- When Do I Need a W-9 for a Contracted Employee? Your Guide to IRS Form W-9

- Understanding the Purpose of IRS Form W-9

- Identifying Information

- Taxpayer Identification Number

- Certification

- When is a W-9 Required for a Contracted Employee?

- Independent Contractor Relationship

- Question-answer:

- What is a W-9 form?

- When do I need to obtain a W-9 from a contracted employee?

- What information is required on a W-9 form?

- What should I do with the completed W-9 form?

As a business owner, it is important to understand the various forms and documents required by the Internal Revenue Service (IRS) when hiring contracted employees. One such form is the W-9, which is used to collect the necessary information from the employee for tax purposes. In this guide, we will explore when you need a W-9 for a contracted employee and how to properly fill out the form.

So, when exactly do you need a W-9 for a contracted employee? The answer is simple: whenever you plan to pay them $600 or more in a calendar year. The IRS requires businesses to obtain a completed W-9 form from any contracted employee who meets this threshold. This form is crucial for ensuring that the correct tax information is reported to the IRS and that the employee receives the appropriate tax documents at the end of the year.

Now that you know when you need a W-9, let’s dive into how to fill out the form. The W-9 form consists of several sections that require the contracted employee to provide their personal information, such as their name, address, and taxpayer identification number (TIN). It is important to ensure that all information provided is accurate and up to date, as any errors or discrepancies could lead to issues with tax reporting.

Remember, as a business owner, it is your responsibility to collect and retain the completed W-9 forms from your contracted employees. Failure to do so could result in penalties from the IRS. By following the guidelines outlined in this guide, you can ensure that you are in compliance with IRS regulations and that your tax reporting is accurate and complete.

When Do I Need a W-9 for a Contracted Employee? Your Guide to IRS Form W-9

As an employer or business owner, it is important to understand when you need to obtain a W-9 form from a contracted employee. The IRS Form W-9 is used to collect the taxpayer identification number (TIN) of the individual or entity that is being paid for services rendered.

So, when do you need a W-9 for a contracted employee? The general rule is that you need to obtain a W-9 form if you are making payments to an individual or entity for services performed as an independent contractor. This includes payments for freelance work, consulting services, or any other type of work where the individual or entity is not considered an employee.

It is important to note that the threshold for obtaining a W-9 form is $600 or more in payments made to the contracted employee within a calendar year. If the total payments made to the individual or entity are less than $600, you are not required to obtain a W-9 form.

Obtaining a W-9 form from a contracted employee is crucial for tax reporting purposes. The information provided on the form, such as the TIN, will be used to report the payments made to the individual or entity to the IRS. This ensures that the contracted employee is properly reporting their income and paying any applicable taxes.

Additionally, having a W-9 form on file for each contracted employee makes it easier to issue Form 1099-MISC at the end of the year. Form 1099-MISC is used to report payments made to independent contractors and is required to be provided to the contracted employee and filed with the IRS.

