- Understanding the Basics

- What is a lien?

- Why file a lien in Washington State?

- Who can file a lien in Washington State?

- Filing a Lien in Washington State

- Gather the necessary information

- Question-answer:

- What is a lien?

- Why would someone file a lien in Washington State?

- What is the deadline for filing a lien in Washington State?

If you are a contractor or supplier in Washington State and have not been paid for your services or materials, filing a lien can be an effective way to protect your rights and ensure payment. A lien is a legal claim against a property that gives you the right to seek payment from the property owner. However, the process of filing a lien can be complex and requires careful attention to detail.

This step-by-step guide will walk you through the process of filing a lien in Washington State:

Step 1: Understand the Requirements

Before filing a lien, it is important to understand the requirements set forth by Washington State law. In order to file a valid lien, you must have a written contract with the property owner, provide a preliminary notice within a certain timeframe, and file the lien within a specific period of time after completing the work or supplying the materials.

Step 2: Gather the Necessary Information

Next, gather all the necessary information to complete the lien form. This includes the property owner’s name and address, a description of the work or materials provided, the amount owed, and any relevant dates. It is important to be as detailed and accurate as possible to ensure the validity of your lien.

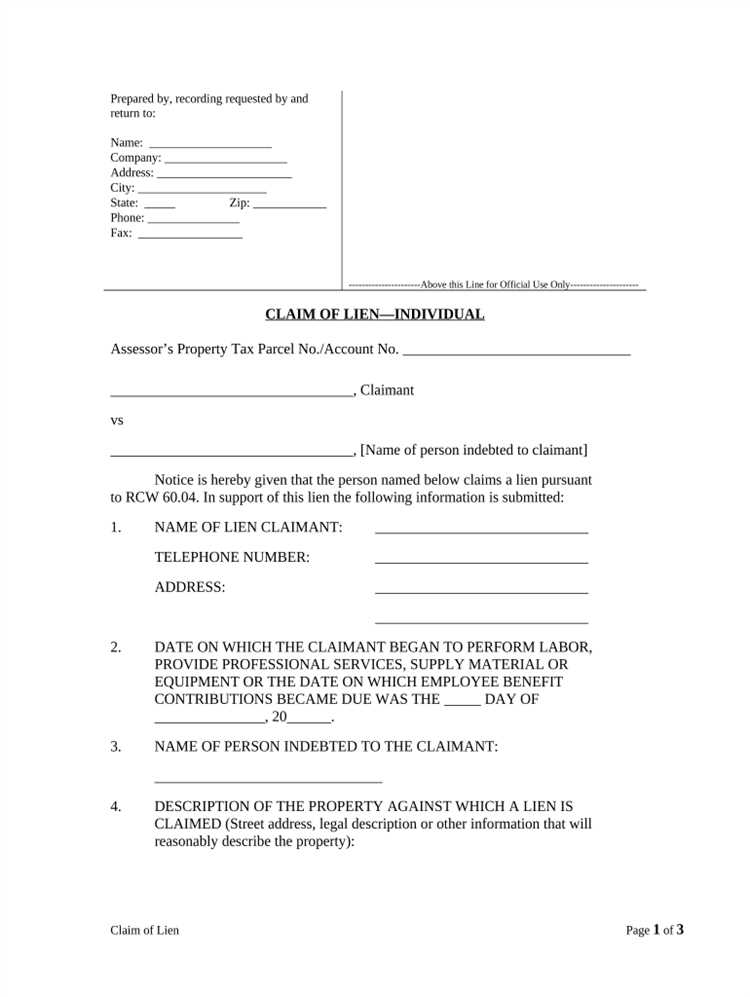

Step 3: Prepare the Lien Form

Once you have gathered all the necessary information, prepare the lien form. Washington State provides a specific form for filing a lien, which can be obtained from the county recorder’s office or online. Fill out the form completely and accurately, following the instructions provided.

Step 4: File the Lien

After completing the lien form, it must be filed with the county recorder’s office in the county where the property is located. There is usually a filing fee, which varies by county. Make sure to keep a copy of the filed lien for your records.

Step 5: Serve the Lien

Once the lien has been filed, it must be served on the property owner. Washington State law requires that the lien be served within a certain timeframe after filing. This can be done by certified mail, personal delivery, or other methods specified by law.

