- Understanding the Importance of Documenting Contract Employees

- Ensuring Compliance with Employment Laws

- Protecting the Rights of Contract Employees

- Legal Requirements for Documenting Contract Employees

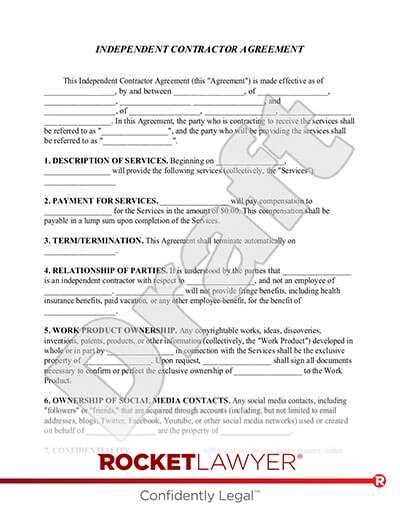

- Written Contract Agreements

- Verification of Employment Eligibility

- Recordkeeping and Reporting Obligations

- Question-answer:

- What are the legal requirements for documenting contract employees?

- Do contract employees need to have work permits?

- What happens if contract employees are not properly documented?

- Are there any specific documents that contract employees need to provide?

- What are the consequences of hiring contract employees without proper documentation?

- What are the legal requirements for documenting contract employees?

- What happens if an employer fails to document contract employees?

Contract employees play a crucial role in today’s workforce, providing flexibility and specialized skills to businesses across various industries. However, when it comes to documentation, there is often confusion surrounding the legal requirements for contract employees. Understanding these requirements is essential for both employers and contract employees to ensure compliance with the law and protect their rights.

One of the key considerations for contract employees is their classification under the law. In many jurisdictions, contract employees are classified as independent contractors, which means they are not considered employees of the company they work for. This classification has significant implications for documentation requirements, as independent contractors are typically responsible for their own documentation, such as tax forms and business licenses.

However, it is important to note that the classification of contract employees can vary depending on the jurisdiction and the specific nature of the working relationship. Some contract employees may be classified as temporary employees or freelancers, which may have different documentation requirements. It is crucial for both employers and contract employees to consult with legal professionals or relevant government agencies to determine the correct classification and associated documentation requirements.

Regardless of the classification, contract employees should always ensure they have the necessary documentation to protect their rights and comply with the law. This may include contracts or agreements outlining the terms of their engagement, proof of their qualifications or certifications, and any necessary permits or licenses required for their specific line of work. Additionally, contract employees should keep records of their work hours, invoices, and any other relevant documentation to support their status as independent contractors or temporary employees.

Understanding the Importance of Documenting Contract Employees

Documenting contract employees is crucial for several reasons. It helps ensure compliance with employment laws, protects the rights of contract employees, and fulfills legal requirements. By properly documenting contract employees, businesses can establish clear expectations, maintain accurate records, and mitigate potential legal risks.

One of the main reasons for documenting contract employees is to ensure compliance with employment laws. By clearly outlining the terms and conditions of the contract, businesses can avoid any misunderstandings or disputes that may arise. This includes specifying the duration of the contract, the scope of work, and any applicable compensation or benefits.

Documenting contract employees also helps protect their rights. By having a written agreement in place, both parties are aware of their rights and responsibilities. This can help prevent any potential exploitation or mistreatment of contract employees. It also provides a legal framework for resolving any disputes that may arise during the course of the contract.

Furthermore, documenting contract employees fulfills legal requirements. Many jurisdictions have specific laws and regulations regarding the employment of contract workers. By maintaining proper documentation, businesses can demonstrate their compliance with these laws and avoid any penalties or legal consequences.

Proper documentation also helps businesses maintain accurate records. This includes keeping track of important information such as the start and end dates of the contract, the hours worked, and any changes or amendments to the contract. Accurate recordkeeping is essential for tax purposes, auditing, and future reference.

In addition, documenting contract employees can help mitigate potential legal risks. By clearly outlining the terms and conditions of the contract, businesses can minimize the likelihood of disputes or claims. In the event of a dispute, having proper documentation can provide evidence to support the business’s position and protect its interests.

Overall, documenting contract employees is essential for ensuring compliance, protecting rights, fulfilling legal requirements, maintaining accurate records, and mitigating legal risks. It is an important aspect of managing contract workers and should not be overlooked by businesses.

Ensuring Compliance with Employment Laws

When it comes to hiring contract employees, it is crucial for employers to ensure compliance with employment laws. This not only protects the rights of contract employees but also helps businesses avoid legal issues and penalties.

One of the key aspects of compliance with employment laws is properly classifying contract employees. It is important to distinguish between independent contractors and employees, as they have different legal rights and obligations. Misclassifying employees as contractors can lead to legal consequences, such as fines and back payment of wages.

Additionally, employers must comply with laws related to minimum wage, overtime, and working hours. Contract employees should receive fair compensation for their work, and employers must ensure that they are paid at least the minimum wage and receive overtime pay when applicable.

