- Does Georgia Have Inheritance Tax? Explained

- Understanding Georgia Inheritance Tax Laws

- What is Inheritance Tax?

- Is There an Inheritance Tax in Georgia?

- Exemptions and Rates

- Question-answer:

- What is inheritance tax?

- Does Georgia have inheritance tax?

- What are the implications of not having inheritance tax in Georgia?

- Are there any other taxes related to inheritance in Georgia?

When it comes to planning for the future, understanding the tax implications of inheritance is crucial. If you are a resident of Georgia or have assets in the state, you may be wondering: does Georgia have inheritance tax? In this comprehensive guide, we will explore the intricacies of Georgia inheritance tax and provide you with the information you need to navigate this complex topic.

First and foremost, it is important to note that Georgia does not have a state-level inheritance tax. This means that beneficiaries in Georgia are not required to pay taxes on the assets they inherit. However, it is essential to understand that this does not mean that inheritance is completely tax-free in Georgia.

While Georgia does not impose an inheritance tax, it does have an estate tax. The estate tax is a tax on the total value of a person’s estate at the time of their death. In Georgia, the estate tax only applies to estates with a value exceeding the federal estate tax exemption, which is currently set at $11.7 million per individual. This means that if the total value of an estate is below this threshold, no estate tax will be owed.

It is also worth noting that Georgia does not have a gift tax. A gift tax is a tax on the transfer of assets during a person’s lifetime. This means that individuals in Georgia can make gifts to their loved ones without incurring any state-level gift tax. However, it is important to be aware of the federal gift tax rules, as there are federal limits on the amount of money or property that can be gifted without incurring a tax liability.

Does Georgia Have Inheritance Tax? Explained

When it comes to inheritance tax, many people are unsure of the laws and regulations in their specific state. In the case of Georgia, it is important to understand whether or not the state has an inheritance tax.

Fortunately, Georgia does not have an inheritance tax. This means that individuals who receive an inheritance in the state of Georgia do not have to pay any taxes on the amount they receive. This can be a relief for many people who are already dealing with the loss of a loved one.

It is important to note, however, that while Georgia does not have an inheritance tax, there may still be federal estate taxes that need to be paid. Estate taxes are different from inheritance taxes and are typically paid by the estate itself, rather than the individual receiving the inheritance.

Understanding the difference between inheritance taxes and estate taxes is crucial when it comes to planning for the future. Inheritance taxes are taxes that are paid by the individual who receives the inheritance, while estate taxes are paid by the estate of the deceased individual.

Understanding Georgia Inheritance Tax Laws

When it comes to understanding inheritance tax laws in Georgia, it is important to have a clear understanding of how the state handles this type of tax. Inheritance tax is a tax that is imposed on the transfer of property or assets from a deceased person to their heirs or beneficiaries. However, it is important to note that Georgia does not currently have an inheritance tax.

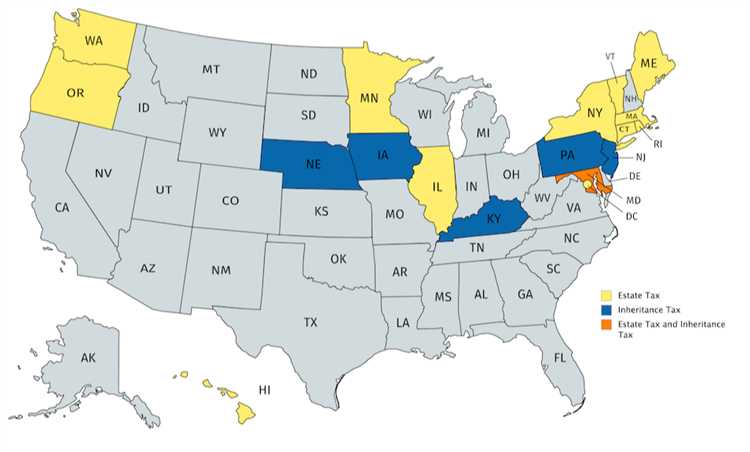

Unlike some other states in the United States, Georgia does not impose an inheritance tax on the transfer of property or assets. This means that when someone passes away in Georgia, their heirs or beneficiaries will not be required to pay any inheritance tax on the assets they receive.

