- Overview of the Income Form

- What is the Income Form?

- Why is the Income Form Important?

- Key Components of the Income Form

- Personal Information

- Contracted Employment Details

- Question-answer:

- What is the purpose of the Form 1099-MISC?

- Who needs to file a Form 1099-MISC?

- What information is required to fill out a Form 1099-MISC?

- What are the deadlines for filing a Form 1099-MISC?

- What are the consequences of not filing a Form 1099-MISC?

- What is the purpose of the Form 1099?

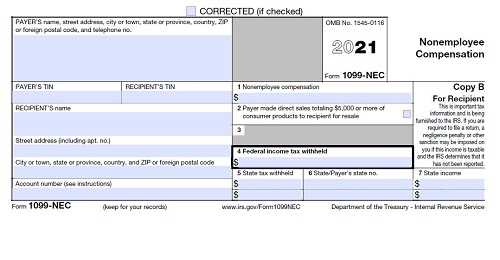

When it comes to filing taxes, understanding the various forms and documents can be a daunting task. For contracted employees, one important form to be familiar with is the form that reflects their income. This form provides a detailed breakdown of the income earned throughout the year and is crucial for accurately reporting earnings to the tax authorities.

The form that reflects income for contracted employees is typically known as the 1099 form. This form is issued by the employer or client who has hired the contracted employee and is used to report the income paid to the employee. Unlike the W-2 form, which is used for regular employees, the 1099 form is specifically designed for individuals who work on a contract basis.

One of the key differences between the 1099 form and the W-2 form is that contracted employees are responsible for paying their own taxes. This means that the income reported on the 1099 form does not have any taxes withheld, and it is up to the contracted employee to calculate and pay their own taxes based on their earnings. This can be a complex process, as contracted employees are also responsible for paying self-employment taxes in addition to income taxes.

It is important for contracted employees to keep accurate records of their income throughout the year, as this information will be used to complete the 1099 form. This includes documenting all payments received from clients or employers, as well as any expenses that can be deducted from the income. By keeping detailed records and understanding the form that reflects their income, contracted employees can ensure that they accurately report their earnings and fulfill their tax obligations.

Overview of the Income Form

The income form is a document that reflects the income earned by contracted employees. It is an essential tool for both employees and employers as it provides a detailed breakdown of the employee’s earnings.

The income form serves as a record of the employee’s income and is used for various purposes, including tax reporting, financial planning, and proof of income for loans or other financial transactions.

Employers are responsible for providing the income form to their contracted employees. The form typically includes information such as the employee’s name, address, social security number, and employment details.

Additionally, the income form includes a breakdown of the employee’s earnings, including wages, bonuses, commissions, and any other forms of compensation. It may also include deductions for taxes, insurance, retirement contributions, and other withholdings.

By providing a comprehensive overview of the employee’s income, the income form allows both the employee and the employer to accurately track and report earnings. It ensures transparency and accountability in the payment process and helps prevent any disputes or misunderstandings regarding compensation.

Furthermore, the income form is crucial for tax purposes. It provides the necessary information for employees to accurately report their income and calculate their tax liability. It also serves as supporting documentation in case of an audit or other tax-related inquiries.

What is the Income Form?

The Income Form is a document that reflects the income earned by contracted employees. It is an essential tool for both employees and employers to keep track of the income generated through contracted work.

This form provides a detailed breakdown of the income received by the employee, including the amount earned, the source of income, and any deductions or taxes withheld. It serves as a record of the employee’s earnings and is often used for tax purposes.

Contracted employees, such as freelancers or independent contractors, rely on the Income Form to accurately report their income and ensure compliance with tax regulations. It helps them calculate their tax liability and file their tax returns correctly.

For employers, the Income Form is crucial for maintaining accurate financial records and fulfilling their obligations to report employee income. It allows them to track the payments made to contracted employees and provide necessary documentation for tax reporting.

Overall, the Income Form plays a vital role in documenting and managing the income earned by contracted employees. It ensures transparency, accuracy, and compliance with tax regulations for both employees and employers.

Why is the Income Form Important?

The income form is an essential document for contracted employees as it serves as a record of their earnings and is used for various purposes. Here are some reasons why the income form is important:

| 1. Proof of Income: | The income form provides proof of the employee’s earnings, which is often required for various financial transactions such as applying for loans, mortgages, or credit cards. |

| 2. Tax Reporting: | The income form contains important information about the employee’s income, including wages, bonuses, and deductions. This information is crucial for accurate tax reporting and filing. |

| 3. Employment Verification: | Employers may request the income form as a means of verifying an employee’s employment and income details. This is often required for background checks or when applying for new job opportunities. |

| 4. Government Benefits: | Some government benefits or assistance programs require individuals to provide proof of their income. The income form can be used to demonstrate eligibility for such programs. |

| 5. Budgeting and Financial Planning: | Having a clear record of income through the income form allows employees to better manage their finances, create budgets, and plan for future expenses. |

Overall, the income form plays a crucial role in documenting and verifying an employee’s income, ensuring compliance with tax regulations, and facilitating various financial transactions and benefits. It is important for contracted employees to accurately fill out and retain their income forms for these reasons.

