- Understanding Inheritance Tax in Texas

- What is Inheritance Tax?

- Is There an Inheritance Tax in Texas?

- How Inheritance Works in Texas

- Understanding the Probate Process

- Question-answer:

- What is inheritance tax?

- Does Texas have inheritance tax?

- Are there any taxes on inherited property in Texas?

- What are the tax implications of inheriting property in Texas?

- Which states have inheritance tax?

When it comes to estate planning and inheritance, one question that often arises is whether Texas has an inheritance tax. Inheritance tax is a tax imposed on the transfer of assets from a deceased person to their heirs. However, the good news for Texans is that the state does not have an inheritance tax.

Unlike some other states, Texas does not impose a tax on the assets inherited by beneficiaries. This means that if you are a resident of Texas and you receive an inheritance, you will not have to pay any state inheritance tax on it. This can be a significant advantage for individuals and families who are planning their estates and want to ensure that their loved ones receive the full value of their assets.

It is important to note, however, that while Texas does not have an inheritance tax, it does have a separate tax called the estate tax. The estate tax is a tax imposed on the total value of a person’s estate at the time of their death. However, the estate tax only applies to estates that exceed a certain threshold, which is currently set at $11.7 million for individuals and $23.4 million for married couples.

For most Texans, the estate tax is not a concern, as their estates are unlikely to exceed the threshold. However, for those with larger estates, it is important to consult with an estate planning attorney to ensure that their assets are properly structured and that they take advantage of any available tax planning strategies to minimize their estate tax liability.

Understanding Inheritance Tax in Texas

Inheritance tax is a tax that is imposed on the transfer of assets or property from a deceased person to their heirs or beneficiaries. It is important to understand how inheritance tax works in Texas, as it can have significant implications for individuals who are inheriting property or assets.

Unlike some other states, Texas does not have an inheritance tax. This means that individuals who inherit property or assets in Texas are not required to pay a specific tax on the value of the inheritance. However, it is important to note that there may still be other taxes or fees associated with the transfer of assets, such as estate taxes or probate fees.

When someone passes away in Texas, their estate may go through the probate process. This is the legal process by which the deceased person’s assets are distributed to their heirs or beneficiaries. During probate, any outstanding debts or taxes owed by the deceased person are typically paid off using the assets of the estate.

It is also important to note that while Texas does not have an inheritance tax, there may still be federal estate taxes that apply. These taxes are imposed on the total value of an individual’s estate and can be significant for larger estates. However, the federal estate tax exemption is quite high, so most individuals will not be subject to federal estate taxes.

What is Inheritance Tax?

Inheritance tax, also known as estate tax or death tax, is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries. It is a tax on the right to transfer property upon death and is based on the value of the assets being transferred.

The purpose of inheritance tax is to generate revenue for the government and to redistribute wealth. It is often seen as a way to prevent the concentration of wealth in the hands of a few individuals and to promote a more equitable distribution of assets.

Inheritance tax is different from estate tax, which is a tax on the total value of a deceased person’s estate. Estate tax is paid by the estate itself before any assets are distributed to the heirs or beneficiaries. Inheritance tax, on the other hand, is paid by the individual recipients of the assets.

The rate of inheritance tax varies depending on the jurisdiction and the value of the assets being transferred. Some countries have a progressive tax system, where the tax rate increases as the value of the assets increases. Others have a flat tax rate that applies to all transfers regardless of the value.

It is important to note that not all countries have inheritance tax. In some jurisdictions, such as the United States, inheritance tax is only imposed at the state level and not at the federal level. In other countries, such as Canada, there is no inheritance tax at all.

Overall, inheritance tax is a complex and often controversial topic. It is subject to frequent changes in legislation and can have a significant impact on the distribution of wealth. It is important for individuals to understand the inheritance tax laws in their jurisdiction and to plan their estate accordingly to minimize the tax burden on their heirs or beneficiaries.

Is There an Inheritance Tax in Texas?

Many people wonder if there is an inheritance tax in Texas. The good news is that Texas does not have an inheritance tax. This means that when someone passes away and leaves assets to their heirs, the heirs do not have to pay a tax on the inheritance they receive.

It is important to note, however, that while Texas does not have an inheritance tax, it does have an estate tax. The estate tax is a tax on the total value of a person’s estate at the time of their death. This tax is paid by the estate itself, not by the heirs. The estate tax only applies to estates that exceed a certain threshold, which is currently set at $11.7 million for individuals and $23.4 million for married couples.

Another important thing to understand is that Texas is a community property state. This means that any property acquired during a marriage is considered community property and is owned equally by both spouses. When one spouse passes away, their share of the community property is transferred to the surviving spouse without any tax consequences.

It is also worth noting that Texas does not have an inheritance tax reciprocity agreement with any other state. This means that even if you inherit property from someone who lived in a state with an inheritance tax, you will not have to pay that tax if you live in Texas.

How Inheritance Works in Texas

When it comes to inheritance in Texas, there are a few key things to understand. In Texas, the process of inheritance is governed by state laws and can vary depending on the specific circumstances.