Step 6: Enforce the Lien

If the property owner does not respond to the lien or fails to make payment, you may need to take further legal action to enforce the lien. This can include filing a lawsuit to foreclose on the lien and force the sale of the property to satisfy the debt.

Remember, filing a lien is a serious legal action and should not be taken lightly. It is recommended to consult with an attorney familiar with Washington State lien laws to ensure compliance and maximize your chances of success.

By following these steps and understanding the requirements, you can navigate the process of filing a lien in Washington State and protect your rights as a contractor or supplier.

Understanding the Basics

Before diving into the process of filing a lien in Washington State, it is important to understand the basics of what a lien is and why it may be necessary to file one.

A lien is a legal claim or right against a property that is used as security for a debt or obligation. It provides the person or entity filing the lien with a legal interest in the property, which can help ensure that they are paid what they are owed.

In Washington State, filing a lien can be a powerful tool for contractors, subcontractors, suppliers, and other parties involved in construction projects. It allows them to protect their right to payment for the work or materials they have provided.

There are several reasons why someone may choose to file a lien in Washington State. One common reason is non-payment for services rendered or materials supplied. If a contractor or supplier has not been paid for their work, they can file a lien to assert their right to payment.

Another reason to file a lien is to prevent the property owner from selling or refinancing the property without first satisfying the debt. By filing a lien, the property owner will have difficulty transferring ownership or obtaining financing until the debt is resolved.

It is important to note that not just anyone can file a lien in Washington State. Only parties who have provided labor, materials, or professional services for the improvement of real property have the right to file a lien. This includes contractors, subcontractors, suppliers, architects, engineers, and other similar parties.

Understanding the basics of liens in Washington State is crucial before proceeding with the filing process. It ensures that individuals and businesses are aware of their rights and responsibilities when it comes to securing payment for their work or materials.

What is a lien?

A lien is a legal claim or right that a person or entity has over someone else’s property as security for a debt or obligation. It gives the lienholder the right to take possession of the property or sell it to satisfy the debt if the debtor fails to fulfill their obligations.

Liens can be placed on various types of property, including real estate, vehicles, and personal property. They are commonly used in situations where a person or business is owed money and wants to ensure that they have a legal right to collect it.

There are different types of liens, such as mechanic’s liens, tax liens, and judgment liens. Each type of lien has specific requirements and procedures for filing and enforcing it.

In Washington State, filing a lien can be a complex process, and it is important to understand the legal requirements and deadlines involved. Filing a lien without following the proper procedures can result in the lien being invalid or unenforceable.

If you are considering filing a lien in Washington State, it is recommended to consult with a qualified attorney or legal professional who can guide you through the process and ensure that your rights are protected.

Why file a lien in Washington State?

Filing a lien in Washington State can provide several benefits for contractors, subcontractors, and suppliers. Here are some reasons why you might want to file a lien:

1. Protecting your right to payment:

By filing a lien, you can secure your right to payment for the work or materials you have provided. This can help ensure that you are compensated for your efforts and expenses.

2. Encouraging prompt payment:

When a lien is filed, it creates a cloud on the property’s title, making it difficult for the property owner to sell or refinance the property without addressing the outstanding debt. This can incentivize the property owner to resolve the payment dispute quickly.

3. Prioritizing your claim:

When multiple parties are owed money on a construction project, filing a lien can help prioritize your claim. Liens are typically paid in the order they were filed, so by filing early, you increase your chances of being paid.

4. Preserving your rights in case of bankruptcy:

If the property owner or general contractor declares bankruptcy, filing a lien can help protect your rights as a creditor. Liens can give you a higher priority in the distribution of assets, increasing your chances of recovering some or all of the money owed to you.

5. Sending a message:

Filing a lien can send a strong message to the property owner and other parties involved in the project. It shows that you are serious about collecting payment and willing to take legal action if necessary. This can sometimes lead to a faster resolution of the payment dispute.

Overall, filing a lien in Washington State can be a powerful tool for contractors, subcontractors, and suppliers to protect their rights and ensure they are fairly compensated for their work and materials.

Who can file a lien in Washington State?

In Washington State, there are specific requirements for who can file a lien. Generally, any person or entity that has provided labor, materials, or services for the improvement of real property has the right to file a lien.

