- Understanding the W2 form

- What is a W2 form?

- Who typically receives a W2 form?

- Contracted employees and W2 forms

- Can a contracted employee receive a W2 form?

- Question-answer:

- Can a contracted employee receive a W2?

- What is the difference between a contracted employee and a regular employee?

- Why can’t a contracted employee receive a W2?

- What tax form does a contracted employee receive?

- Are there any benefits to being classified as a contracted employee instead of a regular employee?

- Can a contracted employee receive a W2 form?

- What tax form should a contracted employee receive?

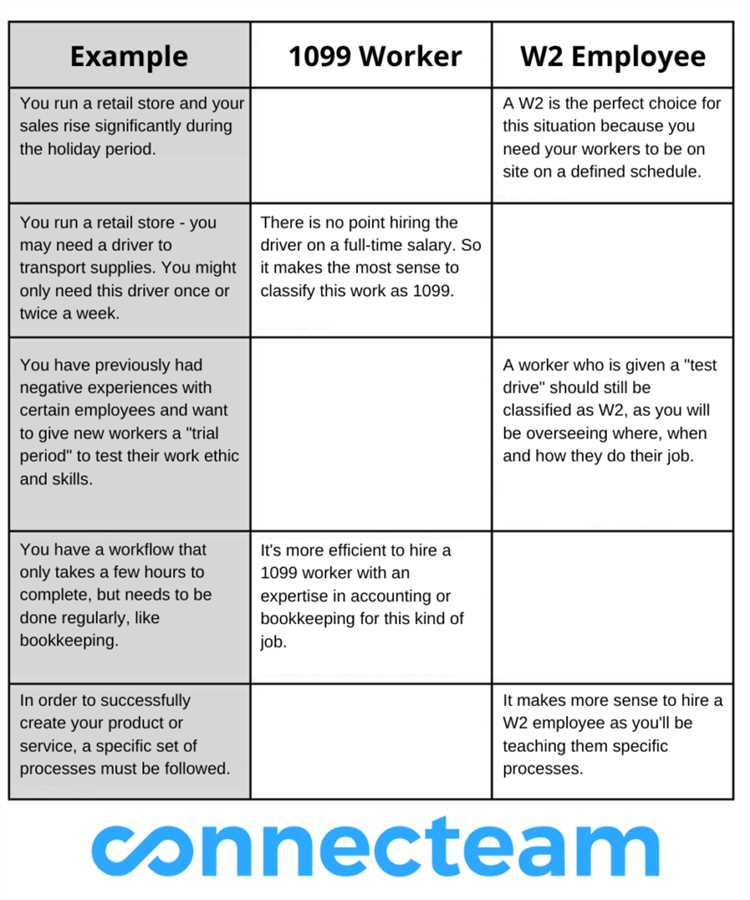

When it comes to tax forms and employment status, there can be some confusion. One common question that arises is whether a W2 can be given to a contracted employee. The answer to this question is not a simple yes or no, as it depends on the specific circumstances and the classification of the worker.

A W2 form is typically used to report wages and taxes withheld for employees who are classified as “employees” by the Internal Revenue Service (IRS). These employees are typically hired by a company and receive a regular salary or hourly wage. The employer withholds taxes from their paycheck and provides them with a W2 form at the end of the year.

On the other hand, contracted employees, also known as independent contractors, are self-employed individuals who work for themselves and provide services to clients or companies on a contract basis. They are responsible for paying their own taxes and are not subject to tax withholding by the client or company they work for.

So, in most cases, a W2 form would not be given to a contracted employee. Instead, they would receive a 1099-MISC form, which is used to report income received by independent contractors. This form is provided by the client or company that the contracted employee worked for and includes information about the payments made to them throughout the year.

Understanding the W2 form

The W2 form is a crucial document used for reporting an employee’s annual wages and the amount of taxes withheld from their paycheck. It provides a summary of the employee’s earnings and tax information for a specific tax year.

