- Do You Need a Contract for a W2 Employee?

- Understanding the Importance of Employment Contracts

- Protecting Your Business

- Clarifying Expectations

- Ensuring Legal Compliance

- Question-answer:

- What is a W2 employee?

- Is a contract necessary for a W2 employee?

- What should be included in a contract for a W2 employee?

- Can a contract for a W2 employee be modified?

- What happens if there is no contract for a W2 employee?

When hiring a W2 employee, it is important to establish a clear and legally binding agreement between the employer and the employee. While a contract may not be required by law, having one in place can provide numerous benefits and protections for both parties involved.

A contract for a W2 employee outlines the terms and conditions of employment, including the job responsibilities, compensation, benefits, and any other relevant details. It serves as a reference point for both the employer and the employee, ensuring that everyone is on the same page and understands their rights and obligations.

One of the main advantages of having a contract is that it helps to prevent misunderstandings and disputes. By clearly defining the expectations and responsibilities of both parties, a contract can help to minimize the risk of disagreements and provide a framework for resolving any issues that may arise.

In addition, a contract can also provide legal protection for both the employer and the employee. It can include clauses that address confidentiality, non-compete agreements, intellectual property rights, and other important matters. This can help to safeguard sensitive information and prevent employees from engaging in activities that may harm the company.

Overall, while a contract may not be legally required for a W2 employee, it is highly recommended to have one in place. It can provide clarity, protection, and peace of mind for both the employer and the employee, ensuring a smooth and mutually beneficial working relationship.

Do You Need a Contract for a W2 Employee?

When hiring a W2 employee, it is essential to have a contract in place. While it may not be legally required, having a written agreement can protect both the employer and the employee.

One of the main reasons to have a contract is to clarify the terms and conditions of employment. This includes the job responsibilities, work schedule, compensation, and any benefits or perks that may be offered. By clearly outlining these details in a contract, both parties can have a clear understanding of what is expected.

Another important aspect of having a contract is to ensure legal compliance. The contract can include provisions that comply with federal, state, and local employment laws. This can help protect the employer from potential legal issues and ensure that the employee’s rights are protected.

Having a contract also provides a level of protection for the employer. It can include provisions such as non-disclosure agreements, non-compete clauses, and intellectual property rights. These provisions can help safeguard the employer’s business interests and prevent the employee from sharing sensitive information or competing with the company.

In addition to protecting the employer, a contract can also benefit the employee. It can provide job security by outlining the terms of employment, including the duration of the contract and any termination clauses. This can give the employee peace of mind knowing that their position is secure for a specific period of time.

Understanding the Importance of Employment Contracts

Employment contracts play a crucial role in the relationship between employers and employees. They serve as legally binding agreements that outline the terms and conditions of employment, ensuring that both parties are aware of their rights and responsibilities.

One of the main reasons why employment contracts are important is that they protect the interests of the business. By clearly defining the expectations and obligations of the employee, the contract helps to minimize the risk of disputes and legal issues. It provides a framework for resolving conflicts and ensures that the employer has the necessary legal recourse in case of any breach of contract.

Moreover, employment contracts help to clarify expectations. They outline the job duties, work hours, compensation, benefits, and other important details that both the employer and employee need to be aware of. This clarity helps to prevent misunderstandings and ensures that everyone is on the same page regarding what is expected from the employment relationship.

Another crucial aspect of employment contracts is ensuring legal compliance. These contracts are designed to comply with labor laws and regulations, protecting both the employer and the employee. They include provisions related to minimum wage, overtime pay, non-disclosure agreements, non-compete clauses, and other legal requirements. By having a well-drafted employment contract, businesses can avoid potential legal pitfalls and penalties.

Protecting Your Business

Having a contract for your W2 employees is essential for protecting your business. It establishes clear guidelines and expectations for both parties involved, ensuring that everyone is on the same page.

By having a contract in place, you can outline the specific terms and conditions of employment, including job responsibilities, work hours, compensation, and benefits. This helps to prevent any misunderstandings or disputes that may arise in the future.

In addition, a contract can also include clauses that protect your business’s intellectual property, confidential information, and trade secrets. This ensures that your proprietary information remains secure and that employees are aware of their obligations to maintain confidentiality.

Furthermore, a contract can include provisions for non-compete agreements and non-solicitation agreements. These clauses prevent employees from leaving your company and immediately starting a competing business or soliciting your clients or employees.

By including these protective measures in your employment contracts, you can safeguard your business’s interests and prevent potential harm or loss. It gives you legal recourse in case of any breaches or violations by your employees.

Overall, having a contract for your W2 employees is a crucial step in protecting your business. It provides clarity, establishes expectations, and safeguards your intellectual property and confidential information. Don’t underestimate the importance of employment contracts in ensuring the long-term success and security of your business.

