- Understanding Inheritance Tax Laws in Louisiana

- Overview of Inheritance Tax

- Exemptions and Thresholds

- Filing and Payment Process

- Question-answer:

- What is inheritance tax?

- Is there an inheritance tax in Louisiana?

- What is the federal estate tax?

- Are there any exemptions to the federal estate tax?

- What happens if an estate exceeds the federal estate tax exemption?

When it comes to estate planning, understanding the intricacies of inheritance tax is crucial. In Louisiana, the rules and regulations surrounding inheritance tax can be complex, but with the right knowledge, you can navigate the process with confidence. Whether you’re an heir or an executor, knowing the ins and outs of inheritance tax in Louisiana is essential.

What is inheritance tax?

Inheritance tax is a tax imposed on the transfer of assets from a deceased person to their heirs. Unlike estate tax, which is based on the total value of the deceased person’s estate, inheritance tax is based on the individual heir’s share of the inheritance. In Louisiana, inheritance tax is levied on certain types of property transfers, including real estate, cash, stocks, and bonds.

Who is subject to inheritance tax in Louisiana?

In Louisiana, inheritance tax is not imposed on all heirs. Immediate family members, such as spouses, children, and grandchildren, are generally exempt from inheritance tax. However, other heirs, such as siblings, nieces, nephews, and friends, may be subject to inheritance tax depending on the value of the inheritance they receive.

How is inheritance tax calculated in Louisiana?

The amount of inheritance tax owed in Louisiana depends on the value of the inheritance and the relationship between the deceased person and the heir. The tax rates range from 1% to 20%, with higher rates applying to more distant relatives. It’s important to note that Louisiana has a progressive inheritance tax system, meaning that the tax rate increases as the value of the inheritance increases.

Are there any exemptions or deductions?

Yes, there are certain exemptions and deductions available in Louisiana that can reduce the amount of inheritance tax owed. For example, there is a $100,000 exemption for surviving spouses, and certain agricultural property may be eligible for a deduction. Additionally, any debts owed by the deceased person can be deducted from the value of the inheritance before calculating the inheritance tax.

Understanding Inheritance Tax Laws in Louisiana

When it comes to inheritance tax laws, Louisiana has its own unique set of rules and regulations. Understanding these laws is crucial for anyone who may be involved in the inheritance process in the state.

In Louisiana, inheritance tax is imposed on the transfer of property from a deceased person to their heirs. It is important to note that inheritance tax is different from estate tax, which is imposed on the total value of a deceased person’s estate.

One key aspect of inheritance tax laws in Louisiana is that it only applies to certain types of property. This includes real estate, tangible personal property, and intangible personal property located in the state. It does not apply to property located outside of Louisiana.

Another important factor to consider is the relationship between the deceased person and the heir. In Louisiana, there are different tax rates depending on the relationship. For example, spouses and children are subject to a lower tax rate compared to other relatives or unrelated individuals.

It is also worth noting that there are exemptions and thresholds in place for inheritance tax in Louisiana. These exemptions allow certain amounts of property to be transferred without incurring any tax. The thresholds determine the tax rate based on the value of the property being transferred.

When it comes to filing and payment process, the executor of the estate is responsible for filing the inheritance tax return and paying any taxes owed. The return must be filed within nine months of the date of death, and the taxes must be paid within 15 months of the date of death.

Overall, understanding inheritance tax laws in Louisiana is essential for anyone involved in the inheritance process. It is important to consult with a legal professional to ensure compliance with these laws and to properly navigate the inheritance tax process.

Overview of Inheritance Tax

Inheritance tax is a tax that is imposed on the transfer of property or assets from a deceased person to their heirs or beneficiaries. It is important to understand that inheritance tax is different from estate tax, as estate tax is imposed on the total value of a deceased person’s estate, while inheritance tax is imposed on the individual beneficiaries who receive the assets.

In Louisiana, inheritance tax is governed by state law and is based on the relationship between the deceased person and the beneficiary. The tax rates and exemptions vary depending on this relationship.

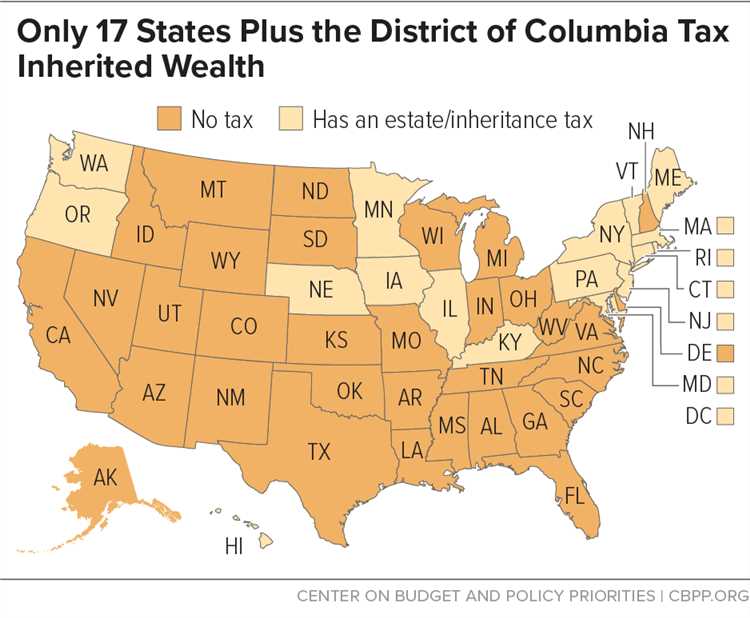

It is important to note that not all states impose an inheritance tax. In fact, only a few states, including Louisiana, have an inheritance tax. Most states have either abolished the inheritance tax or have never had one in place.

