- Do I Need a Signed Contract with My 1099 Employee? [Your Company Name]

- Understanding the Importance of a Signed Contract

- Legal Protection

- Clear Expectations

- Dispute Resolution

- Question-answer:

- What is a 1099 employee?

- Do I need a signed contract with my 1099 employee?

- Can I use a template contract for my 1099 employee?

- What are the consequences of not having a signed contract with a 1099 employee?

- Do I need a signed contract with my 1099 employee?

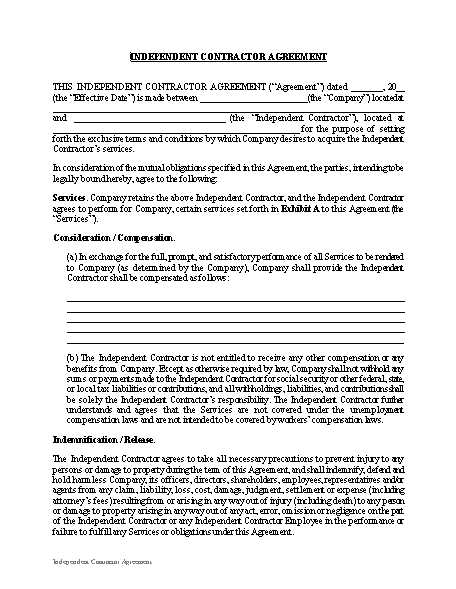

When hiring a 1099 employee, it is important to establish a clear and legally binding agreement. While it may be tempting to skip the formalities and rely on a verbal agreement, having a signed contract is crucial for both parties involved. A signed contract provides protection and clarity, ensuring that both the employer and the employee are on the same page regarding expectations, responsibilities, and compensation.

One of the main reasons to have a signed contract with a 1099 employee is to establish the nature of the working relationship. Unlike traditional employees, 1099 employees are considered independent contractors, which means they are not entitled to the same benefits and protections as regular employees. A signed contract can help clarify this distinction and prevent any misunderstandings or misclassifications.

Additionally, a signed contract can outline the specific terms and conditions of the working arrangement. This includes details such as the scope of work, project deadlines, payment terms, and any confidentiality or non-compete agreements. Having these terms in writing can help prevent disputes and provide a reference point in case any issues arise during the course of the working relationship.

Do I Need a Signed Contract with My 1099 Employee? [Your Company Name]

As an employer, it is crucial to have a signed contract with your 1099 employee. This contract serves as a legally binding agreement between you and the employee, outlining the terms and conditions of their employment.

Having a signed contract provides several benefits for both parties involved. Firstly, it offers legal protection for your company. The contract clearly defines the relationship between you and the employee, ensuring that both parties understand their rights and responsibilities. In the event of a dispute or legal issue, the contract can serve as evidence of the agreed-upon terms.

Additionally, a signed contract helps establish clear expectations. It outlines the scope of work, payment terms, and any other relevant details. This clarity helps prevent misunderstandings and ensures that both parties are on the same page regarding the work to be performed.

Furthermore, a signed contract provides a framework for dispute resolution. In the event of a disagreement or conflict, the contract can serve as a reference point for resolving the issue. It may outline a specific process or procedure for handling disputes, such as mediation or arbitration.

Understanding the Importance of a Signed Contract

When hiring a 1099 employee, it is crucial to have a signed contract in place. This contract serves as a legally binding agreement between you and the employee, outlining the terms and conditions of the working relationship.

There are several reasons why a signed contract is important:

- Legal Protection: A signed contract provides legal protection for both parties involved. It clearly defines the rights and responsibilities of each party, ensuring that both parties are aware of their obligations and can hold each other accountable.

- Clear Expectations: A signed contract helps establish clear expectations for the 1099 employee. It outlines the scope of work, deadlines, and any specific requirements or deliverables. This clarity helps prevent misunderstandings and ensures that both parties are on the same page.

- Dispute Resolution: In the event of a dispute or disagreement, a signed contract can serve as a reference point for resolving the issue. It provides a framework for addressing conflicts and can help facilitate a smoother resolution process.

Overall, a signed contract is essential for establishing a professional and transparent working relationship with your 1099 employee. It protects both parties’ interests, clarifies expectations, and provides a roadmap for resolving any potential conflicts that may arise.

Legal Protection

When hiring a 1099 employee, it is crucial to have a signed contract in place to ensure legal protection for both parties involved. A signed contract serves as a legally binding agreement that outlines the terms and conditions of the working relationship.