Understanding the Purpose of IRS Form W-9

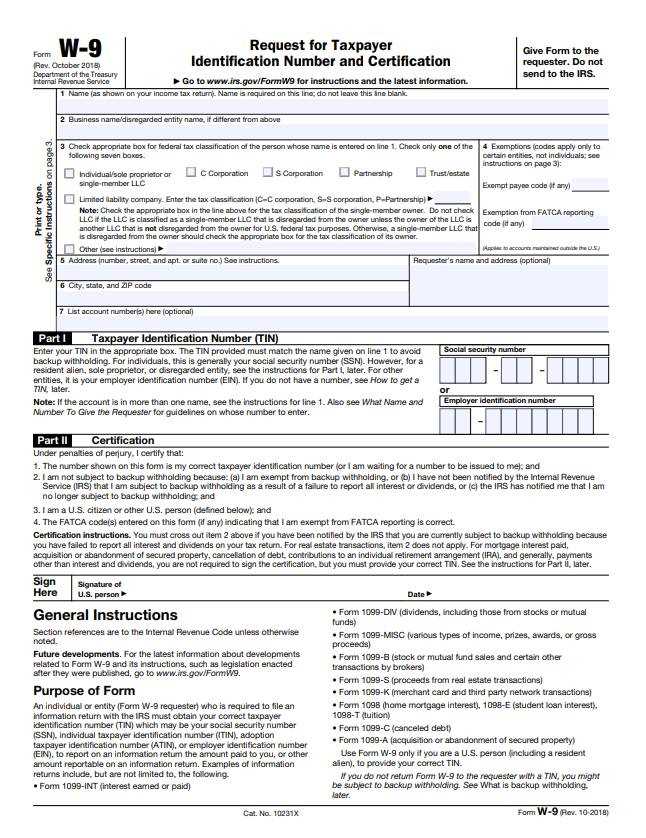

IRS Form W-9, also known as the Request for Taxpayer Identification Number and Certification, is a document used by businesses to gather information from individuals or entities they plan to pay for services rendered. The purpose of Form W-9 is to collect the necessary information to report payments made to the Internal Revenue Service (IRS) and to the payee.

When a business hires an independent contractor or a freelancer, they are required to obtain certain information from the contractor in order to comply with tax regulations. This is where Form W-9 comes into play. The form asks for the contractor’s name, address, and taxpayer identification number (TIN), which is usually their Social Security Number (SSN) or Employer Identification Number (EIN).

By collecting this information, the business can accurately report the payments made to the contractor to the IRS. This is important for tax purposes, as the IRS uses this information to ensure that individuals and businesses are reporting their income accurately and paying the appropriate amount of taxes.

Form W-9 also includes a certification section where the contractor certifies that the information provided is correct and that they are not subject to backup withholding. Backup withholding is a tax withholding method used by the IRS to ensure that individuals or entities who receive income are paying their taxes correctly. By certifying that they are not subject to backup withholding, the contractor confirms that they are responsible for reporting and paying their own taxes.

In summary, the purpose of IRS Form W-9 is to collect the necessary information from contracted employees or independent contractors in order to accurately report payments made to them to the IRS. This helps ensure compliance with tax regulations and allows the IRS to monitor and enforce tax laws effectively.

Identifying Information

Identifying information is a crucial component of IRS Form W-9. This section requires the contracted employee to provide their name, address, and business name (if applicable). It is important to ensure that this information is accurate and up-to-date, as it will be used for tax reporting purposes.

The name provided should match the name on the employee’s tax return, and any changes to the name or address should be reported to the IRS. The address provided should be the employee’s current mailing address, where they can receive any necessary tax documents or correspondence from the IRS.

If the contracted employee is operating under a business name, they should provide that information as well. This is especially important if the employee is a sole proprietor or is operating as a partnership or LLC. The business name should be the legal name under which the employee is conducting business.

It is essential to provide accurate identifying information on IRS Form W-9 to ensure that the correct tax reporting and documentation can be completed. Failure to provide accurate information may result in penalties or delays in processing the employee’s tax documents.

Taxpayer Identification Number

The Taxpayer Identification Number (TIN) is a crucial component of the IRS Form W-9. It is used to identify the contracted employee for tax purposes. The TIN can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

If the contracted employee is an individual, they will provide their SSN as their TIN. This is the most common scenario for independent contractors. The SSN is a unique nine-digit number issued by the Social Security Administration to individuals for tax and identification purposes.

On the other hand, if the contracted employee is a business entity, such as a corporation or partnership, they will provide their EIN as their TIN. The EIN is a unique nine-digit number assigned by the IRS to business entities for tax reporting purposes.

It is important for the contracted employee to provide their correct TIN on the IRS Form W-9. This ensures that the correct tax information is reported to the IRS and that the contracted employee receives the appropriate tax documents, such as a Form 1099-MISC, at the end of the year.

The TIN is a sensitive piece of information and should be handled with care. It is important for businesses to securely store the TINs of their contracted employees and only use them for legitimate tax reporting purposes.

In summary, the Taxpayer Identification Number is a key element of the IRS Form W-9. It helps identify the contracted employee for tax purposes and can be either a Social Security Number (SSN) or an Employer Identification Number (EIN). Providing the correct TIN ensures accurate tax reporting and compliance with IRS regulations.

Certification

The certification section of IRS Form W-9 is where the contracted employee confirms the accuracy of the information provided on the form. By signing the certification, the employee is stating that they are a U.S. citizen or resident alien and that the taxpayer identification number (TIN) provided is correct.

It is important for the contracted employee to carefully review the information they have provided on the form before signing the certification. Any errors or inaccuracies could lead to issues with tax reporting and compliance.

The certification also includes a statement regarding backup withholding. Backup withholding is a tax withholding requirement that may apply in certain situations, such as when the contracted employee fails to provide a correct TIN or fails to report interest or dividend income. The certification section of Form W-9 allows the employee to indicate whether they are subject to backup withholding.

