- Section 1: Understanding the Cost of Goods Manufactured

- What is the Cost of Goods Manufactured?

- Importance of the Cost of Goods Manufactured

- Components of the Cost of Goods Manufactured

- Section 2: Steps to Prepare a Schedule of Cost of Goods Manufactured

- Gather the Necessary Information

- Question-answer:

- What is a schedule of cost of goods manufactured?

- Why is it important to prepare a schedule of cost of goods manufactured?

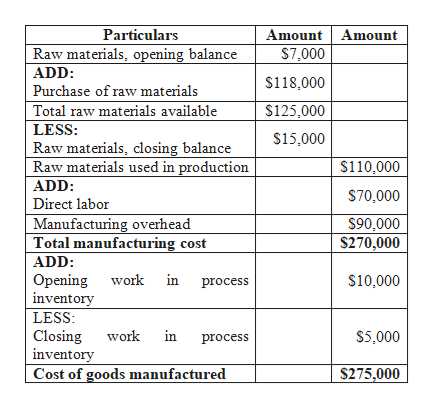

When it comes to manufacturing goods, it is crucial to have a clear understanding of the costs involved. One important tool that helps in this process is the Schedule of Cost of Goods Manufactured. This schedule provides a detailed breakdown of the costs incurred during the manufacturing process, allowing businesses to analyze and control their expenses effectively.

To prepare a Schedule of Cost of Goods Manufactured, there are several steps that need to be followed. The first step is to gather all the necessary information, including the direct materials used, direct labor costs, and manufacturing overhead expenses. It is important to ensure that all costs are accurately recorded and accounted for.

Once the information is gathered, the next step is to calculate the total manufacturing costs. This includes adding up the direct materials used, direct labor costs, and manufacturing overhead expenses. It is important to note that manufacturing overhead expenses may include items such as rent, utilities, and depreciation.

After calculating the total manufacturing costs, the next step is to determine the cost of goods manufactured. This can be done by subtracting the ending work in process inventory from the total manufacturing costs. The ending work in process inventory represents the value of goods that are still in the manufacturing process at the end of the accounting period.

By following these steps, businesses can prepare an accurate Schedule of Cost of Goods Manufactured, which provides valuable insights into the costs involved in the manufacturing process. This information can then be used to make informed decisions, improve cost control, and ultimately, increase profitability.

Section 1: Understanding the Cost of Goods Manufactured

The cost of goods manufactured is an important financial metric that helps businesses understand the total cost involved in producing goods during a specific period. It includes all the costs incurred in the production process, from raw materials to labor and overhead expenses.

Understanding the cost of goods manufactured is crucial for businesses as it allows them to analyze and evaluate their production costs. By knowing the cost of goods manufactured, companies can make informed decisions regarding pricing, inventory management, and overall profitability.

The cost of goods manufactured consists of several components, which are essential to consider when preparing a schedule. These components include:

| Component | Description |

|---|---|

| Direct Materials | The cost of raw materials used in the production process. |

| Direct Labor | The cost of labor directly involved in the production process. |

| Manufacturing Overhead | The indirect costs associated with production, such as utilities, rent, and depreciation. |

| Beginning Work in Process Inventory | The value of partially completed goods from the previous period. |

| Ending Work in Process Inventory | The value of partially completed goods at the end of the current period. |

By understanding these components and their impact on the cost of goods manufactured, businesses can effectively manage their production costs and optimize their operations.

What is the Cost of Goods Manufactured?

The Cost of Goods Manufactured (COGM) is a financial metric that represents the total cost incurred by a company to produce finished goods during a specific period. It includes all the direct and indirect costs associated with the manufacturing process, such as raw materials, labor, and overhead expenses.

COGM is an essential component of a company’s financial statements, particularly the income statement and the balance sheet. It provides valuable insights into the cost structure of a company’s manufacturing operations and helps in evaluating the profitability and efficiency of the production process.

By calculating the COGM, companies can determine the cost per unit of the finished goods produced. This information is crucial for setting the selling price of the products and making informed decisions regarding production volume, pricing strategies, and overall profitability.

Furthermore, the COGM is used in inventory valuation. It is added to the beginning inventory to determine the cost of goods available for sale. The difference between the cost of goods available for sale and the ending inventory gives the cost of goods sold, which is an important figure for calculating the gross profit.

In summary, the Cost of Goods Manufactured is a comprehensive measure of the total cost incurred in the production of finished goods. It plays a crucial role in financial analysis, pricing decisions, and inventory valuation, making it an essential metric for manufacturing companies.

Importance of the Cost of Goods Manufactured

The Cost of Goods Manufactured (COGM) is a crucial financial metric for manufacturing companies. It provides valuable insights into the production process and helps in evaluating the efficiency and profitability of the business. Understanding the COGM is essential for making informed decisions and improving the overall performance of the company.

