- Understanding Inheritance Tax in Virginia

- Overview of Inheritance Tax

- Exemptions and Rates

- Filing Requirements

- Planning for Inheritance Tax in Virginia

- Estate Planning Strategies

- Question-answer:

- What is inheritance tax?

- How does inheritance tax work in Virginia?

- Who is responsible for paying inheritance tax in Virginia?

- Are there any exemptions or deductions for inheritance tax in Virginia?

- What happens if someone fails to pay the federal estate tax in Virginia?

- What is inheritance tax?

- How is inheritance tax calculated in Virginia?

When it comes to estate planning, one important aspect to consider is inheritance tax. In Virginia, inheritance tax is a tax imposed on the transfer of assets from a deceased person to their beneficiaries. Understanding how this tax works and what it means for you and your loved ones is crucial in order to make informed decisions and ensure that your estate is handled properly.

Who is subject to inheritance tax in Virginia?

In Virginia, inheritance tax is not levied on the beneficiaries of an estate. Instead, it is the responsibility of the estate itself to pay the tax. The tax rate varies depending on the value of the estate and the relationship between the deceased person and the beneficiaries. Spouses and direct descendants, such as children and grandchildren, are typically exempt from inheritance tax, while other beneficiaries may be subject to a tax rate ranging from 1% to 16%.

It is important to note that Virginia is one of the few states that still imposes an inheritance tax. Many states have abolished this tax in favor of an estate tax or have no death taxes at all.

How is inheritance tax calculated?

The value of the estate is determined by adding up all the assets owned by the deceased person at the time of their death, including real estate, bank accounts, investments, and personal property. Certain deductions and exemptions may apply, such as funeral expenses, debts, and charitable donations. Once the value of the estate is determined, the inheritance tax rate is applied to calculate the amount of tax owed.

It is important to consult with an experienced estate planning attorney or tax professional to ensure that you understand the specific rules and regulations regarding inheritance tax in Virginia and how it may impact your estate.

Planning ahead for inheritance tax

While inheritance tax can be a complex and sometimes burdensome aspect of estate planning, there are strategies that can be implemented to minimize the tax burden on your beneficiaries. These may include gifting assets during your lifetime, establishing trusts, or utilizing other estate planning tools. By working with a knowledgeable professional, you can develop a comprehensive plan that takes into account your specific circumstances and goals.

Remember, proper estate planning is essential to ensure that your assets are distributed according to your wishes and to minimize the tax implications for your loved ones. Take the time to educate yourself about inheritance tax in Virginia and consult with professionals who can guide you through the process.

Understanding Inheritance Tax in Virginia

When it comes to estate planning, it is important to have a clear understanding of inheritance tax in Virginia. Inheritance tax is a tax that is imposed on the transfer of assets from a deceased person to their beneficiaries. It is important to note that inheritance tax is different from estate tax, which is a tax on the total value of a person’s estate.

In Virginia, inheritance tax is not levied on the beneficiaries of an estate. Instead, it is the responsibility of the estate itself to pay any applicable inheritance tax. The tax rate varies depending on the value of the assets being transferred and the relationship between the deceased person and the beneficiary.

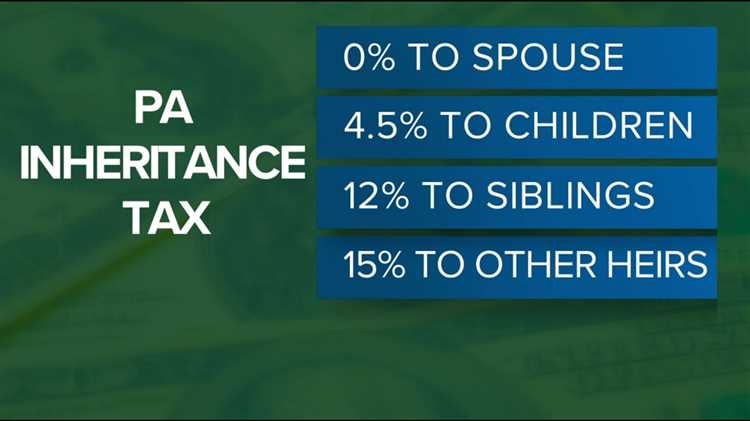

There are certain exemptions and rates that apply to inheritance tax in Virginia. For example, spouses and children are generally exempt from paying inheritance tax. However, other beneficiaries, such as siblings or friends, may be subject to the tax at different rates.

It is important for individuals to understand the filing requirements for inheritance tax in Virginia. In general, the executor of the estate is responsible for filing the necessary tax forms and paying any applicable tax. Failure to comply with these requirements can result in penalties and interest.

Planning for inheritance tax in Virginia is an important part of estate planning. There are various strategies that individuals can use to minimize the impact of inheritance tax on their estate. For example, setting up a trust can help to protect assets and reduce the tax liability for beneficiaries.