Key Components of the Income Form

The income form is a crucial document for contracted employees as it reflects their earnings and provides important information for tax purposes. It contains several key components that need to be accurately filled out to ensure compliance with tax regulations and to avoid any potential issues with the tax authorities.

1. Personal Information: This section requires the contracted employee to provide their full name, address, social security number, and other relevant personal details. It is important to double-check this information for accuracy as any mistakes could lead to delays or complications in the tax filing process.

2. Contracted Employment Details: In this section, the contracted employee needs to provide information about their employment arrangement. This includes the name and address of the contracting company, the duration of the contract, and the nature of the work performed. It is essential to provide clear and concise information to avoid any confusion or misunderstandings.

3. Earnings: This is perhaps the most critical component of the income form. It requires the contracted employee to report their earnings for the specified period. This includes both the gross income received from the contracting company and any deductions or expenses that may be eligible for tax deductions. It is crucial to accurately report all earnings to ensure compliance with tax laws.

4. Tax Withholdings: This section requires the contracted employee to indicate whether they want taxes to be withheld from their earnings or if they prefer to make estimated tax payments. It is important to carefully consider this decision and consult with a tax professional if needed to determine the best approach for your specific situation.

5. Signature: The income form must be signed and dated by the contracted employee to certify the accuracy of the information provided. This signature serves as a legal declaration and can be used as evidence in case of any disputes or audits.

Overall, the key components of the income form play a vital role in accurately reflecting the earnings of contracted employees and ensuring compliance with tax regulations. It is essential to carefully review and complete each section to avoid any potential issues or penalties related to tax filing.

Personal Information

Personal information is a crucial component of the income form for contracted employees. It includes details such as the employee’s full name, address, contact information, and social security number. This information is necessary for the proper identification and documentation of the employee.

When filling out the income form, it is important to provide accurate and up-to-date personal information. Any errors or discrepancies in this section can lead to issues with tax reporting and payment processing.

It is also essential to ensure the security and confidentiality of personal information. Employers should take appropriate measures to protect this data from unauthorized access or misuse.

Additionally, personal information may be used for other purposes, such as verifying eligibility for certain benefits or conducting background checks. Therefore, it is crucial to provide truthful and accurate information in this section.

Overall, personal information plays a vital role in the income form for contracted employees. It helps establish the identity of the employee and ensures the accuracy and integrity of the income reporting process.

Contracted Employment Details

Contracted employment details refer to the specific information related to the employment contract of a contracted employee. This section of the income form is crucial as it provides a comprehensive overview of the terms and conditions of the employment agreement.

Some of the key components included in this section are:

1. Contract Duration:

This specifies the length of the contract, including the start and end dates. It is important to accurately record this information to ensure compliance with labor laws and regulations.

2. Job Title and Description:

This section outlines the job title and provides a detailed description of the contracted employee’s responsibilities and duties. It helps to clarify the scope of work and expectations for the contracted employee.

3. Compensation:

This part of the form includes details about the contracted employee’s salary or hourly rate, as well as any additional benefits or allowances they are entitled to. It is essential to accurately record this information to ensure proper payment and taxation.

4. Working Hours:

This section specifies the contracted employee’s working hours, including the number of hours per day or week and any overtime arrangements. It helps to ensure that the contracted employee is aware of their working schedule and any applicable overtime policies.

5. Leave and Vacation:

This part of the form outlines the contracted employee’s entitlement to leave and vacation days. It includes information about annual leave, sick leave, and any other types of leave the employee is entitled to. It is important to accurately record this information to ensure compliance with labor laws and regulations.

Overall, the contracted employment details section of the income form provides a comprehensive overview of the terms and conditions of the employment contract. It helps to ensure that both the employer and the contracted employee have a clear understanding of their rights and responsibilities.

Question-answer:

What is the purpose of the Form 1099-MISC?

The Form 1099-MISC is used to report income received by contracted employees who are not considered regular employees. It is used to report income from self-employment, freelance work, or other types of contracted work.

Who needs to file a Form 1099-MISC?

Businesses or individuals who have paid $600 or more to a contracted employee during the tax year need to file a Form 1099-MISC. This includes payments for services, rent, prizes, awards, and other types of income.

What information is required to fill out a Form 1099-MISC?

To fill out a Form 1099-MISC, you will need the contracted employee’s name, address, and Social Security number or taxpayer identification number. You will also need to report the total amount of income paid to the employee during the tax year.

What are the deadlines for filing a Form 1099-MISC?

The deadline for filing a Form 1099-MISC with the IRS is January 31st of the year following the tax year. The deadline for providing a copy of the form to the contracted employee is also January 31st.

What are the consequences of not filing a Form 1099-MISC?

Failure to file a Form 1099-MISC or filing it late can result in penalties imposed by the IRS. The penalties vary depending on the length of the delay and the size of the business. It is important to file the form on time to avoid these penalties.

What is the purpose of the Form 1099?

The purpose of Form 1099 is to report income received by contracted employees, such as freelancers or independent contractors, to the Internal Revenue Service (IRS).