- What is Nd Inheritance Tax?

- Definition and Purpose

- Who is Subject to Nd Inheritance Tax?

- How is Nd Inheritance Tax Calculated?

- Important Considerations for Nd Inheritance Tax

- Exemptions and Deductions

- Question-answer:

- What is inheritance tax?

- How does inheritance tax work in North Dakota?

- Who is responsible for paying inheritance tax?

- Are there any exemptions or deductions for inheritance tax in North Dakota?

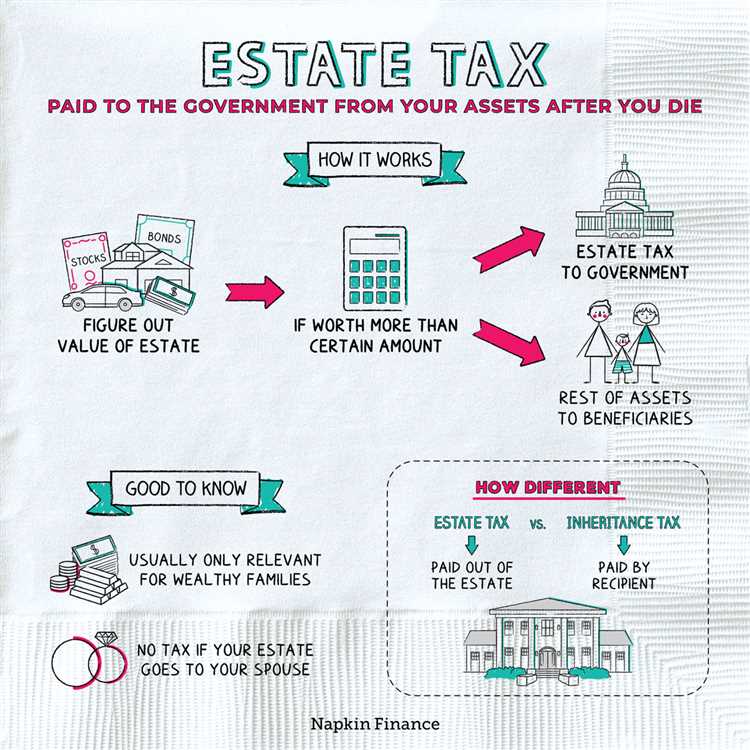

When it comes to estate planning and managing your assets, understanding the basics of inheritance tax is crucial. In North Dakota (Nd), inheritance tax is a tax imposed on the transfer of property from a deceased person to their heirs or beneficiaries. It is important to have a clear understanding of how this tax works and what you need to know to ensure that your loved ones are not burdened with unnecessary taxes.

Who is subject to Nd inheritance tax?

In Nd, inheritance tax is not imposed on all estates. The tax only applies to estates that exceed a certain threshold, which is determined by the state. It is important to note that the threshold can change over time, so it is essential to stay updated on the current regulations. Additionally, certain types of property, such as life insurance proceeds and retirement accounts, may be exempt from inheritance tax.

How is Nd inheritance tax calculated?

The amount of inheritance tax owed in Nd is determined by the value of the taxable estate and the relationship between the deceased person and the heir or beneficiary. The tax rates vary depending on the relationship, with closer relatives typically receiving more favorable rates. It is important to consult with a qualified estate planning attorney or tax professional to accurately calculate the inheritance tax owed.

What are the important deadlines and requirements?

When it comes to Nd inheritance tax, there are important deadlines and requirements that must be met. The executor of the estate is responsible for filing the necessary tax forms and paying the tax owed within a certain timeframe. Failure to meet these deadlines can result in penalties and interest charges. It is crucial to work with an experienced professional who can guide you through the process and ensure that all requirements are met.

What is Nd Inheritance Tax?

Nd Inheritance Tax is a type of tax that is imposed on the transfer of assets or property from a deceased person to their beneficiaries. It is a tax that is levied by the state of North Dakota and is based on the value of the assets that are being transferred.

The purpose of Nd Inheritance Tax is to generate revenue for the state and to ensure that the transfer of wealth is taxed fairly. It is a way for the state to collect taxes on the assets that are being passed down from one generation to the next.