By signing the certification, the contracted employee acknowledges their responsibility to report all income and pay any taxes owed. It is important for both the employee and the employer to understand the implications of the certification and to ensure that all information provided on Form W-9 is accurate and up to date.

Failure to provide a completed and signed Form W-9 when required can result in penalties and potential legal issues. It is essential for both parties to comply with IRS regulations and to maintain accurate records for tax purposes.

Overall, the certification section of IRS Form W-9 serves as a declaration by the contracted employee that the information provided is true and accurate. It is a crucial step in the process of establishing the employee’s tax status and ensuring compliance with IRS requirements.

When is a W-9 Required for a Contracted Employee?

IRS Form W-9 is required for a contracted employee when certain conditions are met. The main factor that determines the need for a W-9 is the classification of the worker as an independent contractor.

According to the IRS, an independent contractor is someone who performs services for a business, but is not an employee of that business. This means that the worker has control over how the work is performed and is responsible for their own taxes and benefits.

When a business hires an independent contractor and pays them $600 or more in a calendar year, they are required to obtain a completed W-9 form from the contractor. The purpose of the W-9 form is to collect the contractor’s taxpayer identification number (TIN) and other identifying information.

The TIN is usually the contractor’s Social Security number (SSN) or employer identification number (EIN). This information is necessary for the business to report the contractor’s income to the IRS and issue a 1099-MISC form at the end of the year.

By obtaining a completed W-9 form, the business ensures that they have the necessary information to accurately report the contractor’s income and comply with tax regulations. It also helps the contractor avoid any potential penalties for failing to provide their TIN.

It’s important for businesses to understand the requirements for obtaining a W-9 form and to keep accurate records of their independent contractor relationships. Failing to comply with these requirements can result in penalties and legal consequences.

Overall, a W-9 form is required for a contracted employee when they are classified as an independent contractor and the business pays them $600 or more in a calendar year. It is a crucial document for ensuring compliance with tax regulations and accurately reporting income to the IRS.

Independent Contractor Relationship

When it comes to determining whether a worker is an independent contractor or an employee, the relationship between the worker and the company is crucial. The IRS uses a set of criteria to determine the nature of the relationship, and it is important for both the company and the worker to understand these criteria.

An independent contractor is someone who is self-employed and provides services to a company on a contract basis. They have control over how the work is performed and are responsible for their own taxes and benefits. On the other hand, an employee is someone who works for a company and is subject to the company’s control and direction.

When hiring a contracted employee, it is important for the company to establish and maintain an independent contractor relationship. This means that the company should not exercise control over how the work is performed, provide training or tools, or dictate the hours and location of work. Instead, the company should focus on the desired outcome and allow the contractor to use their own methods to achieve it.

It is also important for the contractor to understand their role as an independent contractor. They should be responsible for their own taxes, including self-employment taxes, and should not expect to receive benefits such as health insurance or retirement plans from the company. They should also be aware that they may need to provide their own tools and equipment for the job.

By establishing and maintaining an independent contractor relationship, both the company and the contracted employee can benefit. The company can save on payroll taxes and benefits costs, while the contractor can enjoy the flexibility and autonomy that comes with being self-employed.

However, it is important to note that misclassifying an employee as an independent contractor can have serious legal and financial consequences. The IRS and state agencies are cracking down on misclassification, and companies found to be in violation may be subject to penalties and back taxes.

Question-answer:

What is a W-9 form?

A W-9 form is a document used by businesses to collect information from independent contractors or freelancers. It is used to request the contractor’s taxpayer identification number (TIN) for tax reporting purposes.

When do I need to obtain a W-9 from a contracted employee?

You need to obtain a W-9 form from a contracted employee when you plan to pay them $600 or more in a calendar year for their services. This is because the IRS requires businesses to report payments made to independent contractors if the total amount exceeds $600.

What information is required on a W-9 form?

A W-9 form requires the contracted employee to provide their name, business name (if applicable), address, taxpayer identification number (TIN), and their certification of the accuracy of the information provided. The TIN can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

What should I do with the completed W-9 form?

Once you receive a completed W-9 form from a contracted employee, you should keep it on file for at least four years. This is important for tax reporting purposes and in case the IRS requests the information in the future. Make sure to securely store the form to protect the contractor’s sensitive information.