The purpose of inheritance tax is to generate revenue for the state government. It is considered a source of income for the state and is used to fund various public services and programs.

When a person passes away, their estate goes through a process called probate. During this process, the assets of the deceased person are identified, valued, and distributed to the beneficiaries. It is during this distribution process that the inheritance tax is assessed and collected.

The amount of inheritance tax that a beneficiary is required to pay depends on the value of the assets they receive and their relationship to the deceased person. The tax rates can range from a few percent to a significant portion of the value of the assets.

It is important for individuals who are expecting to receive an inheritance to understand the inheritance tax laws in their state. This will help them plan for any potential tax liabilities and ensure that they are prepared to fulfill their tax obligations.

Exemptions and Thresholds

In Louisiana, there are certain exemptions and thresholds that determine whether or not an individual is subject to inheritance tax. These exemptions and thresholds are important to understand in order to properly navigate the inheritance tax laws in the state.

One of the main exemptions in Louisiana is the spousal exemption. This means that any property or assets inherited by a surviving spouse are exempt from inheritance tax. This exemption allows spouses to inherit property without having to worry about paying taxes on it.

Another exemption is the family exemption. This exemption applies to property inherited by direct descendants, such as children or grandchildren. In Louisiana, direct descendants are exempt from inheritance tax up to a certain threshold. This threshold is currently set at $100,000. Any property inherited by direct descendants that exceeds this threshold is subject to inheritance tax.

Additionally, there is an exemption for property inherited by siblings. Siblings are exempt from inheritance tax up to a threshold of $25,000. Any property inherited by siblings that exceeds this threshold is subject to inheritance tax.

It is important to note that these exemptions and thresholds can change over time. It is recommended to consult with a legal professional or tax advisor to ensure that you have the most up-to-date information regarding inheritance tax exemptions and thresholds in Louisiana.

Understanding the exemptions and thresholds for inheritance tax in Louisiana is crucial for individuals who may be inheriting property or assets. By knowing the exemptions and thresholds, individuals can better plan for any potential tax liabilities and ensure that they are in compliance with the state’s inheritance tax laws.

Filing and Payment Process

When it comes to filing and paying inheritance tax in Louisiana, there are certain steps that need to be followed. Here is an overview of the process:

1. Determine if you are required to file:

Not everyone is required to file an inheritance tax return in Louisiana. The first step is to determine if you meet the criteria for filing. Generally, if the value of the estate is below the threshold set by the state, you may not be required to file.

2. Gather necessary documents:

Before filing, you will need to gather all the necessary documents and information. This may include the deceased person’s will, death certificate, and any relevant financial records. It is important to have all the required documentation in order to accurately calculate the inheritance tax.

3. Calculate the inheritance tax:

Once you have all the necessary documents, you can begin calculating the inheritance tax. In Louisiana, the tax rate varies depending on the value of the estate and the relationship between the deceased person and the heir. It is important to accurately calculate the tax to ensure compliance with the law.

4. Complete the inheritance tax return:

After calculating the tax, you will need to complete the inheritance tax return. This is a legal document that provides details about the estate, the heirs, and the calculated tax amount. It is important to fill out the form accurately and completely to avoid any issues or penalties.

5. Submit the inheritance tax return and payment:

Once the inheritance tax return is completed, it must be submitted to the Louisiana Department of Revenue along with the payment for the calculated tax amount. The payment can be made by check or money order, and should be sent to the designated address provided by the department.

6. Keep records:

It is important to keep copies of all the documents related to the inheritance tax filing and payment. This includes the completed tax return, payment receipts, and any correspondence with the Louisiana Department of Revenue. These records should be kept for future reference and in case of any audits or inquiries.

By following these steps, you can ensure that you are properly filing and paying the inheritance tax in Louisiana. It is always recommended to consult with a tax professional or attorney for guidance and assistance throughout the process.

Question-answer:

What is inheritance tax?

Inheritance tax is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries.

Is there an inheritance tax in Louisiana?

No, Louisiana does not have an inheritance tax. However, there is a federal estate tax that may apply to certain estates.

What is the federal estate tax?

The federal estate tax is a tax imposed on the transfer of property upon death. It is based on the value of the estate and can be quite substantial for larger estates.

Are there any exemptions to the federal estate tax?

Yes, there are exemptions to the federal estate tax. For example, the current exemption amount is $11.7 million per individual, meaning that estates valued below this amount are not subject to the tax.

What happens if an estate exceeds the federal estate tax exemption?

If an estate exceeds the federal estate tax exemption, the excess amount will be subject to the estate tax. The tax rate starts at 18% and goes up to 40% for the highest valued estates.