- Determining Your Employment Status

- Employee vs. Independent Contractor

- Factors to Consider

- Rights and Benefits of Contract Employees

- Contractual Agreements

- Question-answer:

- What is a contract employee?

- What are the benefits of being a contract employee?

- What are the disadvantages of being a contract employee?

- How is a contract employee different from a regular employee?

- Can a contract employee become a regular employee?

When it comes to employment, understanding your status is crucial. Are you a contract employee or a full-time employee? The distinction between the two can have significant implications for your rights, benefits, and job security. In this article, we will explore what it means to be a contract employee and how to determine your employment status.

A contract employee, also known as an independent contractor, is someone who works for a company on a temporary basis. Unlike full-time employees, contract employees are not considered permanent staff members. Instead, they are hired for a specific project or a fixed period of time. This arrangement offers flexibility for both the employer and the employee, but it also comes with certain trade-offs.

One of the main differences between contract employees and full-time employees is the level of job security. While full-time employees typically enjoy more stability and long-term employment, contract employees are often subject to shorter-term contracts. This means that once the project or contract is completed, the employment relationship may come to an end. However, it’s important to note that contract employees may have the opportunity to renew or extend their contracts depending on the needs of the company.

Another key distinction is the benefits and protections that contract employees are entitled to. Unlike full-time employees, contract employees are not usually eligible for benefits such as health insurance, retirement plans, or paid time off. Additionally, contract employees are responsible for paying their own taxes and may not be covered by certain employment laws and regulations that protect full-time employees.

Determining Your Employment Status

Understanding your employment status is crucial in order to know your rights and responsibilities as an employee. There are several factors that can help determine whether you are considered an employee or an independent contractor.

One of the main factors to consider is the level of control that your employer has over your work. If your employer has the right to control how, when, and where you perform your work, then you are likely considered an employee. On the other hand, if you have more freedom and control over your work, you may be classified as an independent contractor.

Another factor to consider is the nature of the work relationship. If you have a long-term, ongoing relationship with the employer and are an integral part of their business, you are more likely to be classified as an employee. However, if you are hired for a specific project or task and have a defined end date, you may be considered an independent contractor.

The method of payment can also be an indicator of your employment status. Employees are typically paid a regular salary or hourly wage, while independent contractors are often paid on a per-project basis or receive a flat fee for their services.

Additionally, the level of financial risk can play a role in determining your employment status. Employees generally have less financial risk as they are entitled to benefits such as health insurance, paid time off, and unemployment benefits. Independent contractors, on the other hand, are responsible for their own expenses and do not receive these benefits.

It is important to note that the determination of your employment status is not solely based on one factor, but rather a combination of these factors. The specific laws and regulations of your country or state may also play a role in determining your employment status.

| Factors to Consider | Employee | Independent Contractor |

|---|---|---|

| Level of control | High | Low |

| Nature of work relationship | Long-term, ongoing | Short-term, specific project |

| Method of payment | Regular salary or hourly wage | Per-project or flat fee |

| Level of financial risk | Low | High |

Understanding your employment status is important for both employees and employers. It helps ensure that workers receive the rights and benefits they are entitled to, and that employers comply with the appropriate laws and regulations.

Employee vs. Independent Contractor

When it comes to employment, there are two main categories: employees and independent contractors. Understanding the difference between these two classifications is crucial for both employers and workers.

An employee is someone who works for a company or organization under a contract of employment. They are typically hired to perform specific tasks or roles within the company and are subject to the control and direction of their employer. Employees are entitled to certain rights and benefits, such as minimum wage, overtime pay, and access to employee benefits like health insurance and retirement plans.

On the other hand, an independent contractor is a self-employed individual or business entity that provides services to another company or organization. Independent contractors are not considered employees and are not subject to the same level of control and direction from the company they work for. They have more flexibility in terms of how and when they perform their work and are responsible for their own taxes and benefits.

There are several factors that determine whether someone is classified as an employee or an independent contractor. These factors include the level of control the company has over the worker, the degree of independence the worker has, the method of payment, the provision of tools and equipment, and the duration of the working relationship.

It is important for both employers and workers to correctly classify their employment status. Misclassifying workers can have legal and financial consequences for employers, while workers may miss out on important rights and benefits if they are misclassified as independent contractors.