Firstly, it’s important to note that Texas does not have an inheritance tax. This means that beneficiaries do not have to pay taxes on the assets they inherit. However, it’s worth mentioning that there may still be federal estate taxes to consider if the estate is large enough.

When someone passes away in Texas, their assets are typically distributed through the probate process. This involves the court overseeing the transfer of assets to the rightful beneficiaries. The probate process can be complex and time-consuming, so it’s often advisable to seek legal assistance to navigate through it.

During the probate process, the deceased person’s will is examined to determine how their assets should be distributed. If there is no will, the assets will be distributed according to Texas intestacy laws. These laws dictate how assets are divided among surviving family members.

Once the assets have been identified and valued, they can be distributed to the beneficiaries. This can include real estate, bank accounts, investments, personal belongings, and more. The distribution process may involve selling assets and dividing the proceeds among the beneficiaries, or transferring ownership directly.

It’s important to note that certain assets may not go through the probate process. For example, assets held in a living trust or assets with designated beneficiaries, such as life insurance policies or retirement accounts, can pass directly to the beneficiaries without going through probate.

Understanding the Probate Process

The probate process is a legal procedure that takes place after someone passes away. It involves the distribution of the deceased person’s assets and the settling of their debts. In Texas, the probate process is overseen by the probate court, which ensures that the deceased person’s wishes are carried out and that their estate is distributed according to the law.

During the probate process, several steps are followed to ensure a smooth and fair distribution of the estate. These steps include:

1. Filing a Petition

The first step in the probate process is filing a petition with the probate court. This petition initiates the probate proceedings and provides information about the deceased person, their assets, and their heirs.

2. Notifying Creditors and Beneficiaries

Once the petition is filed, the court will notify the deceased person’s creditors and beneficiaries. This allows creditors to make claims against the estate and beneficiaries to contest the will if necessary.

3. Inventory and Appraisal

The next step is to inventory and appraise the deceased person’s assets. This involves identifying and valuing all of their property, including real estate, bank accounts, investments, and personal belongings.

4. Paying Debts and Taxes

Before the estate can be distributed to the beneficiaries, any outstanding debts and taxes must be paid. This includes paying off any outstanding loans, credit card bills, and taxes owed by the deceased person.

5. Distributing the Estate

Once all debts and taxes have been paid, the remaining assets can be distributed to the beneficiaries. This is done according to the deceased person’s will or, if there is no will, according to the laws of intestate succession in Texas.

6. Closing the Estate

Finally, once the estate has been fully distributed, the probate process can be closed. This involves filing a final accounting with the court, providing a detailed report of all financial transactions related to the estate.

It’s important to note that the probate process can be complex and time-consuming. It’s recommended to seek the assistance of an experienced probate attorney to navigate through the process and ensure that everything is done correctly.

Question-answer:

What is inheritance tax?

Inheritance tax is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries.

Does Texas have inheritance tax?

No, Texas does not have an inheritance tax. It is one of the few states in the United States that does not impose this tax.

Are there any taxes on inherited property in Texas?

No, there are no taxes on inherited property in Texas. The state does not impose an inheritance tax or an estate tax.

What are the tax implications of inheriting property in Texas?

Inheriting property in Texas does not have any tax implications in terms of inheritance tax or estate tax. However, there may be other taxes such as property taxes or capital gains taxes that need to be considered.

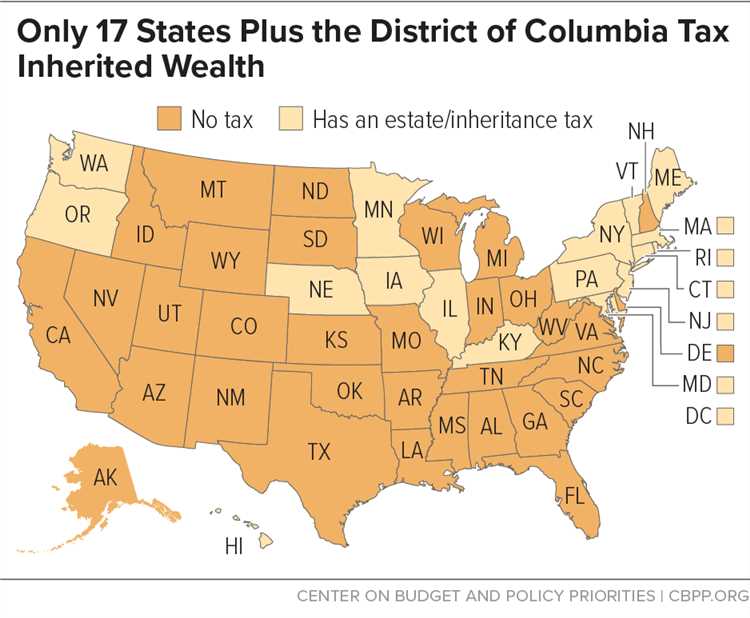

Which states have inheritance tax?

As of 2021, only six states have an inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. Each state has its own rules and exemptions regarding the inheritance tax.