Here are some key reasons why the COGM is important:

| 1. Cost Control: | The COGM helps in identifying the various components of the production cost, such as direct materials, direct labor, and manufacturing overhead. By analyzing these costs, companies can identify areas where they can reduce expenses and improve cost control. |

| 2. Pricing Decisions: | Knowing the COGM is crucial for setting the right prices for products. By understanding the cost of production, companies can determine the appropriate markup and ensure that they are selling their products at a profitable price. |

| 3. Performance Evaluation: | The COGM is used to evaluate the performance of the manufacturing process. By comparing the actual COGM with the budgeted COGM, companies can identify any inefficiencies or deviations from the plan. This information can be used to make necessary adjustments and improve the overall performance of the production process. |

| 4. Financial Reporting: | The COGM is an essential component of the financial statements, such as the income statement and balance sheet. It provides valuable information for calculating the cost of goods sold and determining the profitability of the company. |

| 5. Decision Making: | The COGM plays a crucial role in decision making for manufacturing companies. It helps in determining the feasibility of new projects, evaluating the profitability of different product lines, and making strategic decisions related to production and cost management. |

Components of the Cost of Goods Manufactured

The cost of goods manufactured is a crucial financial metric that helps businesses understand the total cost involved in producing goods during a specific period. It includes various components that contribute to the overall cost of production. Here are the key components of the cost of goods manufactured:

- Direct Materials: This includes the cost of raw materials that are directly used in the production process. It encompasses the cost of purchasing materials, transportation, and any other expenses related to acquiring the necessary materials.

- Direct Labor: This component represents the cost of labor directly involved in the manufacturing process. It includes wages, salaries, benefits, and any other expenses associated with the workforce engaged in production activities.

- Manufacturing Overhead: Manufacturing overhead comprises all indirect costs incurred during the production process. It includes expenses such as rent, utilities, depreciation of machinery, maintenance costs, and other miscellaneous expenses that cannot be directly attributed to a specific product.

- Beginning Work in Process Inventory: This component represents the value of partially completed goods from the previous accounting period. It includes the cost of materials, labor, and overhead that were already incurred but not yet completed.

- Ending Work in Process Inventory: Similar to the beginning work in process inventory, this component represents the value of partially completed goods at the end of the accounting period. It includes the cost of materials, labor, and overhead that are yet to be completed.

By considering these components, businesses can accurately calculate the cost of goods manufactured and gain insights into the efficiency and profitability of their manufacturing operations. Understanding the breakdown of costs allows companies to identify areas for improvement, make informed pricing decisions, and optimize their production processes.

Section 2: Steps to Prepare a Schedule of Cost of Goods Manufactured

Preparing a schedule of cost of goods manufactured involves several steps. By following these steps, you can accurately calculate the cost of goods manufactured for your business.

- Gather the Necessary Information: Before you can begin preparing the schedule, you need to gather all the necessary information. This includes data on direct materials used, direct labor costs, and manufacturing overhead expenses.

- Calculate the Total Manufacturing Costs: The next step is to calculate the total manufacturing costs. This includes the cost of direct materials, direct labor, and manufacturing overhead. Add up these costs to determine the total manufacturing costs for the period.

- Determine the Beginning Work in Process Inventory: If you have any work in process inventory from the previous period, you need to determine its value. This can be done by reviewing the ending work in process inventory from the previous period and adjusting for any changes.

- Add the Total Manufacturing Costs to the Beginning Work in Process Inventory: Once you have determined the value of the beginning work in process inventory, add the total manufacturing costs to it. This will give you the total cost of goods available for sale.

- Deduct the Ending Work in Process Inventory: To calculate the cost of goods manufactured, you need to deduct the value of the ending work in process inventory. This can be determined by reviewing the beginning work in process inventory and adjusting for any changes.

- Calculate the Cost of Goods Manufactured: Finally, subtract the value of the ending work in process inventory from the total cost of goods available for sale. This will give you the cost of goods manufactured for the period.

By following these steps, you can accurately prepare a schedule of cost of goods manufactured for your business. This information is essential for understanding the cost of producing goods and can help you make informed decisions about pricing, production, and profitability.

Gather the Necessary Information

Before you can prepare a schedule of cost of goods manufactured, you need to gather all the necessary information. This includes data related to the production process, such as the quantity of raw materials used, the labor hours spent, and the overhead costs incurred.

Start by collecting information about the raw materials used in the manufacturing process. This includes the quantity of each raw material used, as well as the cost per unit. You will also need to know the beginning and ending inventory of raw materials.

Next, gather data about the labor hours spent on manufacturing. This includes the number of hours worked by each employee involved in the production process, as well as their hourly wage rates. You will also need to know the total labor cost incurred during the period.

In addition to raw materials and labor, you will also need information about the overhead costs incurred during the manufacturing process. This includes expenses such as rent, utilities, depreciation, and maintenance. Collect data on these costs and make sure to allocate them appropriately to the cost of goods manufactured.

Once you have gathered all the necessary information, organize it in a clear and systematic manner. This will make it easier for you to calculate the cost of goods manufactured and prepare the schedule. You can use spreadsheets or accounting software to help you with the calculations and organization of data.

Remember, the accuracy of the schedule of cost of goods manufactured depends on the accuracy of the information you gather. Take the time to double-check your data and ensure that it is complete and reliable. This will help you make informed decisions and effectively manage your manufacturing costs.

Question-answer:

What is a schedule of cost of goods manufactured?

A schedule of cost of goods manufactured is a financial statement that shows the total cost of producing goods during a specific period of time. It includes direct materials, direct labor, and manufacturing overhead costs.

Why is it important to prepare a schedule of cost of goods manufactured?

Preparing a schedule of cost of goods manufactured is important for several reasons. Firstly, it helps businesses track and analyze their manufacturing costs, which is crucial for making informed decisions about pricing and profitability. Additionally, it provides a clear breakdown of the different cost components involved in the production process, allowing for better cost control and optimization.