Overview of Inheritance Tax

Inheritance tax is a tax that is imposed on the transfer of assets from a deceased person to their beneficiaries. In Virginia, inheritance tax is levied on the value of the assets that are transferred through a person’s estate after their death.

Unlike estate tax, which is based on the total value of the estate, inheritance tax is based on the value of the assets that each individual beneficiary receives. This means that each beneficiary may be subject to a different tax rate based on their share of the inheritance.

In Virginia, the inheritance tax rates range from 2% to 16%, depending on the value of the assets received and the relationship between the deceased person and the beneficiary. Spouses, children, and grandchildren are generally subject to lower tax rates, while more distant relatives and non-relatives may be subject to higher rates.

It is important to note that not all assets are subject to inheritance tax in Virginia. Certain assets, such as life insurance proceeds, retirement accounts, and jointly owned property, may be exempt from taxation. Additionally, there are certain exemptions and deductions available that can reduce the overall tax liability.

When it comes to filing requirements, the executor of the estate is responsible for filing the inheritance tax return within nine months of the date of death. The return must include a detailed inventory of the assets and their values, as well as any applicable exemptions or deductions.

Planning for inheritance tax in Virginia can be complex, but there are strategies that can help minimize the tax burden. This may include gifting assets during one’s lifetime, establishing trusts, or utilizing other estate planning tools. It is important to consult with a qualified estate planning attorney to ensure that the most effective strategies are implemented.

Exemptions and Rates

In Virginia, inheritance tax is not levied on the beneficiaries of an estate. Instead, the state imposes an estate tax on the total value of the decedent’s estate. The estate tax is calculated based on the net value of the estate after deducting any debts, funeral expenses, and administrative costs.

There are certain exemptions and rates that apply to the estate tax in Virginia. As of 2021, the estate tax exemption is set at $5 million. This means that estates with a net value below $5 million are not subject to the estate tax. However, for estates with a net value exceeding $5 million, the tax rate starts at 0.5% and gradually increases to a maximum rate of 16% for estates valued at $10 million or more.

It’s important to note that the estate tax exemption is subject to change, as it is periodically adjusted for inflation. Therefore, it is advisable to consult with a qualified estate planning attorney or tax professional to stay updated on the current exemption amount.

In addition to the estate tax, Virginia also imposes a separate inheritance tax on certain assets transferred to beneficiaries. However, this inheritance tax only applies to assets that are located in Virginia and are inherited by individuals who are not immediate family members. The inheritance tax rates range from 1% to 16%, depending on the value of the inherited assets.

It’s worth mentioning that there are certain assets that are exempt from the inheritance tax, such as life insurance proceeds, retirement accounts, and jointly owned property with rights of survivorship. These assets pass directly to the designated beneficiaries and are not subject to the inheritance tax.

Overall, understanding the exemptions and rates associated with inheritance tax in Virginia is crucial for effective estate planning. By taking advantage of the available exemptions and implementing appropriate strategies, individuals can minimize the tax burden on their estates and ensure a smooth transfer of assets to their intended beneficiaries.

Filing Requirements

When it comes to inheritance tax in Virginia, there are certain filing requirements that must be met. These requirements ensure that the appropriate taxes are paid and that the process is carried out correctly. Here are the key filing requirements to keep in mind:

1. Filing Deadline: The inheritance tax return must be filed within nine months from the date of the decedent’s death. It is important to note that extensions are not granted for filing the return, so it is crucial to meet this deadline.

2. Executor’s Responsibility: The executor of the estate is responsible for filing the inheritance tax return. This individual must gather all the necessary information and documentation to accurately complete the return.

3. Valuation of Assets: The inheritance tax return requires the valuation of all assets included in the estate. This includes real estate, bank accounts, investments, and personal property. It is important to obtain professional appraisals or valuations to ensure accurate reporting.

4. Payment of Taxes: The inheritance tax must be paid in full at the time of filing the return. The executor is responsible for ensuring that the taxes are paid from the estate’s assets. Failure to pay the taxes can result in penalties and interest.

5. Reporting of Gifts: In addition to reporting the assets of the estate, any gifts made by the decedent within three years of their death must also be reported on the inheritance tax return. This includes both cash gifts and gifts of property.

6. Documentation: It is essential to keep detailed documentation of all transactions and valuations related to the inheritance tax return. This documentation will be necessary in case of an audit or any questions from the tax authorities.

By understanding and meeting these filing requirements, you can ensure that the inheritance tax process in Virginia is carried out smoothly and in compliance with the law.