It is important to distinguish between inheritance tax and estate tax. While inheritance tax is imposed on the transfer of assets to heirs or beneficiaries, estate tax is imposed on the total value of a deceased person’s estate. Georgia does not have an estate tax either, which means that the total value of a deceased person’s estate is not subject to taxation in the state.

It is worth noting that even though Georgia does not have an inheritance tax or estate tax, there may still be federal tax implications for the transfer of assets. The federal government imposes estate tax on estates that exceed a certain value, which is subject to change. It is important to consult with a tax professional or estate planning attorney to understand the federal tax implications and any potential exemptions that may apply.

What is Inheritance Tax?

Inheritance tax, also known as estate tax or death tax, is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries. It is based on the value of the assets received and is typically paid by the recipient of the inheritance.

The purpose of inheritance tax is to generate revenue for the government and to redistribute wealth. It is often seen as a way to address wealth inequality and ensure that the wealthy contribute their fair share to society.

Inheritance tax laws vary from country to country, and even within different regions or states. Some countries have high inheritance tax rates, while others have no inheritance tax at all. The specific rules and exemptions for inheritance tax can also differ, depending on the relationship between the deceased and the recipient, the value of the assets, and other factors.

It is important to note that inheritance tax is different from estate tax. Estate tax is imposed on the total value of a deceased person’s estate, while inheritance tax is imposed on the individual beneficiaries based on the value of the assets they receive.

Overall, inheritance tax is a complex and often controversial topic. It is important for individuals to understand the inheritance tax laws in their jurisdiction and to plan their estate accordingly to minimize the tax burden on their heirs.

Is There an Inheritance Tax in Georgia?

When it comes to inheritance tax, Georgia is one of the states that does not impose this type of tax. This means that if you are a resident of Georgia or if you inherit property or assets from someone who lived in Georgia, you will not have to pay any inheritance tax.

This is good news for individuals who are planning their estate or who are expecting to receive an inheritance. Without the burden of inheritance tax, you can pass on your assets to your loved ones without worrying about a significant tax liability.

It’s important to note that while Georgia does not have an inheritance tax, it does have an estate tax. Estate tax is a tax on the total value of a person’s estate at the time of their death. However, the estate tax only applies to estates that exceed a certain threshold, which is quite high. For most individuals, this means that they will not be subject to estate tax either.

Overall, Georgia’s lack of inheritance tax is a favorable aspect for residents and individuals who may inherit property or assets from someone in Georgia. It allows for a smoother transfer of wealth and ensures that beneficiaries can receive their inheritance without the burden of additional taxes.

Exemptions and Rates

When it comes to inheritance tax in Georgia, there are certain exemptions and rates that you should be aware of. These exemptions and rates determine how much tax you may have to pay on the inheritance you receive.

Firstly, it’s important to note that Georgia does not have a specific inheritance tax. However, there are other taxes that may apply to inherited assets, such as estate tax and income tax.

For estate tax, Georgia follows the federal estate tax laws. Currently, the federal estate tax exemption is set at $11.7 million per individual. This means that if the value of the inherited assets is below this threshold, no estate tax will be owed. However, if the value exceeds the exemption amount, the excess will be subject to estate tax at a rate of up to 40%.

Additionally, Georgia does not impose an income tax on inherited assets. This means that any income generated from inherited assets, such as interest or dividends, is not subject to state income tax.

It’s important to consult with a tax professional or attorney to fully understand the exemptions and rates that may apply to your specific situation. They can provide guidance and help you navigate the complex tax laws to ensure you comply with all necessary requirements.

Question-answer:

What is inheritance tax?

Inheritance tax is a tax imposed on the transfer of assets or property from a deceased person to their heirs or beneficiaries.

Does Georgia have inheritance tax?

No, Georgia does not have an inheritance tax. Inheritance tax was repealed in Georgia in 2017.

What are the implications of not having inheritance tax in Georgia?

The absence of inheritance tax in Georgia means that beneficiaries do not have to pay any taxes on the assets or property they inherit. This can be beneficial for individuals who are receiving a significant amount of wealth from a deceased family member.

Are there any other taxes related to inheritance in Georgia?

No, there are no other taxes related to inheritance in Georgia. However, it is important to note that there may still be federal estate taxes that apply to certain estates with high values.