalties, back taxes, and potential lawsuits. Therefore, it is advisable to consult with legal and tax professionals to ensure proper classification and adherence to applicable laws.

| Employee | Contractor |

|---|---|

| Works under direct control and supervision of the employer | Has more autonomy and control over how work is performed |

| Entitled to benefits and protections | Responsible for own taxes, insurance, and benefits |

| Hired for an indefinite period | Hired for a specific project or defined period |

| Subject to payroll taxes | Responsible for own taxes |

Employee

An employee is an individual who works for a company or organization under a contract of employment. They are typically hired to perform specific tasks or roles within the company and are subject to the control and direction of the employer. Employees are entitled to certain rights and benefits, such as minimum wage, overtime pay, and protection under employment laws.

Employees are usually provided with the necessary tools and equipment to perform their job duties, and they work at the employer’s premises or designated work location. They are often required to adhere to a set schedule and may be supervised by a manager or supervisor.

Employers are responsible for withholding and remitting taxes on behalf of their employees, as well as providing them with benefits such as health insurance, retirement plans, and paid time off. Employees may also be eligible for other perks and incentives, depending on the company’s policies.

It is important for employers to properly classify their workers as employees to ensure compliance with labor laws and regulations. Misclassifying employees as independent contractors can lead to legal and financial consequences for the employer.

Key characteristics of an employee:

- Works under a contract of employment

- Subject to the control and direction of the employer

- Entitled to certain rights and benefits

- Provided with necessary tools and equipment

- Works at the employer’s premises or designated work location

- May have a set schedule and be supervised by a manager

- Employer withholds taxes and provides benefits

Contractor

A contractor is an individual or a business entity that provides services to another party under a contract. Unlike an employee, a contractor is not considered an employee of the hiring party. Instead, they are considered an independent entity that provides specialized services.

Contractors are typically hired for specific projects or tasks that require specialized skills or expertise. They are responsible for managing their own work and are not subject to the same level of control and supervision as employees. Contractors often have their own tools, equipment, and resources necessary to complete the job.

When hiring a contractor, the hiring party does not have the same level of legal and financial obligations as they would with an employee. Contractors are responsible for their own taxes, insurance, and benefits. They are also not entitled to the same employment rights and protections as employees, such as minimum wage, overtime pay, and unemployment benefits.

Contractor agreements are typically outlined in a contract that specifies the scope of work, payment terms, and duration of the project. The contract may also include provisions for termination and dispute resolution.

It is important for businesses to properly classify workers as employees or contractors to ensure compliance with labor laws and tax regulations. Misclassifying workers can result in legal and financial consequences for both parties involved.

| Employee | Contractor |

|---|---|

| Considered an employee of the hiring party | Considered an independent entity |

| Subject to control and supervision by the employer | Responsible for managing their own work |

| Entitled to employment rights and protections | Not entitled to employment rights and protections |

| Employer responsible for taxes, insurance, and benefits | Contractor responsible for taxes, insurance, and benefits |

Can You Pay the Same Person as Both an Employee and a Contractor?

When it comes to hiring workers, businesses often face the question of whether they can pay the same person as both an employee and a contractor. While it may seem convenient to have one person fulfill multiple roles, there are legal and tax implications that need to be considered.

Firstly, it’s important to understand the difference between an employee and a contractor. An employee is someone who works for a company on a regular basis and is subject to the company’s control and direction. On the other hand, a contractor is an independent worker who provides services to a company but maintains control over how the work is done.

From a legal standpoint, paying the same person as both an employee and a contractor can be risky. This is because the classification of a worker as an employee or a contractor is determined by various factors, such as the level of control the company has over the worker, the nature of the work performed, and the degree of independence the worker has. If a worker is misclassified, the company may face legal consequences, such as fines and penalties.

Additionally, there are tax implications to consider. Employees are subject to payroll taxes, such as Social Security and Medicare taxes, which are typically withheld from their wages by the employer. Contractors, on the other hand, are responsible for paying their own self-employment taxes. If a worker is misclassified as a contractor when they should be an employee, the company may be held liable for unpaid payroll taxes.

Overall, while it may be tempting to pay the same person as both an employee and a contractor, it is important to carefully consider the legal and tax implications. It is advisable to consult with an employment attorney or tax professional to ensure compliance with the relevant laws and regulations.