Factors to Consider

When determining your employment status as either an employee or an independent contractor, there are several factors that should be taken into consideration:

1. Control: One of the main factors to consider is the level of control that the employer has over the work being performed. If the employer has the right to control how, when, and where the work is done, then you are likely an employee. On the other hand, if you have the freedom to determine these aspects of your work, then you are more likely to be classified as an independent contractor.

2. Financial arrangement: Another important factor is the financial arrangement between you and the employer. If you are paid a regular salary or hourly wage, receive benefits, and have taxes withheld from your paycheck, then you are likely an employee. However, if you are paid a flat fee or project-based payment, are responsible for your own taxes, and do not receive benefits, then you are more likely to be considered an independent contractor.

3. Relationship: The nature of the relationship between you and the employer is also a factor to consider. If you have a long-term, ongoing relationship with the employer and are an integral part of their business, then you are more likely to be classified as an employee. On the other hand, if you have a short-term, project-based relationship and are providing a specialized service, then you are more likely to be considered an independent contractor.

4. Skill level: The level of skill required for the work being performed is another factor to consider. If the work requires specialized skills or expertise, then you are more likely to be classified as an independent contractor. However, if the work can be performed by anyone with general skills and training, then you are more likely to be considered an employee.

5. Risk and investment: The level of risk and investment involved in the work is also a factor to consider. If you bear the financial risk of the work, such as purchasing your own equipment or materials, and have the opportunity to make a profit or loss, then you are more likely to be considered an independent contractor. On the other hand, if the employer bears the financial risk and you are guaranteed a regular income, then you are more likely to be classified as an employee.

6. Integration: The degree of integration into the employer’s business is another factor to consider. If you are closely integrated into the employer’s operations, work alongside their employees, and are subject to their policies and procedures, then you are more likely to be classified as an employee. However, if you work independently, have your own clients, and operate your own business, then you are more likely to be considered an independent contractor.

It is important to note that no single factor is determinative in classifying your employment status. The IRS and other governing bodies consider all of these factors together to make a determination. If you are unsure about your employment status, it is recommended to consult with a legal professional or tax advisor.

Rights and Benefits of Contract Employees

Contract employees have certain rights and benefits that are different from those of regular employees. While they may not have the same job security as permanent employees, they often enjoy greater flexibility and higher pay rates. Here are some of the key rights and benefits that contract employees can expect:

| Rights | Benefits |

|---|---|

| 1. Freedom to choose projects and clients | 1. Higher pay rates |

| 2. Flexibility in working hours and location | 2. Opportunity to gain diverse experience |

| 3. Ability to negotiate contract terms | 3. Potential for higher earnings |

| 4. Protection under contract law | 4. Tax advantages for self-employed individuals |

| 5. Right to invoice for services rendered | 5. Independence and autonomy |

| 6. Right to terminate contract with notice | 6. Opportunity to build a professional network |

Contract employees have the freedom to choose the projects and clients they want to work with, allowing them to pursue their interests and develop their skills in specific areas. They also have the flexibility to set their own working hours and location, which can be a major advantage for those who value work-life balance or have other commitments.

One of the main benefits of being a contract employee is the potential for higher pay rates. Contract employees often earn more than regular employees due to their specialized skills and the temporary nature of their employment. They also have the opportunity to gain diverse experience by working on different projects with different clients, which can enhance their professional development and make them more marketable in the future.

Contract employees have the ability to negotiate their contract terms, including the duration of the contract, the scope of work, and the payment terms. This gives them a certain level of control over their work and allows them to ensure that their needs and expectations are met. They are also protected under contract law, which means that both parties are legally bound to fulfill their obligations as outlined in the contract.

Another advantage of being a contract employee is the tax advantages that come with being self-employed. Contract employees can deduct certain business expenses from their taxable income, which can result in significant tax savings. They also have the right to invoice for the services they have rendered, ensuring that they are compensated for their work in a timely manner.

Contract employees have the right to terminate their contract with notice, giving them the flexibility to move on to new opportunities or pursue other interests. This freedom and independence can be highly appealing to individuals who value autonomy and control over their career. Additionally, contract work provides an opportunity to build a professional network, as contract employees often work with different clients and colleagues, allowing them to expand their contacts and potentially open doors to future opportunities.