The W2 form consists of several sections that provide detailed information about the employee’s income, taxes, and deductions. These sections include:

| Box | Description |

|---|---|

| Box 1: Wages, tips, and other compensation | This box shows the total amount of taxable wages the employee earned during the tax year. |

| Box 2: Federal income tax withheld | This box displays the total amount of federal income tax that was withheld from the employee’s wages. |

| Box 3: Social Security wages | This box shows the total amount of wages subject to Social Security tax. |

| Box 4: Social Security tax withheld | This box displays the total amount of Social Security tax that was withheld from the employee’s wages. |

| Box 5: Medicare wages and tips | This box shows the total amount of wages subject to Medicare tax. |

| Box 6: Medicare tax withheld | This box displays the total amount of Medicare tax that was withheld from the employee’s wages. |

| Box 12: Other | This box includes various codes and amounts that represent additional information, such as contributions to retirement plans or health savings accounts. |

| Box 17: State income tax | This box shows the total amount of state income tax that was withheld from the employee’s wages. |

Understanding the information provided in each box of the W2 form is essential for both employees and employers. It helps employees accurately report their income and file their tax returns, while employers use the information to ensure compliance with tax regulations and provide accurate records to the IRS.

It is important for employees to review their W2 form carefully and compare it with their own records to ensure accuracy. Any discrepancies should be addressed with the employer as soon as possible to avoid potential issues with the IRS.

What is a W2 form?

A W2 form is a tax document that is used to report an employee’s wages and taxes withheld for a specific tax year. It is provided by employers to their employees and is used by individuals to file their federal and state income tax returns.

The W2 form contains important information such as the employee’s name, address, and social security number, as well as details about their wages, tips, and other compensation. It also includes information about the taxes withheld from the employee’s paycheck, such as federal income tax, Social Security tax, and Medicare tax.

The W2 form is divided into several sections, each providing specific information about the employee’s earnings and taxes. These sections include:

| Box | Description |

|---|---|

| Box 1 | Total wages, tips, and other compensation |

| Box 2 | Federal income tax withheld |

| Box 3 | Social Security wages |

| Box 4 | Social Security tax withheld |

| Box 5 | Medicare wages and tips |

| Box 6 | Medicare tax withheld |

| Box 12 | Additional information, such as contributions to retirement plans |

Employers are required by law to provide employees with their W2 forms by January 31st of each year. Employees must then use the information on their W2 form to accurately complete their tax returns.

It is important for individuals to keep their W2 forms in a safe place and retain them for at least three years, as they may be needed for future reference or in case of an audit by the Internal Revenue Service (IRS).

Who typically receives a W2 form?

A W2 form is typically received by employees who have been paid wages by an employer during the tax year. This includes full-time and part-time employees, as well as seasonal workers. Independent contractors, on the other hand, do not typically receive a W2 form.

The W2 form is used to report the employee’s annual wages, as well as the amount of taxes withheld from their paycheck. It also includes other important information such as the employee’s Social Security number, the employer’s identification number, and details about any retirement plan contributions.

Employers are required by law to provide their employees with a W2 form by January 31st of each year. The employee then uses this form to file their federal and state income tax returns.

It’s important for employees to review their W2 form carefully to ensure that all the information is accurate. Any discrepancies should be reported to the employer as soon as possible to avoid any issues with the employee’s tax return.

In summary, employees who have been paid wages by an employer during the tax year typically receive a W2 form. This form is used to report their annual wages and taxes withheld, and is an important document for filing income tax returns.

Contracted employees and W2 forms

Contracted employees, also known as independent contractors, are individuals who work for a company on a contract basis rather than as regular employees. They are responsible for their own taxes and are not eligible for benefits such as health insurance or retirement plans.

When it comes to W2 forms, contracted employees typically do not receive them. The reason for this is that W2 forms are used to report wages and taxes withheld for employees who are considered to be employees of the company. Since contracted employees are not considered employees, they do not receive W2 forms.

Instead, contracted employees receive a different tax form called a 1099-MISC. This form is used to report income earned as an independent contractor. It includes information such as the total amount paid to the contractor and any expenses that were reimbursed.

It’s important for contracted employees to keep track of their income and expenses throughout the year in order to accurately report their earnings on their tax return. They may also be required to make quarterly estimated tax payments to the IRS.