Legal Considerations

When considering whether to pay the same person as both an employee and a contractor, there are several legal considerations that need to be taken into account. It is important to understand the legal differences between an employee and a contractor, as misclassification can lead to legal consequences.

An employee is someone who works for an employer under the control and direction of that employer. They are entitled to certain rights and benefits, such as minimum wage, overtime pay, and protection under employment laws. Employers are also responsible for withholding and paying payroll taxes on behalf of their employees.

A contractor, on the other hand, is an independent business entity that provides services to clients. They have more control over how and when they work, and they are responsible for their own taxes and benefits. Contractors are not entitled to the same rights and benefits as employees.

When paying the same person as both an employee and a contractor, it is important to ensure that the classification is accurate and legally defensible. This means that the person must meet the criteria for both classifications and that the nature of their work is clearly defined and documented.

It is recommended to consult with legal counsel or an employment law expert to ensure compliance with all applicable laws and regulations. They can help assess the specific circumstances and provide guidance on how to properly classify and pay the individual.

Additionally, it is important to keep in mind that misclassification can result in penalties and fines from government agencies, as well as potential lawsuits from the individual or other employees who may feel they have been improperly classified.

Tax Implications

When it comes to paying the same person as both an employee and a contractor, there are important tax implications to consider. The classification of a worker as either an employee or a contractor has significant tax consequences for both the employer and the worker.

For employees, the employer is responsible for withholding and paying various taxes on their behalf, such as income tax, Social Security tax, and Medicare tax. These taxes are calculated based on the employee’s wages and are deducted from their paycheck. The employer is also responsible for paying the employer’s portion of Social Security and Medicare taxes.

On the other hand, contractors are responsible for paying their own taxes. They are considered self-employed and must pay self-employment tax, which includes both the employee and employer portions of Social Security and Medicare taxes. Contractors are also responsible for paying income tax on their earnings.

When an individual is classified as both an employee and a contractor, it can create confusion and potential tax issues. The IRS has specific guidelines for determining whether a worker should be classified as an employee or a contractor, and misclassification can result in penalties and back taxes.

It is important for employers to properly classify their workers to ensure compliance with tax laws. If a worker is misclassified, the employer may be held liable for unpaid taxes and penalties. Additionally, misclassified workers may be subject to audits and may be required to pay back taxes.

Employers should consult with a tax professional or legal advisor to ensure they are correctly classifying their workers and fulfilling their tax obligations. It is also important for workers to understand their tax responsibilities and consult with a tax professional to ensure they are properly reporting their income and paying the appropriate taxes.

Question-answer:

Can I hire someone as both an employee and a contractor?

Yes, it is possible to hire someone as both an employee and a contractor. However, there are certain legal and tax implications that need to be considered. It is important to properly classify the individual’s role and responsibilities to ensure compliance with labor laws and tax regulations.

What are the benefits of hiring someone as both an employee and a contractor?

Hiring someone as both an employee and a contractor can provide flexibility in terms of work arrangements and cost management. It allows you to utilize their skills and services on a project basis while also having them as a regular employee for ongoing work. This can be beneficial for businesses that have fluctuating workloads or need specialized expertise for certain projects.

What are the risks of hiring someone as both an employee and a contractor?

There are several risks associated with hiring someone as both an employee and a contractor. One of the main risks is misclassification, which can lead to legal and financial consequences. If the individual is misclassified, you may be liable for unpaid taxes, benefits, and other employment-related costs. It is important to consult with legal and tax professionals to ensure proper classification and compliance with applicable laws.

How do I determine whether to hire someone as an employee or a contractor?

Determining whether to hire someone as an employee or a contractor depends on several factors, including the level of control you have over their work, the nature of the work relationship, and the degree of independence they have. Generally, employees are subject to more control and direction from the employer, while contractors have more autonomy and control over their work. It is important to carefully evaluate these factors and consult with legal and tax professionals to make the correct classification.

What are the tax implications of hiring someone as both an employee and a contractor?

Hiring someone as both an employee and a contractor can have tax implications. As an employer, you are responsible for withholding and paying payroll taxes for employees, while contractors are responsible for paying their own taxes. It is important to properly report and document the individual’s income and expenses to ensure compliance with tax regulations. Consulting with a tax professional can help you navigate the complexities of dual classification and ensure proper tax treatment.