Another important aspect of compliance is providing a safe and healthy work environment for contract employees. Employers must adhere to occupational health and safety regulations and take necessary measures to prevent workplace accidents and injuries. This includes providing proper training, safety equipment, and maintaining a hazard-free workplace.

Furthermore, employers must comply with anti-discrimination laws and ensure that contract employees are not subjected to any form of discrimination or harassment based on their race, gender, age, religion, or other protected characteristics. This includes providing equal opportunities for contract employees and addressing any complaints or concerns promptly and appropriately.

Compliance with employment laws also involves proper recordkeeping and reporting obligations. Employers must maintain accurate records of contract employees’ hours worked, wages paid, and other relevant information. These records may be subject to inspection by government agencies, and failure to maintain them can result in penalties.

Protecting the Rights of Contract Employees

Contract employees play a crucial role in many organizations, and it is essential to protect their rights. While they may not be considered traditional employees, they still deserve fair treatment and legal protection. Here are some key ways to ensure the rights of contract employees are safeguarded:

1. Clear and Fair Contracts: It is crucial to have well-drafted contracts that clearly outline the terms and conditions of the employment relationship. These contracts should include details such as the scope of work, compensation, duration of the contract, and any other relevant provisions. By having clear contracts, both parties can understand their rights and obligations.

2. Equal Treatment: Contract employees should be treated equally and fairly compared to other employees in similar positions. They should not face any discrimination or unfair treatment based on factors such as race, gender, age, or disability. Employers should ensure that all employees, including contract workers, have access to the same benefits, training opportunities, and workplace facilities.

3. Payment and Benefits: Contract employees should receive timely and accurate payment for their work. Employers should adhere to the agreed-upon payment terms and ensure that contract workers are compensated fairly. Additionally, contract employees should have access to benefits such as health insurance, retirement plans, and paid time off, as applicable.

4. Health and Safety: Employers have a responsibility to provide a safe and healthy work environment for all employees, including contract workers. This includes complying with occupational health and safety regulations, providing necessary training and protective equipment, and addressing any workplace hazards promptly. Contract employees should be aware of their rights and responsibilities regarding workplace safety.

5. Grievance Procedures: Employers should establish clear procedures for contract employees to raise any concerns or grievances they may have. This can include a designated point of contact, a formal complaint process, and protection against retaliation for reporting issues. Contract workers should feel comfortable voicing their concerns without fear of negative consequences.

6. Legal Compliance: Employers must ensure that they comply with all relevant employment laws and regulations when engaging contract employees. This includes adhering to minimum wage requirements, providing appropriate working hours and breaks, and complying with tax and labor laws. Employers should stay updated on any changes in employment legislation to ensure ongoing compliance.

By taking these steps, employers can protect the rights of contract employees and create a positive and fair working environment. This not only benefits the contract workers themselves but also contributes to the overall success and reputation of the organization.

Legal Requirements for Documenting Contract Employees

When it comes to hiring contract employees, there are certain legal requirements that employers must follow in order to ensure compliance with employment laws and protect the rights of these workers.

Written Contract Agreements: One of the key legal requirements for documenting contract employees is to have a written contract agreement in place. This agreement should clearly outline the terms and conditions of the employment, including the duration of the contract, the scope of work, and the compensation.

Verification of Employment Eligibility: Employers are also required to verify the employment eligibility of contract employees. This typically involves completing Form I-9, which requires the employee to provide documentation to prove their identity and authorization to work in the United States.

Recordkeeping and Reporting Obligations: In addition, employers must maintain accurate records of contract employees, including their personal information, employment history, and any relevant documentation. These records should be kept for a specified period of time as required by law.

By documenting contract employees in accordance with these legal requirements, employers can ensure that they are in compliance with employment laws and protect the rights of these workers. It also helps to establish a clear understanding between the employer and the contract employee, reducing the risk of disputes or misunderstandings in the future.

Written Contract Agreements

When it comes to documenting contract employees, one of the most important steps is to have written contract agreements in place. These agreements serve as a legal document that outlines the terms and conditions of the employment relationship between the employer and the contract employee.

A written contract agreement should include key details such as the duration of the contract, the scope of work, the compensation and benefits, and any other relevant terms and conditions. This document serves as a reference point for both parties and helps to ensure that there is a clear understanding of the expectations and obligations.

Having a written contract agreement is crucial for several reasons. First, it helps to protect the rights of both the employer and the contract employee. By clearly outlining the terms of the employment relationship, it reduces the risk of misunderstandings or disputes arising in the future.

Second, a written contract agreement helps to establish the legal relationship between the employer and the contract employee. It provides evidence of the agreement and can be used as a reference in case of any legal issues or disputes.

Finally, a written contract agreement is essential for compliance with employment laws. Many jurisdictions require employers to have written contracts with their contract employees, and failure to do so can result in legal consequences.

When drafting a written contract agreement, it is important to ensure that it is clear, concise, and comprehensive. Both parties should have a clear understanding of the terms and conditions, and any ambiguities should be clarified before signing the agreement.