Who is subject to Nd Inheritance Tax? The tax is typically paid by the beneficiaries of the deceased person’s estate. This includes individuals who receive assets or property through a will, as well as those who inherit through intestate succession, which is when someone dies without a will.

How is Nd Inheritance Tax calculated? The tax is calculated based on the value of the assets that are being transferred. The tax rates vary depending on the relationship between the deceased person and the beneficiary. Close relatives, such as spouses and children, may be subject to lower tax rates or may be exempt from the tax altogether.

There are important considerations to keep in mind when it comes to Nd Inheritance Tax. There are certain exemptions and deductions that may apply, such as a family farm or small business exemption. It is important to consult with a tax professional or attorney to understand the specific rules and regulations that apply to your situation.

Definition and Purpose

The Nd Inheritance Tax is a tax imposed on the transfer of property or assets from a deceased person to their beneficiaries. It is a state-level tax that is levied in North Dakota. The purpose of the Nd Inheritance Tax is to generate revenue for the state and to ensure that the transfer of wealth is taxed fairly.

The Nd Inheritance Tax is different from the federal estate tax, which is a tax on the total value of a person’s estate at the time of their death. The Nd Inheritance Tax is specifically focused on the transfer of property and assets to beneficiaries.

The purpose of the Nd Inheritance Tax is twofold. Firstly, it helps to generate revenue for the state of North Dakota. The tax collected from the inheritance transfers can be used to fund various government programs and services. Secondly, the tax ensures that the transfer of wealth is taxed fairly. By imposing a tax on inherited property and assets, the state aims to prevent the concentration of wealth in the hands of a few individuals and promote a more equitable distribution of wealth.

The Nd Inheritance Tax is an important source of revenue for the state of North Dakota. It helps to fund essential services such as education, healthcare, infrastructure development, and public safety. Additionally, the tax serves as a means of wealth redistribution, ensuring that the benefits of inherited wealth are shared more broadly among the population.

| Key Points |

|---|

| – The Nd Inheritance Tax is a state-level tax imposed on the transfer of property and assets from a deceased person to their beneficiaries. |

| – The purpose of the Nd Inheritance Tax is to generate revenue for the state and to ensure a fair taxation of inherited wealth. |

| – The tax helps to fund essential government programs and services and promotes a more equitable distribution of wealth. |

Who is Subject to Nd Inheritance Tax?

In North Dakota, the inheritance tax is applicable to certain individuals who receive property or assets from a deceased person. The tax is imposed on the transfer of property or assets through inheritance, whether it is received through a will or by intestate succession.

Generally, the tax is levied on the beneficiaries of the estate, including relatives, friends, and other individuals who are entitled to receive the deceased person’s property. However, not all beneficiaries are subject to the inheritance tax. There are certain exemptions and deductions that may apply, depending on the relationship between the deceased person and the beneficiary.

Immediate family members, such as spouses, parents, and children, are typically exempt from the inheritance tax. This means that they do not have to pay any tax on the property or assets they inherit from their deceased family member. However, it is important to note that this exemption may vary depending on the specific circumstances and the value of the inherited property.

Other individuals who may be subject to the inheritance tax include more distant relatives, such as siblings, nieces, and nephews. Additionally, friends, business partners, and unrelated individuals who receive property or assets from the deceased person may also be subject to the tax.

It is important to consult with a tax professional or an attorney to determine whether you are subject to the inheritance tax in North Dakota. They can provide guidance on the specific rules and regulations that apply to your situation and help you understand your tax obligations.

How is Nd Inheritance Tax Calculated?

The calculation of Nd Inheritance Tax is based on the total value of the inherited assets. The tax rate is determined by the relationship between the deceased and the beneficiary. Different rates may apply depending on whether the beneficiary is a spouse, child, sibling, or other relative.

To calculate the tax, the first step is to determine the total value of the inherited assets. This includes any real estate, bank accounts, investments, and personal property that the deceased owned at the time of their death.

Once the total value is determined, any debts or liabilities of the deceased are subtracted from the value of the assets. This gives the net value of the estate.

Next, the tax rate is applied to the net value of the estate. The tax rates can vary depending on the state and the relationship between the deceased and the beneficiary. For example, spouses may have a lower tax rate compared to other relatives.