Planning for Inheritance Tax in Virginia

When it comes to planning for inheritance tax in Virginia, there are several strategies that can help minimize the tax burden on your loved ones. Here are some key considerations:

1. Estate Planning

One of the most effective ways to reduce inheritance tax is through proper estate planning. By creating a comprehensive estate plan, you can ensure that your assets are distributed according to your wishes and take advantage of any available tax exemptions and deductions.

2. Lifetime Gifts

Another strategy to consider is making lifetime gifts to your beneficiaries. By gifting assets during your lifetime, you can reduce the overall value of your estate and potentially lower the amount of inheritance tax that will be owed. However, it’s important to be aware of the annual gift tax exclusion and any limitations that may apply.

3. Trusts

Setting up trusts can also be an effective way to minimize inheritance tax. By transferring assets into a trust, you can remove them from your taxable estate while still maintaining control over how they are distributed. There are various types of trusts available, so it’s important to consult with an estate planning attorney to determine which option is best for your specific situation.

4. Life Insurance

Life insurance can be a valuable tool in planning for inheritance tax. By naming a beneficiary on your life insurance policy, the proceeds can pass directly to them without being subject to inheritance tax. This can provide your loved ones with a source of tax-free income to help cover any tax liabilities that may arise.

5. Charitable Giving

Consider making charitable donations as part of your estate planning. By leaving a portion of your estate to a qualified charity, you can reduce the taxable value of your estate and potentially lower the amount of inheritance tax that will be owed. Additionally, charitable donations may also qualify for certain tax deductions.

It’s important to note that inheritance tax laws can be complex and subject to change. Therefore, it’s advisable to consult with a qualified estate planning attorney or tax professional to ensure that you are taking full advantage of any available strategies and exemptions.

Estate Planning Strategies

When it comes to inheritance tax in Virginia, proper estate planning can help minimize the tax burden on your loved ones. Here are some strategies to consider:

- Gifts: One way to reduce the value of your estate subject to inheritance tax is by making gifts during your lifetime. The annual gift tax exclusion allows you to give up to a certain amount to each recipient without incurring gift tax. By strategically gifting assets, you can gradually reduce the size of your estate.

- Trusts: Setting up trusts can be an effective way to protect your assets and minimize inheritance tax. Irrevocable trusts, such as life insurance trusts or charitable remainder trusts, can remove assets from your taxable estate while still allowing you to benefit from them during your lifetime.

- Family Limited Partnerships: Creating a family limited partnership can help you transfer assets to your heirs while retaining control over them. By gifting limited partnership interests to your family members, you can reduce the value of your taxable estate.

- Life Insurance: Life insurance can provide liquidity to pay for inheritance tax liabilities. By purchasing a life insurance policy and naming your loved ones as beneficiaries, you can ensure that they have the funds necessary to cover the tax bill without having to sell assets from the estate.

- Charitable Giving: Donating to charitable organizations can not only benefit causes you care about but also reduce your taxable estate. By leaving a portion of your estate to charity, you can lower the overall value subject to inheritance tax.

- Qualified Personal Residence Trusts: A qualified personal residence trust (QPRT) allows you to transfer your primary residence or vacation home to your heirs at a reduced value for tax purposes. This strategy can be particularly beneficial if you anticipate that the value of your property will appreciate significantly in the future.

- Consult with an Estate Planning Attorney: Estate planning can be complex, and the laws surrounding inheritance tax are subject to change. It is advisable to consult with an experienced estate planning attorney who can help you navigate the intricacies of the tax code and develop a personalized plan that meets your specific needs and goals.

By implementing these estate planning strategies, you can ensure that your loved ones are not burdened with excessive inheritance tax obligations and that your assets are distributed according to your wishes.

Question-answer:

What is inheritance tax?

Inheritance tax is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries.

How does inheritance tax work in Virginia?

In Virginia, inheritance tax was repealed in 2007, so there is no longer a state-level inheritance tax. However, there is still a federal estate tax that may apply to larger estates.

Who is responsible for paying inheritance tax in Virginia?

Since there is no inheritance tax in Virginia, there is no specific person responsible for paying it. However, the executor of the estate is responsible for filing any necessary federal estate tax returns if applicable.

Are there any exemptions or deductions for inheritance tax in Virginia?

As there is no inheritance tax in Virginia, there are no specific exemptions or deductions related to it. However, there may be certain exemptions and deductions available for federal estate tax purposes.

What happens if someone fails to pay the federal estate tax in Virginia?

If someone fails to pay the federal estate tax in Virginia, the IRS may impose penalties and interest on the unpaid amount. It is important to consult with a tax professional to ensure compliance with all tax obligations.

What is inheritance tax?

Inheritance tax is a tax that is imposed on the transfer of assets from a deceased person to their heirs or beneficiaries.

How is inheritance tax calculated in Virginia?

In Virginia, inheritance tax is not calculated. The state does not have an inheritance tax, but it does have an estate tax.