This includes contractors, subcontractors, suppliers, architects, engineers, and other professionals involved in the construction or improvement project. It is important to note that the right to file a lien is not limited to those who have a direct contract with the property owner. Even if you are a subcontractor or supplier working for another contractor, you still have the right to file a lien.

However, it is crucial to ensure that you have followed all the necessary legal requirements and deadlines for filing a lien. Failure to comply with these requirements can result in the invalidation of your lien.

Additionally, it is recommended to consult with an attorney or a legal professional who specializes in construction law to ensure that you understand the specific requirements and procedures for filing a lien in Washington State.

Overall, anyone who has provided labor, materials, or services for the improvement of real property in Washington State has the right to file a lien, regardless of their direct contractual relationship with the property owner.

Filing a Lien in Washington State

When it comes to filing a lien in Washington State, there are several important steps that need to be followed. Filing a lien is a legal process that allows a person or business to claim a right to someone else’s property as security for a debt. This can be a useful tool for contractors, suppliers, and other parties who are owed money for work or materials provided.

The first step in filing a lien in Washington State is to gather all the necessary information. This includes the name and address of the property owner, a description of the property, and the amount of money owed. It is also important to gather any supporting documentation, such as contracts, invoices, or receipts, that can help prove the debt.

Once all the necessary information has been gathered, the next step is to prepare the lien documents. In Washington State, this typically involves filling out a lien claim form, which can be obtained from the county recorder’s office or downloaded from their website. The form will require the necessary information about the property owner, the property itself, and the amount owed.

After the lien claim form has been completed, it must be filed with the county recorder’s office in the county where the property is located. There is usually a filing fee associated with this step, which can vary depending on the county. It is important to keep a copy of the filed lien claim form for your records.

Once the lien claim form has been filed, it is important to serve a copy of the form on the property owner. This can be done by certified mail, with return receipt requested, or by personal delivery. It is important to keep proof of service, such as a signed receipt or affidavit of service, as this may be required if the lien is challenged.

After the lien claim form has been filed and served, it is important to monitor the deadline for enforcing the lien. In Washington State, a lien must be enforced within 90 days of filing, or it will expire. This typically involves filing a lawsuit to foreclose on the lien and force the sale of the property to satisfy the debt.

Gather the necessary information

Before filing a lien in Washington State, it is important to gather all the necessary information to ensure a smooth and successful process. The following information will be required:

| Information | Description |

|---|---|

| 1. Property owner’s name and address | Obtain the full legal name and current address of the property owner. This information can usually be found on the property deed or through public records. |

| 2. General contractor’s name and address | If you are a subcontractor or supplier, you will need to provide the name and address of the general contractor who hired you. This information can usually be found in your contract or through communication with the general contractor. |

| 3. Description of the work or materials provided | Provide a detailed description of the work or materials that were provided to the property. This should include the dates of service, the type of work performed, and any relevant documentation such as invoices or receipts. |

| 4. Amount owed | Determine the total amount owed for the work or materials provided. This should include any additional costs or fees that may have been incurred. |

| 5. Dates of service | Record the dates on which the work or materials were provided to the property. This will help establish the timeline of the project and ensure accuracy in the lien filing. |

| 6. Property description | Provide a detailed description of the property where the work or materials were provided. This should include the address, legal description, and any other identifying information. |

| 7. Documentation | Gather any relevant documentation to support your claim, such as contracts, invoices, receipts, or photographs. These documents will help strengthen your case and provide evidence of the work or materials provided. |

By gathering all the necessary information before filing a lien in Washington State, you can ensure a smooth and successful process. It is important to be thorough and accurate in providing the required information to avoid any delays or complications in the lien filing.

Question-answer:

What is a lien?

A lien is a legal claim on a property that is used as collateral to secure a debt. It gives the creditor the right to take possession of the property if the debt is not repaid.

Why would someone file a lien in Washington State?

Someone would file a lien in Washington State if they are owed money for work or materials provided on a construction project and the debt is not being paid. Filing a lien can help ensure that the person or company owed the money gets paid.

What is the deadline for filing a lien in Washington State?

The deadline for filing a lien in Washington State is 90 days after the completion of the work or the last date that materials were provided. It is important to file the lien within this timeframe to protect your rights.