After applying the tax rate, the final step is to calculate the actual tax amount. This is done by multiplying the net value of the estate by the tax rate. The resulting amount is the Nd Inheritance Tax that the beneficiary is required to pay.

It is important to note that there may be exemptions or deductions available that can reduce the overall tax liability. These exemptions and deductions are typically based on specific criteria, such as the value of the estate or the relationship between the deceased and the beneficiary.

Overall, the calculation of Nd Inheritance Tax can be complex and may require the assistance of a tax professional or estate planner to ensure accurate and compliant calculations.

Important Considerations for Nd Inheritance Tax

When it comes to Nd inheritance tax, there are several important considerations that individuals need to keep in mind. Understanding these considerations can help ensure that the tax is properly calculated and paid, and can also help individuals plan their estates in a way that minimizes the tax burden on their beneficiaries.

One important consideration is the tax rate. Nd inheritance tax rates can vary depending on the value of the estate and the relationship between the deceased and the beneficiary. It is important to be aware of the current tax rates and how they may apply to your specific situation.

Another consideration is the timing of the tax payment. In Nd, inheritance tax is typically due within a certain period of time after the date of death. It is important to understand this timeline and make sure that the tax is paid on time to avoid any penalties or interest charges.

Additionally, individuals should be aware of any exemptions or deductions that may be available to them. Nd offers certain exemptions and deductions that can help reduce the overall tax liability. These may include exemptions for certain types of property or deductions for certain expenses related to the estate.

It is also important to consider the potential impact of Nd inheritance tax on the overall estate plan. Individuals may want to work with a financial advisor or estate planning attorney to ensure that their estate plan is structured in a way that minimizes the tax burden on their beneficiaries. This may involve strategies such as gifting assets during one’s lifetime or setting up trusts to hold assets outside of the taxable estate.

Finally, individuals should be aware of any changes to the Nd inheritance tax laws. Tax laws can change over time, and it is important to stay informed about any updates or revisions that may affect the tax liability. This can help individuals plan their estates and make any necessary adjustments to their estate planning strategies.

Overall, understanding the important considerations for Nd inheritance tax can help individuals navigate the tax system and plan their estates in a way that minimizes the tax burden on their beneficiaries. By staying informed and working with professionals, individuals can ensure that their estates are handled in a tax-efficient manner.

Exemptions and Deductions

When it comes to Nd inheritance tax, there are certain exemptions and deductions that can help reduce the amount of tax owed. These exemptions and deductions are designed to provide relief for certain individuals or types of property.

One common exemption is the spouse exemption. This exemption allows a surviving spouse to inherit property from their deceased spouse without having to pay any inheritance tax. This can be a significant benefit for married couples, as it allows them to pass on their assets to their spouse without any tax consequences.

Another common exemption is the charitable exemption. This exemption allows individuals to leave property to a qualified charitable organization without incurring any inheritance tax. This can be a great way to support a cause or organization that is important to you while also reducing your tax liability.

There are also various deductions that can be applied to reduce the taxable value of an estate. For example, funeral expenses and administrative costs associated with settling the estate can be deducted from the total value of the estate. This can help reduce the overall tax liability for the beneficiaries.

It’s important to note that these exemptions and deductions may vary depending on the specific laws and regulations of Nd inheritance tax. It’s always a good idea to consult with a tax professional or attorney to ensure that you are taking full advantage of any available exemptions and deductions.

| Exemptions | Deductions |

|---|---|

| Spouse exemption | Funeral expenses |

| Charitable exemption | Administrative costs |

Question-answer:

What is inheritance tax?

Inheritance tax is a tax imposed on the transfer of assets from a deceased person to their beneficiaries.

How does inheritance tax work in North Dakota?

In North Dakota, inheritance tax is not levied. However, there is a federal estate tax that may apply to larger estates.

Who is responsible for paying inheritance tax?

The responsibility for paying inheritance tax typically falls on the beneficiaries who receive the assets from the deceased person’s estate.

Are there any exemptions or deductions for inheritance tax in North Dakota?

In North Dakota, there are no specific exemptions or deductions for inheritance tax. However, certain assets may be excluded from the taxable estate for federal estate tax purposes.