While contracted employees do not receive W2 forms, they still have tax obligations and must report their income to the IRS. It’s important for both employers and contracted employees to understand the differences between W2 forms and 1099-MISC forms to ensure compliance with tax laws.

Can a contracted employee receive a W2 form?

Yes, a contracted employee can receive a W2 form. While W2 forms are typically associated with traditional employees who are on the payroll of a company, contracted employees may also receive a W2 form under certain circumstances.

A W2 form is a tax document that employers are required to provide to their employees at the end of each calendar year. It reports the employee’s annual wages, as well as the amount of taxes withheld from their paycheck for federal, state, and local taxes.

Contracted employees, also known as independent contractors or freelancers, are individuals who work for a company on a contract basis rather than being classified as regular employees. They are responsible for paying their own taxes and are not subject to tax withholding by the company they work for.

However, there are situations where a contracted employee may receive a W2 form. This typically occurs when the contracted employee meets certain criteria set by the Internal Revenue Service (IRS) to be classified as a statutory employee.

A statutory employee is a type of worker who is treated as an employee for tax purposes, even though they are technically an independent contractor. They are subject to tax withholding by the company they work for, and the company is required to provide them with a W2 form.

To be classified as a statutory employee, the contracted employee must meet one of the following criteria:

| Criteria | Description |

|---|---|

| Driver | The contracted employee is a driver who distributes beverages (other than milk) or meat, vegetable, fruit, or bakery products. |

| Retailer | The contracted employee works as a full-time life insurance salesperson, or is engaged in the business of selling goods on behalf of a principal. |

| Homeworker | The contracted employee performs work at home on materials or goods that are supplied by the company they work for. |

| Commissioned salesperson | The contracted employee is primarily engaged in selling tangible or intangible items on behalf of a principal, and their compensation is based on sales or orders. |

If a contracted employee meets any of these criteria, they may be considered a statutory employee and will receive a W2 form from the company they work for. This form will report their wages and taxes withheld, just like a regular employee.

It’s important for both the company and the contracted employee to understand the classification and tax obligations associated with their working relationship. If there is any confusion or uncertainty, it is recommended to consult with a tax professional or the IRS for guidance.

Question-answer:

Can a contracted employee receive a W2?

No, a contracted employee cannot receive a W2. W2 forms are only given to employees who are classified as regular employees and not independent contractors.

What is the difference between a contracted employee and a regular employee?

A contracted employee is someone who works for a company on a contract basis, usually for a specific project or period of time. They are not considered regular employees and are not eligible for benefits such as health insurance or retirement plans. Regular employees, on the other hand, are permanent employees of a company and receive benefits and protections under employment laws.

Why can’t a contracted employee receive a W2?

A contracted employee cannot receive a W2 because they are not considered regular employees. W2 forms are used to report wages and taxes withheld for regular employees, while independent contractors receive a 1099 form to report their income. The classification of an employee as either a regular employee or an independent contractor is determined by factors such as control over work, financial arrangement, and relationship with the employer.

What tax form does a contracted employee receive?

A contracted employee receives a 1099 form instead of a W2 form. The 1099 form is used to report income received as an independent contractor. It shows the total amount of income earned during the year, but does not include any taxes withheld. Contracted employees are responsible for paying their own taxes and are not subject to tax withholding by the employer.

Are there any benefits to being classified as a contracted employee instead of a regular employee?

Being classified as a contracted employee can have certain benefits, such as the ability to work on a flexible schedule and the potential for higher pay rates. However, contracted employees do not receive benefits such as health insurance, retirement plans, or paid time off. They are also responsible for paying their own taxes and do not have the same legal protections as regular employees.

Can a contracted employee receive a W2 form?

No, a contracted employee cannot receive a W2 form. W2 forms are only given to employees who are classified as W2 employees, meaning they are considered regular employees of the company and have taxes withheld from their paychecks.

What tax form should a contracted employee receive?

A contracted employee should receive a 1099 form. This form is used to report income received as an independent contractor or freelancer. Unlike a W2 form, a 1099 form does not have taxes withheld, so the contracted employee is responsible for paying their own taxes.