- Understanding the Projected Growth

- Factors Influencing the Expected Percent Increase

- Industry Trends and Forecasts

- Implications for Employers and Employees

- Preparing for the Expected Percent Increase

- Question-answer:

- What is a 1099 employee?

- How is the percent increase for contract 1099 employees determined?

- What are the benefits of being a contract 1099 employee?

- Are there any risks associated with being a contract 1099 employee?

- How can contract 1099 employees negotiate a higher percent increase?

As the gig economy continues to grow, more and more companies are relying on contract 1099 employees to meet their business needs. These workers, also known as independent contractors, provide flexibility and cost savings for employers. However, recent changes in labor laws and regulations have raised concerns about the future of this employment model.

One of the key issues facing contract 1099 employees is the expected percent increase in their compensation. With new regulations being implemented, companies may be required to provide additional benefits and protections to these workers, which could result in higher costs for employers. This, in turn, may lead to a decrease in the number of contract 1099 positions available and a potential decrease in overall compensation.

It is important for both employers and contract 1099 employees to stay informed about these changes and understand how they may impact their working relationship. Employers should be prepared to adjust their budgets and compensation plans to account for any potential increases in costs. Contract 1099 employees should also be aware of their rights and protections under the new regulations, and be prepared to negotiate for fair compensation.

While the exact percent increase for contract 1099 employees is still uncertain, it is clear that changes are on the horizon. By staying informed and proactive, both employers and contract 1099 employees can navigate these changes and ensure a fair and mutually beneficial working relationship.

Understanding the Projected Growth

As businesses continue to evolve and adapt to the changing economic landscape, it is crucial for employers and employees alike to understand the projected growth in the contract 1099 employee sector. This understanding will enable them to make informed decisions and effectively navigate the challenges and opportunities that lie ahead.

Projected growth refers to the anticipated increase in the number of contract 1099 employees in the coming years. This growth is driven by several factors, including the rise of the gig economy, technological advancements, and changing attitudes towards work.

The gig economy, characterized by short-term contracts and freelance work, has gained significant traction in recent years. This trend is expected to continue, as more individuals seek flexible work arrangements and companies look to tap into a diverse pool of talent. As a result, the demand for contract 1099 employees is projected to increase.

Technological advancements have also played a crucial role in driving the projected growth. The advent of digital platforms and remote work capabilities has made it easier for companies to hire contract 1099 employees from anywhere in the world. This has opened up new opportunities for both employers and employees, leading to an increase in the number of contract 1099 positions.

Furthermore, changing attitudes towards work have contributed to the projected growth. Many individuals are now prioritizing work-life balance and flexibility over traditional employment. Contract 1099 positions offer the freedom to choose projects and set one’s own schedule, making them an attractive option for those seeking greater control over their professional lives.

It is important for employers and employees to recognize the implications of this projected growth. For employers, it means adapting their hiring strategies to attract and retain contract 1099 employees. This may involve offering competitive compensation packages, providing opportunities for professional development, and creating a supportive work environment.

For employees, understanding the projected growth can help them make informed career decisions. They can leverage their skills and expertise to take advantage of the increasing demand for contract 1099 employees. This may involve upskilling or expanding their professional network to stay competitive in the evolving job market.

Factors Influencing the Expected Percent Increase

There are several factors that can influence the expected percent increase for contract 1099 employees. These factors can vary depending on the industry and the specific circumstances of the contract. Here are some of the key factors to consider:

| Factor | Description |

|---|---|

| Economic Conditions | The overall state of the economy can have a significant impact on the expected percent increase for contract 1099 employees. During periods of economic growth, there is typically higher demand for contract workers, which can drive up their rates. Conversely, during economic downturns, there may be less demand for contract workers, leading to lower rates. |

| Industry Demand | The demand for contract 1099 employees within a specific industry can also influence the expected percent increase. Industries that are experiencing rapid growth or undergoing significant changes may have higher demand for contract workers, resulting in higher rates. |

| Skills and Experience | The skills and experience of contract 1099 employees can play a role in determining their expected percent increase. Workers with specialized skills or extensive experience in their field may be able to command higher rates compared to those with less experience or in-demand skills. |

| Competition | The level of competition among contract 1099 employees can also impact the expected percent increase. If there is a high supply of workers in a particular field, rates may be more competitive and less likely to increase significantly. Conversely, if there is a shortage of skilled workers, rates may rise. |

| Geographical Location | The geographical location of the contract work can also influence the expected percent increase. Rates may vary depending on the cost of living in a particular area, as well as the demand for contract workers in that region. |

It is important for employers and employees to consider these factors when projecting the expected percent increase for contract 1099 employees. By understanding these influences, both parties can make informed decisions and negotiate fair rates for contract work.

Industry Trends and Forecasts

The expected percent increase for contract 1099 employees is influenced by various industry trends and forecasts. These trends provide insights into the future growth and demand for contract workers in different sectors.

One of the key industry trends is the rise of the gig economy. With the increasing popularity of freelance work and the flexibility it offers, more companies are turning to contract employees to meet their staffing needs. This trend is expected to continue, leading to a higher demand for contract workers in the coming years.

Another trend is the shift towards remote work. The COVID-19 pandemic has accelerated the adoption of remote work arrangements, and many companies are now embracing this model even after the pandemic. Contract employees, who can work remotely and provide specialized skills on a project basis, are well-positioned to benefit from this trend.

Furthermore, technological advancements are shaping the future of work. Automation and artificial intelligence are transforming industries and creating new job opportunities. Contract workers with expertise in emerging technologies are likely to see an increased demand as companies seek to leverage these advancements.

Additionally, industry-specific factors play a role in determining the expected percent increase for contract 1099 employees. For example, sectors such as healthcare, IT, and finance are projected to experience significant growth, leading to a higher demand for contract workers in these fields.