Verification of Employment Eligibility

One of the key legal requirements for documenting contract employees is verifying their employment eligibility. This process ensures that the contract employees are legally allowed to work in the country and helps employers avoid potential legal issues.

Employers are required to verify the employment eligibility of contract employees by completing Form I-9, which is issued by the U.S. Citizenship and Immigration Services (USCIS). This form requires the contract employees to provide certain documents that establish their identity and employment authorization.

When completing Form I-9, employers must carefully review the documents provided by the contract employees to ensure their authenticity and validity. The form includes a list of acceptable documents, such as a U.S. passport, permanent resident card, or employment authorization document, that can be used to establish employment eligibility.

It is important for employers to follow the instructions provided by the USCIS when completing Form I-9 and to keep the completed forms on file for a specified period of time. Failure to comply with the verification requirements can result in penalties and legal consequences for employers.

By verifying the employment eligibility of contract employees, employers can ensure that they are hiring individuals who are legally authorized to work in the country. This helps protect the rights of contract employees and ensures compliance with employment laws.

Recordkeeping and Reporting Obligations

Recordkeeping and reporting obligations are essential when it comes to documenting contract employees. Employers must maintain accurate and up-to-date records of their contract employees to ensure compliance with employment laws and protect the rights of these workers.

One of the primary recordkeeping obligations is to maintain a written contract agreement with each contract employee. This agreement should outline the terms and conditions of the employment, including the duration of the contract, the scope of work, and the compensation. It is crucial to have this document in writing to avoid any misunderstandings or disputes in the future.

In addition to the contract agreement, employers must also keep records of the verification of employment eligibility for contract employees. This includes verifying the employee’s identity and work authorization through the completion of Form I-9. Employers must retain these forms for a specified period, typically three years from the date of hire or one year after the termination of employment, whichever is later.

Furthermore, employers have reporting obligations when it comes to contract employees. They must report certain information to government agencies, such as the Internal Revenue Service (IRS) and the Department of Labor (DOL). This includes reporting wages paid to contract employees, as well as any taxes withheld or contributions made on their behalf.

Employers may also be required to provide contract employees with certain notices, such as those related to wage and hour laws or workplace safety regulations. These notices should be documented and kept on file to demonstrate compliance with applicable laws and regulations.

Overall, recordkeeping and reporting obligations play a crucial role in documenting contract employees. By maintaining accurate records and fulfilling reporting requirements, employers can ensure compliance with employment laws and protect the rights of their contract employees.

Question-answer:

What are the legal requirements for documenting contract employees?

The legal requirements for documenting contract employees vary depending on the country and jurisdiction. In general, contract employees should have a written contract that outlines the terms of their employment, including their job responsibilities, compensation, and duration of the contract. They may also need to provide identification documents, such as a passport or driver’s license, for verification purposes.

Do contract employees need to have work permits?

Whether contract employees need work permits depends on the country and the specific circumstances. In some cases, contract employees may be required to obtain work permits if they are working in a foreign country or if their contract exceeds a certain duration. It is important for both the employer and the contract employee to understand and comply with the immigration laws and regulations of the country where the work is taking place.

What happens if contract employees are not properly documented?

If contract employees are not properly documented, it can lead to legal and financial consequences for both the employer and the employee. The employer may face penalties for hiring undocumented workers, while the employee may be at risk of losing their job or facing immigration issues. It is important for both parties to ensure that all necessary documentation is in place to comply with the legal requirements.

Are there any specific documents that contract employees need to provide?

The specific documents that contract employees need to provide may vary depending on the country and the nature of their work. In general, contract employees may be required to provide identification documents, such as a passport or driver’s license, for verification purposes. They may also need to provide proof of their qualifications or certifications, depending on the requirements of the job. It is important for contract employees to consult with their employer or legal advisor to determine the specific documents they need to provide.

What are the consequences of hiring contract employees without proper documentation?

Hiring contract employees without proper documentation can have serious consequences for employers. They may face legal penalties, fines, and damage to their reputation. Additionally, hiring undocumented workers can create a hostile work environment and lead to employee dissatisfaction. It is important for employers to ensure that all contract employees are properly documented to avoid these potential consequences.

What are the legal requirements for documenting contract employees?

The legal requirements for documenting contract employees vary depending on the country and jurisdiction. In general, contract employees should have a written contract that outlines the terms of their employment, including their job responsibilities, compensation, and duration of the contract. Additionally, employers may be required to verify the eligibility of contract employees to work in the country by completing and retaining certain documentation, such as Form I-9 in the United States.

What happens if an employer fails to document contract employees?

If an employer fails to document contract employees according to the legal requirements, they may face penalties and legal consequences. These consequences can vary depending on the jurisdiction, but they may include fines, lawsuits from employees, and potential damage to the employer’s reputation. It is important for employers to understand and comply with the legal requirements for documenting contract employees to avoid these potential consequences.