Clarifying Expectations

When hiring a W2 employee, it is crucial to have a contract in place to clarify expectations. This contract serves as a written agreement between the employer and the employee, outlining the terms and conditions of the employment relationship.

By having a contract, both parties can clearly understand their roles and responsibilities. This helps to avoid any misunderstandings or disputes that may arise in the future. The contract should include details such as job title, job description, work schedule, compensation, benefits, and any other relevant information.

Having a contract that clearly outlines expectations can also help to improve communication between the employer and the employee. It provides a framework for discussing performance expectations, goals, and objectives. This can lead to a more productive and harmonious working relationship.

Additionally, a contract can help to protect the employer’s interests. It can include provisions such as confidentiality agreements, non-compete clauses, and intellectual property rights. These provisions can help to safeguard sensitive information and prevent employees from taking advantage of their position within the company.

Furthermore, a contract can ensure legal compliance. It can include provisions that comply with federal, state, and local employment laws. This can help to protect the employer from potential legal issues and penalties.

Ensuring Legal Compliance

When hiring a W2 employee, it is crucial to ensure legal compliance through the use of an employment contract. This contract serves as a legally binding agreement between the employer and the employee, outlining the terms and conditions of their working relationship.

By having a contract in place, both parties are protected and aware of their rights and responsibilities. The contract should include important details such as the job title, job description, compensation, benefits, working hours, and any other relevant terms specific to the employment.

One of the main reasons for having an employment contract is to ensure compliance with labor laws and regulations. The contract should clearly state that both the employer and the employee will adhere to all applicable laws, including minimum wage requirements, overtime regulations, and workplace safety standards.

In addition to legal compliance, an employment contract can also help protect the employer’s business interests. It can include provisions such as non-disclosure agreements, non-compete clauses, and intellectual property rights, which prevent the employee from sharing sensitive information or competing with the employer after leaving the company.

Furthermore, the contract can help clarify expectations for both parties. It can outline the employee’s duties and responsibilities, as well as the employer’s expectations regarding performance, conduct, and attendance. This clarity can help prevent misunderstandings and disputes in the future.

Overall, ensuring legal compliance through an employment contract is essential for any business hiring W2 employees. It provides protection, clarity, and peace of mind for both the employer and the employee, establishing a solid foundation for a successful working relationship.

Question-answer:

What is a W2 employee?

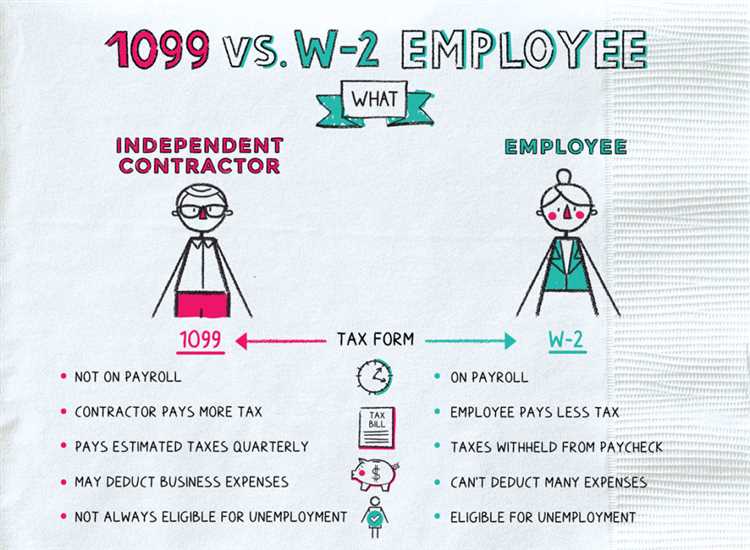

A W2 employee is a worker who is classified as an employee by the company they work for. They receive a W2 form at the end of the year, which reports their wages and taxes withheld.

Is a contract necessary for a W2 employee?

While a contract is not legally required for a W2 employee, it is highly recommended to have one. A contract helps establish the terms and conditions of employment, including job responsibilities, compensation, benefits, and termination procedures.

What should be included in a contract for a W2 employee?

A contract for a W2 employee should include the employee’s job title, duties and responsibilities, compensation and benefits, work schedule, vacation and sick leave policies, confidentiality and non-compete agreements, and termination procedures.

Can a contract for a W2 employee be modified?

Yes, a contract for a W2 employee can be modified if both the employer and employee agree to the changes. It is important to document any modifications in writing and have both parties sign the updated contract.

What happens if there is no contract for a W2 employee?

If there is no contract for a W2 employee, the terms and conditions of employment may be subject to interpretation and disputes. It can also make it more difficult to enforce certain rights or obligations. Having a contract helps provide clarity and protection for both the employer and employee.