Contractual Agreements

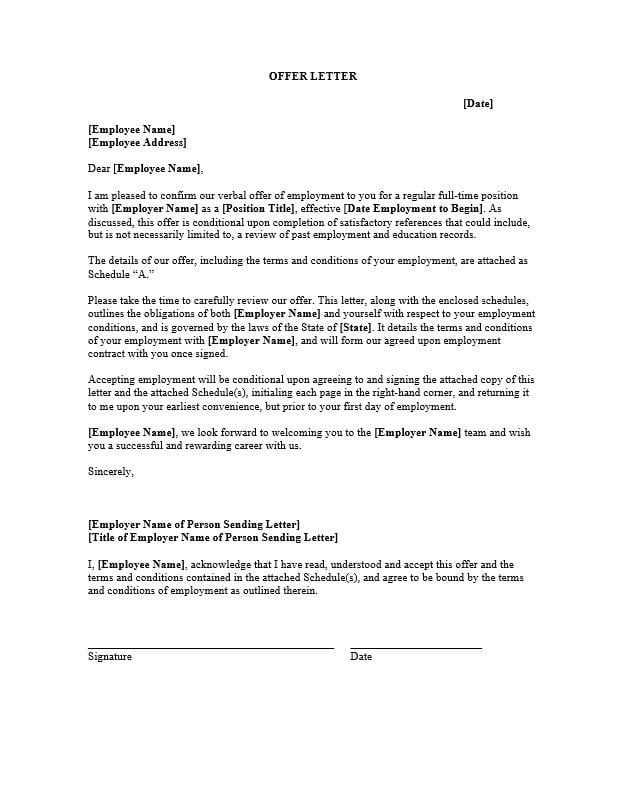

Contractual agreements are an essential part of the relationship between contract employees and their employers. These agreements outline the terms and conditions of the employment arrangement, ensuring that both parties are aware of their rights and responsibilities.

When entering into a contractual agreement, it is crucial for contract employees to carefully review and understand the terms outlined in the contract. This includes the duration of the contract, the scope of work, payment terms, and any additional benefits or perks that may be included.

Contractual agreements also typically include provisions for termination or early termination of the contract. This ensures that both parties have a clear understanding of the circumstances under which the contract can be ended and any associated penalties or consequences.

In addition to outlining the terms of employment, contractual agreements also serve as a legal document that protects the rights of both the contract employee and the employer. In the event of a dispute or disagreement, the contract can be referenced to resolve any issues and ensure that both parties are treated fairly.

It is important for contract employees to carefully negotiate the terms of their contractual agreements to ensure that their rights and interests are protected. This may involve seeking legal advice or consulting with a professional who specializes in employment contracts.

| Key Elements of a Contractual Agreement |

|---|

| 1. Duration of the contract |

| 2. Scope of work |

| 3. Payment terms |

| 4. Additional benefits or perks |

| 5. Termination provisions |

By carefully considering and negotiating the terms of their contractual agreements, contract employees can ensure that they are entering into a fair and mutually beneficial employment arrangement. This can provide them with the necessary protection and peace of mind while working as a contract employee.

Question-answer:

What is a contract employee?

A contract employee is an individual who is hired by a company for a specific period of time or for a specific project. They are not considered permanent employees and their employment is based on a contract or agreement.

What are the benefits of being a contract employee?

Being a contract employee can have its advantages. Some of the benefits include flexibility in terms of working hours and location, the opportunity to work on different projects and gain diverse experience, and the potential for higher pay rates.

What are the disadvantages of being a contract employee?

There are also some disadvantages to being a contract employee. These can include a lack of job security, as contracts are typically for a fixed period of time, no access to company benefits such as health insurance or retirement plans, and the need to constantly search for new contracts or projects once the current one ends.

How is a contract employee different from a regular employee?

A contract employee differs from a regular employee in several ways. While regular employees have a permanent position within a company and receive benefits, contract employees are hired for a specific period of time or project and do not receive the same benefits. Contract employees also have more flexibility in terms of their working arrangements and are often paid on an hourly or project basis.

Can a contract employee become a regular employee?

In some cases, a contract employee may have the opportunity to become a regular employee. This usually depends on the company’s policies and the availability of permanent positions. If a contract employee proves their value and fits well within the company, they may be offered a permanent position. However, this is not guaranteed and varies from company to company.