By having a signed contract, you can protect your business from potential legal disputes and liabilities. The contract should clearly define the scope of work, payment terms, and any other relevant details. This helps to establish a clear understanding between you and the 1099 employee, minimizing the risk of misunderstandings or disagreements.

In the event of a dispute, a signed contract can serve as evidence of the agreed-upon terms. It can help resolve conflicts more efficiently and effectively, as both parties can refer to the contract to determine their rights and obligations.

Additionally, a signed contract can provide protection against misclassification claims. Classifying a worker as a 1099 employee means they are considered an independent contractor, not an employee. However, misclassification can lead to legal consequences and potential penalties. Having a signed contract that clearly states the independent contractor relationship can help demonstrate that the worker is not an employee.

In summary, a signed contract with a 1099 employee is essential for legal protection. It establishes clear expectations, helps resolve disputes, and provides evidence of the working relationship. By ensuring that both parties are on the same page, a signed contract can help protect your business and mitigate potential legal risks.

Clear Expectations

Having a signed contract with your 1099 employee is crucial for establishing clear expectations. This document outlines the scope of work, deadlines, and deliverables that both parties agree upon. By clearly defining the responsibilities and tasks, you can avoid any misunderstandings or disputes in the future.

A signed contract ensures that your 1099 employee understands what is expected of them and what they will be accountable for. It sets the groundwork for a successful working relationship by providing a roadmap for both parties to follow.

With clear expectations in place, your 1099 employee will have a better understanding of their role and responsibilities. They will know what tasks they need to complete, the quality of work expected, and any specific guidelines or requirements they need to adhere to.

Additionally, a signed contract can help manage expectations regarding timelines and deadlines. It allows you to specify project milestones and due dates, ensuring that your 1099 employee understands the timeline for completing their work. This clarity helps prevent any delays or misunderstandings that could impact the overall project or business operations.

By establishing clear expectations through a signed contract, you can foster a productive and efficient working relationship with your 1099 employee. It provides a framework for communication and accountability, allowing both parties to work towards a common goal.

Overall, having a signed contract with your 1099 employee is essential for setting clear expectations. It helps avoid misunderstandings, ensures accountability, and promotes a successful working relationship. Make sure to draft a comprehensive contract that covers all relevant aspects of the working arrangement to protect both parties and facilitate a smooth collaboration.

Dispute Resolution

Disputes can arise in any business relationship, and it’s important to have a clear process in place for resolving them. When working with a 1099 employee, having a signed contract can be especially beneficial in this regard.

A signed contract outlines the steps that both parties must take in the event of a dispute. This can include requirements for mediation or arbitration, which can help to resolve conflicts in a more efficient and cost-effective manner than going to court.

By including a dispute resolution clause in the contract, you can ensure that both parties are aware of the process and are committed to following it. This can help to prevent misunderstandings and disagreements from escalating into full-blown legal battles.

Additionally, a signed contract can provide evidence of the agreed-upon terms and conditions of the working relationship. This can be crucial in resolving disputes, as it can help to clarify any ambiguities or disagreements that may arise.

Overall, having a signed contract with your 1099 employee can provide a solid foundation for resolving disputes. It can help to ensure that both parties are on the same page and are committed to finding a fair and equitable solution.

Question-answer:

What is a 1099 employee?

A 1099 employee, also known as an independent contractor, is a worker who is not considered an employee by the company they work for. Instead, they are self-employed and are responsible for paying their own taxes.

Do I need a signed contract with my 1099 employee?

Yes, it is highly recommended to have a signed contract with your 1099 employee. A contract helps establish the terms and conditions of the working relationship, including the scope of work, payment terms, and any other important details. It provides protection for both parties and helps prevent misunderstandings or disputes in the future.

Can I use a template contract for my 1099 employee?

Yes, using a template contract can be a good starting point for creating a contract with your 1099 employee. However, it is important to customize the template to fit the specific needs of your business and the nature of the work being performed. It is recommended to consult with a legal professional to ensure the contract is legally binding and covers all necessary aspects.

What are the consequences of not having a signed contract with a 1099 employee?

Not having a signed contract with a 1099 employee can lead to various issues and potential legal disputes. Without a contract, it may be difficult to prove the terms and conditions of the working relationship, which can result in disagreements over payment, scope of work, or other important details. Additionally, a contract helps establish the independent contractor status of the worker, which can be important for tax purposes. It is always best to have a signed contract in place to protect both parties involved.

Do I need a signed contract with my 1099 employee?

Yes, it is highly recommended to have a signed contract with your 1099 employee. This contract will outline the terms and conditions of the working relationship, including the scope of work, payment terms, and any other important details. Having a signed contract can help protect both parties in case of any disputes or misunderstandings.