Overall, industry trends and forecasts indicate a positive outlook for contract 1099 employees. The gig economy, remote work, technological advancements, and sector-specific growth are all contributing to the expected percent increase in contract employment. Employers and employees should stay informed about these trends to effectively navigate the changing landscape of the labor market.

Implications for Employers and Employees

As the expected percent increase for contract 1099 employees continues to rise, both employers and employees need to be aware of the implications it brings. This increase means that employers will have to allocate more resources towards their contract workforce, including higher wages and benefits.

For employers, this may result in increased costs and a need to reevaluate their budget and financial plans. They may need to adjust their pricing strategies or seek alternative solutions to manage the increased expenses. Additionally, employers may need to invest in training and development programs to ensure that their contract employees have the necessary skills to meet the growing demands of the industry.

On the other hand, employees can expect better compensation and benefits as a result of the expected percent increase. This can lead to improved job satisfaction and increased loyalty towards their employers. Contract employees may also have more bargaining power when negotiating their contracts, as employers will be more willing to meet their demands in order to retain their services.

However, employees should also be prepared for potential challenges that come with the increase. With higher expectations, contract employees may face increased pressure to perform and deliver results. They may also experience more competition as more individuals are attracted to contract work due to the improved compensation. Therefore, it is important for employees to continuously update their skills and stay competitive in the market.

Overall, the expected percent increase for contract 1099 employees has significant implications for both employers and employees. Employers need to adapt their strategies and budgets to accommodate the rising costs, while employees can expect better compensation and benefits. It is crucial for both parties to stay informed and proactive in order to navigate the changing landscape of contract work.

Preparing for the Expected Percent Increase

As the projected growth for contract 1099 employees continues to rise, it is crucial for employers and employees to be prepared for the expected percent increase. Here are some steps that can be taken to ensure a smooth transition:

| Evaluate Current Contracts | Review all existing contracts with 1099 employees to determine if any adjustments need to be made. Consider factors such as the length of the contract, payment terms, and scope of work. It may be necessary to renegotiate contracts to account for the expected percent increase. |

| Assess Budget and Resources | Take a close look at your budget and available resources to determine if any adjustments need to be made. Consider factors such as increased labor costs, potential hiring needs, and any additional expenses that may arise as a result of the expected percent increase. This will help ensure that you are financially prepared for the growth. |

| Communicate with Employees | Open and transparent communication with your 1099 employees is essential during this time. Inform them about the projected growth and the expected percent increase. Discuss any changes that may occur in their contracts or work arrangements. This will help build trust and ensure that everyone is on the same page. |

| Invest in Training and Development | With the expected percent increase, it is important to invest in the training and development of your 1099 employees. This will not only enhance their skills and capabilities but also increase their productivity and efficiency. Consider providing opportunities for professional growth and offering relevant training programs. |

| Stay Updated on Industry Trends | Keep a close eye on industry trends and forecasts to stay ahead of the curve. This will help you anticipate any changes or challenges that may arise as a result of the expected percent increase. Stay informed about market conditions, competitor strategies, and emerging technologies that may impact your business. |

By following these steps, employers and employees can effectively prepare for the expected percent increase in contract 1099 employees. It is important to be proactive and adaptable in order to thrive in a changing business landscape.

Question-answer:

What is a 1099 employee?

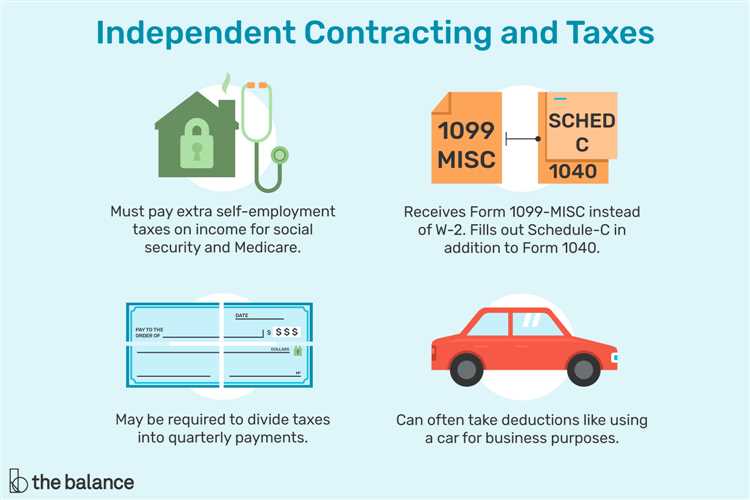

A 1099 employee is a worker who is classified as an independent contractor rather than an employee. They receive a Form 1099-MISC at the end of the year instead of a W-2.

How is the percent increase for contract 1099 employees determined?

The percent increase for contract 1099 employees is determined based on various factors such as market demand, industry standards, and the individual’s skills and experience. It can vary from one contract to another.

What are the benefits of being a contract 1099 employee?

Being a contract 1099 employee offers flexibility in terms of work schedule and location. It also allows individuals to potentially earn a higher income compared to being a traditional employee. However, contract 1099 employees are responsible for paying their own taxes and do not receive benefits such as health insurance or retirement plans.

Are there any risks associated with being a contract 1099 employee?

Yes, there are risks associated with being a contract 1099 employee. Since they are not considered employees, they do not have the same legal protections and benefits as traditional employees. They may also face challenges in finding consistent work and managing their own finances and taxes.

How can contract 1099 employees negotiate a higher percent increase?

Contract 1099 employees can negotiate a higher percent increase by demonstrating their value and expertise to the client or employer. They can highlight their skills, experience, and track record of delivering results. It’s also important to research industry standards and market rates to have a realistic expectation for the negotiation.